- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence As A Service Market Size Report, 2030GVR Report cover

![Artificial Intelligence As A Service Market Size, Share & Trends Report]()

Artificial Intelligence As A Service Market Size, Share & Trends Analysis Report By Technology (Machine Learning, Computer Vision), By Service Type (Software, Services), By Organization Size, By Deployment, By Vertical, By Offering, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-002-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global artificial intelligence as a service market size was estimated at USD 7.79 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 37.4% from 2023 to 2030. The increasing demand for machine learning services in the form of application programming interfaces (API) and software development kits (SDK), along with the rising number of innovative startups, are factors expected to aid market growth. For instance, in April 2023, CHATCRYPTO, a blockchain enterprise, introduced its latest innovation, the ChatCrypto token, a deflationary artificial intelligence token. This token serves as a key to access blockchain as a service (BaaS), artificial intelligence as a service (AIaaS), and the rental of high-performance computing (HPC) power through their infrastructure as a service (IaaS). The ChatCrypto token aims to establish a sustainable and resilient ecosystem, fostering stability for both the platform and its users.

Enterprises are investing extensively in AI services these days to unlock the power of their businesses. They are implementing the solutions to execute activities ranging from forecasting, planning, and predictive maintenance to customer service chatbots and other applications. The growing advancement of technology in recent years has resulted in a new threat scenario, compelling firms to explore advanced defensive tactics. Security experts will have tremendous resources to secure sensitive networks and avoid future data breaches if AI is integrated into cybersecurity. As AI performs more enterprise activities, firms will see a massive transformation in their business activities. Such factors are likely to boost the market growth during the forecast period.

Several government agencies, especially in emerging economies, understand the benefits and power of AI, and thus heavily promote AI-based infrastructure advancement. For instance, in June 2022, in the presence of the Union Minister of Education of India Dharmendra Pradhan, Data Tech Labs Inc. launched a campaign named 'AI for India.' This campaign is powered by Amazon Web Services, Inc. and supported by the All India Council for Technical Education (AICTE) and the Ministry of Education (GOI), with the main objective being training, evaluating, practicing, allocating projects, certifying, and employing 25 lakh people across India.

The increased spending on artificial intelligence and technical improvement for workflow optimization is projected to drive the demand for sophisticated analytical systems. Furthermore, the increased usage of cloud-based solutions and the growing need for artificial intelligence and cognitive computing are likely to expand the market size. For instance, in July 2022, IBM Corporation announced the acquisition of Databand.ai, Ltd., a provider of data observability software. The addition of Databand.ai expands IBM Corporation's R&D efforts and strategic partnerships in automation and artificial intelligence. IBM is well-positioned to address the complete spectrum of observability across IT operations by merging Databand.ai, Ltd. with IBM observability by IBM Watson Studio and Instana APM.

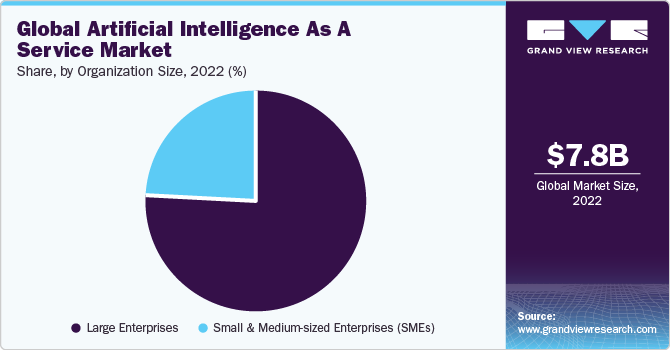

Organization Size Insights

The large enterprises segment dominated the market in 2022 with a revenue share of more than 73%. The high share can be attributed to the increased demand for AI in various end-user industries and the financial capability of these large enterprises to implement AIaaS into their workflows. For instance, in July 2022, Shenzhen Super Eagle Technology Co., Ltd., a company specializing in power supply, car chargers, mobile phone chargers, and desktop chargers, announced the release of IPAW Model L, its AI robot server, a tremendously exciting development for the hospitality business. The IPAW Model L is capable of meal delivery, voice interaction, precise navigation, customer attraction, smart obstacle avoidance, and multi-machine collaboration. The startup is currently collaborating with Heineken, McDonald's, and Hilton to bring this fascinating technology to the people.

The small and medium-sized enterprises segment is poised to expand at the fastest CAGR of 39.5% during the projection period. Businesses are becoming more digitalized, and small and medium-sized enterprises are experimenting with AI solutions to optimize their processes and operations, boosting the demand for AI services. SMEs can utilize predictive analytics to reduce risks, automate business forecasts with real-time data, and improve asset management efficiency. Enhanced prediction capabilities also enable broader market segmentation and open new avenues to innovation. SMEs can source external AI solutions and expertise through knowledge markets, often compensating for the lack of internal capacity.

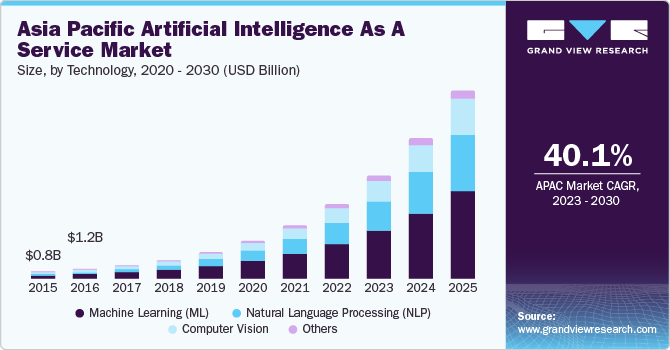

Technology Insights

The machine learning (ML) segment led the market in 2022 with a revenue share of over 40%. Machine learning platforms, such as reinforcement machine learning algorithms, supervised machine learning algorithms, and unsupervised machine learning algorithms, are primarily concerned with developing computer systems that can access data and use it for self-learning. Machine learning algorithms, methodologies, and frameworks enable businesses to tackle complex problems fast. Furthermore, the most successful firms and industries plan and create new concepts and strategies to reduce workload. For instance, in June 2022, Amazon Web Services, Inc. unveiled Amazon CodeWhisperer. This new AI service employs machine learning to produce code suggestions for software engineers, bolstering its efforts in the emerging field of AI-powered programming. The Amazon CodeWhisperer provides code recommendations based on contextual information.

The natural language processing segment is anticipated to register the fastest CAGR of 38.9% over the forecast period. The segment's growth can be attributed to the capability of the technology to analyze user actions, which aids in providing an improved customer experience. For instance, in June 2023, NLP Cloud, an AI-as-a-service platform that has captured significant attention in recent years, initiated the integration of models powered by Graphcore IPUs into its range of commercial services. Commencing with the Whisper, a widely-used speech-to-text model, the company plans to incorporate additional language models optimized for Graphcore hardware.

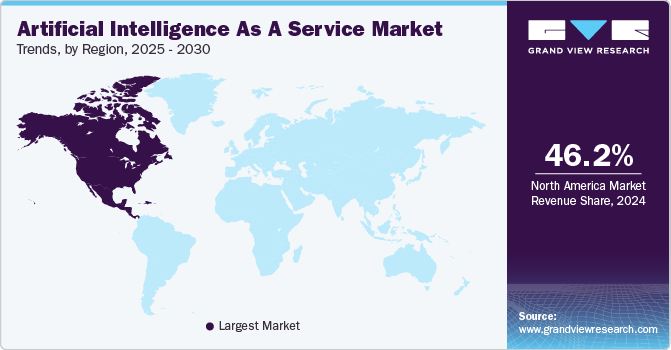

Regional Insights

North America dominated the market in 2022 with a revenue share of over 45% of the global revenue. This growth can be attributed to technical improvements and the increasing acceptance of digital technology. The region is one of the most important cognitive computing markets; numerous large industries and IT infrastructure, government regulations regarding data security, and cloud application and security information services contribute to market growth. For instance, in June 2022, Guardforce AI Co., Limited, a provider of comprehensive security solutions, announced the opening of new offices in San Francisco, California, and Tokyo, Japan, to develop its Robotics-as-a-Service business lines in these two regions. The T-series robot for food delivery robots, reception services, and disinfection robots for shopping malls, hotels, and restaurants will be among the robotics solutions offered by the company.

The Asia Pacific region is anticipated to witness significant growth in the AI as a service industry. Global investment in artificial intelligence is quickly expanding, with the Asia-Pacific area leading the way. Furthermore, the use of AI as a service is quickly expanding in nations such as India and China. As a result, the industry's scope and demand for artificial intelligence are rising.

Service Type Insights

The software segment dominated the market in 2022 with a revenue share of more than 77%. Software tools play a vital role in predicting outcomes from vast amounts of data by uncovering hidden patterns in data and datasets. Furthermore, software tools aid in the development of various company strategies and the making of business-critical decisions. For instance, in July 2022, FutureAI.guru, Inc., a consulting firm specializing in bridging the knowledge gap in artificial intelligence for businesses, launched Sallie, its newly designed software and an artificial entity. The software learns in real-time with speaking, hearing, vision, and mobility, allowing it to reach conclusions, a critical aspect of authentic thinking. Without prior information, Sallie can distinguish objects with eyesight, construct an internal model, ask questions, and take instructions.

The services segment is anticipated to register the fastest CAGR of 39.4% over the forecast period. The increasing adoption of smart solutions is likely to fuel the demand for AI services. These services use the capabilities of solutions that speed up corporate operations. For instance, in June 2021, Google launched Vertex AI, a managed AI service with new features designed to assist businesses in accelerating the deployment of AI models. The new Vertex AI will continue to speed up the deployment of machine learning models across enterprises. It also democratizes AI so that more users can deploy models in production, continually monitor, and create business impact with AI.

Deployment Insights

The public cloud segment dominated the market in 2022 with a revenue share of over 55%. Public cloud infrastructure can support massive data storage and the scalable processing capabilities required to crunch vast volumes of data and AI algorithms. The public cloud provides a variety of data storage alternatives, such as data warehouses, server less databases, data lakes, and NoSQL data stores. By operating specific workloads on the public cloud, while preserving highly sensitive data in their data center to suit client needs or regulatory requirements, organizations receive the freedom and innovation that the public cloud brings.

The hybrid cloud segment is anticipated to register a notable CAGR over the forecast period. Hybrid cloud technology gives precise, cost-effective computing and a route for leveraging large amounts of data. It enables businesses to successfully manage their data, providing strategic insights and suggestions, revealing patterns and trends in data, improving customer experience, and automating workflows. For instance, in June 2022, Microsoft released new Azure capabilities that will make it easier for businesses to operate AI software in hybrid cloud environments. Microsoft's new hybrid cloud artificial intelligence capabilities are based on Azure Kubernetes Service, a service for managing software container deployments, and Azure Machine Learning, a set of tools for developing neural networks.

Vertical Insights

The BFSI segment led the market in 2022 with the largest revenue share of over 19% of global revenue. The BFSI sector benefits from AI as a service to develop various growth prospects. Artificial intelligence is primarily employed in the BFSI sector for fraud detection, client suggestion, algorithmic trading, and chatbots. Banks are experimenting with chatbots, which are expected to drive other financial institutions to invest in comparable technologies. AI in finance can be valuable in assessing real-time activity in any setting. It gives reliable predictions and forecasts based on various variables, which are critical for business planning. For instance, in June 2022, Kiya.ai, an innovative digital solutions provider servicing financial institutions and governments worldwide, announced the arrival of Kiyaverse, a banking metaverse. India's first metaverse is allowing clients to access numerous banking services remotely. Kiya.ai will initially enable banks to launch their metaverse for partners, clients, and employees.

Other verticals, such as telecommunications, retail, government and defense, energy, manufacturing, and others, are expected to significantly contribute to the growth of the AI as a service market. AI assists in increasing the need for real-time data, accelerating time to market, lowering infrastructure costs, and improving business process time. For instance, in July 2022, Vodafone Idea Limited, one of the world's major telecommunications firms, launched a MLOps service across the organization with the assistance of Google Cloud. The AI Booster project intends to automate and standardize the creation and distribution of machine-learning models inside the carrier.

Offering Insights

The software as a service (SaaS) segment dominated the market in 2022 with the largest revenue share exceeding 63% in 2022. SaaS solutions provide cost-efficiency by offering subscription-based models and reducing hardware, software licenses, and IT infrastructure expenses. The accessibility of SaaS allows users to access data and applications from anywhere globally, which is ideal for businesses with international reach. Moreover, the user-friendly nature of SaaS makes it simple for even technically limited retailers to adopt and benefit from these solutions quickly.

The Infrastructure-as-a-service (IaaS) segment is anticipated to register the fastest CAGR of 43.4% over the forecast period. The increasing demands for reducing IT complexities, hiring a skilled workforce to manage IT infrastructures, and reducing deployment costs for data centers are factors attributed to driving the adoption of IaaS. Moreover, IaaS enables businesses to launch new applications, allows users to customize and access storage capacity, and helps manage the purchasing of on-premise hardware. For instance, in October 2023, DGPT, Inc. unveiled its cutting-edge AI computational power-sharing platform designed to democratize AI advantages for a broader audience. Presently, the platform supports hundreds of clients, boasting a node scale that extends into the hundreds of thousands, making its position as a top-tier provider of distributed AI infrastructure-as-a-service (AIaaS).

Key Companies & Market Share Insights

The artificial intelligence-as-a-service industry is fragmented, with most companies creating solutions in silos. AI will become increasingly incorporated into various systems and applications in the future, from data management to retail buying. The key players employ multiple techniques and policies to broaden their consumer base. These policies and strategies include collaborations, mergers, acquisitions, extensions, joint ventures, establishments, new manufacturing techniques, inventions, technology expansion of existing items, and partnerships. For instance, in August 2023, Lyric.ai unveiled LyriclQ, its innovative Artificial Intelligence as a Service (AIaaS) solution. The new solution harnesses the power of AI, ML, and predictive modeling to redefine payment accuracy processes for health plan payers, obtaining a new generation of efficiency and precision in the healthcare sector.

Key Artificial Intelligence As A Service Companies:

- Amazon Web Services, Inc.

- Salesforce, Inc.

- International Business Machines Corporation

- Intel Corporation

- Microsoft

- BigML, Inc.

- Google LLC

- SAP SE

- Siemens

- Fair Isaac Corporation

Artificial Intelligence As A Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.34 billion

Revenue forecast in 2030

USD 105.04 billion

Growth Rate

CAGR of 37.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, service type, organization size, deployment, vertical, offering, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Salesforce, Inc.; International Business Machines Corporation; Intel Corporation; Microsoft; BigML, Inc.; Google LLC; SAP SE; Fair Isaac Corporation; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence as a service market report based on technology, service type, organization size, deployment, vertical, offering, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning (ML)

-

Computer Vision

-

Natural Language Processing (NLP)

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Data Storage and Archiving

-

Modeler and Processing

-

Cloud and Web-Based Application Programming Interface (APIs)

-

Others

-

-

Services

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Banking, Financial, and Insurance (BFSI)

-

Healthcare and Life Sciences

-

Retail

-

IT & Telecommunication

-

Government and defense

-

Manufacturing

-

Energy & Utility

-

Others (Automotive, Education, Agriculture, Others)

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

SaaS

-

PaaS

-

IaaS

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence as a service market size was estimated at USD 7.79 billion in 2022 and is expected to reach USD 11.34 billion in 2023.

b. The global artificial intelligence as a service market is expected to grow at a compound annual growth rate of 37.4% from 2023 to 2030 to reach USD 105.04 billion by 2030.

b. North America dominated the artificial intelligence as a service market with a share of 45.9% in 2022. This growth can be attributed to technical improvements and the region's increasing acceptance of digital technology.

b. Some key players operating in the artificial intelligence as a service market include Amazon Web Services, Inc., Salesforce, Inc., International Business Machines Corporation, Intel Corporation, Microsoft, BigML, Inc., Google, SAP SE, Siemens, and Fair Isaac Corporation.

b. Key factors driving the artificial intelligence as a service market include the rising demand for machine learning services in the form of the software development kit (SDK) and application programming interface (API), as well as the growing number of innovative startups.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."