- Home

- »

- Healthcare IT

- »

-

AI-based Surgical Robots Market Size Report, 2030GVR Report cover

![AI-based Surgical Robots Market Size, Share & Trends Report]()

AI-based Surgical Robots Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Services, Instruments & Accessories), By Application (Orthopedics, Neurology, Urology, Gynecology), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-457-3

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI-based Surgical Robots Market Summary

The global AI-based surgical robots market size was valued at USD 6.4 billion in 2022 and is projected to reach USD 25.2 billion by 2030, growing at a CAGR of 18.9% from 2023 to 2030. The growth can be attributed to the increasing prevalence of chronic disorders globally and technological advancements in automated robotic surgeries.

Key Market Trends & Insights

- North America accounted for the highest revenue share of over 41.9% in 2022.

- Asia Pacific is anticipated to register the fastest growth rate of 24.0% during the forecast period.

- Based on type, the instruments and accessories segment dominated with the highest revenue share of around 54.3% in 2022.

- Based on application, the others segment dominated with the highest revenue share of 35.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 6.4 Billion

- 2030 Projected Market Size: USD 25.2 Billion

- CAGR (2023-2030): 18.9%

- North America: Largest market in 2022

The increased efficiency and success rate of robotic surgery are also expected to boost its adoption in the coming years. The rising trend of using minimally invasive medical devices is also anticipated to fuel the market. The growing integration of Artificial Intelligence (AI) in automated robotic surgeries for clinical decision-making is also propelling the market growth.

In addition, AI and robotics have proven to be priceless assets and are being preferred by surgeons across the world. As compared to standard procedures, AI-based robotic surgeries are minimally invasive and result in quick recovery & less blood loss. These robots are revolutionizing the ways of modern-day medical procedures with machine learning and simplifying the medium of interaction between surgeons & robots.

AI-assisted surgical robots help surgeons in decision-making, speech recognition, and problem-solving, which is anticipated to accelerate their adoption in the coming years. The growing concern about the shortage of medical professionals globally is also expected to boost the adoption of AI-based surgical robots, thereby propelling the market growth.

Furthermore, an increase in the trend to practice medical procedures using technology-based approaches rather than conventional practices is also anticipated to drive market growth during the forecast period. The upsurge in the adoption of AI-based robotic instruments for various applications such as detecting cancer types, helping analyze scans & surgeries, and facilitating instrument positioning also accelerates its adoption in healthcare institutions.

For instance, 2018 data published in Annals of Surgery stated that AI can be beneficial in decreasing lumpectomy rate by around 30% in breast needle biopsy patients by assisting surgeons and radiologists during the procedure. Recently, continuous innovation is ongoing to use AI-incorporated robots in several medical procedures. For instance, as of 2018, Stryker Corporations’ MAKO surgical robotic arm was used in over 76,000 hip and knee replacements.

Moreover, an increase in the number of strategic activities by manufacturers, such as acquisitions, mergers, partnerships, and technological advancements, is also anticipated to boost AI-based surgical robots market growth in the coming years. For instance, in 2019, Medtronic launched Mazor X Stealth robotic platform in the U.S. to assist in spine surgical platforms.

In addition, Stryker Corporation acquired Mobius Imaging and its subsidiary Cardan Robotics, in 2019 to acquire expertise in advanced robotics & medical imaging. Similarly, in May 2020, Active Surgical launched ActivEdge, an AI and machine learning platform, for robotic surgeries. Thus, such strategic initiatives being undertaken by top manufacturers are expected to propel market growth during the forecast period.

The COVID-19 pandemic had a negative impact on the market in 2020. Healthcare facilities prioritized treatment and management of COVID-19 patients and postponed elective robotic surgeries. For instance, as per the data published by Becker’s Hospital in 2021, about 106 hospitals postponed or suspended elective surgical procedures in the U.S. due to the pandemic.

Furthermore, a significant decrease in revenue of top players during COVID-19 also affected the market growth. For instance, according to the annual report by Intuitive Surgical, Inc., the net revenue of the company decreased by about 2.7% in 2020 as compared to 2019. The decrease in revenue of leading market players is mainly associated with the supply chain disruption and reduction in sales of surgical robots.

However, the growing prevalence of chronic diseases and increasing preference for robot assist procedures are further anticipated to drive the market during the post-pandemic period. In addition, technological advancements and increased adoption of AI-equipped surgical robots are further creating traction for market growth.

For instance, according to the data published in Mint 2022, several hospitals are now shifting toward robot-assisted surgeries for clearing the pending backlog of elective surgeries. Furthermore, the Robotic Surgery and Urology consultant of Apollo Hospitals, India stated that there is an increase in preference for robotic surgery in the post-pandemic period due to its advantages, such as the limited need for manpower and reduced chances of disease transmission.

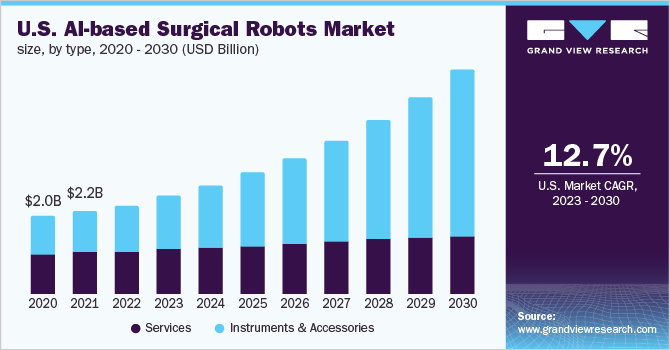

Type Insights

The instruments and accessories segment dominated with the highest revenue share of around 54.3% in 2022. This is attributed to the increase in AI-based surgical robotic equipment developmental activities by leading players. In addition, the increasing number of robotic surgeries and rising acceptance of AI-based robots by surgeons & patients globally are further driving the segment. In addition, upgrades in accessories and robotic instruments equipped with AI as per the healthcare providers’ needs further support segment growth.

The instruments and accessories are anticipated to register the fastest growth rate of 24.3% during the forecast period. Growing surgical automated instrument development activities by manufacturers is one of the major factors supporting revenue growth in this segment. In addition, increasing popularity and growing preference to use minimally invasive automated robotic products are further propelling segment growth.

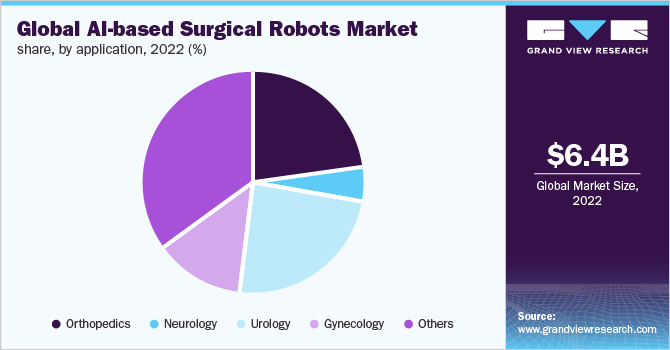

Application Insights

The others segment dominated with the highest revenue share of 35.5% in 2022. This high share of the segment is attributed to the growing number of oncology, laparoscopy, ophthalmology, and general surgeries using robotic instruments. In addition, the increasing prevalence of chronic disorders such as cancer, heart disease, and complications due to diabetes is also anticipated to drive the segment in terms of revenue. Moreover, the rise in the adoption of minimally invasive AI-equipped robotic devices for laparoscopic surgeries by surgeons also supports segment growth.

The neurology are anticipated to register the fastest growth rate of 22.9% during the forecast period. The high efficiency and increasing success rate of AI-based surgical robots used in neurological procedures as compared to conventional methods are anticipated to accelerate segment growth during the coming years. In addition, growing initiatives by healthcare institutions for the adoption and usage of technologically advanced AI-equipped robotic devices for neurological procedures are expected to propel segment growth.

For instance, in November 2020, Medtronic selected the Medical Center of University Hospitals (UH) Cleveland as its second site for cranial robotic surgery tools used for neurosurgery. Therefore, such activities of using robotic surgery platforms for minimally invasive neurosurgery are anticipated to drive segment growth in the coming years.

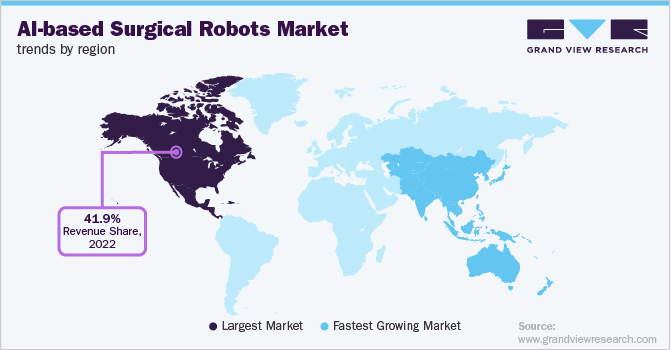

Regional Insights

North America accounted for the highest revenue share of over 41.9% in 2022. This revenue share is attributed to the growing adoption of modern medical technology as well as established medical infrastructure. The increasing presence of major players in the U.S and ongoing AI-based robotic devices are also supporting the growth. Furthermore, the growing adoption of minimally invasive surgical procedures and AI-equipped robot-assisted surgeries is anticipated to accelerate market growth in North America.

However, Asia Pacific is anticipated to register the fastest growth rate of 24.0% during the forecast period. This growth can be attributed to the increasing number of patients with chronic diseases and growing awareness to adopt minimally invasive automated robotic medical devices. In addition, the rise in the geographic expansion of leading manufacturers in the Asia Pacific region is further expected to boost the growth.

Key Companies & Market Share Insights

Technological advancements in medical procedures and growing demand for automated AI-based surgical robots drive manufacturers to innovate new devices & garner a stronghold in the global market. In addition, key players are also focusing on industrial consolidation activities such as mergers, acquisitions, & partnerships to increase their product portfolio and market share.

The growing demand for automated minimally invasive procedures has also increased the entry of new companies in recent years. The increasing number of new players is likely to shift the market nature from consolidated to oligopolistic. For instance, emerging players such as Activ Surgical, Inc.; CMR Surgical, Inc.; and other new robotic surgical instrument manufacturers are expected to gain higher revenue share during the forecast period due to their technologically advanced product portfolios. Some prominent players in the global AI-based surgical robots market are:

-

Accuray Incorporated

-

Intuitive Surgical, Inc.

-

Medtronic, plc

-

Medrobotics Corporation

-

Zimmer Biomet

-

Stereotaxis, Inc.

-

Transenterix, Inc. (Asensus Inc)

-

Stryker Corporation

-

Activ Surgical, Inc.

-

Titan Medical, Inc.

-

CMR Surgical, Inc.

-

Smith and Nephew

AI-based Surgical Robots Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.5 billion

Revenue forecast in 2030

USD 25.2 billion

Growth rate

CAGR of 18.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Russia; China; Japan; India; South Korea; Australia; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Accuray Incorporated; Intuitive Surgical, Inc.; Medtronic, plc; Medrobotics Corporation; Zimmer Biomet; Stereotaxis, Inc.; Transenterix, Inc (Asensus Inc); Stryker Corporation; Activ Surgical, Inc.; Titan Medical, Inc.; CMR Surgical, Inc.; Smith and Nephew

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI-based Surgical Robots Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the global AI-based surgical robots market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Services

-

Instruments & Accessories

-

-

Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Orthopedics

-

Neurology

-

Urology

-

Gynecology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

Australia

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global AI-based surgical robots market size was estimated at USD 6.4 billion in 2022 and is expected to reach USD 7.5 billion in 2023.

b. The global AI-based surgical robots market is expected to grow at a compound annual growth rate of 18.9% from 2023 to 2030 to reach USD 25.2 billion by 2030.

b. Based on application, the others segment dominated the market for AI-based surgical robots and accounted for the largest revenue share of 35.5% in 2022.

b. In 2022, North America dominated the AI-based surgical robots market and accounted for the largest revenue share of 41.9%.

b. Based on product, the instruments and accessories segment dominated the market for AI-based surgical robots and accounted for the largest revenue share of 54.3% in 2022.

b. Some key players operating in the AI-based surgical robots market include Accuray Incorporated; Intuitive Surgical, Inc.; Medtronic, plc; Medrobotics Corporation; Zimmer Biomet; Stereotaxis, Inc.; Transenterix, Inc (Asensus Inc); Stryker Corporation; Activ Surgical, Inc.; Titan Medical, Inc.; CMR Surgical, Inc. and Smith and Nephew.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.