- Home

- »

- Healthcare IT

- »

-

Artificial Intelligence In Drug Discovery Market Report, 2033GVR Report cover

![Artificial Intelligence In Drug Discovery Market Size, Share & Trends Report]()

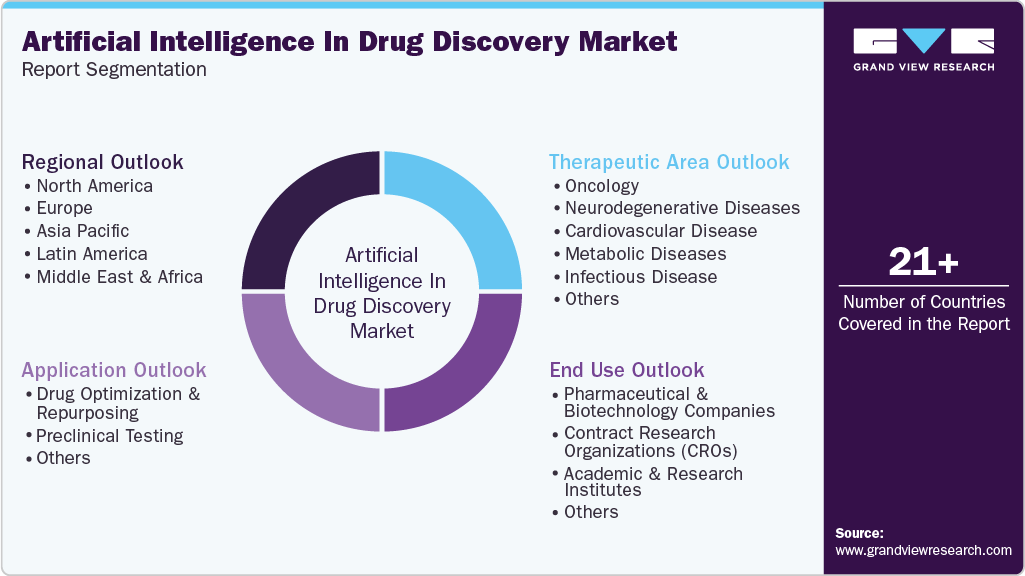

Artificial Intelligence In Drug Discovery Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Drug Optimization and Repurposing, Preclinical Testing), By Therapeutic Area (Oncology, Neurodegenerative Disease), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-029-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Intelligence In Drug Discovery Market Summary

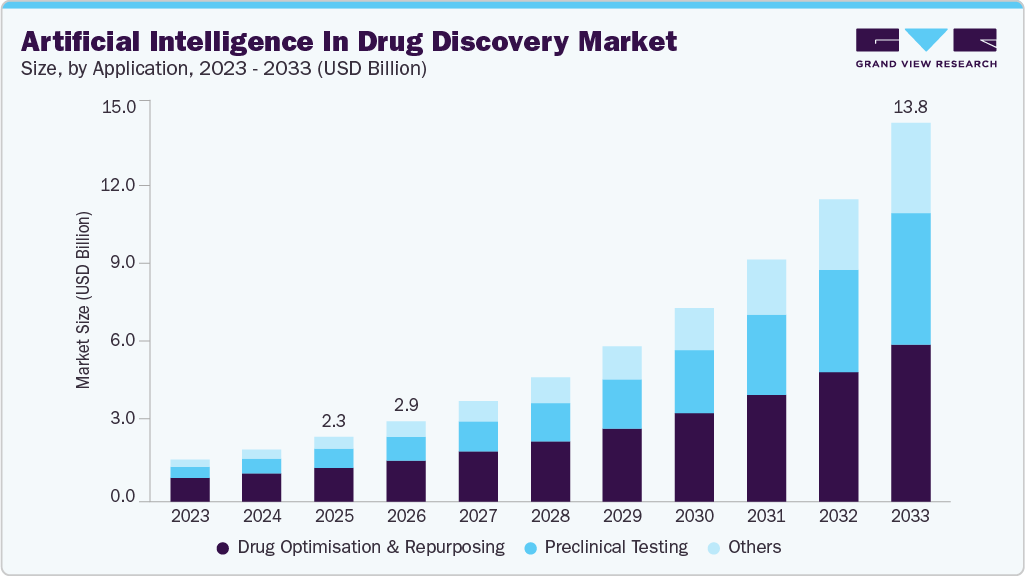

The global artificial intelligence in drug discovery market size was estimated at USD 2.35 billion in 2025 and is projected to reach USD 13.77 billion by 2033, growing at a CAGR of 24.8% from 2026 to 2033. The rising demand for cost-effective drug development, the increasing number of clinical trials in drug repurposing, and the growing prevalence of chronic diseases are significant factors contributing to market growth.

Key Market Trends & Insights

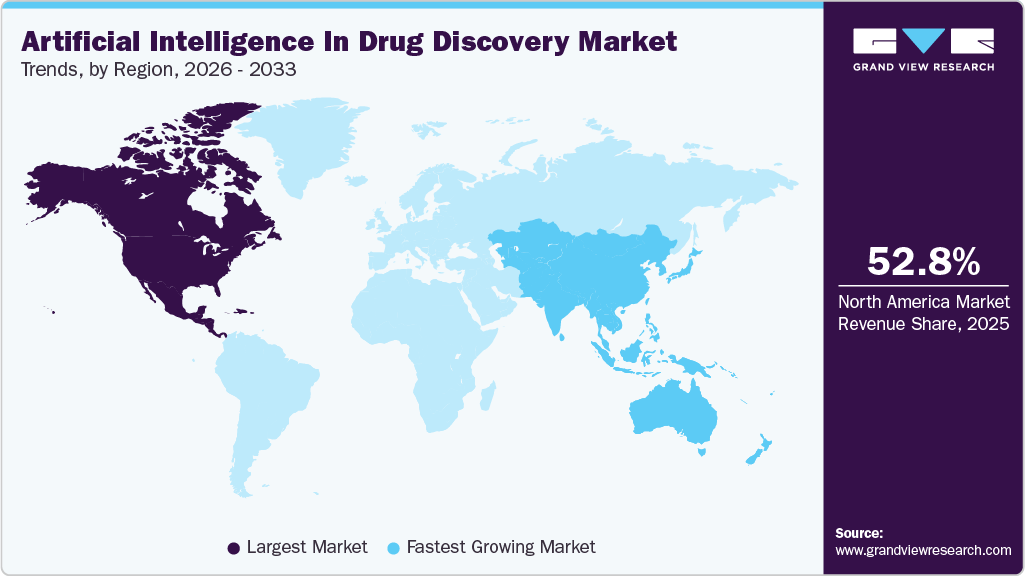

- North America dominated the global artificial intelligence in drug discovery market with the largest revenue share of 52.85% in 2025.

- The artificial intelligence in the drug discovery industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By application, the drug optimization and repurposing segment led the market with the largest revenue share of 52.4% in 2025.

- By therapeutic area, the oncology segment led the market with the largest revenue share of 24.3% in 2025.

- By end use, the academic and research institutes segment is expected to grow at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 2.35 Billion

- 2033 Projected Market Size: USD 13.77 Billion

- CAGR (2026-2033): 24.8%

- North America : Largest market in 2025

- Asia Pacific : Fastest growing market

In addition, the growing focus on precision medicine and targeted drug development, as well as improvements in computing power and cloud infrastructure, are other factors fueling market growth. The rising demand for cost-effective drug development strategies substantially drives the growth of artificial intelligence (AI) in the drug discovery industry. According to an article published in the Frontiers in Pharmacology Journal in October 2025, Traditional drug discovery involves lengthy timelines, often exceeding a decade, and costs frequently exceed USD 2 billion per drug. AI in drug discovery and repurposing offers a strategy to bypass early-stage safety testing by focusing on approved or investigational drugs for new indications. Drug repurposing is anticipated to reduce risks and bring drugs to the market in 3-12 years, with an average investment of USD 300 million.

AI accelerates this process by rapidly analyzing extensive biological, chemical, and clinical datasets to identify novel associations between drugs and diseases. This reduces development timelines and costs, offering pharmaceutical companies and healthcare providers an economically viable alternative to the development of new drugs. Integrating artificial intelligence with drug repurposing effectively addresses key industry challenges by enhancing productivity while reducing associated risks and investments. AI enhances this economic advantage by efficiently analyzing extensive chemical libraries, biomedical literature, omics datasets, and real-world evidence to identify a limited set of high-probability candidates, rather than supporting broad empirical screening.

“Vast combinatory possibilities in optimal drug design lead to high costs, lengthy timelines, and low success rates. AI efficiently navigates this complex landscape, pinpointing the most promising candidates-an achievement unimaginable just a few years ago.”

- Ming-Ming Zhou, PhD, Dr. Harold and Golden Lamport Professor in Physiology and Biophysics and Chair of the Department of Pharmacological Sciences at the Icahn School of Medicine at Mount Sinai

Moreover, the artificial intelligence in the drug discovery industry is characterized by significant innovation, driven by the integration of sophisticated algorithms, machine learning, and data analytics. Innovations focus on enhancing the efficiency and accuracy of drug discovery processes, from target identification to lead optimization and clinical trial design. These advancements are substantially reducing the time and cost associated with bringing new drugs to market, transforming the pharmaceutical industry. For instance, in December 2023, Merck launched ADDISON drug discovery software, the first software-as-a-service platform to integrate virtual molecule design with real-world manufacturability through the SynthiaTM retrosynthesis software application programming interface (API). The platform combines machine learning, generative AI, and computer-aided drug design to accelerate the development of new drugs.

Similarly, in November 2025, Ginkgo Datapoints launched the Virtual Cell Pharmacology Initiative (VCPI), an open-source platform for standardized virtual cell modeling in AI drug discovery. It aims to test over 100,000 compounds, generating more than 12 billion data points using the V-Ref293 engineered cell line and DRUG-seq RNA profiling. Such factors are expected to further fuel market growth.

Recent Developments in the AI In Drug Discovery Market

Company

Year

Month

Description

Quotient Sciences and Intrepid Labs

2025

December

Quotient Sciences and Intrepid Labs announced a multi-year strategic partnership to advance AI in early drug development. Quotient gains access to Intrepid's ANDROMEDA ML model for optimizing drug product formulations, reducing experiments, drug substance use, and timelines.

“This is a truly unique offering. It blends Quotient’s decades of experience in drug product development and accelerated clinical testing using Translational Pharmaceutics with Intrepid’s cutting-edge AI capabilities to reduce drug substance requirements in early development, shorten development cycles, increase speed to clinic, and deliver more informed decision-making for pharmaceutical companies.”

-Thierry Van Nieuwenhove, CEO of Quotient Sciences

Quantori and Expert Systems

2025

December

Quantori and Expert Systems announced a strategic partnership to integrate Expert Systems' predictive AI models as Q-Models into Quantori's Q-Scientist platform. This enhances drug discovery workflows for target identification, compound optimization, and toxicity prediction.

Global Health Drug Discovery Institute

2025

December

Global Health Drug Discovery Institute launched the AI Kongming platform in Beijing to enhance drug development efficiency from target discovery to clinical candidates.

Insilico Medicine & Eli Lilly

2025

November

Insilico Medicine entered a research and licensing collaboration with Eli Lilly to co-discover and advance novel therapies using Insilico’s Pharma.AI platform. Insilico is anticipated to generate, design, and optimize compounds for Lilly-defined targets.

“We are delighted to collaborate with Lilly, a global leader in the pharmaceutical industry, renowned for its commitment to medical innovation. Lilly has been a valued user of our Pharma.AI software suite, and this expanded collaboration further recognizes Insilico’s AI-driven drug discovery capabilities while strengthening our longstanding partnership. By joining forces, we are accelerating the development of transformative therapies to address urgent patient needs worldwide.”

- Alex Zhavoronkov, PhD, Founder and Co-CEO of Insilico Medicine.

Eli Lilly

2025

September

Eli Lilly launched TuneLab, an AI/ML platform, sharing drug-discovery models trained on over USD 1 billion of Lilly data with select biotechs, including Circle Pharma and insitro. Biotechs run models locally via federated learning on Rhino's NVIDIA FLARE platform, fine-tuning without sharing raw data.

NVIDIA and Novo Nordisk

2025

June

NVIDIA announced a collaboration with Novo Nordisk and DCAI to accelerate drug discovery using Gefion AI supercomputer powered by NVIDIA DGX SuperPOD. Novo Nordisk leverages BioNeMo for generative AI, NIM/NeMo for agentic workflows, and Omniverse for simulations.

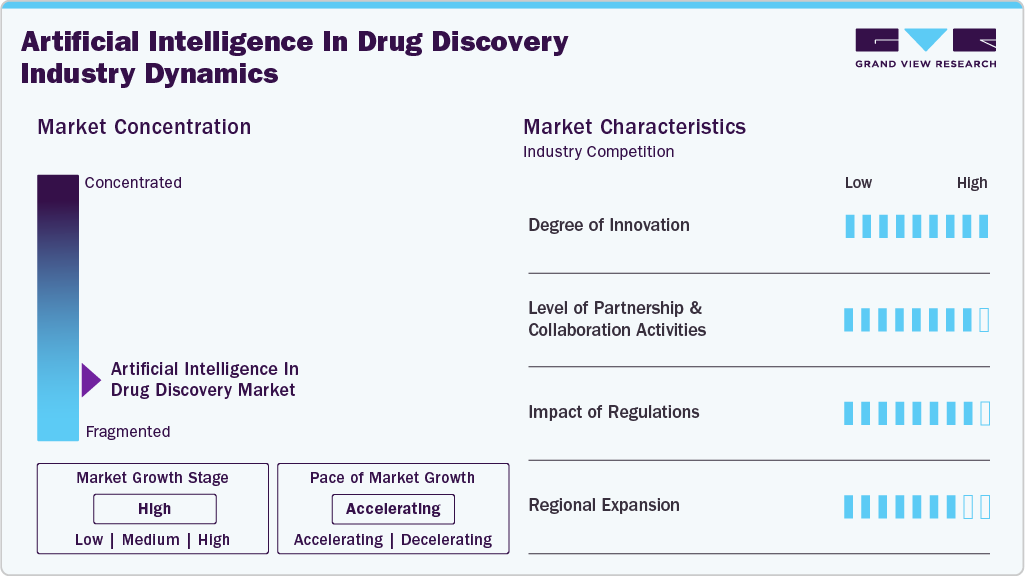

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion.

The artificial intelligence in the drug discovery industry is highly fragmented. In addition, several emerging players are entering the market, thereby contributing to increased fragmentation within the market. The degree of innovation, the level of partnership and collaboration activities, the impact of regulations, and regional expansion of the industry are high.

The degree of innovation in artificial intelligence in drug discovery industry is notably high, driven by the integration of advanced computational methods with vast biomedical datasets. For instance, in December 2025, Hits’ Hyperlab launches as a ‘virtual AI lab’ for new drug discovery.

The artificial intelligence in drug discovery industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in September 2025, Capgemini partnered with Insilico Medicine to accelerate AI-powered drug discovery for life sciences firms, integrating Capgemini's consulting with Insilico's Pharma.AI platform. The collaboration develops Pharmaceutical Superintelligence (PSI), an agentic AI system for end-to-end workflows, from target identification to clinical design, utilizing generative AI and predictive modeling.

Global regulations governing artificial intelligence in drug discovery industry emphasize ensuring the safety, efficacy, and transparency of AI-assisted therapeutic development. Regulatory agencies such as the U.S. FDA have issued draft guidances focused on incorporating AI into drug development and regulatory decision-making processes with a risk-based approach. The framework encourages rigorous validation, interpretability, and ongoing monitoring of AI models to prevent bias and errors.

The artificial intelligence in drug discovery industry is witnessing high geographical expansion. Companies in the artificial intelligence-driven drug discovery industry are seeking geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions.

Application Insights

The drug optimization and repurposing segment led the market with the largest revenue share of 52.46% in 2025. The rising demand for cost-effective drug development strategies substantially drives the segment’s growth. Generative AI models hypothesize novel drug-target interactions, while natural language processing (NLP) systems extract hidden insights from biomedical literature, patents, and clinical trial data.

The preclinical testing segment is expected to grow at the fastest CAGR during the forecast period. AI in the preclinical testing segment enhances the evaluation of drug candidates before human trials. Machine learning models predict toxicity, efficacy, and pharmacokinetics from molecular and biological data. In silicon testing reduces reliance on animal studies. Early risk identification improves candidate selection, thereby increasing preclinical success rates.

Therapeutic Area Insights

The oncology segment led the market with the largest revenue share of 24.38% in 2025. Artificial intelligence (AI) in oncology facilitates the identification of novel cancer targets and biomarkers by applying machine learning to genomic and transcriptomic tumor data. Predictive models identify driver mutations and pathway dependencies, which support precision drug design and advance data-driven targeting within oncology development pipelines. For instance, in June 2025, Revolution Medicines and Iambic Therapeutics announced a multi-year AI collaboration for novel oncology candidates, utilizing NeuralPLexer for protein-ligand prediction, trained on Revolution's data.

The infectious diseases segment is anticipated to register at the fastest CAGR from 2026 to 2033. AI accelerates the identification of novel drug targets against pathogens. Machine learning models analyze genomic and proteomic data from viruses and bacteria. Rapid mutation patterns are efficiently mapped, supporting a rapid response to emerging threats, thereby enabling precise target validation.

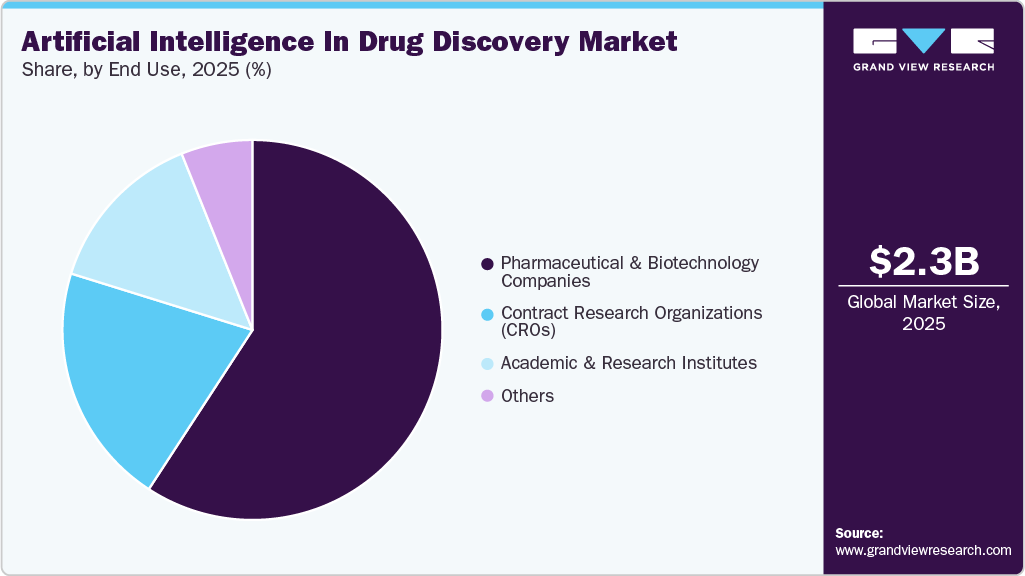

End Use Insights

The pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 59.19% in 2025. In addition, this segment is anticipated to grow at the fastest CAGR during the forecast period. Pharmaceutical and biotechnology companies are primary adopters of AI in drug discovery to enhance pipeline efficiency. AI platforms support target identification, lead optimization, and candidate prioritization.

The academic and research institutes segment is expected to grow at the fastest CAGR over the forecast period. These institutions harness extensive biomedical data and computational expertise to develop novel AI methodologies that accelerate drug discovery and drug repurposing efforts. Their focus encompasses algorithm development, predictive modeling, and multi-omics data integration, facilitating the identification of potential therapeutic candidates with high precision. Moreover, academic and research institutes are essential collaborators for pharmaceutical companies and AI startups, bridging the gap between scientific discovery and commercialization.

Regional Insights

North America dominated the global artificial intelligence in drug discovery market with the largest revenue share of 52.85% in 2025. The market is driven by substantial R&D investments from pharmaceutical and biotechnology firms, coupled with robust venture capital funding for AI-driven drug discovery startups. In addition, the presence of advanced healthcare IT infrastructure enables efficient integration of large-scale genomic and clinical datasets. Strategic collaborations between academia, pharma, and AI companies accelerate the translation of repurposing research into clinical applications.

U.S. Artificial Intelligence in Drug Discovery Market Trends

The artificial intelligence in drug discovery market in the U.S. accounted for the largest market revenue share in North America in 2025. The U.S. market benefits from the dominance of leading AI and pharmaceutical companies actively deploying AI for drug discovery. The country has extensive biomedical data repositories, including EHRs, genomic databases, and clinical trial registries, which strengthen AI model training. Regulatory flexibility, including accelerated approval pathways for orphan drugs, encourages investment in AI-enabled drug discovery.

Europe Artificial Intelligence in Drug Discovery Market Trends

The artificial intelligence in drug discovery market in Europe is expected to witness at a significant CAGR during the forecast period, owing to the Pan-European initiatives promoting digital health and AI integration into drug discovery. The presence of advanced healthcare systems with structured EHRs supports large-scale data utilization. In addition, the region’s robust spending on biological research and development contributes to further market growth.

The UK artificial intelligence in drug discovery market held the significant market share in the European region in 2025. The UK market benefits from the NHS’s centralized data infrastructure, which enables AI models to access high-quality, population-wide health records. Collaborations between AI startups, universities, and global pharmaceutical firms are rapidly accelerating clinical translation. For instance, in July 2025, UK-based Healx partnered with SCI Ventures to apply AI-powered drug discovery using Healx’s AI platform in developing therapies for spinal cord injury (SCI). This partnership aims to accelerate treatments through AI-driven target discovery and drug repurposing, with broader implications for neurological diseases like ALS, MS, and Alzheimer’s.

The artificial intelligence in drug discovery market in Germany is expected to grow at a substantial CAGR over the forecast period. The Germany market is driven by its strong pharmaceutical industry and leadership in digital health innovation. For instance, in September 2025, Merck KGaA and Siemens signed a new MoU on extending their partnership to accelerate AI and data-driven drug discovery and development. The collaboration integrates Merck's SaaS products with Siemens' Xcelerator platform and Luma. Moreover, the government’s Digital Healthcare Act encourages the integration of AI into clinical and research workflows, fostering drug repurposing initiatives.

Asia Pacific Artificial Intelligence in Drug Discovery Market Trends

The artificial intelligence in drug discovery market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, propelled by expanding AI adoption in healthcare, supported by government-led digital health initiatives in countries like China, India, and South Korea. Rapid growth in clinical trial activity across the region creates diverse datasets for repurposing applications. Pharma companies are increasingly collaborating with regional AI startups to accelerate drug development. The rising burden of chronic diseases and rare conditions fuels demand for affordable, repurposed therapies. Growing investments in cloud-based healthcare infrastructure enhance the scalability of AI platforms. For instance, in May 2025, China’s Viva Biotech launched its AI-Driven Drug Discovery (AIDD) platform, featuring V-Scepter, V-Orb, and V-Mantle modules. It integrates structure prediction, molecular modeling, and data-driven insights, cutting small molecule timelines from 2-4 years to 1-2 years and costs by 50-70%.

The India artificial intelligence in drug discovery marketis expanding rapidly, driven by the high prevalence of chronic and rare diseases, government health initiatives, and technological innovation. Furthermore, the market is experiencing a growing adoption of AI technologies by biological research institutes in the country.

The artificial intelligence in drug discovery market in Japan is driven by its aging population and rising incidence of chronic and rare diseases, necessitating cost-effective therapeutic options. Moreover, the Pharmaceuticals and Medical Devices Agency (PMDA) regulatory reforms aid accelerated pathways for innovative therapies, including repurposed drugs. Japan’s emphasis on precision medicine further supports AI-based repurposing strategies.

Latin America Artificial Intelligence in Drug Discovery Market Trends

The artificial intelligence in drug discovery market in Latin America is anticipated to grow at a significant CAGR over the forecast period. Latin America’s market is driven by the increasing adoption of AI technologies in healthcare research and the rising focus on cost-effective drug development strategies. Moreover, the region benefits from its vast patient pool and rapidly growing clinical trial ecosystem, generating robust datasets for AI-based repurposing.

Middle East and Africa Artificial Intelligence in Drug Discovery Market Trends

The artificial intelligence in drug discovery market in Middle East & Africa is expected to grow at a significant CAGR over the forecast period. The region is driven by government-led initiatives to modernize healthcare systems and adopt AI-driven solutions. Countries such as the UAE and Saudi Arabia are actively investing in digital health and precision medicine, fostering AI-based drug repurposing research. Collaborations between international pharmaceutical firms and regional research centers are gaining traction. In addition, the growing incidence of cancer, cardiovascular, and metabolic diseases create demand for innovative therapies. Furthermore, investment in genomic and clinical data infrastructure supports the development of AI-driven repurposing models.

Key Artificial Intelligence in Drug Discovery Company Insights

Key players operating in the artificial intelligence in drug discovery industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key Artificial Intelligence In Drug Discovery Companies:

The following are the leading companies in the Artificial Intelligence In Drug Discovery market. These companies collectively hold the largest market share and dictate industry trends.

- Healx

- BostonGene Corporation

- BenevolentAI

- Innophore

- Delta4.ai

- BioXcel Therapeutics Inc.

- BullFrog AI Holdings, Inc.

- Graphwise

- Owkin, Inc

- Insilico Medicine

- IBM

- Exscientia

- Google (DeepMind)

- BioSymetrics, Inc.

- BPGbio Inc. (Berg Health)

- Atomwise Inc.

- Recursion

- Aitia

- insitro

Recent Developments

-

In December 2025, PRISM BioLab (Japan) and Talus Bioscience (U.S.) announced a collaboration to discover novel inhibitors targeting transcription factors (TF) and protein-protein interactions (PPI).

-

In December 2025, ChemLex, a Chinese AI-for-science startup, raised USD 45 million, led by Granite Asia, to establish its global headquarters and self-driving lab in Singapore. Signed MOU with Singapore's EDDC to accelerate small molecule discovery via automation.

-

In October 2025, Algen Biotechnologies and AstraZeneca announced a multi-target partnership to advance AI-powered drug discovery in immunology using Algen's AlgenBrain platform.

-

In May 2024, Every Cure and BioPhy partnered to transform drug repurposing using BioPhy’s AI platform, BioLogicAI, which identifies promising drug-disease matches and optimizes clinical trials to increase success rates and reduce costs.

Artificial Intelligence In Drug Discovery Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.91 billion

Revenue forecast in 2033

USD 13.7 billion

Growth rate

CAGR of 24.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Healx; BostonGene Corporation; BenevolentAI; Innophore

Delta4.ai; BioXcel Therapeutics Inc.; BullFrog AI Holdings, Inc.; Graphwise; Owkin, Inc; Insilico Medicine; IBM; Exscientia; Google (DeepMind); BioSymetrics, Inc.; BPGbio Inc. (Berg Health); Atomwise Inc.; Recursion; Aitia; Insitro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence In Drug Discovery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global artificial intelligence in drug discovery market report based on application, therapeutic area, end use, and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug optimization and repurposing

-

Preclinical testing

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Neurodegenerative Diseases

-

Cardiovascular Disease

-

Metabolic Diseases

-

Infectious Disease

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations (CROs)

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in drug discovery market size was estimated at USD 2.35 billion in 2025 and is expected to reach USD 2.91 billion in 2026.

b. The global artificial intelligence in drug discovery market is expected to grow at a compound annual growth rate of 24.83% from 2026 to 2033 to reach USD 13.77 billion by 2033.

b. North America held the largest market share of 52.85% in 2025. The market is driven by substantial R&D investments from pharmaceutical and biotechnology firms, coupled with robust venture capital funding for AI-driven drug discovery startups. In addition, the presence of advanced healthcare IT infrastructure enables efficient integration of large-scale genomic and clinical datasets.

b. Some key players operating in the artificial intelligence in drug discovery market include IHealx; BostonGene Corporation; BenevolentAI; Innophore Delta4.ai; BioXcel Therapeutics Inc.; BullFrog AI Holdings, Inc.; Graphwise; Owkin, Inc; Insilico Medicine; IBM; Exscientia; Google (DeepMind); BioSymetrics, Inc.; BPGbio Inc. (Berg Health); Atomwise Inc.; Recursion; Aitia; insitro.

b. Key factors driving artificial intelligence in drug discovery market growth include the rising demand for cost-effective drug development, increasing clinical trials in drug repurposing, and growing prevalence of chronic diseases are significant factors contributing to market growth. In addition, growing focus on precision medicine and targeted drug development and improvements in computing power and cloud infrastructure are some other factors fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.