- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence In Agriculture Market Size Report, 2030GVR Report cover

![Artificial Intelligence In Agriculture Market Size, Share & Trends Report]()

Artificial Intelligence In Agriculture Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-941-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

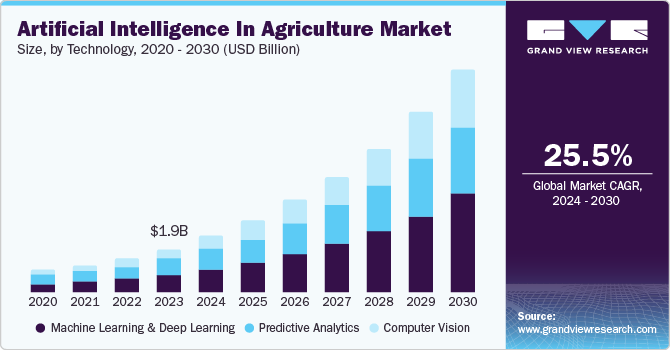

The global artificial intelligence in agriculture market size was valued at USD 1.91 billion in 2023 and is projected to grow at a CAGR of 25.5% from 2024 to 2030. Adopting artificial intelligence technology in agriculture has presented unprecedented advantages for numerous stakeholders in this industry. This includes real-time monitoring assistance and insights for farmers, harvest quality enhancements, implementation of automated irrigation systems, improved control over outcomes, reduced risks of false treatments, and more.

The growing population, popularity of trends such as veganism, and unceasing demand for plant-based foods have developed the requirement of interrupted supply of agricultural harvest and increased crop productivity. The emergence of advanced technologies such as drones, precision farming, agriculture robots, device and systems-based labor management, etc., have resulted in demand for sophisticated tools in the agriculture market driven by advanced technologies such as artificial intelligence.

The support from governments and other welfare organizations has contributed to the growth of this industry in recent years. Entry of multiple technology industry participants in this market to deliver advanced tools and techniques to assist farmers in enhancing crop quality, managing activities in a hassle-free manner, remote monitoring, livestock management, tracking, predicting, and more has resulted in the availability of numerous products and solutions based in artificial intelligence. Increased accessibility and availability of such solutions will generate greater demand for this market in the approaching years.

According to the World Resource Institute, the global population is predicted to reach approximately ten billion by 2050. This has presented an alarming need for increased volumes of processed agricultural products (PAPs), which must be attained against every hurdle posed by natural calamities, the consequences of climate change, reducing groundwater levels in multiple countries, and more.

Technologies like AI are expected to support the agricultural industry in achieving these results through various solutions. These include analyzing demand, prices, and the availability of essential resources for specific crops, using historical data on weather, soil, and other factors, monitoring landscapes, managing farms, and employing robotics, among other applications.

In addition, growing market penetration of technologies related to precision farming, livestock monitoring, automated agriculture devices, and vehicles, and continuous innovation by key market participants backed by enhanced research and development is expected to generate an upsurge in demand for artificial intelligence in the agriculture market during the forecast period.

Component Insights

Based on components, the software segment dominated artificial intelligence in the agriculture market and accounted for a revenue share of 53.9 % in 2023. The growth of this segment is driven by increasing demand for precise farming and resource allocation. With the adoption of modern technologies in agriculture, a vast amount of data is gathered from various sources, including sensors, drones, and weather stations. Software plays vital role in offering insights into crop health, soil conditions, and weather patterns based on the collected data, enabling farmers to make data-driven decisions to ensure increased crop yields and reduced waste. Furthermore, the development of advanced AI software for specific agricultural applications, such as precision irrigation management, autonomous farming equipment, and livestock monitoring, has also contributed to the growth of this segment in recent years.

The hardware segment is anticipated to witness the fastest CAGR during the forecast period. The increasing adoption of AI-powered sensors and drones has driven the growth of this segment. The hardware systems help farmers precisely monitor multiple dynamics related to the agriculture industry. Using sensors for soil monitoring requires placing tools that assess different factors such as soil moisture, temperature, pH levels, and nutrient content. In addition, advancements in computer vision and machine learning enable the development of more sophisticated AI-powered hardware, including smart cameras and IoT sensors, which can detect crop diseases, pests, and nutrient deficiencies. For instance, in August 2024, Bayer introduced FieldView Drive 2.0, a compact and easy-to-use device that allows farmers to link, track, and document operations on various types and brands of farm machinery. As farmers seek to optimize crop yields and reduce costs, the demand for hardware is expected to grow at a rapid rate in approaching years.

Technology Insights

Machine learning & deep learning technology segment accounted for the largest revenue share in 2023. These technologies have enabled farmers to reach precise decisions through insights derived from the analysis of complex data sets. Machine learning and deep learning optimize historical data, weather patterns, and soil conditions to predict crop yields, detect diseases, and identify the most suitable planting times. Furthermore, integrating these technologies into AI is expected to assist in developing innovative and advanced solutions for agriculture, such as predictive analytics platforms and AI-powered farm management systems. These factors are anticipated to generate greater growth for this segment during the forecast period.

The computer vision segment is expected to witness the fastest CAGR over the forecast period. Computer vision technology utilizes advanced algorithms, other technology driven tools to analyze visual data captured through cameras, and sensors, detect issues, and allow swift action to prevent crop losses. It allows real-time data analysis, which can lead to timely decision-making and improved yield outcomes. The increasing availability of high-resolution images, advancements in deep learning algorithms and reduction hardware costs driven by technology accessibility and affordability is expected to result in increasing growth for this segment.

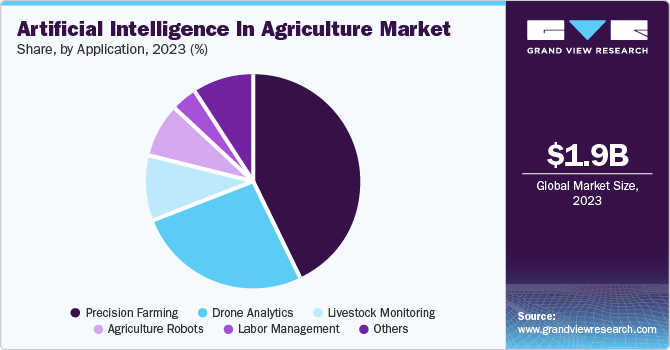

Application Insights

Based on application, the precision farming segment dominated the market in 2023. Precision farming is rapidly emerging as one of the leading applications of artificial intelligence in agriculture. It enables farmers to reduce expenses and efficiently manage their resources. AI-powered precision farming uses advanced technologies such as GPS, drones, and satellite imaging to gather real-time data on soil conditions, temperature, and moisture levels, enabling farmers to make data-driven decisions. This customization allows farmers to target specific areas for irrigation and fertilization, as precision farming minimizes waste, reduces costs, and enhances crop yields.

The agriculture robots segment is expected to experience the fastest CAGR during the forecast period. Technological advancements in robotics, computer vision, and machine learning also enable robots to perform complex crop monitoring and harvesting tasks. The increasing demand for food production, the rising need for enhanced efficiency and productivity in farming practices, and advancements in robotics technology are the key factors driving the segment's growth. Integrating AI with robotics is another factor fueling the growth by enabling precision agriculture techniques that optimize resource use and reduce waste, thereby improving sustainability. Furthermore, the increasing labor costs and shortage of skilled agricultural workers are anticipated to propel the adoption of robotic solutions in the next few years. Increasing affordability and ease of accessibility have also contributed to the growth of this segment in recent times.

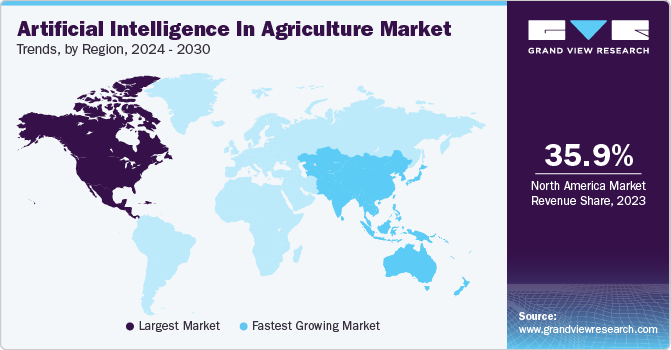

Regional Insights

North America dominated artificial intelligence in the agriculture market and held the largest share of 35.9% in 2023. Robust technological innovation and early adoption of AI solutions are among the key growth factors for this segment. The advancements in technology industry and growing penetration of technologies such as AI, machine learning, and data analytics in the region have also contributed to the growth of this market. The increasing focus on sustainability and environmental stewardship in the region have resulted in growing adoption of technologies such as AI to reduce wastage, improve crop quality, and limit use of pesticides or fertilizers. Increasing investments in research & development related to enhancements of existing technologies and its applications are expected to fuel growth for this regional industry in approaching years.

U.S. Artificial Intelligence In Agriculture Market Trends

The U.S. artificial intelligence in agriculture market held largest revenue share of the regional industry in 2023. The growth of this market is attributed to the early adoption and growing acceptance of AI technologies in agriculture industry across the country. Presence of large and diverse agricultural industry, with significant production of crops such as corn, soybeans, and wheat has acted as vast testing ground of innovation for multiple companies operating in the technology industry. Existence of numerous prominent companies from information & technology industry in the country has also contributed to the growth experienced by the market in recent years. Support of government, and encouragement through investments in research and development to enhance technology assistance for agriculture industry.

Europe Artificial Intelligence In Agriculture Market Trends

Europe held a significant revenue share of the global artificial intelligence in the agriculture market in 2023. The region’s robust agricultural tradition is coupled with advanced technological infrastructure and the increasing adoption of AI technologies in farming. European countries such as the UK, Germany, Netherlands, and others are increasing their investment in research and development (R&D) for precision agriculture technologies, aiming to enhance productivity to meet the rising food demand. For instance, in April 2023, FarmWise, a prominent player in agricultural technology, launched its next-generation weeding machine “Vulcan” to enhance the efficiency of weed management in crop production by utilizing advanced artificial intelligence (AI) and robotics. Furthermore, stringent regulations regarding food safety and environmental protection compel farmers to adopt innovative technologies that can optimize resource use and minimize waste.

Germany artificial intelligence in agriculture market held the largest share in 2023. The growth of this market is attributed to the strong agricultural sector, favorable government initiatives, and an innovative technological ecosystem. The country is home to multiple companies from the innovation and technology industry, such as Bayer AG, BASF, and others. In addition, the growing demand for technology-driven smart solutions for enhanced processes, improved outcomes, and reduced wastage in the agriculture industry is expected to drive growth for this market during the forecast period.

Asia Pacific Artificial Intelligence In Agriculture Market Trends

Asia Pacific is anticipated to witness the fastest CAGR from 2024 to 2030. The growth of this regional industry is attributed to its rising population, increasing agricultural productivity demands, and significant investments in agro-tech innovations by governments and other organizations. Countries such as China and India are experiencing a surge in population, which drives the need for enhanced food production methods to ensure food security. In addition, governments in these nations are actively promoting smart farming practices through subsidies and initiatives aimed at modernizing agriculture. For example, in September 2024, the Union Cabinet Committee led by the Prime Minister of the Government of India sanctioned approval for the Digital Agriculture Mission, which includes heavy investments from the central government and state governments. In addition, academic and research institutions are also part of associated digital agriculture initiatives, including the development of Digital Public Infrastructure, the initiation of the Digital General Crop Estimation Survey (DGCES), and more.

China artificial intelligence in agriculture market held significant revenue share of regional industry in 2023. This industry is primarily driven by factors such as an unprecedented increase in demand for crop yields, ease of availability and accessibility of the technology, entry of multiple key companies from other regions, and a vast agriculture industry in the country. China holds a significant share in the total global production of various crops such as rice, pears, walnuts, tangerines, peaches & nectarines, and others. The government authorities in the country have prioritized AI development as part of its key strategy, investing heavily in research and infrastructure to modernize agricultural processes. For instance, in December 2023, China unveiled the first AI-powered vertical farm (unmanned) with 20 floors to enhance productivity through smart farming technologies.

Key Artificial Intelligence In Agriculture Company Insights

Some key companies involved in artificial intelligence in agriculture include Corteva, Deere & Company, Climate LLC, IBM, and others. To address the growing competition and increasing demand for user-friendly advanced technology tools, industry companies are adopting strategies such as enhanced research and development activities, innovation-backed new product launches, collaboration and partnerships with other organizations, and more.

-

Corteva offers a comprehensive range of seed and crop protection products and digital solutions. The company's platform for protecting crops provides products to defend crop yields from weeds, insects, and disease.

-

Deere & Company, commonly known as John Deere, major market participant in manufacturing agricultural machinery, heavy equipment, forestry machinery industry. It offers wide array of products, including Agricultural Equipment such as combine harvesters, tractors, cotton harvesters, construction equipment, and forestry equipment.

Key Artificial Intelligence In Agriculture Companies:

The following are the leading companies in the artificial intelligence in agriculture market. These companies collectively hold the largest market share and dictate industry trends.

- Blue River Technology (John Deere)

- Climate LLC

- Corteva

- Deere & Company

- Ecorobotix SA

- Farmers Edge Inc.

- IBM

- Microsoft

- Trimble Inc.

- VALMONT INDUSTRIES, INC.

Recent Developments

-

In March 2024, Corteva launched Corteva Catalyst, an investment and partnership platform focused on agricultural innovations that advance the company’s R&D priorities and drive value creation. Corteva Catalyst aims to collaborate with entrepreneurs and innovators to fast-track the advancement of early-stage, groundbreaking technologies that empower farmers to produce food and feed sustainably in greater quantities.

-

In February 2024, Bayer and Microsoft announced the launch of the Microsoft Azure Data Manager for Agriculture platform and Bayer AgPowered Services. This partnership aims to enhance agricultural productivity through advanced data management and analytics capabilities. The primary goal of this collaboration is to leverage cloud computing and data analytics to improve farming practices.

Artificial Intelligence In Agriculture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.44 billion

Revenue Forecast in 2030

USD 9.55 billion

Growth rate

CAGR of 25.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Blue River Technology; Climate LLC; Corteva; Deere & Company; Ecorobotix SA; Farmers Edge Inc.; IBM; Microsoft; Trimble Inc.; VALMONT INDUSTRIES, INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence In Agriculture Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence in agriculture market report based on component, technology, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning & Deep Learning

-

Predictive Analytics

-

Computer Vision

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Precision Farming

-

Drone Analytics

-

Agriculture Robots

-

Livestock Monitoring

-

Labor Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in manufacturing market size was estimated at USD 5.32 billion in 2024 and is expected to reach USD 7.09 billion in 2025.

b. The global artificial intelligence in manufacturing market is expected to grow at a compound annual growth rate of 46.5 % from 2025 to 2030, reaching USD 47.88 billion by 2030.

b. North America dominated the artificial intelligence in manufacturing market with a share of 33.2 % in 2024. The regional market's revenue growth is propelled by the presence of top-tier companies producing high-performance hardware components essential for running advanced AI models.

b. Some key players operating in the artificial intelligence in manufacturing market include Amazon Web Services, Cisco Systems Inc, General Electric Company, Google LLC (Alphabet Inc., IBM Corporation, Intel Corporation, Microsoft Corporation, Mitsubishi Electric Corporation, NVIDIA Corporation, Oracle Corporation, Rethink Robotics, Rockwell Automation Inc, SAP SE, Siemens AG.

b. Key factors driving market growth include the Developing market for Industry 4.0 and smart factories and the Development of advanced technologies such as AI, ML, and DL.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.