- Home

- »

- Healthcare IT

- »

-

AI In Oncology Market Size & Share, Industry Report, 2033GVR Report cover

![AI In Oncology Market Size, Share & Trends Report]()

AI In Oncology Market (2026 - 2033) Size, Share & Trends Analysis Report By Component Type (Software Solutions, Hardware), By Cancer Type (Breast Cancer, Lung Cancer), By Application (Diagnostics, Radiation Therapy), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-985-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Oncology Market Summary

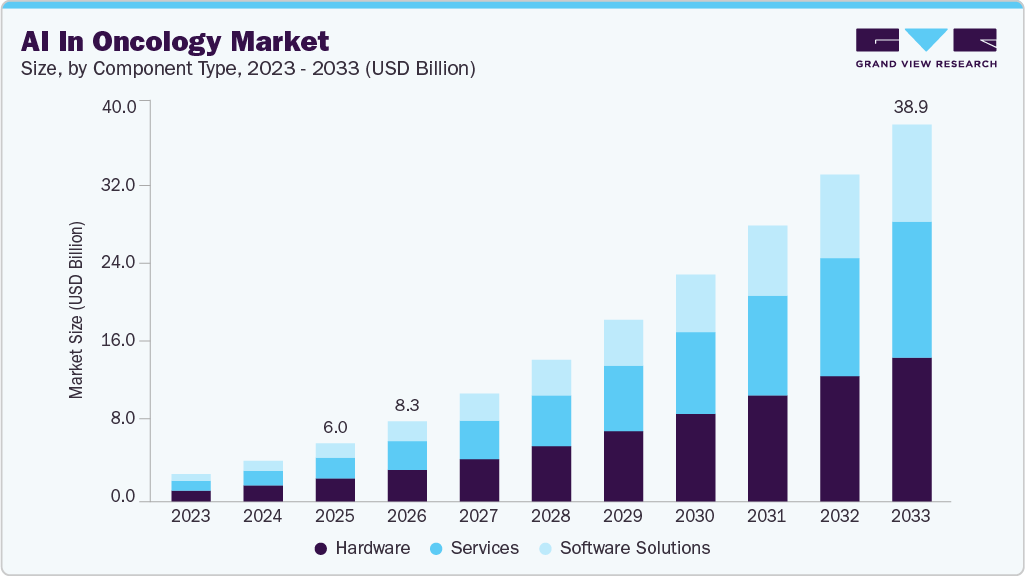

The global AI in oncology market size was estimated at USD 6.00 billion in 2025 and is expected to reach USD 38.91 billion by 2033, growing at a CAGR of 24.77% from 2026 to 2033. The growth of the market is attributed to increasing prevalence of cancer, technological advancement in cancer diagnostics & healthcare infrastructure, and an increasing demand for early detection and classification of cancer.

Key Market Trends & Insights

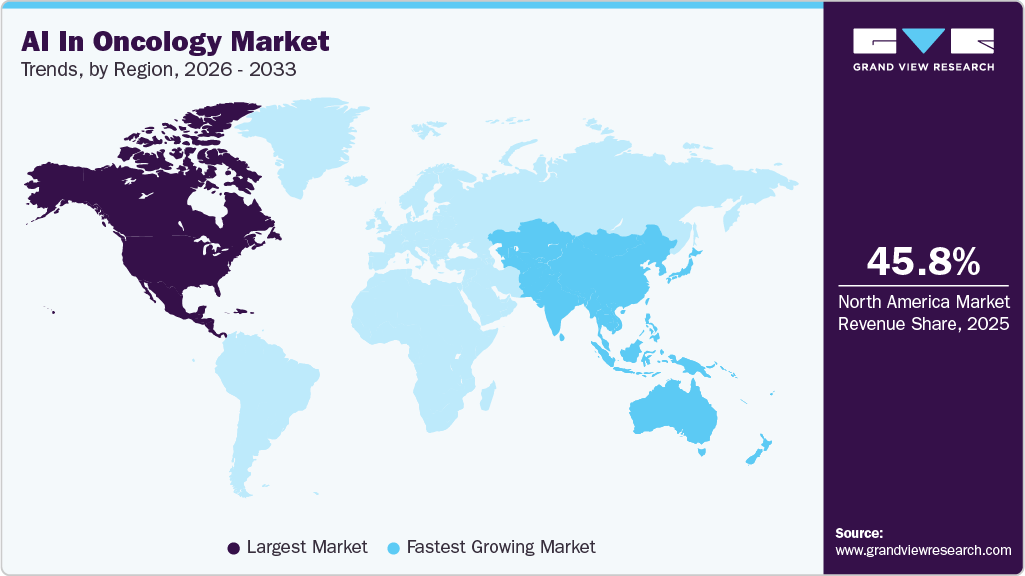

- North America dominated the AI in oncology market with the largest revenue share of 45.81% in 2025.

- The AI in oncology market in the U.S. held the largest share in the North American AI in oncology market in 2025.

- Based on component, the hardware segment led the market with the largest revenue share of 39.43% in 2025.

- Based on cancer type, the breast cancer segment led the market with the largest revenue share of 20.99% in 2025.

- Based on application, the diagnostics segment led the market with the largest revenue share of 37.65% in 2025.

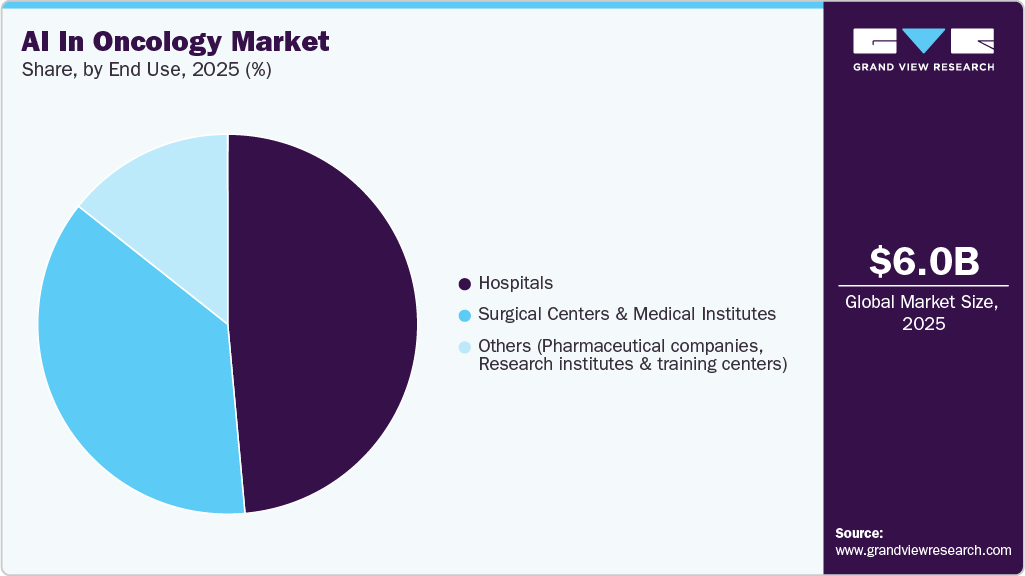

- Based on end use, the hospitals segment led the market with the largest revenue share of 48.55% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.00 Billion

- 2033 Projected Market Size: USD 38.91 Billion

- CAGR (2026-2033): 24.77%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, rising adoption of precision medicine is drives market growth further. The increasing incidence of cancer globally has led to a growing dependence on AI in the field of oncology. According to the NIH estimates of 2023, approximately 2.0 million individuals in the U.S. are diagnosed with cancer. Breast cancer was the most diagnosed cancer, with an estimated 297,790 cases in women and 2,800 cases in men. Among men, prostate cancer was the most frequently diagnosed cancer, and overall, it was the second most common diagnosis, with an anticipated 288,300 cases. The estimated number of new cases of lung and bronchus cancer made it the third most diagnosed cancer.

The growing initiatives undertaken by public and private organizations to invest in research and development (R&D) for introduction of novel technologies are further anticipated to fuel growth of the market. For instance, in October 2022, Tempus, a company specializing in precision medicine and AI, recently announced a program called Tempus+. This proprietary program utilizes real-world data to power collaborative precision oncology research. A community of researchers, including Baylor College of Medicine, Allegheny Health Network, Stanford Cancer Center, Rush University Medical Center, TriHealth, and others, is already using the Tempus+ program to advance their research. Furthermore, increasing product approval of AI-associated medical devices is anticipated to boost market growth. In January 2024, the U.S. FDA approved the first AI medical device, DermaSensor, to detect skin cancer.

The future of AI applications in cancer care is poised for groundbreaking advancements, encompassing early detection, precision medicine, and personalized treatment plans. AI's ability to analyze vast datasets, identify subtle patterns, and provide real-time insights holds the potential to revolutionize cancer diagnosis and therapy, ushering in a new era of improved patient outcomes and more efficient healthcare delivery.

Survey Insights

-

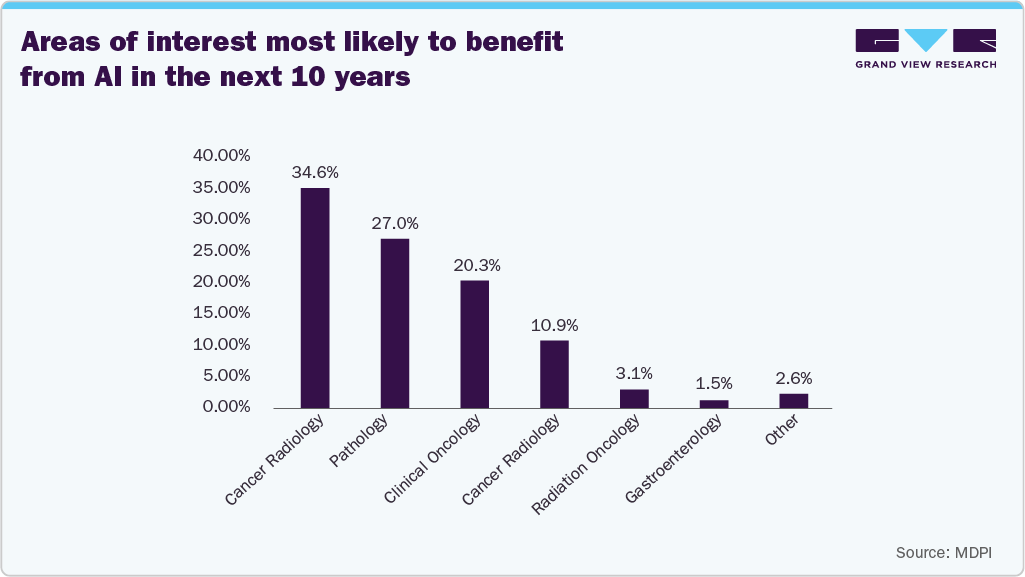

The individuals who participated in the survey were writers of articles or review articles related to AI and cancer that were published between September 20, 2020, & September 20, 2022. These articles were indexed in WoS SCI-EXPANDED.

-

Out of the 25,000 researchers invited to participate in the study, only 1,030 responded, resulting in a response rate of 4.12%.

-

The following chart displays the fields that are most likely to benefit from AI in the next decade. Approximately one-third of respondents believe that cancer radiology would benefit the most, with pathology coming in second at 27.02%. Gynecology was considered to have the least potential for benefitting from AI, with only 1.46% of respondents selecting it. Some respondents (2.58%) mentioned that other areas not listed in the survey would benefit the most.

Furthermore, rising adoption of precision medicine drives market growth. precision medicine aims to customize medical care according to individual characteristics, risks, and responses to treatments. The rising adoption and launch of AI-driven precision medicine in oncology serves as a potent growth driver. In January 2024, Penn Medicine researchers created iStar, an AI tool that analyzes gene activities in medical images. This tool provides single-cell insights into diseases in tissues & microenvironments. iStar has the capability to automatically identify important antitumor immune formations known as "tertiary lymphoid structures." These structures are linked to a patient's probable survival and favorable response to immunotherapy, a cancer treatment that requires precise patient selection. As a result, iStar can help identify patients who would benefit the most from immunotherapy.

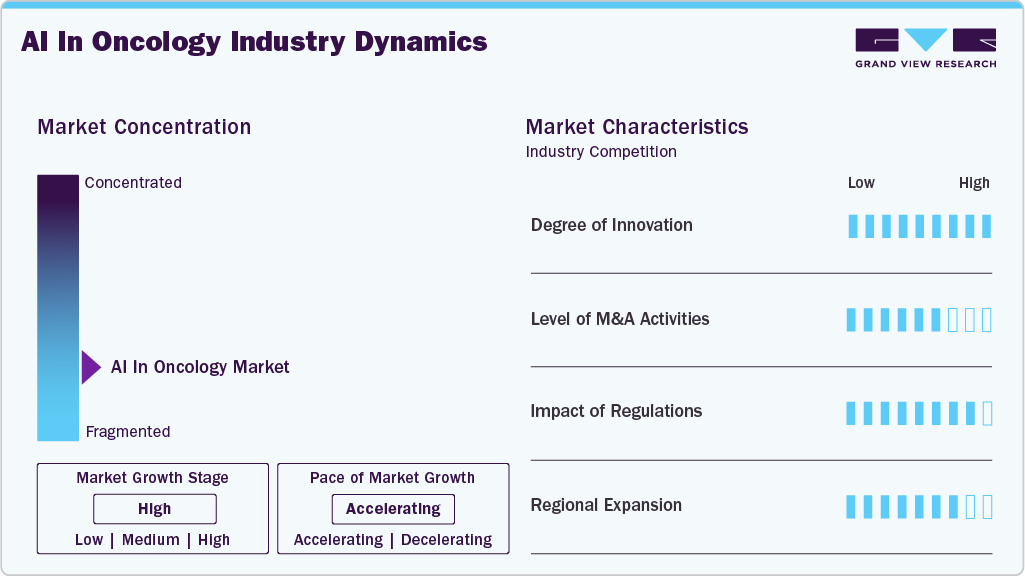

Market Concentration & Characteristics

Technological advancements and incorporation of AI in applications such as classification, detection, segmentation, characterization, and monitoring in cancer diagnosis are fueling growth of the market. Government and private investment in the field of oncology for adoption of artificial intelligence is enhancing the diagnostic and therapeutic scenario of providing efficient oncological solutions. For instance, in June 2025, Researchers from the University of Melbourne and Western Health in Australia developed an AI-powered tool, PredicTx, that uses image recognition and machine learning to analyze CT scans and accurately predict chemotherapy doses based on a patient's body composition (fat, bone, and muscle percentages).

Various growth strategies are implemented by market players to strengthen their business revenues, further facilitating global market growth. For instance, in December 2023, ConcertAI acquired CancerLinQ, previously a subsidiary of the American Society of Clinical Oncology (ASCO). Concurrently, ASCO has entered into a multiyear cooperation agreement with CancerLinQ. The new partnership seeks to build on CancerLinQ’s original mission, launched by ASCO in 2013, to improve cancer care and expedite clinical research. The venture will leverage real-world data, analytics, next-generation AI, and other advanced technologies to enhance and expand CancerLinQ’s capabilities.

Regulations play a crucial role in shaping the AI landscape in the oncology market, ensuring ethical use, patient privacy, and data security. Stringent regulatory frameworks contribute to trust and acceptance, fostering innovation while safeguarding against potential risks. Compliance with established standards enhances the credibility of AI applications, facilitating seamless integration into clinical practices and promoting responsible development in the evolving field of AI in oncology. In April 2021, the European Commission introduced the initial regulatory framework for AI within the EU. The proposal involves evaluating and categorizing AI systems capable of various applications based on the level of risk they present to users. The varying degrees of risk will determine the extent of regulatory measures applied to these AI systems.

Major players are focusing on geographical expansion to capture the untapped market. The expansion is generally done through launching facilities, or plants in new geographies or through merging or acquiring companies based in different locations. For instance, in July 2023, Lunit, a company specializing in AI-driven solutions for cancer diagnosis and treatment, is broadening its presence in the Middle East through a secured supply agreement with Seha Virtual Hospital. According to the arrangement, Lunit is set to provide its AI solution, Lunit INSIGHT MMG, for the analysis of mammography to Dr. Sulaiman Al Habib Medical Group.

Case Study Insights

Leveraging AI to Develop More Personalized Cancer Treatment Strategies at the University of Oxford

Cancer treatment is often challenged by the complexity and heterogeneity of tumors, which is expected to lead to treatment resistance and relapse. Traditional approaches typically apply maximum tolerated doses (MTD) of chemotherapy or fixed schedules, which may not optimally control tumor growth or prevent drug resistance. Researchers at the University of Oxford have demonstrated how artificial intelligence (AI), specifically deep reinforcement learning (DRL), can be used to design adaptive, personalized cancer treatment strategies that dynamically adjust therapy based on individual patient responses. This approach promises to improve treatment effectiveness and delay cancer recurrence.

Component Type Insights

Based on component type, the hardware segment dominated the market with a revenue share of over 39.43% in 2025. Medical device manufacturers use AI technologies to innovate products to help healthcare providers enhance patient care. One of the major advantages of AI in medical devices is its capability to learn from real-world data and experience and improve its performance. Hence, several key players are investing in launching and advancing AI-based cancer therapy solutions. Moreover, governments are undertaking initiatives to promote the growth of AI-based medical devices. For instance, in January 2021, the U.S. FDA introduced an action plan for AI/ML-based Software as a Medical Device (SaMD). The plan was developed to support innovative work regulating medical devices and additional digital health technologies.

The software solutions segment is expected to witness the fastest growth over the forecast period from 2026 to 2033. The increasing adoption of AI software solutions by healthcare providers and payers operating in oncology is one of the major factors fueling software solutions segment growth. The software solutions are highly effective at predicting various types of cancer, including brain, breast, liver, lung, and prostate cancer. They offer better accuracy compared to clinicians. Hence, numerous key players are focusing on developing & launching new tools and platforms, increasing the competition in the market. For instance, in October 2023, Philips partnered with Quibim, a company specializing in imaging biomarkers, to launch AI-powered imaging and reporting solutions for Magnetic Resonance (MR) prostate screenings. In August 2023, MVision AI launched Contour+, an auto-contouring software offering standardization and shorter durations of cancer therapy.

Cancer Type Insights

Based on cancer type, the breast cancer segment held the largest revenue share of 20.99% in 2025. The dominance of this segment is attributed to increasing prevalence of breast cancer among the population. According to the American Cancer Society, 316,950 new cases of invasive breast cancer are expected to be diagnosed in the U.S. in 2025. Growing cases amongst the population are propelling the need for introduction of technologically advanced products in the market, further propelling the growth of the overall market.

The prostate cancer segment is expected to register the fastest CAGR over the forecast period. Prostate cancer generally affects 13 out of every 100 men in the U.S., according to the data published by CDC. In addition, according to the American Cancer Society, 313,780 new cases of prostate cancer are estimated to be diagnosed in the U.S. in 2025. Moreover, companies are expanding their portfolios by launching new products and services, for instance, in January 2024, Quibim expanded its AI-based prostate cancer solutions portfolio by introducing QP-Prostate, an AI-based detection tool. The tool reduces the processing time and increases accuracy & quality.

Application Insights

Based on application, the diagnostics segment dominated the market with the largest revenue share of over 37% in 2025. Cancer diagnostics is an essential starting point for designing relevant therapeutic strategies and clinical management, and its AI-based advancement makes it more efficient and effective. Several companies are developing approaches for early diagnosis that include screening patients at risk with no symptoms & appropriately and rapidly investigating those who do. For instance, in December 2023, Dedalus S.p.A. partnered with Ibex Medical Analytics to launch an end-to-end AI-powered digital pathology solution to detect cancer.

The research & development segment is expected to grow at the fastest CAGR over the forecast period due to rapid advancements in AI technologies, including machine learning and deep learning, which are increasingly integrated into cancer drug discovery, target identification, and clinical trial design. These innovations accelerate the identification of novel therapeutics, streamline preclinical and clinical workflows, and enable personalized treatment approaches by analyzing multi-omics and real-world data. Growing investments from pharmaceutical and biotech companies, coupled with supportive regulatory frameworks, further drive R&D expansion.

End Use Insights

Based on end use, the hospitals segment dominated the market with a revenue share of over 48% in 2025. This growth is attributed to the rising adoption of AI-powered solutions by hospitals, the increasing number of companies entering the market to cater to cancer care in hospitals, and positive responses from patients, the market is anticipated to grow significantly during the forecast period.

In addition, this segment is also expected to grow at the fastest growth rate over the forecast period, owing to technological advancements in the healthcare sector that have increased over recent years. Digitalizing processes and implementing AI, virtual reality, and immersive technologies are key examples that changed healthcare institutions’ diagnostic, treatment, and data collection processes, including hospitals. Furthermore, hospitals are integrating AI-powered algorithms in cancer therapy to enhance accuracy by avoiding misdiagnosis. For instance, in November 2024, IDIBAPS-Hospital Clínic Barcelona unveiled a new AI tool designed to assist in the diagnosis of prostate cancer. This tool utilizes a repository of healthcare images to improve the analysis of images associated with diagnosing, predicting, and monitoring prostate cancer.

Regional Insights

North America dominated the AI in oncology market with a revenue share of over 45.81% in 2025 due to presence of well-developed digital infrastructure, favorable regulatory & reimbursement policies, and rising government initiatives to boost the adoption of AI technology in the healthcare industry. Rising prevalence of various cancers is propelling the need for development of advanced therapeutics and diagnostics which is further enabling growth of the regional market. In November 2021, Sanofi entered into collaboration with Owkin Inc. and invested USD 180 million in Owkin’s AI for advancement of the oncology pipeline.

U.S. AI In Oncology Market Trends

The AI in oncology market in the U.S. held the largest share in the North American AI in oncology market in 2025. The market is experiencing significant growth owing to the surging demand for AI applications to revolutionize medicine and advance research, diagnostics, & cancer treatment. For instance, in April 2025, Risa Labs secured USD 3.5 million in funding to enhance cancer treatment through an AI operating system.

Moreover, increasing FDA initiatives significantly contribute to the growth of the U.S. AI in oncology market. For instance, FDA's efforts as highlighted in a December 2023 factsheet have led to the authorization, clearance, or approval of over 690 AI-enabled devices.

Europe AI In Oncology Market Trends

The Europe AI in oncology market is experiencing growth at a significant CAGR due to the transition to value-based healthcare, aiming to enhance patient outcomes while ensuring a more sustainable cost structure. In addition, increasing investments in AI in the healthcare sector act as a significant driver for market growth in Europe. For instance, in September 2024, Finnish pharmaceutical company Orion partnered with AI biotech firm Aitia to leverage artificial intelligence in oncology drug discovery and simulation. The collaboration focuses on developing Gemini Digital Twins, advanced AI-driven models that simulate cancer biology to enhance treatment strategies. Combining Aitia’s causal AI technology and multi-omic patient data with Orion’s preclinical and clinical expertise, the partnership aims to discover and validate novel drug targets and develop drug candidates across multiple cancer types.

The AI in oncology market in Germany held the largest revenue share in the European region in 2025 due to the rising adoption of AI by health insurers and its application in medical imaging for cancer diagnosis. Substantial investments in AI in healthcare have positively impacted market expansion. In addition, German universities and research organizations are collaborating with market players to advance AI applications in oncology.

The AI in oncology market in the UK is propelled by several key factors. One significant driver is the adoption of AI technologies by the National Health Service (NHS) and healthcare specialists. This adoption aims to enhance the diagnostic capabilities in oncology, offering more accurate and efficient methods for disease detection and assessment. In addition, market players are actively engaging in business initiatives to contribute to the growth of AI in oncology. These initiatives involve the development and deployment of AI solutions tailored to address specific challenges in oncological diagnosis and treatment, further contributing to the advancement of healthcare practices in the UK. For instance, in April 2025, Peninsula Imaging Network (PenRAD) in Southwest England launched the UK’s first commercial deployment of Qure.ai’s AI-powered chest CT service (qCT) across five imaging sites in four NHS trusts covering Devon, Cornwall, and the Isles of Scilly.

Asia Pacific AI In Oncology Market Trends

Asia Pacific is expected to grow at the fastest growth rate over the projected period. The growth is attributed to rising adoption of digitalization in diagnostic laboratories and hospitals aided by growing geriatric population and an increasing prevalence of cancer among the population. For instance, according to GLOBOCAN in 2022, there were an estimated 19.9 million new cancer cases worldwide, with Asia-Pacific accounting for 9.8 million. Furthermore, key players are taking initiatives to improve cancer care in the region. In June 2022, GE Healthcare collaborated with National Cancer Centre Singapore with an aim to focus on artificial intelligence to improve cancer care.

The AI in oncology market in China held the largest share in the APAC region in 2025. Ongoing research initiatives leverage advancements in ML, image analysis, and data processing to enhance the accuracy & efficiency of AI applications in oncology. For instance, in April 2025, Hong Kong-based researchers developed a thyroid cancer AI assistant to diagnose and classify thyroid cancer stages and risks. Such developments are expected to enhance diagnostic efficiency and improve patient management.

The AI in oncology market in India is primarily driven by various factors such as the increasing prevalence of cancer, the growing need for advanced diagnostic & treatment solutions, and the rising adoption of AI technologies in healthcare for improved patient outcomes. According to GLOBOCAN 2022, more than 1.4 million new cancer cases were diagnosed in India in 2022. Moreover, advancements in healthcare infrastructure and digitalization efforts support the integration of AI technologies to assist in early detection, diagnosis, and personalized cancer treatment.

Latin America AI In Oncology Market Trends

The AI in the oncology market in Latin America region is primarily driven by increasing collaborations between technology companies and healthcare providers. These collaborations aim to leverage AI technologies for early detection, diagnosis, and personalized cancer treatment. Moreover, the adoption of digital health solutions, including telemedicine and AI-based diagnostic tools, has become integral to healthcare practices. Government initiatives and investments in digital health infrastructure further contribute to the growth of AI in oncology market in the region.

Middle East And Africa AI In Oncology Market Trends

Middle East and Africa AI in oncology market is expected to grow significantly over the forecast period. Increasing cancer prevalence and growing awareness are boosting the demand for integrating AI-powered algorithms in their solutions. The incidence of cancer is rapidly increasing owing to various factors such as a sedentary lifestyle, poor eating habits, and physical inactivity. Rapid advancements in digital technology owing to partnerships between government, industry players, and other investors in the healthcare ecosystem are boosting the market growth in MEA.

Key AI In Oncology Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Market players such as Azra AI; ICAD, INC.; Siemens Healthcare GmbH; Intel Corporation; GE Healthcare, and others dominated the market. These key players have been developing novel technologies to cater to different end-use applications. For instance, in January 2023, Massive Bio announced the plans to adopt AI use in oncology with development and launch of drug matching product in 2023. Furthermore, key participants in the industry are embracing the strategy of introducing new products to sustain a competitive advantage within the market. For instance, in January 2020, ConcertAI launched eurekaHealth 3.0, combining use-case-aligned RWD and AI technologies to develop real-world evidence services and insights for oncology clinical development.

Key AI In Oncology Companies:

The following are the leading companies in the AI in oncology market. These companies collectively hold the largest market share and dictate industry trends.

- Azra AI

- ICAD, INC.

- Siemens Healthcare GmbH

- Intel Corporation

- GE HealthCare

- NVIDIA Corporation

- Digital Diagnostics Inc.

- ConcertAI

- Median Technologies

- PathAI

- MVision AI

Recent Developments

-

In April 2025, scientists at the Johns Hopkins Kimmel Cancer Center developed an AI-based liquid biopsy to detect brain cancer. This technique uses machine learning technology to dentify patterns of DNA fragments circulating in the blood linked to brain tumors.

-

In April 2025, iCAD announced the integration of its ProFound AI Breast Health Suite into Microsoft's Precision Imaging Network, enabling cloud-hosted access for radiologists and healthcare providers. This collaboration aims to enhance mammography solutions, improve cancer detection rates, and reduce false positive results.

-

In April 2025, Roche received FDA Breakthrough Device Designation for its AI-powered companion diagnostic test to identify patients with advanced non-small cell lung cancer (NSCLC).

-

In April 2025, Gestalt Diagnostics, a U.S.-based startup raised USD 7.5 million to advance AI-enabled cancer detection.

-

In April 2025, South Korea-based scientists developed an advanced artificial tumor model using AI and 3D printing to study the internal environment of cancer patient's body. This research is likely to support and enhance personalized cancer prognosis in the future.

-

In April 2025, researchers at Ankara University, Turkey developed an AI-supported mobile application that detects early-stage lung cancer through patient voice analysis.

-

In April 2025, MVision AI's Contour+ received market clearance in the United Arab Emirates. This approval is expected to help MVision AI leverage its regional presence and enhance clinical radiation therapy workflows.

-

In January 2024, NVIDIA Corporation partnered with Deepcell to accelerate the use of generative AI in single-cell research for stem cells, cancer, and cell therapies.

-

In January 2024, MVision AI launched a comprehensive GBS™ solution for radiation therapy cancer treatment is now available for implementation in Canadian clinics.

-

In January 2024, PathAI launched six more oncology indications for PathExplore, an AI-powered pathology panel used for spatial analysis of tumor microenvironment (TME).

-

In December 2023, ConcertAI acquired CancerLinQ, previously a subsidiary of the American Society of Clinical Oncology (ASCO). Concurrently, ASCO has entered into a multiyear cooperation agreement with CancerLinQ. The new partnership seeks to build on CancerLinQ’s original mission, launched by ASCO in 2013, to improve cancer care and expedite clinical research. The venture will leverage real-world data, analytics, next-generation AI, and other advanced technologies to enhance and expand CancerLinQ’s capabilities.

-

In November 2023, GE Healthcare launched MyBreastAI suite, a platform that integrates three AI applications from software developed by iCAD to help with breast cancer detection and workflows.

-

In March 2023, Qritive launched QAi Prostate, a novel tool powered with AI for diagnosis of prostate cancer. The product helps in accurate identification of prostatic adenocarcinoma regions as well as in classifying benign and malignant tumors in biopsy tissue samples.

-

In November 2022, Azra AI partnered with Massive Bio to improve cancer clinical care through early identification and targeted treatment options for patients.

AI In Oncology Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.26 billion

Revenue forecast in 2033

USD 38.91 billion

Growth rate

CAGR of 24.77% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component type, cancer type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Azra AI; ICAD, INC.; Siemens Healthcare GmbH; Intel Corporation; GE HealthCare; NVIDIA Corporation; Digital Diagnostics Inc.; ConcertAI; Median Technologies; PathAI, MVision AI

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Oncology Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global AI in oncology market report based on component type, cancer type, application, end use, and region:

-

Component Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Software Solutions

-

Hardware

-

Services

-

-

Cancer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Breast Cancer

-

Lung Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Brain Tumor

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostics (Pathology, Cancer Radiology)

-

Radiation therapy (Radiotherapy)

-

Research & Development (Drug design, development process, etc.)

-

Chemotherapy

-

Immunotherapy

-

-

End Use Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Surgical Centers & Medical Institutes

-

Others (Pharmaceutical companies, Research institutes & training centers)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global AI in oncology market size was estimated at USD 6.00 billion in 2025 and is expected to reach USD 8.26 billion in 2026.

b. The global AI in oncology market is expected to grow at a compound annual growth rate of 24.77% from 2026 to 2033 to reach USD 38.91 billion by 2033.

b. The hardware segment held the largest market share of 39.43% in 2025.

b. Some key players operating in the AI in oncology market include Azra AI; ICAD, INC.; Siemens Healthcare GmbH; Intel Corporation; GE HealthCare; NVIDIA Corporation; Digital Diagnostics Inc.; ConcertAI; Median Technologies; PathAI, MVision AI

b. Key factors that are driving the AI in oncology market are increasing prevalence of cancer, technological advancement in cancer diagnostics & healthcare infrastructure, and an increasing demand for early and accurate diagnosis of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.