- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Industrial Fasteners Market Size, Report, 2030GVR Report cover

![Asia Pacific Industrial Fasteners Market Size, Share & Trends Report]()

Asia Pacific Industrial Fasteners Market Size, Share & Trends Analysis Report By Product (Externally Threaded, Aerospace Grade), By Raw Material, By Application, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-397-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

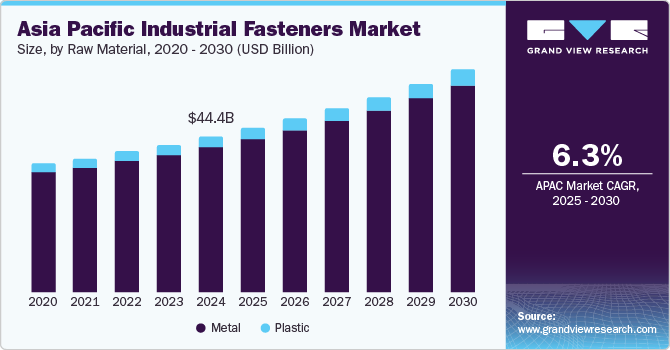

The Asia Pacific industrial fasteners market size was valued at USD 44.4 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. Rapid urbanization and significant investments in infrastructure development are creating a high demand for industrial fasteners in construction and real estate projects. Additionally, the burgeoning manufacturing sector in the region, particularly in countries like China, India, and Japan, is contributing to the increased need for fasteners in various industrial applications. Technological advancements and the adoption of high-quality materials also enhance the performance and durability of fasteners, further boosting market growth.

Government policies play a crucial role in shaping the industrial fasteners market in Asia Pacific. In China, initiatives like the Belt and Road Initiative drive significant infrastructure investments, generating a strong demand for fasteners critical to construction and manufacturing projects. Moreover, the Chinese government's favorable policies, including support for domestic manufacturing and export incentives, enhance the competitiveness of local fastener producers, enabling them to secure a larger share of both domestic and international markets.

In India, recent mandates such as the Bureau of Indian Standards (BIS) certification for fasteners have sparked debate. BIS certification requirements significantly impact small and medium enterprises (SMEs) in the Indian fasteners market, presenting challenges and opportunities. The mandatory certification aims to enhance product quality and safety, but the associated costs and complexities can be particularly burdensome for SMEs. Obtaining BIS certification involves extensive testing, documentation, and compliance with stringent standards, which can be financially prohibitive for smaller manufacturers who typically operate with tight margins.

Raw Material Insights

The metal industrial fasteners segment accounted for 88.2% of the total revenue generated in 2024 due to their superior strength, durability, and versatility. These qualities make metal fasteners indispensable across various applications, including automotive, aerospace, construction, and industrial machinery. The widespread use of metals like steel and aluminum in fastener production ensures high performance and reliability, catering to the stringent requirements of these industries.

The plastic industrial fasteners segment is expected to grow at a CAGR of 7.0% over the forecast period, driven by the increasing demand for lightweight and corrosion-resistant fastening solutions, particularly in the automotive and electronics industries. Plastic fasteners offer advantages such as reduced weight, cost-effectiveness, and resistance to chemicals and moisture, making them an attractive alternative to metal fasteners in specific applications. The rising adoption of advanced plastic materials and the continuous innovation in fastener design are further propelling the growth of this segment.

Product Insights

The externally threaded fasteners dominated the Asia Pacific industrial fasteners market in 2024. These fasteners, which include screws, bolts, and studs, are widely used across various industries due to their versatility and reliability in joining components securely. The high demand for externally threaded fasteners is driven by their extensive application in sectors such as automotive, construction, and industrial machinery, where strong and durable fastening solutions are essential.

The aerospace-grade segment is expected to grow fastest from 2025 to 2030. Aerospace-grade fasteners are designed to meet stringent quality and performance standards required in the aerospace industry. The growth in this segment is fueled by the increasing production of aircraft and spacecraft and advancements in aerospace technology. The demand for high-strength, lightweight, and corrosion-resistant fasteners is rising, driven by the need for enhanced safety and efficiency in aerospace applications.

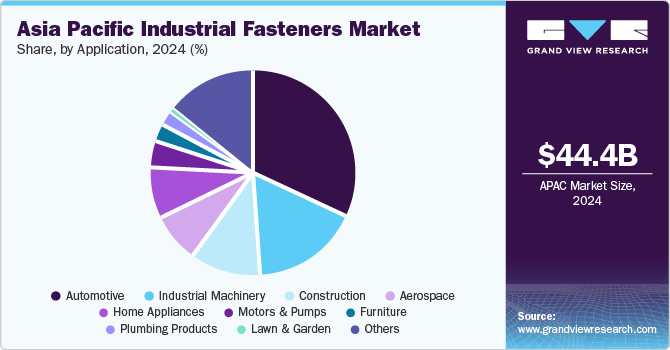

Application Insights

The automotive segment contributed the largest share of the total revenue in 2024 attributed to the continuous growth in automotive production and the increasing demand for high-quality fasteners in vehicle assembly. Fasteners are essential for ensuring the structural integrity and safety of vehicles, and the rising production of passenger cars, commercial vehicles, and electric vehicles further fuels the demand for reliable fastening solutions. The automotive industry's focus on lightweight and durable materials also contributes to the significant revenue share of this segment.

The aerospace segment is anticipated to grow at the fastest CAGR of 9.2% over the forecast period attributed to the expanding aerospace industry, driven by increasing air travel, advancements in aircraft technology, and the rising demand for commercial and military aircraft. Aerospace-grade fasteners are designed to meet stringent quality and performance standards, ensuring the safety and reliability of aircraft components. The growing investments in aerospace infrastructure and the development of new aircraft models are expected to propel the demand for high-performance fasteners, leading to the segment's robust growth.

Country Insights

China Industrial Fasteners Market Trends

China held the largest revenue share in the Asia Pacific industrial fasteners market in 2024 attributed to China's extensive manufacturing base, rapid urbanization, and significant investments in infrastructure projects. The Chinese government's initiatives, such as the Belt and Road Initiative, have further fueled the demand for industrial fasteners in the construction and manufacturing sectors.

India Industrial Fasteners Market Trends

India's industrial fasteners market is expected to grow at a CAGR of 6.1% from 2025 to 2030 driven by the country's rapid economic expansion, urbanization, and infrastructure development projects. The rising middle-class spending power, increasing disposable income, and globalization support the expansion of the industrial fasteners industry. The Make in India initiative aims to bolster local manufacturing capabilities, leading to increased demand for high-quality fasteners across various industries, including automotive and construction.

Japan Industrial Fasteners Market Trends

Japan industrial fasteners market is projected to grow steadily over the forecast period. Japan is known for its emphasis on accuracy and quality in manufacturing, which extends to the fastener industry. The country's strong automotive and electronics sectors drive the demand for high-quality fasteners. Japanese manufacturers adhere to strict quality guidelines, ensuring the reliability and robustness of their products. The need for specialized and miniature fasteners in electronics and technology further supports market growth.

South Korea Industrial Fasteners Market Trends

South Korea accounted for a substantial share of the Asia Pacific industrial fasteners market in 2024, owing to the growth of the automotive, construction, and machinery sectors. The South Korean government's focus on industrial development and technological innovation also contributes to the steady demand for industrial fasteners.

Key Asia Pacific Industrial Fasteners Company Insights

Some of the key companies in the Asia Pacific industrial fasteners market include Bossard Group, Sundram Fasteners Limited, Penn Engineering & Manufacturing Corporation, EJOT, Fontana Luigi S.p.A., and others.

-

Mentor Worldwide LLC, a subsidiary of Johnson & Johnson, is a prominent player in the industrial fasteners market. The company offers a wide range of tissue expanders, including smooth, textured, and externally threaded designs, catering to various reconstructive needs.

-

PMT Corporation specializes in manufacturing medical devices for plastic and reconstructive surgery, including extremity tissue expanders. Its product offerings include Integra and Accuspan tissue expanders.

Key Asia Pacific Industrial Fasteners Companies:

- Bossard Group

- Sundram Fasteners Limited

- Penn Engineering & Manufacturing Corporation

- EJOT

- Fontana Luigi S.p.A.

- Ochiai Co., Ltd.

- LISI S.A.

- TR Fastenings, Ltd.

- Wilhelm Böllhoff GmbH & Co. KG

- Simmonds Marshall Ltd.

Recent Developments

-

In September 2024, Gexpro Services announced the acquisition of Tech Component Resources Pte. Ltd. (TCR), a distributor of industrial components. This strategic move expands Gexpro's geographic reach, enabling us to serve existing customers better and capitalize on growth opportunities in the region. TCR's expertise in fasteners, mechanical components, and related products complements Gexpro's existing offerings.

-

In May 2024, H.B. Fuller Company completed the acquisition of ND Industries Inc., a leading manufacturer of specialty adhesives and fastener solutions. ND Industries specializes in formulating and producing diverse materials for fastening and assembly applications, serving customers across multiple industries, including automotive, electronics, and aerospace.

Asia Pacific Industrial Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 46.9 billion

Revenue forecast in 2030

USD 63.5 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, region

Country scope

U.S., India, Japan, South Korea, Malaysia, Indonesia, Thailand

Key companies profiled

Bossard Group, Sundram Fasteners Limited, Penn Engineering & Manufacturing Corporation, EJOT, Fontana Luigi S.p.A., Ochiai Co., Ltd., LISI S.A., TR Fastenings, Ltd., Wilhelm Böllhoff GmbH & Co. KG, Simmonds Marshall Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Industrial Fasteners Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific industrial fasteners market report based on raw material, product, application, and region.

-

Raw material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Externally Threaded

-

Internally Threaded

-

Non-threaded

-

Aerospace Grade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Construction

-

Industrial Machinery

-

Home Appliances

-

Lawn and Garden

-

Motors and Pumps

-

Furniture

-

Plumbing Products

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Thailand

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."