- Home

- »

- Medical Devices

- »

-

Asia Pacific Bone Grafts & Substitutes Market Report, 2030GVR Report cover

![Asia Pacific Bone Grafts & Substitutes Market Size, Share & Trends Report]()

Asia Pacific Bone Grafts & Substitutes Market Size, Share & Trends Analysis Report By Material Type (Allograft, Synthetic), By Application (Craniomaxillofacial, Dental), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-938-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

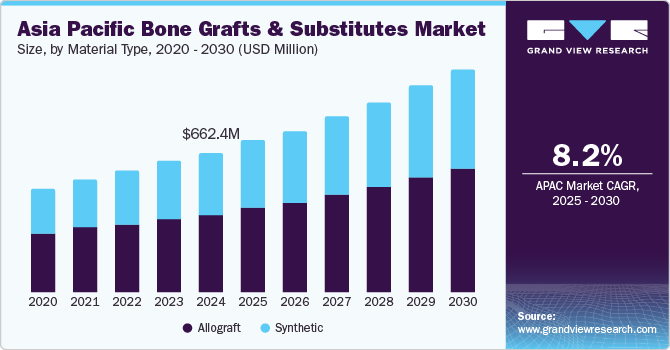

Asia Pacific bone grafts & substitutes market size was estimated at USD 662.4 million in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. The increasing prevalence of orthopedic disorders and musculoskeletal injuries, driven by an aging population and rising incidences of road accidents and sports injuries, is creating a higher demand for effective treatment solutions. There is a growing shift toward minimally invasive surgical procedures, which are preferred for benefits such as reduced recovery times and lower complication rates, further driving the adoption of advanced bone graft substitutes.

The growing prevalence of bone disorders such as osteoporosis and osteoarthritis within the aging population in the Asia Pacific region is contributing to the Asia Pacific bone grafts & substitutes industry expansion. As these conditions become more common, there is an increased need for effective treatment options, including bone grafts and substitutes. The rising incidence of spinal surgeries and orthopedic procedures needs innovative solutions supporting bone healing and regeneration. In addition, the increasing awareness among healthcare professionals about the benefits of using synthetic and biocompatible materials in bone grafting is driving demand.

In addition, government initiatives aimed at improving healthcare infrastructure in emerging economies are playing a crucial role in boosting the Asia Pacific bone grafts & substitutes industry growth. Investments in healthcare facilities and rising healthcare expenditures facilitate better access to advanced medical technologies and treatments. This environment encourages developing and distributing innovative bone graft substitutes tailored to meet specific clinical needs.

Material Type Insights

The allograft segment dominated the market with a revenue share of 57.6% in 2024, driven by its superior biological compatibility and effectiveness in promoting bone healing. Allografts from human donors offer a natural scaffold for new bone growth, making them highly effective for various orthopedic and dental applications. Due to their proven success rates and lower risk of complications compared to autografts, the increasing acceptance of allografts among surgeons and patients has further contributed to their dominance in the Asia Pacific bone grafts & substitutes industry. Moreover, advancements in processing techniques that enhance the safety and sterility of allografts have supported their appeal, leading to a growing preference for these grafts in surgical procedures.

The synthetic segment is projected to grow at the highest CAGR of 9.2% over the forecast period, which can be attributed to the rising demand for innovative and cost-effective solutions in bone grafting. Synthetic bone grafts, made from hydroxyapatite and tricalcium phosphate, provide several advantages, including consistent quality, reduced risk of disease transmission, and customizable properties tailored to specific clinical needs. Furthermore, ongoing research and development efforts to enhance synthetic materials bioactivity and mechanical properties are expected to drive their adoption in various surgical applications.

Application Insights

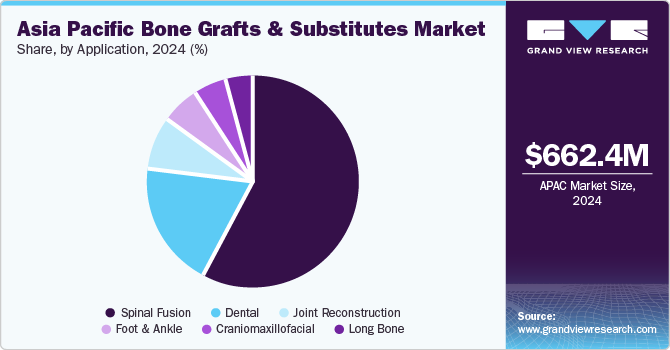

The spinal fusion segment dominated the market with the largest revenue share in 2024, driven by the growing prevalence of spinal disorders and an aging population requiring surgical interventions. Spinal fusion procedures often require effective bone grafts to promote healing and stability post-surgery. The increasing incidence of conditions such as degenerative disc disease and spinal injuries has resulted in a higher demand for spinal surgeries, thereby boosting the use of bone grafts in the Asia Pacific bone grafts & substitutes industry. In addition, advancements in surgical techniques and technologies that enhance patient outcomes encourage more healthcare facilities to adopt innovative grafting solutions for spinal procedures.

The dental segment is projected to grow at the highest CAGR over the forecast period, driven by a rising aging population and greater awareness of oral health, increasing demand for dental implants. As more individuals experience tooth loss, there is a heightened need for effective bone graft substitutes that support dental implants, ensuring successful integration and stability. In addition, advancements in dental technologies have made implant procedures more accessible and efficient, further fueling this demand. The growing popularity of cosmetic dentistry also plays a crucial role, as patients seek aesthetic solutions that enhance their smiles, thereby increasing the acceptance of dental implants as a preferred treatment option. These factors contribute to the robust growth anticipated in the dental segment of the Asia Pacific bone grafts & substitutes industry.

Key Asia Pacific Bone Grafts & Substitutes Company Insights

Some key companies operating in the market include Baxter.; Medical Device Business Services, Inc. ; Medtronic; NuVasive, Inc., and Stryker. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in Asia Pacific bone grafts & substitutes market.

-

Baxter International Inc. offers a wide range of products, including Altapore Shape Bioactive Bone Graft, specifically designed to enhance bone regeneration and healing for orthopedic and spinal applications. The company also provides synthetic grafts from biocompatible materials such as hydroxyapatite and tricalcium phosphate.

-

NuVasive, Inc. provides a range of products for the bone grafts and substitutes market, focusing on minimally invasive surgical techniques. Its key product, the COHERE Porous PEEK implant, is specifically designed for the eXtreme Lateral Interbody Fusion (XLIF) procedure, enhancing bone growth and fusion for better clinical outcomes. The company also offers various spinal implants, biologics, and surgical instruments, along with a dedicated training center in Singapore to support advancements in spine surgery.

Key Asia Pacific Bone Grafts & Substitutes Companies:

- Baxter.

- Medical Device Business Services, Inc.

- NuVasive, Inc.

- Stryker

- Medtronic

- Zimmer Biomet.

- Smith+Nephew.

- Orthofix Medical Inc.

- Wright Medical Group N.V.

- Geistlich Pharma AG

View a comprehensive list of companies in the Asia Pacific Bone Grafts & Substitutes Market

Recent Developments

-

In October 2023, Orthofix Medical Inc. announced 510(k) clearance from the FDA for its new bioactive synthetic graft, OsteoCove, designed for spine and orthopedic procedures. This graft aims to enhance bone regeneration through a unique formulation that mimics the natural bone environment, providing surgeons with a reliable option for complex orthopedic challenges.

-

In July 2020, Baxter International Inc. received FDA clearance for its Altapore Shape Bioactive Bone Graft, which is designed to improve bone growth and facilitate fusion during skeletal surgeries. This graft offers surgeons versatile, moldable options that aim to improve clinical outcomes, as evidenced by a recent clinical study showing significant reductions in patient pain and disability after spinal fusion, with its optimized porosity and proprietary technology.

Asia Pacific Bone Grafts & Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 712.6 million

Revenue forecast in 2030

USD 1.06 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Material type, application, country

Regional scope

Asia Pacific

Country scope

China, Japan, India, South Korea, Australia, and Thailand.

Key companies profiled

Baxter.; Medical Device Business Services, Inc.; Medtronic; NuVasive, Inc.; Orthofix Medical Inc.; Smith+Nephew.; Stryker; Wright Medical Group N.V.; Zimmer Biomet.; Geistlich Pharma AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Bone Grafts & Substitutes Market Report Segmentation

This report forecasts region revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific bone grafts & substitutes market report based on material type, application, and country.

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allograft

-

Demineralized Bone Matrix

-

Others

-

-

Synthetic

-

Ceramics

-

HAP

-

ß-TCP

-

α-TCP

-

bi-phasic calcium phosphates (BCP)

-

Others

-

-

Composites

-

Polymers

-

Bone Morphogenic Proteins (BMP)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Craniomaxillofacial

-

Dental

-

Foot and Ankle

-

Joint Reconstruction

-

Long Bone

-

Spinal Fusion

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Frequently Asked Questions About This Report

b. The Asia Pacific bone grafts & substitutes market size was estimated at USD 662.4 million in 2024 and is expected to reach USD 712.6 million in 2025.

b. The Asia Pacific bone grafts & substitutes market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 1.06 billion by 2030.

b. Spinal fusion dominated the Asia Pacific bone grafts & substitutes market with a share of 58.2% in 2024. This is attributable to an increased number of spinal fusion procedures in this region.

b. Some key players operating in the Asia Pacific bone grafts & substitutes market include Medtronic PLC; Nuvasive, Inc.; Orthofix Holdings, Inc.; DePuy Synthes; Baxter, Wright Medical Group N.V.; and Stryker Corp.

b. Key factors that are driving the market growth include the growing prevalence of orthopedic defects, increased number of medical tourism, and government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."