- Home

- »

- Conventional Energy

- »

-

Asia Pacific Carbon Dioxide Market Size & Trends Report 2030GVR Report cover

![Asia Pacific Carbon Dioxide Market Size, Share & Trends Report]()

Asia Pacific Carbon Dioxide Market Size, Share & Trends Analysis Report By Source (Ethyl Alcohol, Substitute Natural Gas), By Application (Food & Beverage, Medical), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-006-7

- Number of Report Pages: 112

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Energy & Power

Report Overview

The Asia Pacific carbon dioxide market size was valued at USD 2.60 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030. The market is expected to witness growth during the forecast period owing to the increasing usage of carbon dioxide for medical as well as industrial applications in emerging economies such as China and India. There has been an increased demand for carbonated beverages due to the rising disposable income of people in Southeast Asian countries, which is expected to boost the demand for food-grade carbon dioxide during the forecast period.

The availability of funding from governments across the region in the form of funds for research and development regarding carbon capture storage and utilization is expected to lead to the manufacture of carbon dioxide from carbon emissions at an economical cost, which is expected to limit carbon emissions and provide an innovative alternative to reuse the emitted carbon for industrial or any other suitable application.

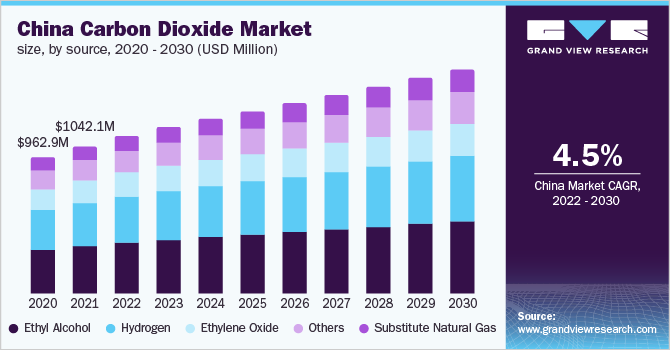

China is a major consumer of carbon dioxide in the world. Increasing greenhouse gas emissions and the growing demand from end-use industries are propelling companies in China to come up with new ways to reduce emissions and increase production to cater to its applications.

The increased demand for carbon dioxide has increased the competitive rivalry with many domestic and international players trying to capture the increasing demand. For instance, in March 2021, Guanggang Gas acquired Linde Wuhu Carbon Dioxide Company for an undisclosed amount. The acquisition included East China’s largest carbon dioxide plant, with an annual production capacity of 100,000 tons of food and industrial-grade carbon dioxide. The company also announced its plans to expand the facility and add dry ice to its product portfolio. These factors are expected to propel the growth of the market during the forecast period.

Source Insights

The ethyl alcohol segment led the market and accounted for a revenue share of over 30.0% in 2021. Carbon dioxide is obtained as a by-product in the production of ethyl alcohol through alcoholic fermentation. In addition, the combustion of ethanol leads to the release of carbon dioxide and water vapor. Carbon dioxide obtained from these processes is primarily used for food and beverage applications such as carbonation and as a chilling, cooling, and freezing agent.

Ethanol combustion is another source of carbon dioxide as this process releases water vapor and carbon dioxide. As the combustion of ethanol is particulate-free, it is a preferred source of high-purity carbon dioxide. An ethanol plant producing 50 million gallons of ethyl alcohol per year can produce approximately 150,000 MT of CO2/yr.

Substitute natural gas is expected to expand at the highest CAGR in the forecast period. Substitute natural gas, also known as synthetic natural gas, is produced from coal and is used as a substitute for natural gas. It is suitable for transmission in natural gas pipelines. Substitute natural gas is produced by thermochemical conversion in various stages, including gasification and water-gas shift reaction.

Substitute natural gas production has increased owing to restricted supply and volatility in prices of natural gas, which has led countries such as China and South Korea to construct substitute natural gas plants as an alternative to natural gas. Further, research and development activities are going on regarding the economic production of substitute natural gas to make it financially viable.

Application Insights

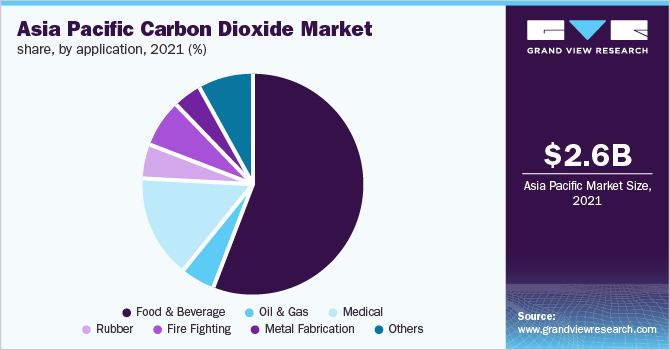

The food and beverage segment led the market and accounted for a revenue share of over 50.0% in 2021. Carbon dioxide (CO2) is used for a wide range of applications in the food & beverage industry including modified atmospheric packaging (MAP), chilling and freezing, and controlling the temperature of products during transportation and storage. It is primarily used to maintain quality and increase the shelf life of food products. It is also used to detect food quality during processing and storage.

The most common and largest application of CO2 in the beverage industry is the production of carbonated beverages. Food-grade liquid carbon dioxide is a key ingredient in carbonated drinks, which helps prevent mold growth and inhibits the growth of bacteria depending upon the concentration of carbonation. Rising demand for carbonated drinks is expected to be a significant contributor to the growth of the food & beverages segment during the forecast period.

Regional Insights

Asia dominated the market and accounted for a revenue share of more than 90.0% in 2021. China dominated the carbon dioxide market in the Asia region in 2021 owing to high growth from the end-use application industries in the country. The expected growth in carbon dioxide demand in oil recovery followed by its demand in food & beverages, medical, and other applications is anticipated to further augment the market growth in China. In addition, the rapid industrial growth in the country is likely to propel the demand for fire extinguishers in order to avoid industrial hazards and ensure compliance with government regulations on industrial safety, which is projected to propel the market growth.

The demand for carbon dioxide in Taiwan is on the rise owing to increasing industrial activity. Taiwan is a major producer of semiconductors accounting for 65% of all semiconductors manufactured. Carbon dioxide is used in these manufacturing facilities for inerting and controlling the temperature. Many companies are planning expansions in order to capitalize on their position in the market. For instance, in August 2022, TSMC announced the construction of a new semiconductor manufacturing facility in Kaohsiung, Taiwan. The new facility will produce 7 nanometers and 28-nanometer chips and is expected to begin production by 2024.

Key Companies & Market Share Insights

The market in Asia Pacific is moderately consolidated with the presence of various multinational players. This factor makes the industry highly competitive as it also requires high initial investment and R&D costs. Major companies around the world are utilizing mergers & acquisition strategies to enhance their market shares and network on a global scale. Some prominent players in the Asia Pacific carbon dioxide market include:

-

Air Liquide

-

Air Products and Chemicals, Inc.

-

Coregas

-

Cosmo Engineering Co., Ltd.

-

Linde Plc

-

Messer

-

S.S. Gas Lab Asia Pvt. Ltd.

-

Sicgil India Limited

-

Suzhou Xinglu Air Separation Plant Science and Technology Development, Ltd.

-

Taiyo Nippon Sanso Corporation

Asia Pacific Carbon Dioxide Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.81 billion

Revenue forecast in 2030

USD 4.35 billion

Growth Rate

CAGR of 5.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Region scope

Asia; Pacific

Countries scope

Taiwan; China; Philippines; Vietnam; Thailand; Malaysia; Singapore; Indonesia; India; Australia

Key companies profiled

Air Liquide; Linde Plc; Air Products and Chemicals, Inc.; Taiyo Nippon Sanso Corporation; Messer; Sicgil India Limited; Cosmo Engineering Co., Ltd.; S.S. Gas Lab Asia Pvt. Ltd.; Suzhou Xinglu Air Separation Plant Science and Technology Development, Ltd.; Coregas

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Carbon Dioxide Market Segmentation

This report forecasts revenue and volume growth at the regional and country levels. It provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the Asia Pacific carbon dioxide market report based on source, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Hydrogen

-

Ethyl Alcohol

-

Ethylene Oxide

-

Substitute Natural Gas

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Food & Beverage

-

Oil & Gas

-

Medical

-

Rubber

-

Fire Fighting

-

Metal Fabrication

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Asia

-

Taiwan

-

China

-

Philippines

-

Vietnam

-

Thailand

-

Malaysia

-

Singapore

-

Indonesia

-

India

-

-

Pacific

-

Australia

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific carbon dioxide market size was estimated at USD 2.60 billion in 2021 and is expected to reach USD 2.81 billion in 2022.

b. The Asia Pacific carbon dioxide market is expected to grow at a compound annual growth rate of 5.6% from 2022 to 2030 to reach USD 4.35 billion by 2030.

b. Asia dominated the Asia Pacific carbon dioxide market with a share of 94.14% in 2021. The increasing consumption of carbon dioxide in Asia can be attributed to the growth and expansion of its end-use industries in China. The country is a key consumer of carbon dioxide both in Asia Pacific and globally.

b. Some key players operating in the Asia Pacific carbon dioxide market include Air Liquide, Linde Plc, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, Messer, Sicgil India Limited, Cosmo Engineering Co., Ltd., S.S. Gas Lab Asia Pvt. Ltd., Suzhou Xinglu Air Separation Plant Science and Technology Development, Ltd., Coregas.

b. Key factors that are driving the market growth include increased demand for frozen foods and carbonated beverages and increasing application of CO2 in medical industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."