- Home

- »

- Medical Devices

- »

-

Asia Pacific Family Floater Health Insurance Market Report 2030GVR Report cover

![Asia Pacific Family Floater Health Insurance Market Size, Share & Trends Report]()

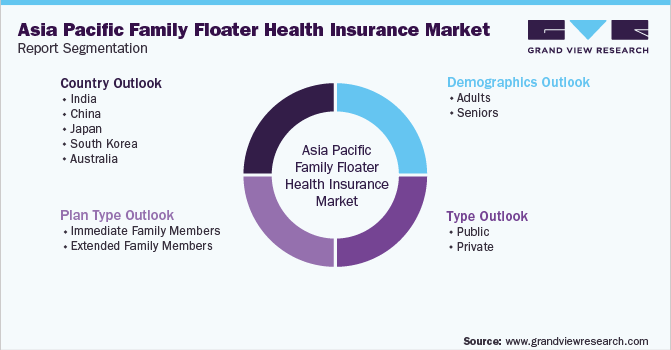

Asia Pacific Family Floater Health Insurance Market Size, Share & Trends Analysis Report By Type (Public, Private), By Demographics (Adults, Seniors), By Plan Type (Immediate, Extended Family Members), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The Asia Pacific family floater health insurance market size was valued at USD 5.64 trillion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.38% from 2023 to 2030. The increasing cost of healthcare and rising awareness are among the major factors that are leading to the rising demand for health insurance in many countries. Moreover, the introduction of new products, technologies, and marketing strategies by insurance providers to attract more customers is also leading to market growth in the region. The increasing prevalence of chronic diseases is another factor contributing to the growth of the market. Treatment of chronic diseases, such as heart disease and cancer, can be financially challenging for patients and their families.

Therefore, to avoid such a sudden burden to incur a huge amount of money for hospitals and other medical expenses, many individuals are opting for health insurance plans. According to a research study published by the National Centers for Biotechnology Information, in 2022, the proportion of elderly people aged 60 years or older with one chronic disease or more in China was 76.35%, and 37.2% of the elderly were suffering from multiple chronic conditions. In addition, families are preferring family floater health insurance plans more frequently, which is propelling the market expansion. These policies are an affordable way to cover a person’s immediate or extended family under one policy, where the money insured is split among all family members. It is therefore the best choice, especially for nuclear families.

Type Insights

The public segment dominated the industry in 2022 and accounted for the maximum share of more than 89.40% of the overall revenue due to the widespread use of government-sponsored health insurance in nations like Australia, Japan, China, and South Korea. India is also concentrating on expanding its healthcare spending by developing new programs that would protect the low-income population against various medical expenses. For instance, in September 2018, the Indian government introduced the Pradhan Mantri Jan Arogya Yojana, which aims to reach the bottom 40% of the Indian population.

However, over the predicted period, the private sector is anticipated to register the fastest CAGR from 2023 to 2030. A potential opportunity for private participants in the Asia Pacific market is being created by factors such as high co-pay requirements, medicine exclusions, and rigid plans by national health insurance. Private health insurance may also help improve the standard of medical care. Private payers need to compete for patients, so they seek out the best provider networks, ones that provide the broadest choice of cutting-edge therapies and exhibit the best results.

Plan Type Insights

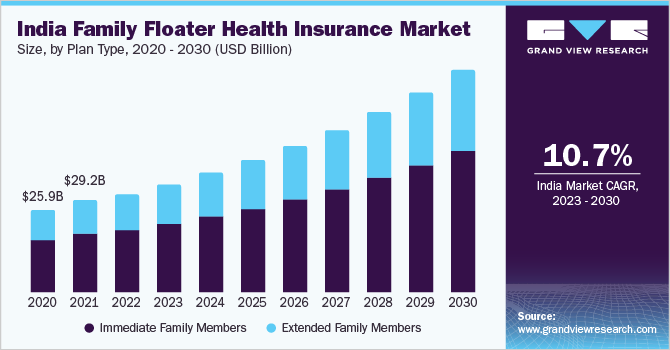

The plans that cover immediate family members accounted for the highest revenue share of more than 76.15% in 2022 due to the wide availability of family floater plans for nuclear families or immediate family members. In addition, most insurance companies do not recommend a family floater plan that includes parents aged 60 years and above, as there are higher chances that the sum insured may not be enough. In addition, including dependent parents who are over 60 years of age would also rack up the premium, as the premium is based on the oldest member of the family covered.

The extended family insurance covers parents and parents-in-law, along with the immediate family members. However, in most cases, it is advisable to purchase individual plans for senior citizens, as they are more prone to developing chronic diseases. Covering them with an individual plan is highly recommended as family floater may not be sufficient, which can lead to an increase in out-of-pocket spending.

Demographics Insights

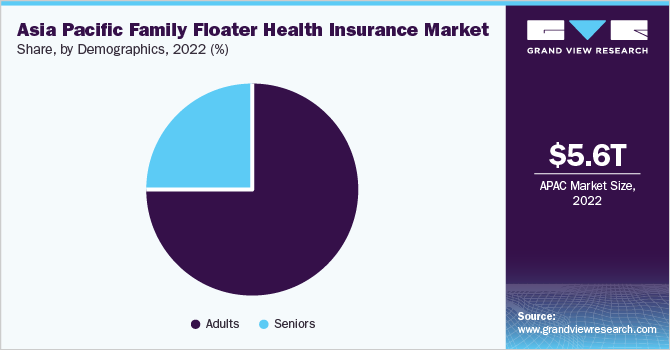

On the basis of demographics, the overall market has been further bifurcated into adults and seniors. The adult demographics segment dominated the market in 2022 and accounted for the maximum share of more than 75.39% of the overall revenue, owing to the increasing adoption of family floaters by young couples. The segment is estimated to expand further at the fastest growth rate, retaining its leading position throughout the forecast period. The family floater plan covers dependent children only up to the age of 25 years.

Therefore, the family floater plan is mainly purchased by young couples who can seek a cover for themselves and their dependent children under one umbrella at a lower premium. Senior adults may also opt for a family-floater plan. However, these plans are not very popular among senior adults. But a few senior individuals may still purchase a family floater at a higher premium cost as it will still be lower than individual insurance plans for each family member.

Country Insights

China accounted for the highest revenue share of more than 80.85% in 2022 and dominated the market as China is the second-most populated country and about 95% of its population is covered under public health insurance schemes. Despite this huge coverage, the country still represents great opportunities for private health insurance providers, in terms of improving the quality of healthcare provided in the country. Moreover, the cost of premiums in the country is very high compared to other Asian countries. According to a news article published in November 2022, China is currently the world’s second-largest insurance market and is expected to overtake the U.S. for the top spot in the next decade.

India is anticipated to register the fastest growth rate over the forecast period. Although health insurance in India has grown rapidly since 2016 at a CAGR of 20%, according to the Health Insurance Consumer Pulse Survey Published in 2020, there is further potential for growth as retail health policies cover only 3% of the total Indian population. With the huge impact that the COVID-19 pandemic had on the country, more individuals in India are opting for health insurance plans to reduce their spending on healthcare services.

Key Companies & Market Share Insights

As an attempt to broaden the industry presence and availability of products, key players are focusing on carrying out various strategies, such as partnerships and collaborations, the launch of new products, and investments in local insurance companies. In July 2021, Niva Bupa entered into a partnership with Axis Bank to offer comprehensive health insurance. Customer-centricity, product innovation, digitization, and execution will be the alliance’s main priorities, driving growth during the following stage. Some of the prominent players in the Asia Pacific family floater health insurance market include:

-

Cigna

-

BUPA

-

Now Health International

-

Aetna Inc.

-

HBF Health Ltd.

-

AXA

-

Allianz Care

-

Aviva

-

AIA Group Ltd.

-

Oracle Corp.

Asia Pacific Family Floater Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.93 trillion

Revenue forecast in 2030

USD 8.58 trillion

Growth rate

CAGR of 5.38% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/trillion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, plan type, demographics, country

Regional scope

Asia Pacific

Country scope

India; China; Japan; South Korea; Australia

Key companies profiled

Cigna; BUPA; Now Health International; Aetna Inc.; HBF Health Ltd.; AXA; Allianz Care; Aviva; AIA Group Ltd.; Oracle Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Family Floater Health Insurance Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Asia Pacific family floater health insurance market report on the basis of type, plan type, demographics, and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

Agents

-

Website

-

Aggregators

-

Bank

-

-

-

Plan Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Immediate Family Members

-

Extended Family Members

-

-

Demographics Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adults

-

Seniors

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific family floater health insurance market was estimated at USD 5.64 trillion in 2022 and is expected to reach USD 5.93 trillion in 2023.

b. The Asia Pacific family floater health insurance market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 8.58 trillion by 2030.

b. China dominated the Asia Pacific family floater health insurance market with a share of 80.88%. This is due to presence of large population adn successful penetration of public health insurance.

b. Some key players operating in the Asia Pacific family floater health insurance market include Cigna, Bupa, Now Health International, Aetna Inc., HBF Health Limited, AXA, Allianz Care, Aviva, AIA Group Limited, Oracle Corporation

b. Key factors that are driving the Asia Pacific family floater health insurance market are increasing cost of healthcare and rising awareness of health insurance and increasing prevalence of chronic diseases

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."