- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Food Service Equipment Market, Industry Report, 2030GVR Report cover

![Asia Pacific Food Service Equipment Market Size, Share & Trends Report]()

Asia Pacific Food Service Equipment Market Size, Share & Trends Analysis Report By Type (Kitchen Purpose Equipment), By End-user (Full Service Restaurant), By Country (China, India) And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-224-9

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Advanced Materials

Market Size & Trends

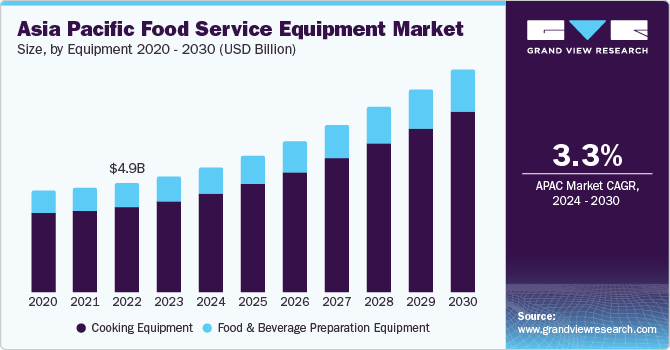

The Asia Pacific food service equipment market was valued at USD 13.1 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. This growth can be attributed to the rapid urbanization and expansion of the hospitality industry, coupled with increasing demand for ready-to-eat food. Additionally, technological advancements in food service equipment, such as the integration of IoT and AI, are enhancing operational efficiency, thereby attracting more investments in this sector. Furthermore, the rising awareness about energy-efficient and eco-friendly equipment is also expected to propel the market growth during the forecast period.

Regulations have a significant impact on the Asia Pacific food service equipment market. For instance, the EU Deforestation Regulation has been hotly debated and is expected to have a considerable effect on the food and beverage sector, including the food service equipment market. This regulation could potentially influence the sourcing and supply chain practices of businesses in the Asia Pacific region.

Another example is the increased governmental scrutiny over pre-packaged and processed food nutritional labeling and packaging. This has led to changes in the packaging requirements for food service providers, thereby influencing the demand for certain types of food service equipment.

New regulations in India related to hemp, and Singapore’s sugary beverage control policy, have also been identified as significant factors that could impact the food service equipment market. These regulations may lead to changes in the types of food and beverages served, and consequently, the types of equipment needed.

Furthermore, emerging rules around plant-based labeling in multiple countries are set to affect the food and beverage industry, including the food service equipment market. As these regulations influence the types of food products that are in demand, they can also shape the requirements for food service equipment.

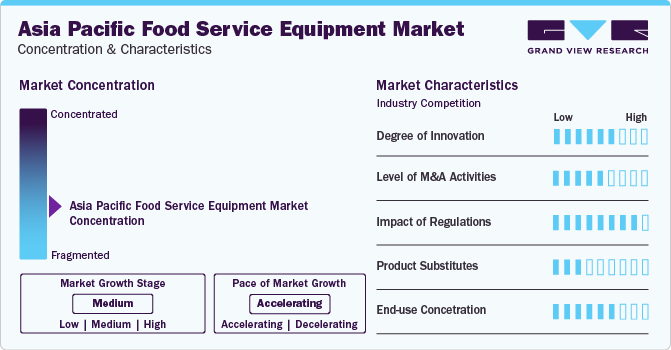

Market Concentration & Characteristics

Innovation plays a significant role in the Asia-Pacific food service equipment market. The market has evolved rapidly to meet the changing needs of clients for outfitting their kitchen spaces. Technological advancements have led to the development of a range of technologically advanced and innovative products. For instance, the emergence of smart and energy-efficient food service equipment has been a notable innovation in the industry.

In the market for food service equipment, alternatives emerge as different approaches to food processing and storage. The rising popularity of plant-based eating and alternative protein sources has prompted changes in food preparation equipment, allowing for the creation of meat alternatives that are tailored to the specific qualities of plant-based ingredients.

End-user Insights

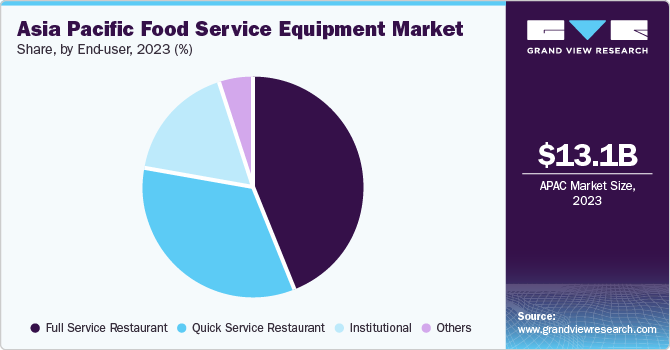

In the Asia Pacific region, full-service restaurants (FSRs) are a dominant force in the food service equipment market, boasting the largest market share at 43.6%. This dominance is driven by a surge in dine-in customers and the popularity of online food deliveries, necessitating advanced equipment for prompt order handling and quality service. The FSR segment has seen its numbers double over the last decade, offering significant opportunities for equipment manufacturers, especially in the realms of cooking equipment and refrigerators, which are essential to FSR operations.

On the other hand, quick service restaurants (QSRs) are on the rise, with the fastest growth rate in the market, projected at a CAGR of 7.2% from 2024 to 2030. This growth is fueled by rapid urbanization and improved living standards in countries like China, India, Japan, and South Korea. The shift in consumer preferences towards fast and convenient dining options, coupled with the rising demand for convenience food, propels the expansion of QSRs. These establishments face operational challenges that can be mitigated by investing in modern, efficient food service equipment, which is crucial for maintaining the speed and quality of food preparation.

Type Insights

The kitchen purpose equipment segment holds the largest market share, accounting for approximately 39.9% of the total market. These essential tools and appliances are used in commercial kitchens for food preparation, cooking, and serving. As the dining-out culture grows and urbanization continues, the demand for efficient kitchen equipment has surged. This segment is also the fastest-growing due to factors such as changing lifestyles and increased restaurant and hotel expansion.

The food holding and storing equipment segment is projected to experience the second-fastest growth with a CAGR of 7.2% from 2024 to 2030. The increasing emphasis on food safety, hygiene, and quality drives the demand for reliable food holding and storage solutions.

Country Insights

Asia Pacific dominated the global market with more than 36% market share in terms of revenue and is also expected to be the fastest-growing regional market in the forecast period.

China Food Service Equipment Market Trends

China holds the largest market share in the Asia Pacific food service equipment market, accounting for 37.5%. This dominance can be attributed to the country's robust food industry, which is driven by its large population and growing middle class. The increasing demand for fast food and casual dining, coupled with the expansion of food service chains in the country, has led to a surge in the demand for food service equipment. Furthermore, advancements in technology and the introduction of energy-efficient and innovative products are expected to propel the market growth in China.

India Food Service Equipment Market Trends

On the other hand, India is witnessing the fastest growth in the Asia Pacific food service equipment market, with a CAGR of 10% from 2024 to 2030. Rapid urbanization, changing lifestyles, and increasing disposable income in India are driving the growth of the food service industry, thereby fuelling the demand for food service equipment. Moreover, the government's initiatives to promote the hospitality sector and the increasing trend of dining out and takeaway food services among the younger population are further expected to boost the market growth in India.

Key Asia Pacific Food Service Equipment Company Insights

The Asia Pacific food service equipment market is characterized by a moderate level of market concentration. The market is dominated by several key players, including Illinois Tool Works Inc., Rational AG, and Fujimak Corporation.

-

Illinois Tool Works Inc. (ITW) is a diversified manufacturer of specialized industrial equipment, consumables, and related service businesses. In the context of the Asia Pacific food service equipment market, ITW has established a strong presence through its wide range of products that cater to the needs of the food service industry.

-

Rational AG is renowned for its innovative cooking appliances that are a staple in commercial kitchens around the world. In the Asia Pacific region, Rational AG has made significant inroads by offering technologically advanced kitchen solutions that meet the diverse culinary needs of this dynamic market.

Key Asia Pacific Food Service Equipment Companies:

- Illinois Tool Works Inc.

- Rational AG

- Fujimak Corporation

- AB Electrolux

- Manitowac Company

- Hobart Corporation

- Duke Manufacturing Co. Inc.

- Sia Haut

- Town Food Service Equipment Co.

- Haier Group

Recent Developments

-

In December 2023, Haier acquired the global commercial refrigeration business of Carrier Global. The acquisition will help Haier boost its presence to food retail refrigeration and cold storage.

-

In August 2023, Rational announced a new product called the iHexagon. This product is a combination of convection, steam, and microwave technology. It will be soon available in Asian markets, extending the company’s portfolio.

-

In February 2024, Electrolux announced that the rumors of potentially closing its Asia Pacific operation were not true. Electrolux emphasized that Singapore's regional headquarters will remain a very important hub for the continued growth of its business in the Asia Pacific.

Asia Pacific Food Service Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.9 billion

Revenue forecast in 2030

USD 22.7 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, end-user, country

Regional scope

Asia Pacific

Country scope

China; India; Japan; Australia; South Korea

Key companies profiled

Illinois Tool Works Inc.; Rational AG; Fujimark Corporation; AB Electrolux; Manitowac Company; Hobart Corporation; Duke Manufacturing Co. Inc.; Sia Haut; Town Food Service Equipment Co.; Haier Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Food Service Equipment Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific food service equipment market report based on type, end-user, and country:

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Kitchen Purpose Equipment

-

Cooking Equipment

-

Food & Beverage Preparation Equipment

-

-

Refrigeration Equipment

-

Ware Washing Equipment

-

Food Holding & Storing Equipment

-

Others

-

-

End-user Outlook (Revenue, USD Billion; 2018 - 2030)

-

Full Service Restaurant (FSR)

-

Quick Service Restaurant (QSR)

-

Institutional

-

Others

-

-

Country Outlook (Revenue, USD Billion; 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific food service equipment market size was estimated at USD 13.1 billion in 2023 and is expected to be USD 13.9 billion in 2024.

b. The Asia Pacific food service equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 22.7 billion by 2030.

b. The full-service restaurants (FSR) segment dominated the Asia Pacific food service equipment market with a revenue share of 43.6% in 2023, on account of several factors including the prevalence of these establishments in the Asia Pacific, as well as the comprehensive equipment needs that come with offering full table service.

b. Some of the key players operating in the Asia Pacific food service equipment market include Electrolux; Dover Corporation; Ali Group; Alto-Shaam, Inc.; Cambro Manufacturing Co. Inc.; Castle Stove; Duke Manufacturing Co. Inc.; Illinois Tool Works Inc.; Darden Restaurants, Inc.; Haier Group

b. Key factors that are driving the Asia Pacific food service equipment market growth include the rapid expansion of the food service industry, driven by changing consumer lifestyles and a growing preference for dining out or takeaway food, which is also boosting the demand for advanced food service equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."