- Home

- »

- Medical Devices

- »

-

Asia Pacific Group Health Insurance Market Size Report, 2030GVR Report cover

![Asia Pacific Group Health Insurance Market Size, Share & Trends Report]()

Asia Pacific Group Health Insurance Market Size, Share & Trends Analysis Report By Firm Size (Large Firm, Small Firm), By Sales Channel (Agents, Websites, Banks), By Country (Australia, India, China), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

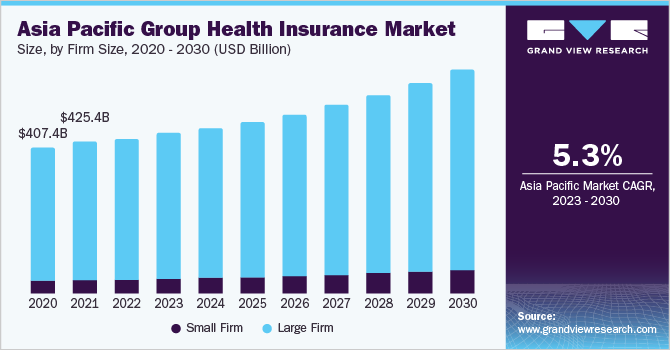

The Asia Pacific group health insurance market size was estimated at USD 437.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. Businesses, particularly small- and medium-sized organizations, are encouraging the adoption of group health plans in the Asia Pacific region. Furthermore, rising healthcare costs have made the group health insurance an attractive option for employers recruiting and retaining talented employees. Group health plans benefit employers and employees by providing access to more affordable healthcare and increasing productivity and job satisfaction.

Governments of Asia Pacific countries, such as Australia, are incentivizing businesses to offer group health insurance by providing a tax rebate (8.5%-33.9%, depending on age and income) and a Medicare Levy surcharge (1%-1.5%) for earners above AUD 90,000 (singles) and AUD 180,000 (families). These rising government initiatives are anticipated to boost market growth over the forecast period. In 2020, the COVID-19 pandemic had a limited impact on the market due to decreased total employment. Furthermore, in countries, such as South Korea, there is no clear evidence that unemployment due to COVID-19 has directly impacted overall private health insurance coverage.

In addition, an article published in January 2021 in Elsevier, titled “Implementation of Universal Health Coverage by South Korea During the COVID-19 Pandemic”, indicates that South Korea has a national health insurance system that covers all citizens and residents; thus, access to health insurance is not as dependent on employment as in other countries. However, an article published in May 2021 on the P4H Web portal suggests that healthcare utilization has decreased during the pandemic in South Korea, potentially affecting the private health insurance industry to some extent.Furthermore, a large pool of the senior population in the Asia Pacific region contributes to the rising demand for health insurance, including group health insurance.

According to a July 2022 article by the United Nations Economic and Social Commission for Asia and the Pacific, this region is aging faster than any other in the world, with 630 million people aged 60 years and above representing 60% of the world’s geriatric population. By 2050, this number is projected to reach 1.3 billion. Furthermore, employers are likely to provide health insurance to senior employees to cover the rising costs of medical care due to their increased risk of developing chronic diseases, such as obesity, heart disease, and diabetes. This rising disease risk gives health insurance providers special opportunities as Asian citizens grow older and more overweight.

Firm Size Insights

On the basis of firm sizes, the market is segmented into large (employee size greater than 200) and small (with less than 199 employees). In 2022, the large firms segmentaccounted for the largestshare of 90.71% and is projected to remain dominant throughout the forecast period. Publicly funded health insurance is frequently insufficient to pay out-of-pocket charges, such as dental, paramedical, eye, and prescription drug prices. As a result, many people rely on employer-provided or individual health insurance. Furthermore, due to government initiatives, the rising acceptance of group health insurance by major businesses, including government and private establishments, is fueling market expansion.

For instance, in response to the COVID-19 pandemic, the Insurance Regulatory and Development Authority of India (IRDAI) has mandated that all industrial and commercial businesses provide complete group health insurance coverage to their workforces. In addition, group health insurance was previously only offered to employees of certain companies and governments, now it is available to any institution in India that meets the set eligibility criteria.The small firm category in the Asia Pacific region is bifurcated into fully insured plans and self-funded or level-funded plans. Level-funded plans are projected to experience significant growth in the near future as they offer cost savings and flexibility to small- and medium-sized businesses.

These plans are generally tailored for groups of 10-99 employees and offer an expected monthly premium that combines a fixed cost with a claims fund, allowing employers to take advantage of the benefits of self-insurance, such as reduced costs and increased control over plan design, while still having some protection against high claims.An example of a level-funded plan in the Asia Pacific region is the Allianz Care Asia Pacific Corporate plan. This plan is designed for small to medium-sized businesses in the region and offers a range of benefits, including inpatient and outpatient coverage, maternity care, and emergency medical evacuation.

Sales Channel Insights

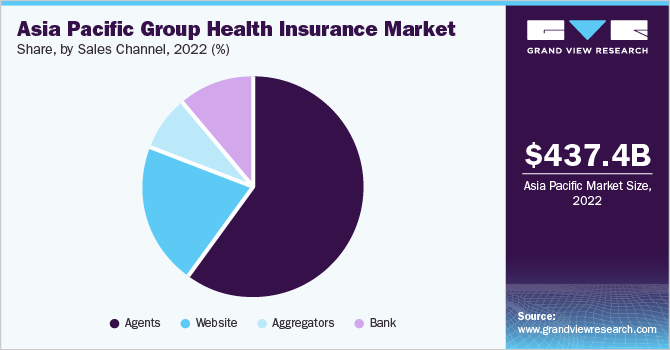

The Asia Pacific insurance industry, which includes group health insurance, is large and diverse, with differences between countries in regulation, client preferences, and insurance product offers. As a result, the sales channels utilized for group health insurance vary depending on the distinct market and the expectations of the market’s employers and employees. The agents’ segment held the largest revenue share of 59.27% in 2022. This is due to the fact that agents primarily assist clients in understanding insurance options, selecting the best plan for their needs, and navigating the claims process.

Furthermore, agents can build strong relationships with clients and offer continuous assistance and advocacy. This can aid in the development of client trust and loyalty, which is very crucial in the health insurance sector. However, insurers are increasingly leveraging digital platforms to reach customers and offer innovative products and services, fueling the growth of the website segment. This could potentially have a significant impact on the distribution of insurance products in the future.

Country Insights

China held the largest share of 53.81% of the market in 2022 due to its strong economy, demand for insurance, high levels of awareness & government investment, and technological advances. A survey by Oliver Wyman revealed that more than 60% of non-policyholders intend to purchase health insurance, indicating the potential for increased uptake of group health insurance. Furthermore, it is anticipated that the country will remain dominant over the forecast period, due to the Chinese government’s initiatives to expand coverage and improve the healthcare system.

These include Huiminbao, a low-cost inclusive supplementary medical insurance plan, raising awareness about insurance among the public. These government initiatives would support overall health insurance market growth, including group and individual health insurance.India is anticipated to witness the fastest growth rate of over 9% from 2023 to 2030. This is due to an increase in the adoption of health insurance in India, further supported by the COVID-19 pandemic. To improve the uptake of health insurance, insurers in India need to invest in breakthrough initiatives, such as digital insurance services, which would drive market growth over the forecast.

Key Companies & Market Share Insights

Major competitors are adopting strategic initiatives, such as improving service offerings through product portfolio improvements, as well as exploring acquisitions and alliances, to increase their client base and get a larger portion of the overall market. As a result, the APAC health insurance market, including group health insurance, is becoming increasingly competitive.For instance, in September 2017, NIB Holdings Ltd. entered into a strategic agreement to purchase Grand United Corporate Health Ltd. (GU Health), a specialized corporate group health insurer in Australia. GU Health looks after more than 34,000 policyholders & 260 corporate customers, allowing NIB to broaden its product range & customer base, thus improving its revenue share.

Furthermore, strategic mergers in the market are expected to consolidate the health insurance sector, enabling providers to widen their product reach. Moreover, insurers are influencing client behavior to lower risk to remain competitive. Influencing client behavior involves providing incentives and advice through a business model that uses data to provide risk coaches. For instance, AIA Vitality, Prudential Pulse, and Manulife Move are companies whose health-focused apps reward clients for leading active lifestyles. Some of the prominent players in the Asia Pacific group health insurance market include:

-

BUPA

-

NIB Holdings Ltd.

-

AIA Group Ltd.

-

Kunlun Health

-

Ping An Insurance (Group) Company of China, Ltd. (Ping An Health)

-

Aetna Inc.

-

CIGNA (Asia Pacific Businesses Acquired by Chubb)

-

Now Health International

-

Bajaj Allianz Group Health Insurance

-

Bharti AXA Group Health Insurance

Asia Pacific Group Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 452.0 billion

Revenue forecast in 2030

USD 649.5 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Firm size, sales channel, region

Country scope

India; China; Japan; South Korea; Australia

Key companies profiled

BUPA; CIGNA (Asia Pacific Businesses Acquired by Chubb); NIB Holdings Ltd.; AIA Group Ltd.; Kunlun Health; Ping An Insurance (Group) Company of China, Ltd. (Ping An Health); Aetna Inc.; Now Health International; Bajaj Allianz Group Health Insurance; Bharti AXA Group Health Insurance

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Group Health Insurance Market Report Segmentation

This report forecasts revenue growth at regional and country levelsand provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Asia Pacific group health insurance market report on the basis of firm size, sales channel, and country:

-

Firm Size Outlook (Revenue, Billion, 2018 - 2030)

-

Small Firm

-

Self-funded or Level-funded Plan

-

Fully Insured

-

-

Large Firm

-

-

Sales Channel Outlook (Revenue, Billion, 2018 - 2030)

-

Agents

-

Website

-

Aggregators

-

Bank

-

-

Country Outlook (Revenue, Billion, 2018 - 2030)

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific group health insurance market size was estimated at USD 437.4 billion in 2022 and is expected to reach USD 452.0 billion in 2023.

b. The Asia Pacific group health insurance market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 649.5 billion by 2030.

b. China dominated the Asia Pacific group health insurance market with a share of 53.8% in 2022. This is attributable to its strong economy, growing demand for insurance, and high levels of government investment, awareness, and technological advances.

b. Some key players operating in the Asia Pacific group health insurance market include BUPA; CIGNA (ASIA PACIFIC BUSNESSES ACQUIRED BY CHUBB); NIB HOLDINGS LIMITED; AIA GROUP LIMITED; KUNLUN HEALTH; PING AN INSURANCE (GROUP) COMPANY OF CHINA ,LTD. (PING AN HEALTH); AETNA INC.; NOW HEALTH INTERNATIONAL; BAJAJ ALLIANZ GROUP HEALTH INSURANCE; BHARTI AXA GROUP HEALTH INSURANCE.

b. Key factors that are driving the market growth include increasing adoption of group health insurance, increasing government initiatives, and growing awareness of overall health insurance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."