- Home

- »

- Homecare & Decor

- »

-

Asia Pacific MICE Market Size, Share, Industry Report, 2030GVR Report cover

![Asia Pacific MICE Market Size, Share & Trends Report]()

Asia Pacific MICE Market Size, Share & Trends Analysis Report By Event Type (Meetings, Incentives, Conferences, Events), By Country (China, India, Japan, Australia, South Korea), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-221-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Asia Pacific MICE Market Size & Trends

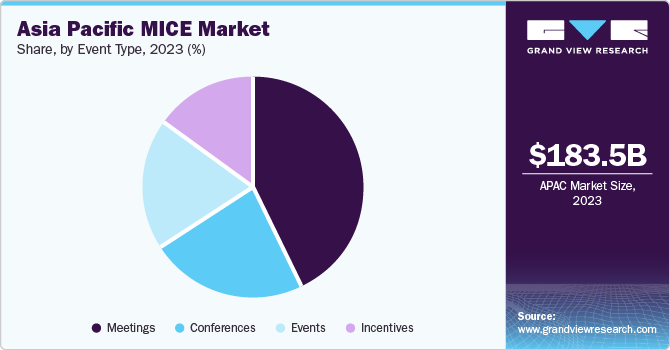

The Asia Pacific MICE market size was estimated at USD 183.47 billion in 2023 and is expected to grow at a CAGR of 10.0% from 2024 to 2030. The market penetration of meetings, incentives, conferences, and exhibitions (MICE) has increased as more businesses choose to implement a mixed work culture. The MICE sector is also being driven by an increase in business travelers for corporate events and exhibitions, as well as by elements like employee engagement. Employee engagement is a crucial component that all organizations take into account since it helps them to inspire and develop their workforce.

The Asia Pacific MICE market held over 22.90% of the global MICE market revenue in 2023. One of the world's fastest-developing regions is Asia Pacific, and the rise of the MICE industry has the potential to greatly accelerate intellectual advancement, interregional cooperation, and economic growth. The aforementioned activities have significantly increased as a result of the corporate industries' expansion, the SMEs' quick ascent, and the globalization of business. In addition to the rise in business travel, other factors contributing to the market's expansion include the shifting travel preferences of business travelers toward leisure travel, growing urbanization, and rising disposable incomes.

However, industry growth is constrained by the high expense of MICE events and the volatility of geopolitical conditions. Investments in infrastructure development and technology advancements are probably going to open up lucrative opportunities for market growth.

Furthermore, the growth of the travel and tourism industry has a big impact on the expansion of the MICE market in Asia Pacific. For example, the World Tourism Organization reports that in the first nine months of 2022, international arrivals in Asia Pacific more than tripled (+230%), a reflection of the opening of numerous locations, including Japan at the end of September. This is anticipated to fuel market expansion.

In the MICE market for Asia Pacific, the meetings category had a substantial market share contribution. Favorable economic changes, better infrastructure, more tourists, and the internationalization of Asian companies are accelerating segmental expansion.

Market Concentration & Characteristics

The MICE market is quite competitive because there are many companies with a global presence, great brand awareness, and wide distribution networks. The market is expected to prioritize innovation while investing more in research and development. Businesses looking to expand their geographic reach are expected to increase the number of mergers and acquisitions during the projected period.

Because customers' needs vary, companies in this industry have been emphasizing the idea of service differentiation. Over the course of the projection period, one of the main factors luring new players is anticipated to be the growing popularity of incentive and leisure travel.

Additionally, businesses can concentrate on partnerships and sponsorships, which greatly aid in identifying the proper target market. By promoting pertinent images via social media, client recommendations, and trade show participation, businesses can present themselves as the ones who arrange meetings, conferences, and exhibitions. This will enable them to engage with the appropriate customer base.Companies can also target the growing trend of sustainable events to break into the MICE sector. Moreover, a growing trend of customization and on-demand setting and décor in accordance with event themes is providing new market entrants with a substantial economic opportunity.

Event Type Insights

The meetings event type accounted for the market share 40.8% in 2023. The rise in business events taking place globally is driving the need for meetings in the industry. Among the formats are general meetings, management meetings, shareholder meetings, etc. The increasing popularity of regional attractions as well as tier cities with lower population density is another factor driving the need for meetings in these places. For instance, several governments offer financial support to encourage business travel and events.

The incentives segment is predicted to increase at the fastest rate during the projection period. The growing demand from millennials for unique travel experiences is propelling the incentive travel sector. Companies give travel rewards, sometimes referred to as incentives, to their teams, partners, affiliates, and workers to uplift and support them. The increasing desire for travel among millennials is placing pressure on companies to choose interesting and easily accessible holiday destinations. Furthermore, the increasing trend of businesses providing customized packages is contributing to the growth of leisure travel.

Country Insights

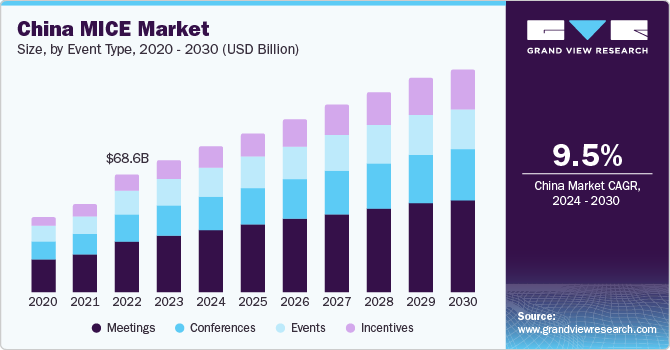

China MICE Market Trends

Market expansion is being driven by rising infrastructure development expenditures in China. For example, a destination development analysis by Pacific World predicts that the Belt and Road Initiative (BRI) and Made in China 2025, which seek to establish China as the global leader in high technology, will contribute to an increase in corporate events.

India MICE Market Trends

In India, MICE tourism is rising dramatically. It helps the economy in many ways, such as by creating new business opportunities, disseminating information, providing training, and enhancing skills. MICE locations are essential to the expansion of the sector. The central and state governments of India considerably facilitate travel to MICE locations. While the Central Government will be in charge of promoting India in international markets, developing aviation infrastructure, liberalizing the VISA regime, and other things, the State Governments are tasked with providing last-mile connectivity, local civic infrastructure & services, and facilitating core MICE infrastructure. Over the course of the projected period, these factors are anticipated to boost market expansion.

Japan MICE Market Trends

The MICE market will benefit from the rising number of visitors to Japan. For example, the number of tourists arriving in Japan climbed from 934,500 in November 2022 to 1,370,000 in December, according to the Japan National Tourist Organization. Furthermore, as per WorldData.info, Japan's tourism industry generated about USD 11.40 billion in income in 2020. This amounts to about 35 percent of all international tourism receipts in East Asia and 0.23 percent of the nation's GDP.

In 2021, the conference sector accounted for a sizeable portion of the MICE market in Japan. Over the course of the projection period, the country's growing conference scene is anticipated to support the MICE industry. 29 international conferences were place in Japan in 2021, with seven of those taking place in October and November, according to Conference Index. The COVID-19 outbreak in Japan that year nearly put an end to international conferences.

Key Asia Pacific MICE Company Insights

Both recently established and well-known firms populate the market. Many large players are prioritizing mergers and acquisitions above expansion in order to compete with one another. For instance: BCD Travel Ventura Spa, a dependable Italian partner, bought the business travel, meetings, and events services.

Key Asia Pacific MICE Companies:

- Global Air-American Express Travel Services (Global Business Travel Group, Inc.)

- CWT Meetings & Events

- BCD Meetings & Events

- Maritz

- Conference Care

- ATPI Ltd.

- FCM Meetings & Events

- Global Cynergies, LLC

- Capita plc

- AVIAREPS AG

Recent Developments

-

In August 2022, by adding two new offices in Africa, AVIAREPS expands its worldwide footprint to 65 operations across 58 countries.

-

In February 2020, BCD Travel Ventura Spa, its long-time Milan-based partner in Italy, has acquired the business travel and meetings and also events operations.

Asia Pacific MICE Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 200.72 billion

Revenue forecast in 2030

USD 355.73 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Actuals

2018 - 2022

Forecast Period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event type, country

Regional scope

Asia Pacific

Country scope

China; India; Japan; Australia; South Korea

Key companies profiled

Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; AVIAREPS AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific MICE Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific MICE market report based on event type, and country:

-

Event Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Meetings

-

Incentives

-

Conferences

-

Events

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific MICE market is expected to grow at a compound annual growth rate of 10.0% from 2024 to 2030 to reach USD 355.73 billion by 2030.

b. The Asia Pacific MICE market was estimated at USD 183.47 billion in 2023 and is expected to reach USD 200.72 billion in 2024.

b. China dominated the Asia Pacific MICE market with a share of around 26.7% in 2023. Market expansion is being driven by rising infrastructure development expenditures in China.

b. Some of the key players operating in the Asia Pacific MICE market include Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; AVIAREPS AG

b. The expansion of businesses, communities, and destinations is positively impacted by the size and growth of the MICE market in the Asia Pacific region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."