- Home

- »

- Specialty Polymers

- »

-

Asia Pacific Thermoplastic Elastomers Market, Report, 2030GVR Report cover

![Asia Pacific Thermoplastic Elastomers Market Size, Share & Trends Report]()

Asia Pacific Thermoplastic Elastomers Market Size, Share & Trends Analysis Report By Material (Poly Styrenes, Poly Olefins, Poly Ether Imides, Poly Urethanes), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-625-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

Asia Pacific thermoplastic elastomers market size was valued at USD 8.76 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. The growing need for lightweight, durable, and cost-effective materials in various industries, including automotive, construction, and consumer goods has triggered the need for thermoplastic elastomers. The expanding construction activities and infrastructural developments in the region are anticipated to contribute to the market growth. In addition, stringent environmental regulations and the push for sustainable solutions accelerate the adoption of TPEs.

Advancements in manufacturing technologies are also propelling market growth. New processing techniques, such as injection molding and extrusion have improved the TPE quality and production efficiency. This has enabled manufacturers to meet the increasing demand for better matching high-performance products and controlling manufacturing costs. In addition, sustainable bio-based TPEs, which use renewable resources, cater to sustainability goals.

Another major factor is the growing electronics and electrical industry in Asia Pacific. The consumer electronics market is booming driven by rising disposable income and technological advancements, materials that offer superior flexibility, heat resistance, and electrical insulation properties - attributes that TPEs provide. Furthermore, the medical sector's expansion, fueled by increasing healthcare expenditure and advancements in medical device technologies is anticipated to drive the demand for TPEs. These materials are used in medical applications for their biocompatibility, sterilization, and versatility in product design, further propelling their adoption in the region.

Material Insights

Poly styrenes dominated the market and accounted for a share of 38.0% in 2023 owing to polystyrene-based TPE which provides a cost-effective balance of elasticity, strength, and processability, making it suitable for various applications. In addition, the growing regional automotive industry is driving demand for lightweight and durable, polystyrene-based TPE. Furthermore, increasing investments in infrastructure and the expanding electronics industry contribute to the industrial adoption of these materials.

Poly esters are expected to register a fast-growing CAGR of 9.5% during the forecast period. This is due to poly esters offering mechanical properties such as tensile strength and flexibility for automobiles and industries. Additionally, polyesters are green, eco-friendly, and recyclable products with minimal environmental influence. The technologies used in polyester production boost their performance which generates end use products that are priced reasonably.

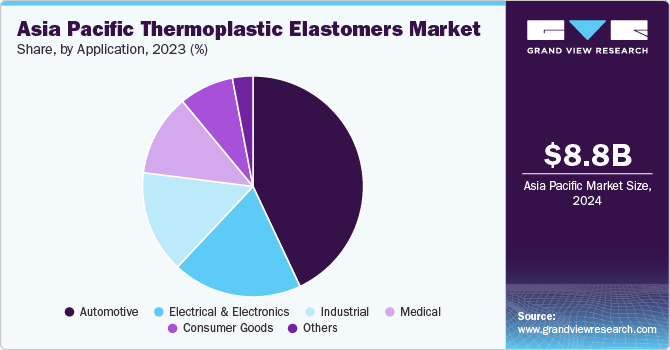

Application Insights

The automotive segment dominated the market in 2023 based on the demand for advanced materials and well-developed processes for vehicle production. In addition, the growing interest in thermoplastic elastomers towards developing lightweight vehicles due to fuel efficiency and emission standards is anticipated to drive the market growth. Furthermore, the adoption of electric vehicles has also increased the demand for thermosetting plastics because electric vehicles need superior quality material for improving durability and energy efficiency.

The medical segment is projected to grow at a CAGR of 9.5% over the forecast period due to the increasing healthcare expenditure in the region and the growing medical device industry. In addition, the thermoplastic elastomers in medical applications such as tubing, catheters, and medical bags are anticipated to drive the market growth. Furthermore, the innovation of new medical technologies and increasing trends related to patient care and comfort further propel the demand for thermoplastic elastomers in the medical segment.

Country Insights

Asia Pacific Thermoplastic Elastomers Market Trends

Asia Pacific thermoplastic elastomers market is anticipated to witness significant growth over the forecast period due to the rapid industrialization and urbanization, which are driving demand for TPEs in automotive, construction, and consumer goods. In addition, the awareness of sustainability and commitment to legal requirements of environmental standards is pushing the use of TPE eco-friendly materials. Furthermore, there is an increasing vehicle production in the region with a constant need for better-performing materials such as TPEs. Furthermore, the development of manufacturing technologies and the growth of the medical device segments that accept biocompatible and diverse materials are further propelling the market.

The China thermoplastic elastomers market dominated the Asia Pacific market with a share of 28.9% in 2023. China has a comprehensive manufacturing industrial sector and robust industrial facilities that contribute to the high product demand in many spheres, including the automotive industry, electronics, and construction. Additionally, stringent government policies on environmental management have supported TPEs, which are eco-friendly, and easily recyclable, with a lower environmental impact.

Key Asia Pacific Thermoplastic Elastomers Company Insights

Some key companies in the Asia Pacific thermoplastic elastomers market include BASF SE, Bayer MaterialScience LLC, China Petroleum & Chemical Corporation, Huntsman Corporation, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are undertaking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Arkema S.A. is a French multinational company that produces chemicals and advanced materials. It offers a wide range of products in its three main segments including high-performance materials, industrial specialties, and coating solutions. These include polymers, adhesives, and chemical specialties used in various industries such as consumer goods, electronics, and automotive.

-

Avient Corporation is a global provider of specialty polymer products, pigments, and additive solutions. The company’s diverse portfolio includes high-performance materials, sustainable solutions, and custom formulations for different industries, such as healthcare, packaging, consumer goods, and automotive.

Key Asia Pacific Thermoplastic Elastomers Companies:

- Arkema S.A.

- BASF SE

- Bayer MaterialScience LLC

- China Petroleum & Chemical Corporation

- Huntsman Corporation

- Kraton Polymers LLC

- LG Chem

- LyondellBasell Industries N.V.

- Teknor Apex

- Avient Corporation

- Nippon Polyurethane Industry Co. Ltd

Recent Developments

-

In March 2024, Hexcel achieved a significant milestone in collaboration with Arkema by completing the first aeronautical structure made from thermoplastic composites. This achievement demonstrates their ability to create materials such as HexPly thermoplastic tapes that use Arkema’s Kepstan PEKK resin and Hexcel’s HexTow carbon fibers. The project was initiated under HAICoPAS and its goal is to improve aerospace item design and manufacturing and to focus on lifecycle cost and efficiency over traditional metallic materials.

-

In February 2023, Avient launched Resound REC thermoplastic elastomers that use recycled materials from post-consumer recycled polycarbonate and ABS. The new materials are developed for overmolding, as it enhances manufacturing sustainability since recycled plastics are used in their production. Avient aims to cater to the growing demand for environmentally friendly solutions in industries requiring durable, flexible materials for overmolding applications.

Asia Pacific Thermoplastic Elastomers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.43 billion

Revenue forecast in 2030

USD 15.92 billion

Growth rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, country

Regional scope

Asia Pacific

Country scope

China, India, Japan, Australia, South Korea, Thailand, Indonesia

Key companies profiled

Arkema S.A., BASF SE, Bayer MaterialScience LLC, China Petroleum & Chemical Corporation, Huntsman Corporation, Kraton Polymers LLC, LG Chem, LyondellBasell Industries N.V., Teknor Apex, Avient Corporation, Nippon Polyurethane Industry Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Thermoplastic Elastomers Market Report Segmentation

This report forecasts revenue growth at regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific thermoplastic elastomers market report based on material, application, and country:

-

Material Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Poly Styrenes

-

Poly Olefins

-

Poly Ether Imides

-

Poly Urethanes

-

Poly Esters

-

Poly Amides

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Industrial

-

Medical

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."