- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Asia Pacific Vapor Deposition Equipment Market, Industry Report 2030GVR Report cover

![Asia Pacific Vapor Deposition Equipment Market Size, Share & Trends Report]()

Asia Pacific Vapor Deposition Equipment Market Size, Share & Trends Analysis Report By Technology (PVD, CVD), By Application (Microelectronics, Medical Equipment), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-602-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

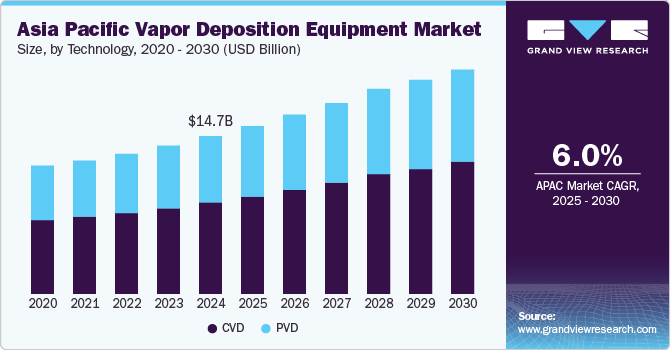

The Asia Pacific vapor deposition equipment market size was estimated at USD 14.67 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. Market growth worldwide is driven by the rapid expansion of the semiconductor manufacturing sector in key countries such as China, South Korea, and Taiwan. This region has emerged as a global hub for semiconductor production, with increasing investments in advanced manufacturing technologies. As a result, there is a substantial surge in demand for vapor deposition equipment, which is fundamental for the fabrication of microelectronics and advanced electronic devices. The ongoing quest for miniaturization and enhanced performance in electronic components is further propelling the adoption of this equipment.

Furthermore, the increasing emphasis on renewable energy, particularly solar power, is driving demand for advanced vapor deposition technologies. As investments in solar infrastructure rise, the necessity for high-quality solar products has escalated. Countries such as China, with leading firms employing chemical vapor deposition (CVD) techniques, are advancing efficiency in solar cell production while supporting national renewable energy goals.

Advancements in the healthcare sector also play a critical role in driving the vapor deposition equipment market. Rising disposable incomes and heightened health awareness have led to greater investments in medical devices, which increasingly utilize sophisticated manufacturing processes, including vapor deposition for wear-resistant coatings. These technological enhancements improve the functionality and longevity of medical equipment, thereby addressing critical healthcare needs. As the healthcare sector evolves, the demand for high-quality, reliable medical devices is expected to escalate further.

Lastly, continued technological innovations in vapor deposition techniques, such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), enhance product performance and expand their applications across various industries. The development of more efficient and versatile deposition methods not only improves manufacturing processes but also increases the competitiveness of vapor-deposited products. Moreover, government initiatives that support domestic manufacturing capabilities create a conducive environment for market growth. As the Asia Pacific region recovers from the pandemic, driven by vaccine rollouts and revitalized economic activity, the demand for vapor deposition solutions is anticipated to witness significant growth.

Technology Insights

CVD led the market with a revenue share of 58.1% in 2024, driven by China and South Korea’s rising dominance in microelectronic production, relying on chemical vapor deposition (CVD) for high-performance component manufacturing. The emphasis on renewable energy, especially in solar panel production, drives the demand for innovative vapor deposition solutions across various sectors, supported by substantial investments in R&D.

PVD is expected to register significant growth over the forecast period. The region’s robust manufacturing infrastructure drives the demand for PVD coatings to improve component durability and performance. Furthermore, the emphasis on lightweight materials and enhanced efficiency in automotive production accelerates PVD adoption, while advancements such as magnetron sputtering provide high-quality coatings for diverse applications, including medical devices and solar panels.

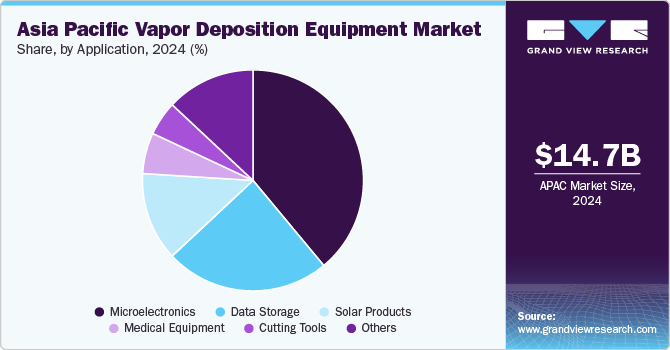

Application Insights

The microelectronics segment dominated the market and accounted for a share of 38.6% in 2024, driven by the swift expansion of semiconductor manufacturing and the rising demand for advanced electronic devices. Regional investments in microelectronics support technological advancements in AI, IoT, and 5G. Government initiatives such as India’s Semicon India Program and China’s "Made in China 2025" significantly strengthen investments, driving overall market growth.

Medical equipment is projected to grow at the fastest CAGR of 7.1% over the forecast period. Vapor deposition technologies deliver wear-resistant and biocompatible coatings crucial for enhancing the performance and durability of medical devices and surgical instruments. The increasing demand for advanced medical solutions, alongside rising healthcare expenditures in nations such as China and India, further propels this requirement, emphasizing the need for high-quality coatings.

Country Insights

China Vapor Deposition Equipment Market Trends

The China vapor deposition equipment market dominated the global market, with a revenue share of 44.1% in 2024, driven by significant investments in microelectronics and renewable energy. Initiatives such as "Made in China 2025" foster innovation and manufacturing capabilities, while the increasing demand for high-quality coatings in automotive and solar applications further solidifies China’s leadership in the vapor deposition market.

India Vapor Deposition Equipment Market Trends

The India vapor deposition equipment market is expected to register the fastest CAGR of 6.5% in the forecast period, fueled by rising investments in the semiconductor and electronics sectors, supported by government initiatives such as the Production Linked Incentive (PLI) scheme to enhance domestic manufacturing. Furthermore, increasing demand for medical devices and renewable energy products positions India as a promising market for advanced vapor deposition technologies.

Key Asia Pacific Vapor Deposition Equipment Company Insights

Some key companies operating in the market include Bühler AG, Vacuum Techniques Pvt Ltd, Ningbo Danko Vacuum Technology Co., Ltd., vergason.com, and Vapor Technologies, Inc., among others. Companies are prioritizing technological innovations and partnerships, exemplified by manufacturers collaborating with coating firms to incorporate advanced vapor deposition technologies into their product offerings.

-

Bühler AG delivers advanced coating solutions leveraging its expertise in PVD technologies. The company aims to enhance surface properties across diverse sectors, including food processing, electronics, and automotive, thereby promoting efficiency and sustainability in manufacturing processes.

-

Ningbo Danko Vacuum Technology Co., Ltd. specializes in the production of vacuum equipment and vapor deposition systems, with a primary focus on PVD technologies that deliver innovative, high-quality coatings to enhance durability and performance across various applications.

Key Asia Pacific Vapor Deposition Equipment Companies:

- Bühler AG

- Vacuum Techniques Pvt Ltd

- Ningbo Danko Vacuum Technology Co., Ltd.

- vergason.com

- Vapor Technologies, Inc.

- AJA International, Inc.

- KOBE STEEL, LTD.

- Milman Thin Film Systems Pvt. Ltd.

- Focus Technology Co., Ltd.

- IKS PVD Technology (Shenyang) Co., Ltd

Recent Developments

-

In August 2024, Vapor Technologies introduced the V.MAX1500 PVD coating system, enhancing in-house coating capabilities across various industries with advanced features for versatility, efficiency, and maintenance, celebrating 40 years of excellence in PVD solutions.

-

In August 2024, Bühler India launched SmartLine solutions, including the DirectBake Smart oven and RotaMold Smart molder, to cater to the growing biscuit and cracker market with innovative, efficient technologies tailored for local manufacturers.

Asia Pacific Vapor Deposition Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.61 billion

Revenue forecast in 2030

USD 20.88 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, application, country

Country scope

Asia Pacific

Country scope

China, Japan, India, Australia, South Korea

Key companies profiled

Bühler AG; Vacuum Techniques Pvt Ltd; Ningbo Danko Vacuum Technology Co., Ltd.; vergason.com; Vapor Technologies, Inc.; AJA International, Inc.; KOBE STEEL, LTD.; Milman Thin Film Systems Pvt. Ltd.; Focus Technology Co., Ltd.; IKS PVD Technology (Shenyang) Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Vapor Deposition Equipment Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific vapor deposition equipment market report based on technology, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PVD

-

CVD

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Microelectronics

-

Data Storage

-

Solar Products

-

Cutting Tools

-

Medical Equipment

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."