- Home

- »

- Renewable Chemicals

- »

-

Aspartic Acid Market Size, Share & Growth Report, 2030GVR Report cover

![Aspartic Acid Market Size, Share & Trends Report]()

Aspartic Acid Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (L-Aspartic Acid, D-Aspartic Acid, DL- Aspartic Acid), By Application, By Region And Segment Forecasts

- Report ID: 978-1-68038-388-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aspartic Acid Market Size & Trends

“2030 Aspartic Acid market value to reach USD 168.0 million”

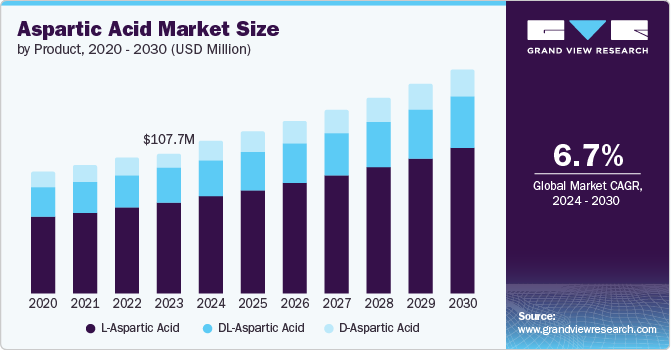

The global aspartic acid market size was valued at USD 107.7 million in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. The market growth can be attributable to the increased focus on manufacturing processes and a shift towards natural labeled foods and the purity of consumer products. Many consumers are looking for products that are beneficial to their health and comply with environmental values. Aspartic acid, which has many applications in various industries, is increasing in demand due to its natural origin and compatibility with white-label standards, driving the market growth.

Aspartic acid has many applications in the pharmaceutical industry and is expected to grow in the global market. Rising health awareness among consumers is expected to increase the demand for dietary supplements and aspartic acid over the forecast period. Aspartic acid is used with several minerals in dietary supplements, including magnesium aspartate, magnesium aspartate, and calcium aspartate.

Dietary supplements are in high demand due to the awareness and acceptance of these supplements among consumers. Dietary supplements come in many forms, such as powdered supplements, food, and capsules. Aspartic acid plays a vital role in the pathogenesis of psychiatric and neurologic disorders and alterations in BCAA levels in diabetes and hyperammonemia. It increases testosterone levels and muscle mass and helps increase male stamina. Population growth is expected to play a major role in the demand for food and nutritional supplements, which will increase the demand in the fitness sector, which is expected to drive the growth of the aspartic acid market.

Product Insights

“The dl-aspartic acid segment is expected to witness growth at 6.2% CAGR”

The L-aspartic acid segment dominated the market and accounted for a share of 63.4% in 2023, as the L-aspartic acid can be easily used by the body. It is better for medicines, sports supplements, and even some foods.

DL-aspartic acid is expected to grow at substantial rate. This is owing to DL-aspartic acid is generally cheaper to produce than the more specific L-aspartic acid. While the body is unable to use DL-aspartic acid directly, it breaks it down into usable components, making it a cost-effective option for applications where the specific benefits of L-aspartic acid are irrelevant, such as in some fertilizers or as a general supplement ingredient. As manufacturers look for cost-efficient options, the demand for DL-aspartic acid is anticipated to rise.

Application Insights

“The aspartame segment is expected to grow at a CAGR of 7.0%”

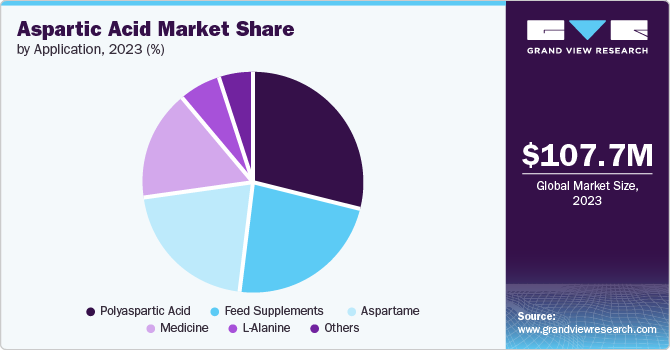

Polyaspartic acid segment accounted for the largest market revenue share in 2023. This is attributable to the fact that polyaspartic acid is an alternative to non-biodegradable materials. This eco-friendly aspect optimistic, especially as consumers and businesses become more environmentally conscious. In addition, polyaspartic acid has good water solubility and binding capacity, making it very useful in a variety of applications, such as soaps and water treatment processes.

The feed supplements segment is anticipated to witness a significant CAGR over the forecast period. This is owing to the fact that the global livestock industry is constantly looking for ways to improve animal health and productivity. Aspartic acid, an essential amino acid, plays an important role in protein synthesis and overall animal health. Aspartic acid supplementation can improve growth rates and improve feed conversion efficiency. Additionally, increasing consumer awareness of animal welfare is increasing the demand for natural and organic food supplements. Aspartic acid, a natural amino acid, fits well in this situation and increases the growth of the food supplement.

Regional Insights

“Canada to witness market growth of CAGR 7.0%”

North America aspartic acid market dominated the market in 2023. This is attributable to strong government support for research and development in health and agriculture which promotes innovation in aspartic acid applications. This opens market for new aspartame-based sweeteners, biological materials and agricultural advances using aspartic acid. Additionally, growing health awareness among North American consumers will drive demand for aspartame and other aspartic acid compounds in nutritional products and sports supplements.

U.S. Aspartic Acid Market Trends

The U.S. dominated the North America aspartic acid market with a share of 84.5% in 2023 pertaining to the increased focus on health and fitness that increases demand for aspartame and other aspartic acid flavours in food and beverages. Additionally, the U.S. has a pharmaceutical industry that actively uses aspartic acid in various drugs and supplements.

Europe Aspartic Acid Market Trends

Europe aspartic acid was identified as a lucrative region in this industry. The aspartic acid market in Europe is growing due to healthcare consumers driving demand for food products, laws favouring environmental products such as bioplastics-to-aspartic acid, and the active pharmaceutical sector using aspartic acid in medicines.

UK aspartic acid market is expected to grow rapidly in the coming years due to the fact Consumers are switching to sugar-free options that use aspartame, and governments are supporting green materials such as aspartate-based bioplastics. British pharmaceutical companies increase demand for aspartic acid applications.

Asia Pacific Aspartic Acid Market Trends

Asia Pacific aspartic acid market is anticipated to witness significant growth in the aspartic acid market. With the rise of the middle class and disposable income, the demand for health products and organic products is increasing. The region is playing an important role in the production of aspartic acid as pharmaceutical products are increasingly in demand.

China aspartic acid market held a substantial market share in 2023 owing to strong pharmaceutical sector and large population consuming aspartame products. This makes it a major player in Asia Pacific.

Key Aspartic Acid Company Insights

The market is extremely fragmented with various global and regional product manufacturers releasing innovative systems and technologies. Various industry participants' strategies typically involve new product development, product upgrades, and expansions to boost market penetration and respond to the changing technical needs of the application industries. The major players form technical partnerships to innovate and develop novel product lines, therefore expanding their consumer base.

-

Ajinomoto Co., Inc. is a Japanese food company and the producer of monosodium glutamate (MSG), a popular savoury flavour enhancer. The company also offers a variety of products such as edible oils, processed foods, and even pharmaceuticals.

-

Evonik Industries AG offers specialty chemicals and develops innovative materials to improve everyday products, from pharmaceuticals to tires, with a focus on sustainability.

Key Aspartic Acid Companies:

The following are the leading companies in the aspartic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Prinova Group LLC.

- Iris Biotech GmbH

- AnaSpec, Inc.

- ChemPep Inc.

- KYOWA HAKKO BIO CO.,LTD.

- Tocris Bioscience

- Flexible Solutions Inc

- Yantai Hengyuan Bioengineering Co. Ltd.

Recent Developments

-

In March, 2024, Evonik and Shandong Vland Biotech launched a joint venture in China to focus on animal gut health products. The venture will leverage Evonik's expertise in probiotics and Vland's market presence to develop new solutions for the Greater China region and beyond. This collaboration aims to be a leading provider in animal gut health through innovation and efficient production.

-

In August, 2023, Prinova showcased its premix capabilities for functional food and beverages at FiAsia Thailand, targeting the growing market in Asia Pacific. They presented innovative beverage concepts to inspire manufacturers looking to develop new healthy products.

-

In April, 2023, Evonik restructured its animal nutrition business to improve efficiency and profitability. The company will create separate operating models for its amino acids and specialty nutrition businesses, while investing in global production hubs to reduce costs and improve sustainability.

Aspartic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 114.1 million

Revenue forecast in 2030

USD 168.0 million

Growth rate

CAGR of 6.7% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030, volume in kilotons

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Japan; China; India; Australia; South Korea; Thailand; Indonesia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

AJINOMOTO CO.,INC.; Evonik Industries AG; Prinova Group LLC.; Iris Biotech GmbH; AnaSpec, Inc.; ChemPep Inc.; KYOWA HAKKO BIO CO.,LTD.; Tocris Bioscience; Flexible Solutions Inc; Yantai Hengyuan Bioengineering Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Aspartic Acid Market Report Segmentation

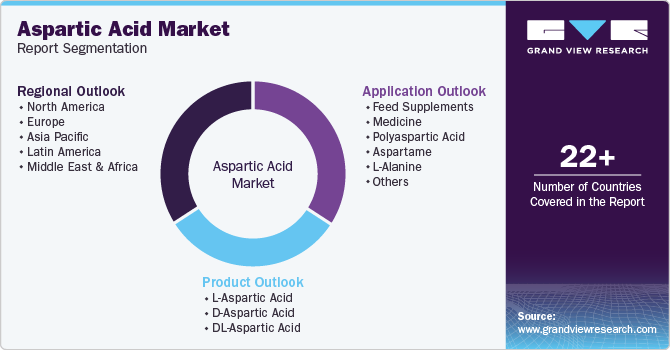

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aspartic acid market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030, Volume in Kilotons)

-

L-Aspartic Acid

-

D-Aspartic Acid

-

DL-Aspartic Acid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030, Volume in Kilotons)

-

Feed Supplements

-

Medicine

-

Polyaspartic Acid

-

Aspartame

-

L-Alanine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030, Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.