- Home

- »

- Advanced Interior Materials

- »

-

Asphalt Mixing Plants Market Size And Share Report, 2030GVR Report cover

![Asphalt Mixing Plants Market Size, Share & Trends Report]()

Asphalt Mixing Plants Market (2024 - 2030) Size, Share & Trends Analysis Report By Process (Batch Mix Plant), By Mobility (Mobile, Stationary), By Product, By Capacity, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-310-9

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asphalt Mixing Plants Market Size & Trends

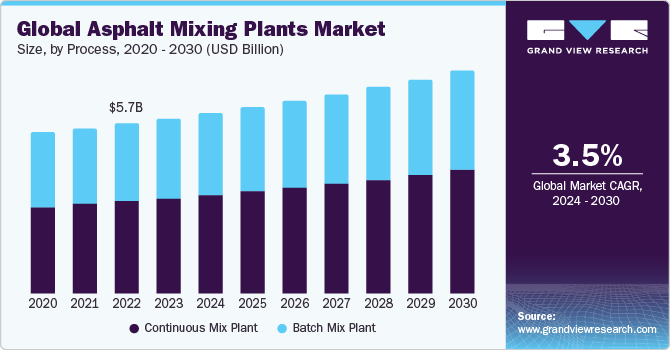

The global asphalt mixing plants market size was estimated at USD 5,211.3 million in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. One major driving factor propelling the global market is the escalating demand for high-quality asphalt across various construction and infrastructure projects worldwide. With increasing urbanization and infrastructure development initiatives, there's a growing need for durable, reliable, and sustainable road surfaces.

Asphalt mixing plants play a pivotal role in meeting this demand by efficiently producing asphalt mixtures tailored to specific project requirements. Moreover, the emphasis on sustainability in construction practices, coupled with the rising popularity of warm mix asphalt (WMA) technologies, further drives the adoption of asphalt mixing plants. In addition, government initiatives aimed at enhancing transportation infrastructure and investments in road maintenance and rehabilitation projects contribute significantly to the market's growth trajectory.

As urban areas expand and populations rise, there's a corresponding surge in the demand for transportation infrastructure, including roads, highways, and airports. Asphalt mixing plants are necessary to meet this demand by providing the necessary asphalt for construction and maintenance activities. In addition, advancements in technology and innovations in asphalt mixing plant designs have led to improved efficiency, productivity, and environmental sustainability, further driving market growth.

The implementation of stringent regulations and standards regarding road quality and environmental impact also encourages the adoption of modern asphalt mixing plants, driving market expansion. Furthermore, the globalization of construction practices and the rise of mega-infrastructure projects worldwide present lucrative opportunities for market players, further fueling market growth.

The increasing frequency and severity of extreme weather events, such as heavy rainfall, temperature fluctuations, and freeze-thaw cycles, drive the demand for resilient and weather-resistant asphalt mixtures. Asphalt mixing plants capable of producing such durable materials are in high demand, especially in regions prone to harsh weather conditions. In addition, the growing focus on sustainable development and environmental conservation fosters the adoption of asphalt mixing plants equipped with recycling technologies. These plants enable the reuse of reclaimed asphalt pavement (RAP) materials, reducing the consumption of natural resources and lowering environmental impact.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations significantly shape the dynamics of the market, influencing everything from product design to operational practices. One impact of regulations is seen in the industry's push for environmentally sustainable practices. Stringent environmental regulations often dictate emissions standards and pollution control measures, prompting asphalt mixing plant manufacturers to develop cleaner and more energy-efficient technologies. This has led to the adoption of innovations like warm mix asphalt (WMA) and recycling technologies, which reduce energy consumption and greenhouse gas emissions compared to traditional hot mix asphalt production methods.

Regulatory bodies often set standards and requirements for road construction materials and processes, driving the need for innovation in asphalt mixing plant technologies. Stricter regulations regarding emissions, energy efficiency, and environmental impact push manufacturers to develop innovative solutions that meet or exceed these standards. As a result, there's a continuous drive toward the development of advanced control systems, automation features, and energy-efficient components within asphalt mixing plants.

The concentration of end users in the market refers to the distribution and dominance of certain types of users within the industry. While the market typically encompasses a diverse range of end users, including construction companies, government agencies, infrastructure developers, municipalities, and engineering firms, the degree of concentration can vary based on various factors. In some regions or market segments, there may be a high concentration of large construction companies and government agencies that undertake significant infrastructure projects requiring substantial quantities of asphalt mixtures. These major players often have the resources, expertise, and capacity to procure asphalt from mixing plants on a large scale, leading to a concentration of demand among a smaller number of key end users.

Substitutes for asphalt mixing plants within the construction industry are limited due to the unique properties and applications of asphalt mixtures in road construction and infrastructure projects. However, there are alternative materials and processes that can serve as partial substitutes or complements to traditional asphalt production methods. One substitute is concrete, which is commonly used for road construction in certain applications, such as highways, bridges, and airport runways. While concrete offers durability and strength, it has higher initial costs and longer curing times than asphalt. Concrete requires specialized equipment and expertise for mixing, pouring, and curing, making it less flexible and versatile than asphalt in certain situations.

Process Insights

Based on process, the continuous mix process segment led the market with the largest revenue share of 54.70% in 2023. One of the primary factors behind the growth of this segment is the demand for high-volume asphalt production solutions capable of meeting the requirements of large-scale road construction and infrastructure projects. Continuous mixed asphalt plants offer a continuous and uninterrupted production process, allowing for an efficient and steady supply of asphalt mixtures at a consistent rate, which is essential for projects with high material demand and tight deadlines.

The batch mix plant segment is expected to grow at a significant CAGR during the forecast period. Batch mix plants offer a batch-wise production process, allowing operators to produce different types of asphalt mixtures in discrete batches, thereby facilitating customization and optimization of mix designs according to project specifications and regional preferences.

Mobility Insights

Based on mobility, the stationary mobility segment led the market with the largest revenue share of 66.68% in 2023. The segment is primarily driven by the increasing demand for high-quality asphalt mixtures in road construction and maintenance projects. As urbanization accelerates and infrastructure development expands globally, there's a growing need for durable and long-lasting roads that withstand heavy traffic loads and adverse weather conditions. Also, they provide continuous production of large quantities of asphalt mixtures, ensuring a steady supply for construction projects of various scales. This continuous production capability enhances efficiency and minimizes downtime, making stationary plants particularly suitable for high-volume applications.

The mobile mobility segment is expected to grow at a significant CAGR during the forecast period. Mobile asphalt mixing plants offer portability and mobility, allowing contractors and construction companies to quickly set up and commence production at various project locations without significant infrastructure investments or site preparation. In addition, mobile asphalt mixing plants equipped with recycling capabilities enable the integration of reclaimed asphalt pavement (RAP) materials into new asphalt mixtures, thereby reducing the consumption of virgin aggregates and conserving natural resources.

Product Insights

The hot mix plant segment led the market with the largest revenue share of 82.12% in 2023. One of the primary driving forces behind this segment is the ubiquitous demand for high-quality hot mix asphalt (HMA) in road construction projects worldwide. Hot mix plants specialize in efficiently heating and blending aggregates with bitumen to produce HMA at elevated temperatures, ensuring optimal compaction and pavement performance.

The cold mix plant segment is expected to grow at a significant CAGR during the forecast period. The cold mix plant segment benefits from its ability to produce asphalt mixtures that can be stockpiled and used as needed, offering flexibility and convenience for road repair and maintenance operations. Unlike hot mix plants, which require continuous heating and production processes, cold mix plants enable the preparation of asphalt mixtures in advance and storage for extended periods without compromising quality or performance.

Capacity Insights

Based on capacity, the 151 to 300 TPH segment held the market with the largest revenue share of 43.64% in 2023. The 151 to 300 TPH capacity segment benefits from its ability to handle a wide range of asphalt mix designs and production volumes, offering versatility and adaptability to suit different project specifications and market demands. These plants can produce a variety of asphalt mixtures, including hot mix asphalt (HMA), warm mix asphalt (WMA), and specialized mixtures tailored to specific applications, providing flexibility to contractors and construction companies to meet diverse project requirements.

The 51 to 150 TPH segment is expected to grow at a significant CAGR during the forecast period. These plants offer precise control over the asphalt mixing process, ensuring consistent and uniform asphalt mixtures with accurate aggregates, bitumen, and additives proportions. This level of quality control is essential for achieving desired pavement properties, such as durability, stability, and resistance to deformation, ensuring the long-term performance of road surfaces under diverse traffic and environmental conditions.

Application Insights

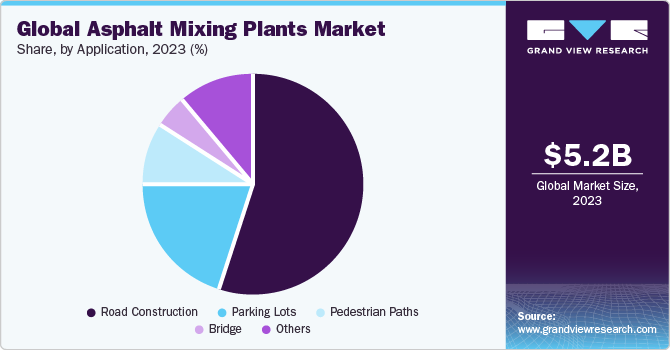

Based on application, the road construction segment led the market with the largest revenue share of 55% in 2023. One of the primary drivers is the continuous expansion and maintenance of transportation infrastructure networks globally. As urbanization accelerates and populations grow, there's an increasing need for well-connected and efficient road systems to facilitate the movement of goods, services, and people. Road construction projects encompass a wide range of activities, including building new roads, highways, bridges, and tunnels and upgrading existing infrastructure to meet modern standards and accommodate growing traffic volumes.

The parking lots segment is projected to grow at a significant CAGR over the forecast period. The expansion of commercial establishments, shopping centers, office buildings, and recreational facilities contributes to the demand for parking lots. Businesses and organizations recognize the importance of providing adequate parking facilities to attract customers, employees, and visitors. Well-designed and efficiently managed parking lots enhance the overall accessibility and attractiveness of commercial and recreational venues, thereby supporting economic activity and urban development.

Regional Insights

The asphalt mixing plants market in North America accounted for the revenue share of 23.81% in 2023. The North American market is witnessing increasing adoption of recycling technologies in asphalt production. Asphalt mixing plants with recycling capabilities, which allow for the reuse of reclaimed asphalt pavement (RAP) materials, are gaining popularity. These plants help reduce the consumption of virgin aggregates, conserve natural resources, and lower production costs while maintaining high-quality asphalt mixtures.

U.S. Asphalt Mixing Plants Market Trends

The asphalt mixing plants market in U.S. is anticipated to grow at the fastest CAGR of 2.6% from 2024 to 2030. The U.S. is witnessing a growing emphasis on environmental sustainability in road construction practices. There is increasing pressure to reduce carbon emissions, conserve natural resources, and minimize environmental impact in infrastructure projects. Asphalt mixing plants equipped with advanced technologies for producing eco-friendly asphalt mixtures are in high demand to meet these sustainability goals. This includes the adoption of recycling technologies that allow for the reuse of reclaimed asphalt pavement (RAP) materials, reducing the need for virgin aggregates and lowering production costs.

The Canada asphalt mixing plants market held over 11.5% market share in the North America. The country's extensive transportation infrastructure network, which spans vast distances and includes roads, highways, bridges, and airports. Canada's infrastructure requires ongoing maintenance, repair, and expansion to accommodate economic growth and population movements. Asphalt mixing plants play a crucial role in supplying the asphalt needed for these projects, driving demand in the market.

Asia Pacific Asphalt Mixing Plants Market Trends

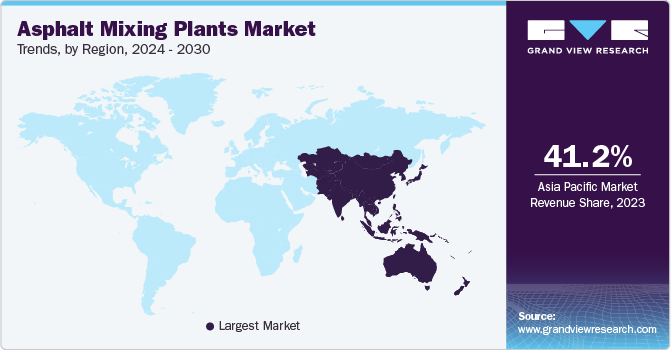

Asia Pacific dominated the asphalt mixing plants market with the largest revenue share of 41.25% in 2023. Asia Pacific countries are experiencing rapid urbanization, driving the need for extensive road networks to support growing populations and economic activities. This surge in infrastructure development fuels the demand for asphalt mixing plants for road construction projects across the region.

The asphalt mixing plants market in China is estimated to grow at a significant CAGR over the forecast period. China has been undergoing rapid urbanization and industrialization, leading to extensive construction of roads, highways, bridges, and other transportation infrastructure. Asphalt mixing plants are essential for producing the asphalt needed for these projects, making them integral to China's infrastructure expansion efforts.

The India asphalt mixing plants market held over an 11.1% market share in the Asia Pacific. The Indian government's focus on improving the quality and durability of road surfaces is driving the adoption of advanced asphalt mixing plant technologies. There is a growing emphasis on using high-quality materials and adhering to stringent construction standards to enhance road safety and longevity. Asphalt mixing plants equipped with modern technologies for producing superior quality asphalt mixtures are in high demand to meet these requirements.

Europe Asphalt Mixing Plants Market Trends

The asphalt mixing plants market in Europe is anticipated to grow at a significant CAGR from 2024 to 2030. Europe's emphasis on sustainable development and environmental protection is driving the adoption of eco-friendly asphalt technologies. There is increasing pressure to reduce carbon emissions, conserve natural resources, and minimize environmental impact in infrastructure projects. Asphalt mixing plants equipped with advanced technologies for producing environmentally friendly asphalt mixtures, such as recycling capabilities that allow for the reuse of reclaimed asphalt pavement (RAP) materials, are in high demand to meet these sustainability goals.

The Germany asphalt mixing plants market is expected to grow at a significant CAGR of around 3.5% during the forecast period. Germany's commitment to infrastructure resilience and climate adaptation is influencing the market growth. There is a rising demand for durable and weather-resistant asphalt mixtures capable of withstanding extreme weather events, such as heavy rainfall, temperature fluctuations, and freeze-thaw cycles. Asphalt mixing plants that can produce resilient asphalt mixtures suitable for climate-resilient infrastructure projects are increasingly sought after in the German market.

The asphalt mixing plants market in UK holds a significant share of the European market owing to the rising end-use industries. The UK's infrastructure network requires continuous maintenance, repair, and expansion to accommodate economic growth, population movements, and international trade. Asphalt mixing plants play a crucial role in supplying the asphalt needed for these infrastructure projects, driving demand in the market.

Central & South America Asphalt Mixing Plants Market Trends

The asphalt mixing plants market in Central and South America is estimated to grow at a rapid CAGR over the forecast period. Central and South America's participation in regional infrastructure projects, such as the Inter-American Highway and various transnational transportation corridors, is driving demand for asphalt mixing plants. These projects aim to improve connectivity and trade within the region and require significant investments in road infrastructure, further boosting the demand for asphalt mixing plants.

The Brazil asphalt mixing plants market holds a significant share in the Central and South American markets, owing to the rising end-use industries. Brazil's participation in regional infrastructure projects, such as the integration of the Mercosur trade bloc and the development of transnational transportation corridors, is driving demand for asphalt mixing plants. These projects aim to improve connectivity and trade within South America and require significant investments in road infrastructure, further boosting the demand for asphalt mixing plants in Brazil.

Middle East & Africa Asphalt Mixing Plants Market Trends

The asphalt mixing plants market in the Middle East and Africa is experiencing rapid development, due to ongoing industrialization and urbanization. The region is home to several countries with ambitious infrastructure development plans. Governments in the region are investing heavily in large-scale infrastructure projects, such as new cities, transportation networks, and industrial zones, to diversify their economies and support economic growth. Asphalt mixing plants are essential for producing the asphalt required for these projects, further fueling demand in the market.

The UAE asphalt mixing plants market held a significant share in the Middle East & African market, owing to the rising end-use industries. Rapid urbanization in the UAE, especially in cities like Dubai and Abu Dhabi, demands better transportation networks. This necessitates the construction and maintenance of roads, driving the demand for asphalt mixing plants. Also, the UAE government has been investing heavily in infrastructure projects as part of its economic diversification efforts. Policies and initiatives aimed at improving transportation infrastructure contribute to the market growth.

Key Asphalt Mixing Plants Company Insights

Some of the key players operating in the market include the global market, NIKKO Co., Ltd., and Gencor Industries, Inc.

-

NIKKO Co., Ltd. is a prominent player in the asphalt mixing plant industry, renowned for its expertise and innovative solutions. Specializing in asphalt mixing plants, NIKKO has established itself as a global leader in providing high-quality, reliable, and efficient equipment for the production of asphalt mixtures. With a rich history spanning several decades, NIKKO has continually evolved its technologies to meet the evolving needs of the market and deliver cutting-edge solutions to its customers

-

Gencor offers a comprehensive lineup of asphalt plants, including stationary, portable, and relocatable models, designed to cater to varying production requirements and project specifications. These plants are equipped with advanced control systems, precision-engineered components, and energy-efficient designs to ensure optimal performance, productivity, and cost-effectiveness

Asphalt Drum Mixers, Inc., NFLG Inc. are some of the emerging market participants in the asphalt mixing plant market.

- With decades of experience in the industry, ADM has honed its expertise in designing and manufacturing high-performance asphalt mixing plants. The company offers a comprehensive range of asphalt plants, including stationary, portable, and relocatable models, designed to meet various production requirements and project specifications

- NFLG's asphalt mixing plants are known for their advanced technology, superior performance, and reliability. Equipped with state-of-the-art control systems, precision-engineered components, and energy-efficient designs, NFLG's plants deliver exceptional performance, productivity, and durability, ensuring consistent quality and output for asphalt production

Key Asphalt Mixing Plants Companies:

The following are the leading companies in the asphalt mixing plants market. These companies collectively hold the largest market share and dictate industry trends.

- Astec Industries Inc.

- Gencor Industries, Inc.

- NIKKO Co., Ltd.

- FAYAT Group

- Aimix Group

- Ammann Group

- Asphalt Drum Mixers, Inc.

- Benninghoven GmbH & Co. KG

- NFLG Inc.

- Sany Group

- Gongyi Santai Machinery Co., Ltd.

- SPEED CRAFTS

- Solmec Earthmovers Pvt. Ltd.

- Arky Construction

- Atlas industries

Recent Developments

-

In April 2024, Aggregate Industries expanded its existing operation by opening a new asphalt plant to cater to Staffordshire and its adjoining areas as part of a USD 11.46 million investment. Along with Amman supplier, they also installed an Amman ABP 240 universal asphalt mixing plant, which can produce 240 tones of asphalt in an hour

-

In August 2022, Construction Partners, Inc. (ROAD), a vertically integrated civil infrastructure firm specializing in roadway construction and maintenance across five southeastern states, acquired Southern Asphalt, Inc. Based in Conway, South Carolina, this acquisition saw the addition of two hot-mix asphalt plants and over 200 employees in the Myrtle Beach metropolitan area.

Asphalt Mixing Plants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5,368.7 million

Revenue forecast in 2030

USD 6,610.1 million

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, mobility, product, capacity, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Astec Industries Inc.; Gencor Industries, Inc.; NIKKO Co., Ltd.; FAYAT Group; Aimix Group; Ammann Group; Asphalt Drum Mixers, Inc.; Benninghoven GmbH & Co. KG; NFLG Inc.; Sany Group; Gongyi Santai Machinery Co., Ltd.; SPEED CRAFTS; Solmec Earthmovers Pvt. Ltd.; Arky Construction; Atlas industries

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Asphalt Mixing Plants Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global asphalt mixing plants market report based on process, mobility, product, capacity, application, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Batch Mix Plant

-

Continuous Mix Plant

-

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Stationary

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hot Mix Plant

-

Cold Mix Plant

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 50 TPH

-

51 to 150 TPH

-

151 to 300 TPH

-

Above 300 TPH

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Road Construction

-

Parking Lots

-

Pedestrian Paths

-

Bridge

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global asphalt mixing plant market size was estimated at USD 5,211.3 million in 2023 and is expected to reach USD 5,368.7 million in 2024.

b. The asphalt mixing plant market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 6,610.1 million by 2030.

b. Asia Pacific dominated the global asphalt mixing plant market and accounted for a 41.3% share, in terms of revenue, in 2023. APAC countries are experiencing rapid urbanization, driving the need for extensive road networks to support growing populations and economic activities. This surge in infrastructure development fuels the demand for asphalt mixing plants for road construction projects across the region.

b. Some of the key players operating in the asphalt mixing plant market include Astec Industries Inc., Gencor Industries, Inc., NIKKO Co., Ltd., FAYAT Group, Aimix Group, Ammann Group, Asphalt Drum Mixers, Inc., Benninghoven GmbH & Co. KG, NFLG Inc., Sany Group among others.

b. Asphalt mixing plants market is projected to observe increasing growth on account of rising investments in infrastructure including highways, expressways and bridges among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.