- Home

- »

- Pharmaceuticals

- »

-

Attention Deficit Hyperactivity Disorder Market Report, 2030GVR Report cover

![Attention Deficit Hyperactivity Disorder Market Size, Share & Trends Report]()

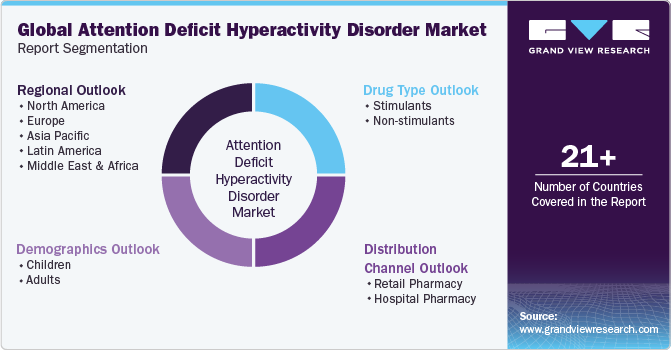

Attention Deficit Hyperactivity Disorder Market (2024 - 2030) Size, Share & Trends Analysis Report By Drug Type (Stimulants, Non-stimulants), By Demographics (Children, Adults), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-795-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ADHD Market Summary

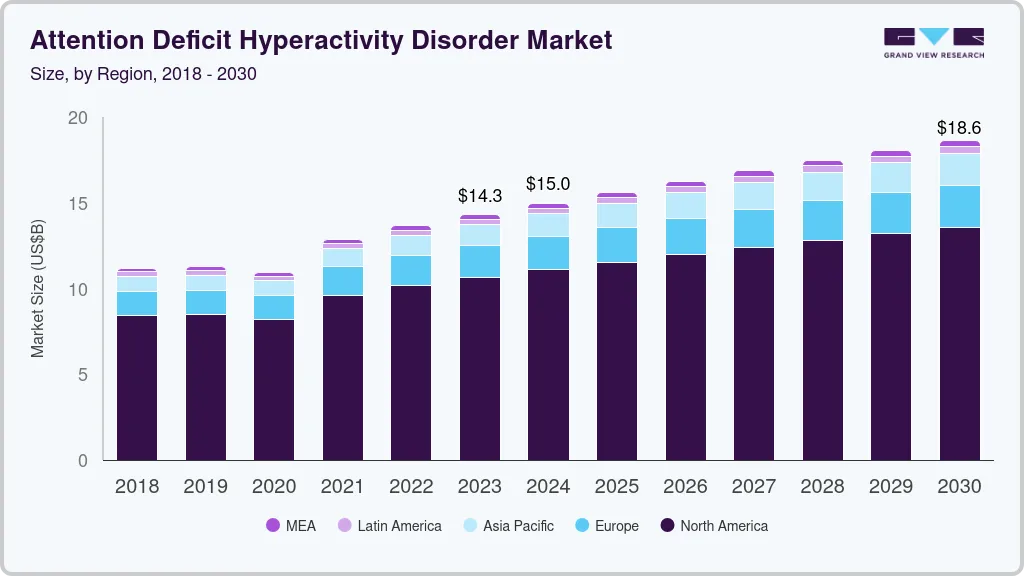

The global attention deficit hyperactivity disorder market size was estimated at USD 14.3 billion in 2023 and is expected to reach USD 18.6 billion by 2030, growing at a CAGR of 3.7% from 2024 to 2030. The market's growth can be attributed to the escalating demand for attention deficit hyperactivity disorder (ADHD) drugs, driven by the rising global prevalence of ADHD.

Key Market Trends & Insights

- The attention deficit hyperactivity disorder market growth in North America is attributable to the launch and rapid uptake of multiple drugs.

- The attention deficit hyperactivity disorder market in the U.S. dominated the global industry with a revenue share of 69.1% in 2023.

- Based on drug type, the stimulants segment dominated the market and accounted for the largest share of 70.9% in 2023.

- Based on demographics, the adult segment accounted for the largest market share in 2023. This is attributable to the rising prevalence of adult ADHD.

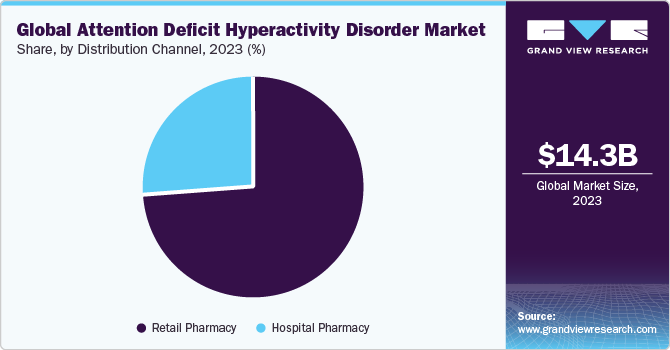

- Based on distribution channel, the retail pharmacy segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.3 Billion

- 2030 Projected Market Size: USD 18.6 Billion

- CAGR (2024-2030): 3.7%

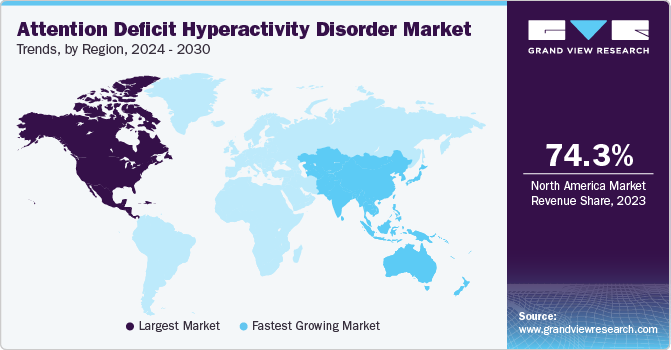

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This growth is further fueled by the increasing awareness about the disorder among healthcare professionals and patients, as well as the escalating healthcare expenditure across various regions. The prevalence of ADHD in children has been linked to reduced health and well-being for patients and their families. As a common neurological developmental disorder, ADHD is increasingly recognized in adolescents, adults, and children. According to a study published in the Italian Journal of Pediatrics in 2023, the global prevalence of ADHD in children aged 3 to 12 years is 7.6%, while it is 5.6% for those aged 12 to 18 years. The Forbes Health Report of 2023 indicates that approximately 129 million adolescents and children between 5 to 19 years old are living with ADHD. Consequently, the rising prevalence of ADHD is expected to drive the demand for medications used in its treatment.

The growing awareness of ADHD among patients, healthcare professionals, and other medical practitioners is expected to stimulate the diagnosis and treatment of the condition, propelling market growth. Enhanced understanding of ADHD is expected to contribute to improved academic outcomes for students affected by the disorder. In an effort to advance treatment quality for children with ADHD, the National Institute for Children's Health Quality has implemented a collaborative model in partnership with children and adults with Attention-Deficit/Hyperactivity Disorder (CHADD) and the American Academy of Pediatrics (AAP).

In addition to the efforts of the National Institute for Children's Health Quality, organizations such as the ADHD Coaches Organization (ACO), Attention Deficit Disorder Association (ADDA), and CHADD are proactively working to raise awareness about ADHD and available treatment options globally through various campaigns. For instance, in 2022, these organizations organized a program called "Reframing ADHD: Discovering New Perspectives," that aimed to address aspects including ADHD relationships and communications, diagnosis in children and adults, treatment plans, and co-occurring situations.

October is recognized worldwide as ADHD Awareness Month, dedicated to increasing understanding and educating people about ADHD. According to CHADD, the healthcare costs associated with treating ADHD in adults aged 18 to 64 range from USD 137 to USD 4,100 per person annually. Consequently, the growing financial burden has led to a heightened need for evaluating efficient, low-cost treatment options for ADHD that significantly contribute to market growth.

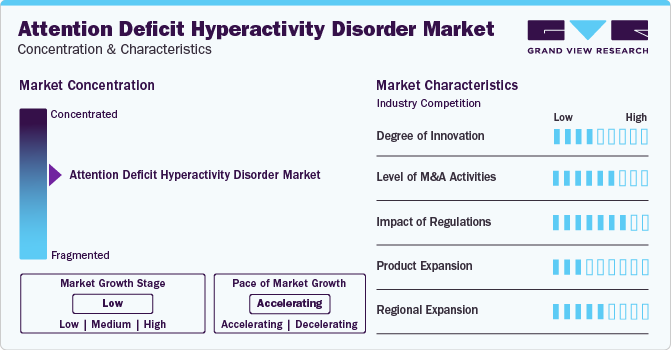

Market Concentration & Characteristics

The industry is characterized by a moderate degree of innovation owing to research and development activities. For instance, in December 2020, Supernus Pharmaceuticals, Inc. announced topline positive data from a phase 3 trial on Qelbree in adult patients with ADHD. The positive results helped the company expand the use of Qelbree after FDA approval in the adult segment.

The ADHD market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to acquire new products and marketing rights. For instance, in February 2021, Neos Therapeutics merged with Aytu BioPharma, Inc., a commercial pharmaceutical company. This merger gave rights to Aytu BioPharma, Inc. to develop & commercialize neuroscience products of NEOS Therapeutics, Inc.

The ADHD market is subject to increasing regulatory scrutiny. This is due to concerns about the potential adverse effects of the drugs. As a result, governments around the world are developing regulations to govern the ADHD drug market. These regulations could have a significant impact on the market. For instance, in May 2019, the FDA released a draft guidance for the industry, titled "Attention Deficit Hyperactivity Disorder: Developing Stimulant Drugs for Treatment." This guidance aims to aid sponsors in the clinical development of stimulant drugs for treating ADHD in pediatric and adult patients.

Drug Type Insights

Based on drug type, the stimulants segment dominated the market and accounted for the largest share of 70.9% in 2023. This high percentage can be attributed to the launch of new products, increasing drug abuse, and approval of extended versions of drugs to be the most effective drugs. According to the U.S. Substance Abuse and Mental Health Services Administration (SAMHSA), there were 16.1 million users of prescription stimulants, out of which 5.1 million were youth (aged 12 &older), and 1.6 million were adults (aged 18-25) in 2020. Stimulant is the most researched medication for the treatment of ADHD, with over 250 controlled stimulant trials involving 6,000 children, making it the most lucrative market.

In August 2023, the FDA approved generic versions of Vyvanse for treating ADHD (ages 6+) and moderate to severe Binge-Eating Disorder (BED) in adults. This approval came after the FDA declared a shortage of immediate-release Adderall in October 2022. Thus, the approval and launch of novel drugs used to treat patients with ADHD are expected to drive market growth.

The non-simulants segment is expected to register the fastest CAGR during the forecast period. Various factors contributing to the growth of nonstimulants market include relatively longer-lasting effects as compared to stimulants and no risk of substance abuse or addiction, making it an alternative option to treat ADHD with fewer adverse effects than stimulant drugs. Nonstimulants are new and often prescribed to individuals if they do not respond to stimulants, and have a history of bipolar disorder, cardiovascular disease, and drug use. This is also driving their demand and development. According to a Medical News Today article published in May 2022, the U.S. FDA extended its approval of viloxazine extended-release capsules, branded as Qelbree, for the treatment of ADHD in adults. Initially sanctioned in 2021 for managing ADHD in children aged 6-17, Qelbree became the first nonstimulant medication authorized for ADHD treatment in adults in 20 years.

Demographic Insights

Based on demographics, the adult segment accounted for the largest market share in 2023. This is attributable to the rising prevalence of adult ADHD. According to Forbes Media LLC. article published in August 2023, recent statistics highlighted a notable surge in the prevalence of adult ADHD globally, which is expected to be a significant growth driver for the adult segment of the market. An estimated 8.7 million adults are affected by ADHD in the U.S. alone, and about 2.6% of adults, totaling 139.8 million individuals globally, exhibit persistent ADHD symptoms stemming from childhood into adulthood.

The children segment is expected to grow substantially during the forecast period. The rising prevalence of ADHD in children is fueling the market growth. According to a BioMed Central Ltd. article published in April 2023, the study's investigation into ADHD prevalence among children and adolescents highlights the significant impact of this neurodevelopmental disorder in the children segment. The findings disclose that 7.6% of children aged 3 to 12 are affected with ADHD. This statistic highlights the substantial prevalence of ADHD among children and emphasizes the pressing need to address this issue in this specific age group. In August 2023, the FDA communicated to the public regarding the management of ADHD. It highlighted approved treatments aimed at alleviating ADHD symptoms and enhancing functionality, particularly in children as young as 6 years old. This initiative aligns with governmental efforts to address ADHD comprehensively.

Distribution Channel Insights

Based on distribution channel, the retail pharmacy segment dominated the market in 2023. The segment growth is attributed to the fact that most ADHD patients are treated in outpatient settings. Moreover, there is an increased focus on patient care initiatives, such as Greenway Medical Technologies, to provide personal Electronic Health Records (EHRs) to customers to keep track of medication history and basic care. In addition, factors such as increasing healthcare expenditure, growing awareness, and rising volume of prescriptions for ADHD drugs are further adding to the market growth. According to the U.S. Substance Abuse and Mental Health Services Administration (SAMHSA), in 2021, 101,000 people started using methamphetamine prescription stimulants in the past year.

The hospital pharmacy segment is expected to grow substantially over the forecast period. The segment growth is driven by factors such as increasing prevalence of ADHD, availability of multiple treatment options, and launch of new therapeutics for better & more effective treatment with minimum adverse effects. On a global scale, ADHD presents a significant concern, with an estimated 129 million children and adolescents aged 5 to 19 diagnosed with the disorder. Beyond childhood and adolescence, ADHD extends into adulthood, with more than 366 million adults worldwide reported to have ADHD by 2020. These estimates emphasize the pervasive nature of ADHD and the need for comprehensive approaches to diagnose, treat, and support services across various age groups & geographic regions.

Regional Insights

The attention deficit hyperactivity disorder market growth in North America is attributable to the launch and rapid uptake of multiple drugs. Moreover, favorable reimbursement policies, increased awareness about current treatment therapies, improved patient affordability, and the launch of new products are expected to drive market growth over the forecast period. In September 2023, Tris Pharma, Inc. announced that Health Canada granted authorization to use Quillivant ER (extended-release) in treating ADHD in children aged six years to 12 years. Quillivant ER will be offered in oral suspension and chewable tablet forms, representing the first approval of once-daily, long-acting, chewable, & oral suspension formulations of methylphenidate for ADHD treatment in Canada.

U.S. Attention Deficit Hyperactivity Disorder Market Trends

The attention deficit hyperactivity disorder market in the U.S. dominated the global industry with a revenue share of 69.1% in 2023 due to factors such as high awareness among healthcare professionals about drugs available to treat ADHD, a rise in disease prevalence, and new product approvals. According to the New York Times, prescriptions for the Attention-Deficit/Hyperactivity Disorder (ADHD) drug Adderall reached 41.2 million in October 2022, increasing by 16% over the previous year.

Europe Attention Deficit Hyperactivity Disorder Market Trends

The attention deficit hyperactivity disorder market in Europe is rising due to the prevalence of ADHD among children and adults is the major factor expected to drive the market over the forecast period. Key market players in this region are developing and commercializing new drugs, which is expected to further contribute to market growth. In recent years, the European Commission approved several drugs for ADHD care in the region, including INTUNIV. These factors are expected to drive market growth.

The UK attention deficit hyperactivity disorder market is expected to grow rapidly in the coming years due to underdiagnosed and undertreated ADHD. The growing prevalence of ADHD among children and increased efforts to spread awareness & provide diagnosis and treatment are expected to propel the market growth. For instance, the UK Adult ADHD Network (UKAAN) provides research & training for mental health professionals, cost-effective services, and education to increase awareness of ADHD.

The attention deficit hyperactivity disorder market in Germany held a substantial market share in 2023 owing to a genetic disposition that is reflected in a familial accumulation of the disease. The first choice of treatment prescribed in Germany is Ritalin in small doses, i.e., 5-10mg. The dose is increased progressively based on feedback from the patient.

Asia Pacific Attention Deficit Hyperactivity Disorder Market Trends

The market in Asia Pacific is expected to grow at the fastest rate during the forecast period owing to the rising prevalence of mental disorders, including ADHD, and increasing government initiatives to provide better & effective treatment for ADHD. According to the Institute of Mental Health (IMH), there are no local studies available on the prevalence of ADHD; however, international studies estimate that approximately 5% of the country's pediatric population has ADHD.

The Japan attention deficit hyperactivity disorder market is expected to witness significant growth during the forecast period owing to the increasing prevalence of the disease and increased prescription rate for ADHD drugs due to increased awareness about the disease & its treatment. According to Japan Medical Data Center Co., Ltd. (JMDC, Inc.), 3 million people are living with ADHD in Japan, accounting for 2.5% of the total population of Japan.

The attention deficit hyperactivity disorder market in China held a substantial market share in 2023. The psychiatry branch of the Chinese Medical Association estimated that over 40 million individuals in China may be affected by ADHD, with only 10% of them actively seeking professional assistance. This suggests a significant gap between the potential prevalence of ADHD and the utilization of professional support services for the condition in China.

Key Attention Deficit Hyperactivity Disorder Company Insights

Some of the key companies operating in the attention deficit hyperactivity disorder market include Novartis AG, Eli Lilly and Company, Johnson & Johnson Services, Inc. etc.

-

Novartis AG, a global pharmaceutical company, offers various brands for the treatment of attention deficit hyperactivity disorder. Some of the notable Novartis AG brands for ADHD include Ritalin, Concerta, Adderall, Vyvanse, and Strattera.

-

Eli Lilly and Company, a multinational pharmaceutical corporation, also offers a variety of brands for the management of attention deficit hyperactivity disorder. The Eli Lilly and Company brands for ADHD include Adderall XR and QuilliChew ER.

Lupin, Takeda Pharmaceutical Company Limited, Mallinckrodt plc, Pfizer, Inc. are some of the other market participants in the attention deficit hyperactivity disorder market.

Key Attention Deficit Hyperactivity Disorder Companies:

The following are the leading companies in the ADHD market. These companies collectively hold the largest market share and dictate industry trends.

- Eli Lilly and Company.

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- Lupin

- Novartis AG

- Takeda Pharmaceutical Company Limited

- Mallinckrodt Inc.

- Purdue Pharma LP

- NEOS Therapeutics Inc.

- Supernus Pharmaceutical, Inc.

Recent Developments

-

In July 2022, Swedish pharmaceutical company AGB-Pharma introduced Adaflex, the first melatonin product in the UK designed for insomnia in children and adolescents aged 6 to 17 years with ADHD when conventional sleep hygiene measures prove insufficient.

-

In April 2022, Supernus Pharmaceuticals, Inc. received FDA approval for Qelbree, developed by Supernus Pharmaceuticals, Inc., for treating ADHD patients aged 18 years and above. This approval was anticipated to increase the consumer base for the product.

Attention Deficit Hyperactivity Disorder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.0 billion

Revenue forecast in 2030

USD 18.6 billion

Growth Rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug Type, demographics, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novartis AG; Eli Lilly and Company; Johnson & Johnson Services, Inc.; Lupin; Takeda Pharmaceutical Company Limited; Mallinckrodt plc.; Pfizer, Inc.; Purdue Pharma L.P.; Aytu BioPharma, Inc. (NEOS Therapeutics Inc.), Supernus Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Attention Deficit Hyperactivity Disorder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global attention deficit hyperactivity disorder market report based on drug type, demographics, distribution channel, and region.

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stimulants

-

Amphetamine

-

Methylphenidate

-

Lisdexamfetamine

-

Dexmethylphenidate

-

-

Non-stimulants

-

Atomoxetine

-

Guanfacine

-

Clonidine

-

Others

-

-

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Children

-

Adults

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacy

-

Hospital Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global attention deficit hyperactivity disorder market size was valued at USD 14.3 billion in 2023 and is anticipated to reach USD 15.0 billion in 2024.

b. The global attention deficit hyperactivity disorder market is expected to witness a compound annual growth rate of 3.7% from 2024 to 2030 to reach USD 18.6 billion by 2030.

b. Based on drug type, the stimulant segment accounted for a share of 70.91% in 2023 due to high prescription and usage rate of stimulant drugs due to good efficacy and immediate result.

b. Some of the key players in the ADHD market are Novartis AG, Eli Lilly and Company, Johnson & Johnson Services, Inc., Lupin, Takeda Pharmaceutical Company Limited, Mallinckrodt plc., Pfizer, Inc., Purdue Pharma L.P., NEOS Therapeutics Inc., Supernus Pharmaceuticals Inc.

b. The major factors driving the market growth are the increasing prevalence of ADHD and increasing awareness about ADHD among physicians and patients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.