- Home

- »

- Next Generation Technologies

- »

-

Audiobooks Market Size & Share, Industry Report, 2030GVR Report cover

![Audiobooks Market Size, Share & Trends Report]()

Audiobooks Market (2025 - 2030) Size, Share & Trends Analysis Report By Genre (Fiction, Non-Fiction), By Preferred Device (Smartphones, Laptops & Tablets), By Distribution Channel, By Target Audience, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-588-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Audiobooks Market Summary

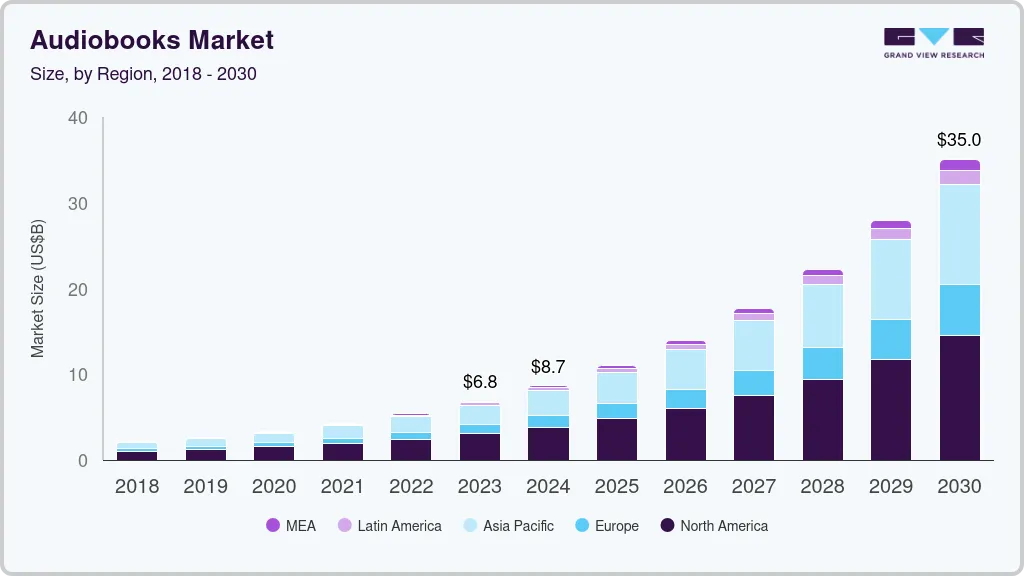

The global audiobooks market size was estimated at USD 8.70 billion in 2024 and is projected to reach USD 35.47 billion by 2030, growing at a CAGR of 26.2% from 2025 to 2030.The growing adoption of smartphones has significantly contributed to the increased popularity of audiobooks, enabling on-demand access from any location at any time.

Key Market Trends & Insights

- North America accounted for the highest revenue share of over 44% in 2024.

- The audiobooks market in the U.S. is expected to grow at a CAGR of 24% over the forecast period.

- By genre, the fiction segment dominated the market with a share of over 64% in 2024.

- By preferred device, the smartphone segment registered the largest revenue share in 2024.

- By distribution channel, the one-time download segment registered the highest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.70 Billion

- 2030 Projected Market Size: USD 35.47 Billion

- CAGR (2025-2030): 26.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the growing advancements in digital technology have further enhanced accessibility through online platforms and mobile devices, accelerating the audiobook industry's growth. Furthermore, the growing expansion of internet connectivity has broadened the consumer base of audiobooks, which is expected to present lucrative opportunities for audiobook industry expansion in the coming years.

The ongoing digital transformation drives significant market innovation, reshaping how audiobooks are created, distributed, and consumed. The growing advances in technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) have streamlined audiobook access, making them more readily available to customers. Furthermore, AI has improved the user experience by delivering personalized recommendations tailored to individual preferences and behaviors, further boosting the user experience and driving audiobook industry growth.

Moreover, key companies are adopting innovative strategies to enhance user engagement by offering personalized experiences that boost satisfaction. By leveraging AI-powered algorithms to analyze users' listening histories, these companies can recommend content that aligns with individual interests, thereby increasing user interaction. For instance, in September 2024, Audible, Inc. began testing AI-powered features to enhance audiobook discovery, including AI-generated tags that analyze customer feedback to provide personalized recommendations.

Furthermore, the rising popularity of audiobooks among younger audiences is significantly boosting the audiobooks industry’s expansion. This demographic increasingly favors audio formats over traditional print books, drawn to the dynamic listening experience provided by professional narrators or even celebrity voices. These elements enrich the storytelling experience, appealing to younger listeners and further fueling audiobooks industry demand.

Moreover, an increased focus on diverse and inclusive content propels the industry's growth. Publishers increasingly prioritize a broader range of voices, authors, and stories that reflect different cultures, backgrounds, and experiences. This shift is in response to the demand for more representation in media and is driving the expansion of audiobook catalogs to include diverse genres, languages, and perspectives. As a result, listeners now have access to a wider variety of audiobooks that cater to a global audience, including more stories from marginalized communities. Such trends are expected to drive the audiobook industry growth in the coming years.

Genre Insights

The fiction segment dominated the market with a market share of over 64% in 2024, driven by the increasing demand for immersive storytelling and entertainment. As consumers seek more convenient ways to engage with fiction, audiobooks provide an accessible and flexible solution for enjoying popular genres such as fantasy, romance, and thriller. The popularity of audiobook narrators, often featuring professional voices or celebrity performances, enhances the overall listening experience, making it more engaging. In addition, the rise of subscription-based audiobook services has expanded access to a wide variety of fiction titles, further fueling demand for this genre.

The non-fiction segment is expected to witness the highest CAGR of over 27% from 2025 to 2030, driven by the increasing demand for educational and self-improvement content. With busy lifestyles, consumers are turning to audiobooks as a convenient way to consume valuable knowledge on topics such as business, personal development, health, and history. The flexibility of audiobooks allows listeners to access informative content during commutes, workouts, or daily routines. Furthermore, the growth of professional and business-focused audiobooks has attracted a larger audience of individuals seeking continuous learning and skill development.

Preferred Device Insights

The smartphone segment registered the largest revenue share in 2024, owing to the widespread use of mobile devices and the increasing reliance on smartphones for entertainment and education. With easy access to audiobook apps such as Audible, Inc., Google Play Books, and Apple Books, consumers are now able to listen to books on-the-go, making audiobooks more accessible and convenient. Moreover, advancements in smartphone features such as longer battery life, improved sound quality, and enhanced screen capabilities support market growth. The growing trend of multitasking and consuming content during commuting or exercising has led to more consumers adopting audiobooks, thereby driving segmental growth.

The personal digital assistants or voice-enabled speaker segment is expected to grow fastest from 2025 to 2030. The rise of voice-enabled devices such as Amazon Alexa, Google Assistant, and Apple’s Siri drives market growth by allowing users to access audiobooks seamlessly through voice commands. This trend is fueled by the increasing adoption of smart speakers in homes and the growing desire for hands-free, on-demand entertainment. Integrating audiobook features into these voice assistants enables users to listen to books without interacting directly with a screen, enhancing convenience and user experience and contributing to the segment’s expansion.

Distribution Channel Insights

The one-time download segment in the market registered the highest share in 2024, driven by consumers who prefer to purchase and own individual titles rather than subscriptions. This model appeals to those who listen to audiobooks infrequently or only seek specific books, as it offers the flexibility to buy without ongoing fees. The ability to download and own audiobooks permanently, combined with the convenience of platforms such as Audible and Google Play, makes this option attractive for listeners who prefer a straightforward purchase model.

The subscription-based segment is expected to record the fastest growth over 2024 - 2030. This is attributed to the development of Streaming Books-On-Demand (SBOD) models. Consumers' access to a diverse content selection, when they subscribe to a package, fosters segmental growth. The trend of important firms offering unlimited subscription packages to gain a competitive advantage over other market participants significantly impacts market growth.

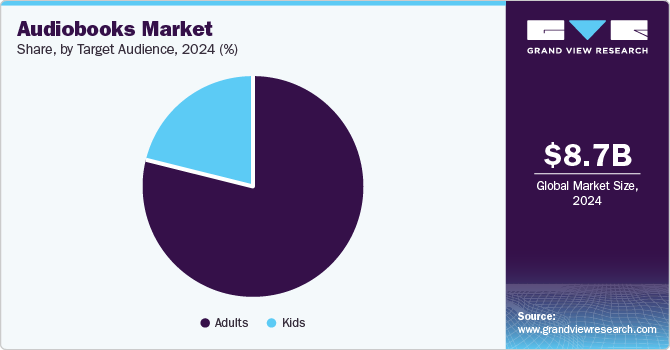

Target Audience Insights

The adults segment registered the largest revenue share in 2024, driven by the wide variety of genres and titles designed for adult audiences. This segment has experienced significant growth in recent years, with a broad range of content catering to various tastes and preferences among adult listeners. In addition, the trend of companies launching region-specific or community-targeted audiobooks to attract consumers and gain a competitive market advantage contributes to the segment's expansion.

The kids segment is expected to grow at the fastest CAGR from 2025 to 2030, largely owing to the increasing use of audiobooks for educational purposes. Many audiobooks are also being created for children's entertainment. The benefits of audiobooks for kids, including improved vocabulary, enhanced imagination, and better narrative understanding, contribute to stronger reading comprehension skills. The growing demand for these advantages is expected to present lucrative growth opportunities for the segment.

Regional Insights

North America accounted for the highest revenue share of over 44% in 2024, driven by the high adoption of digital content, widespread internet access, and the growing popularity of smartphones and smart speakers. Consumers in the region increasingly seek on-the-go entertainment and education, leading to a surge in audiobook consumption. Moreover, the rise of subscription-based platforms like Audible and the growing demand for audiobooks across genres such as self-help, business, and fiction contribute to market growth. The increasing focus on convenience and multitasking also fuels the demand for audiobooks in North America.

U.S. Audiobooks Market Trends

The audiobooks market in the U.S. is expected to grow at a CAGR of over 24% from 2025 to 2030, driven by the widespread adoption of smartphones, tablets, and digital platforms such as Audible, Inc., making audiobooks highly accessible. The growing demand for on-the-go content and a strong preference for entertainment and self-help genres fuels market growth. Furthermore, increasing interest in podcasts and audio-based learning supports the rise of audiobooks.

Europe Audiobooks Market Trends

The audiobooks market in Europe is expected to grow at a CAGR of over 28% from 2025 to 2030, owing to the rising popularity of digital media and an increasing shift toward audio-based content consumption. The growing use of mobile devices and e-readers and a strong cultural storytelling tradition further support the market. The rise of local language audiobooks catering to diverse European populations and the increasing availability of subscription services have bolstered the market. In addition, the growing focus on education and personal development has spurred demand for audiobooks in genres like educational, self-help, and children's content.

The UK audiobooks market is expected to grow significantly in the coming years. The country's strong literary culture and the increasing demand for audiobooks in genres like fiction, crime, and historical fiction are key drivers. Moreover, the audiobook surge for educational purposes contributes to market growth.

The audiobooks market in Germany is driven by the growing availability of audiobooks in German and localized content for various genres, such as fiction and self-help, which is further attracting more consumers. The increasing adoption of subscription models and the rise of audiobooks in education are also driving the market.

Asia Pacific Audiobooks Market Trends

The audiobooks market in Asia Pacific is expected to grow at the highest CAGR of over 25% from 2025 to 2030, owing to the rising smartphone penetration, increasing internet access, and the growing acceptance of digital entertainment formats. With a large young population and a growing middle class, there is a rising demand for educational audiobooks, particularly in countries like China, Japan, and India. The trend of integrating audiobooks with e-learning platforms and the increasing popularity of regional and vernacular language content is further driving the market.

Japan audiobooks market is gaining traction, fueled by the nation’s strong culture of reading and storytelling and the widespread use of mobile devices and digital platforms. The increasing demand for audiobooks in Japan, especially for genres like fantasy, manga adaptations, and educational content, contributes to market growth. The popularity of subscription services and the growth of audio content for personal development are also key drivers.

The audiobooks market in China is rapidly expanding owing to the widespread use of smartphones and the increasing availability of platforms offering Chinese-language content. The rise of digital learning and audio-based entertainment, particularly among younger generations, is a key driver. Moreover, the increasing demand for audiobooks in local dialects and regional languages is expanding the market’s reach.

Key Audiobooks Company Insights

Some key players operating in the market include Amazon.com, Inc. and Spotify AB.

-

Amazon.com, Inc. (Amazon Music) is a streaming service offering a vast library of music, podcasts, and other audio content. It provides users with access to millions of songs across various genres, available through different subscription tiers, including Amazon Music Unlimited and Amazon Prime Music. Amazon Music is integrated into Amazon's broader ecosystem, allowing users to enjoy seamless playback across devices, including Echo smart speakers. Beyond music, Amazon Music is expanding its offerings to include podcasts and audiobooks, strengthening its position in the audio entertainment market.

-

Spotify AB offers a selection of audiobooks and spoken word content, positioning itself as a competitor to traditional audiobook platforms. Spotify’s audiobook offering is integrated with its music streaming service, providing users seamless access to music and audio content. As part of its strategy to diversify its offerings, Spotify continues investing in expanding its audiobook library to capture a broader audience with free and premium subscription models.

Downpour.com & Storytel. are some of the emerging market participants.

-

Downpour.com offers a wide range of digital audiobooks for purchase or rental. The platform provides audiobooks across various genres, from bestsellers to niche titles, and operates on both a pay-per-title and subscription-based model. Downpour is known for offering competitive pricing and a straightforward, user-friendly interface, catering to audiophiles looking for an alternative to larger audiobook services.

-

Storytel AB is an audiobook and e-book streaming service that operates in multiple countries, including Sweden, India, and other European markets. The company offers a subscription-based service that provides unlimited access to a vast library of audiobooks and e-books across various genres. Storytel’s extensive catalog includes both international bestsellers and localized content in several languages.

Key Audiobooks Companies:

The following are the leading companies in the audiobooks market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Apple Inc.

- Audible, Inc

- Barnes & Noble Booksellers, Inc.

- Downpour.com

- Google LLC

- PLAYSTER (SOFTONIC INTERNATIONAL S.A.)

- Rakuten Group, Inc.

- Storytel AB

- VoiceVerse

- Spotify AB

Recent Developments

-

In March 2025, Amazon.com, Inc. announced the integration of Audible's extensive audiobook catalog into its Unlimited subscription service, expanding access to audiobooks for subscribers in the U.S., UK, Canada, France, Australia, and New Zealand.

-

In October 2024, Spotify AB expanded its Audiobook service to France, Belgium, the Netherlands, and Luxembourg, offering over 200,000 titles to Premium subscribers. The service includes 12 hours of free audiobook listening per month, with additional listening time available for purchase.

-

In January 2024, RBmedia expanded its audiobook catalog by acquiring Berrett-Koehler's audiobook publishing company. This acquisition included a diverse range of titles, strengthening RBmedia's position in the educational and professional audiobook segments.

Audiobooks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.06 billion

Revenue forecast in 2030

USD 35.47 billion

Growth rate

CAGR of 26.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Genre, preferred device, distribution channel, target audience, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia; Nordic Countries; China; Australia; Japan; India; South Korea; Brazil; Mexico; Argentina; Chile; South Africa; Saudi Arabia; UAE; Egypt; Turkey

Key companies profiled

Amazon.com, Inc.; Apple Inc.; Audible, Inc; Barnes & Noble Booksellers, Inc.; Downpour; Google LLC; PLAYSTER (SOFTONIC INTERNATIONAL S.A.); Rakuten Group, Inc.; Storytel AB; Spotify AB.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Audiobooks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global audiobooks market report based on genre, preferred device, distribution channel, target audience, and region:

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiction

-

Non-Fiction

-

-

Preferred Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Laptops & Tablets

-

Personal Digital Assistants

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

One-time download

-

Subscription-Based

-

-

Target Audience Outlook (Revenue, USD Million, 2018 - 2030)

-

Kids

-

Adults

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Nordic Countries

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global audiobooks market size was estimated at USD 8.70 billion in 2024 and is expected to reach USD 11.06 billion in 2025.

b. The global audiobooks market is expected to grow at a compound annual growth rate of 26.2% from 2025 to 2030 to reach USD 35.47 billion by 2030.

b. The North American region observed the highest revenue share of over 44% in 2024 and is anticipated to dominate the market in the forecast period. This is due to the early and quick technological adoption to improve user experience.

b. Some key players operating in the audiobooks market include Amazon.com, Inc., Apple Inc., Audible, Inc, Barnes & Noble Booksellers, Inc., Downpour.com and Google LLC

b. Key factors that are driving the availability of the internet and various IoT devices provide easier ways for consumers to listen to audiobooks, increasingly popularity among younger age groups and growing users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.