- Home

- »

- Clinical Diagnostics

- »

-

Autoimmune Disease Diagnostics Market Size Report, 2033GVR Report cover

![Autoimmune Disease Diagnostics Market Size, Share & Trends Report]()

Autoimmune Disease Diagnostics Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Systemic Autoimmune Disease Diagnostics, Localized Autoimmune Disease Diagnostics), By Product, By Test, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-292-1

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autoimmune Disease Diagnostics Market Summary

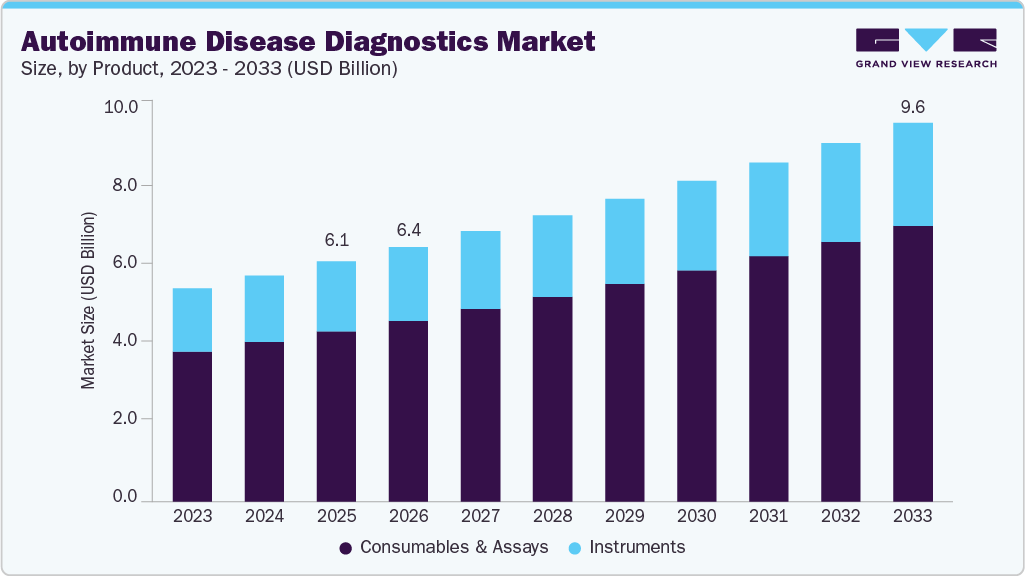

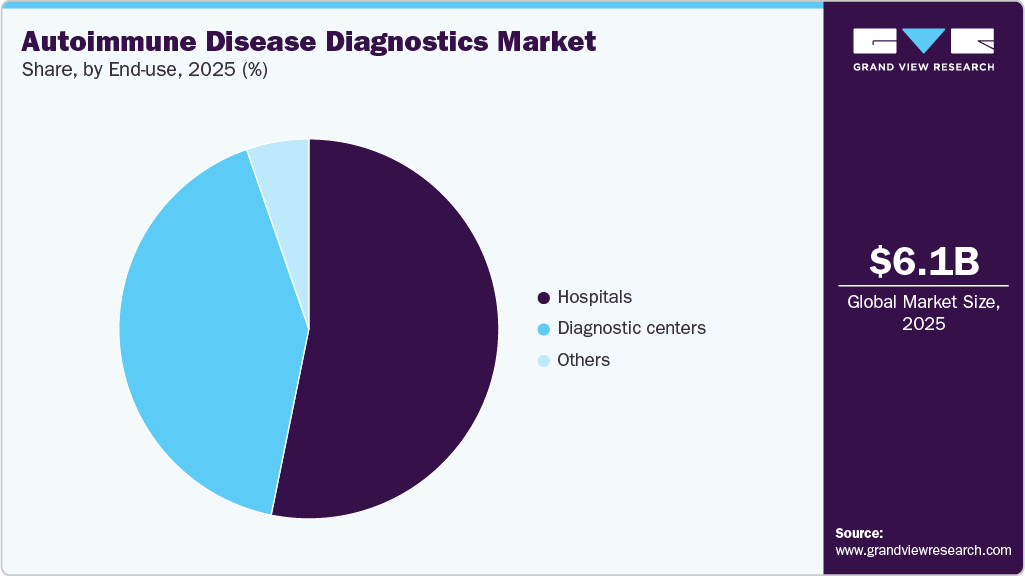

The global autoimmune disease diagnostics market size was estimated at USD 6.07 billion in 2025 and is projected to reach USD 9.58 billion by 2033, growing at a CAGR of 5.84% from 2026 to 2033. The increasing prevalence of autoimmune disorders such as type 1 diabetes in newborn babies, coupled with the demand for rapid diagnostics, is the key driver accentuating growth.

Key Market Trends & Insights

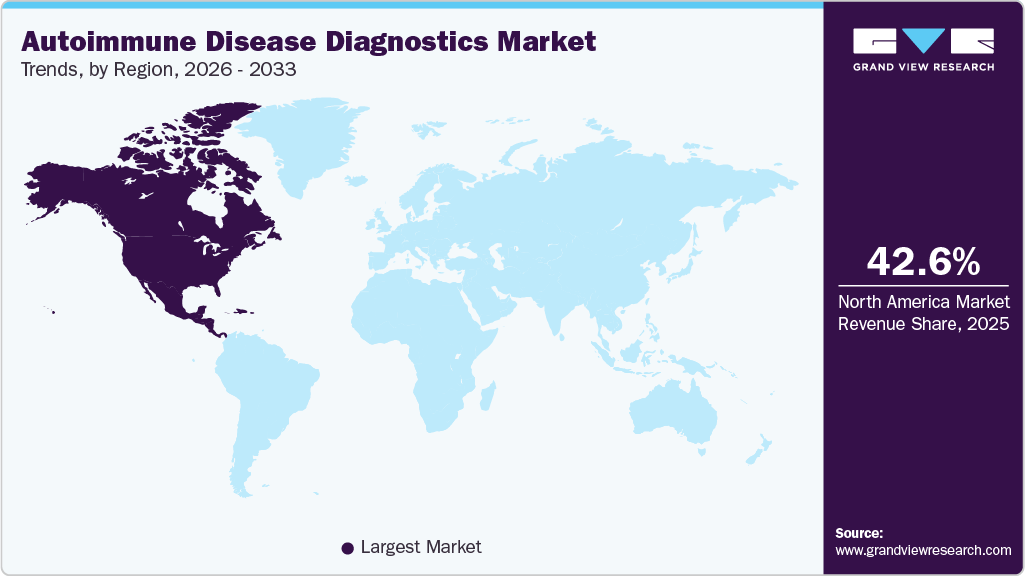

- The North America autoimmune disease diagnostics market dominated the global industry and accounted for the largest revenue share of 42.57% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- Based on the type, the localized autoimmune disease diagnostics segment dominated the global market with a 63.84% market share in 2025.

- On the basis of product, the consumables & assays segment held the largest revenue share of 70.70% in 2025.

- Based on the test, the antinuclear antibody tests (ANA) segment held the largest revenue share of 42.76% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.07 Billion

- 2033 Projected Market Size: USD 9.58 Billion

- CAGR (2026-2033): 5.84%

- North America: Largest market in 2025

In addition, there is an increasing focus on investments and funding for research related to autoimmune diseases, which further propels market growth. Furthermore, developing countries offer untapped opportunities for market expansion, presenting significant growth prospects in the years to come.The establishment of technological advancements and the expansion of lab automation rates are anticipated to boost market growth. Clinicians are implementing advanced technology to conduct several tests at the same time with faster and more precise results.

Autoimmune diseases are a group of more than 100 chronic, debilitating conditions that affect approximately 3% of the US population. Some of the most common autoimmune diseases include obesity, cardiovascular diseases, type 2 diabetes mellitus, and all cancers. Thus, genetic factors, environmental influences, specific hormones, and susceptibility to certain infections are key contributors to the rising prevalence of autoimmune diseases globally. According to an article published by the National Health Council in September 2024, autoimmune diseases affect approximately 50 million Americans, and women account for 80% of this number. Given the inherent complexity involved in diagnosing these conditions, this figure is likely understated. More concerning is the fact that autoimmune diseases are approaching epidemic proportions, with several studies indicating annual growth rates in the range of 3%-12%.

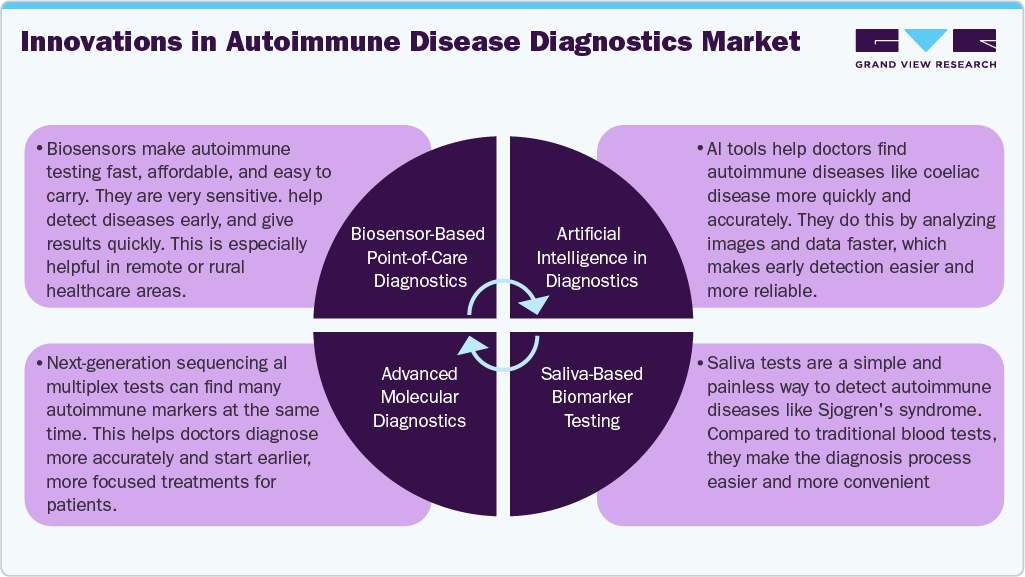

An increasing rate of novel technological advancements and the corresponding emergence of laboratory automation technologies significantly contribute to market expansion. This trend is driven by the growing adoption of advanced technologies among clinicians, enabling them to conduct a wide range of tests while achieving faster and more accurate results. For instance, in January 2025, Werfen received FDA clearance for Aptiva Antiphospholipid Syndrome (APS) Immunoglobulin G (IgG) and Immunoglobulin M (IgM) Reagents. These assays enhance the accuracy of antiphospholipid syndrome (APS) diagnosis, addressing a significant unmet need in the diagnosis of autoimmune diseases.

In addition, the implementation of government initiatives across economies supports market developments. Work by organizations such as the Autoimmunity Centers of Excellence (ACE), the Cooperative Study Group for Autoimmune Disease Prevention (CSGADP), and the North American Rheumatoid Arthritis Consortium (NARAC) contributes to market growth by creating awareness among patients and healthcare professionals regarding proper diagnosis and treatment protocols.

The involvement of organizations such as the Autoimmunity Centers of Excellence, Cooperative Study Group for Autoimmune Disease Prevention, and North American Rheumatoid Arthritis Consortium in educating patients and healthcare professionals about proper diagnosis and treatment is anticipated to have a positive impact on market dynamics, as it promotes awareness and early intervention in autoimmune diseases. This, in turn, is expected to drive the growth of the autoimmune disease diagnostics market. Besides, favorable government initiatives aimed at increasing access to diagnostic tests, improving disease management and reducing healthcare costs, among other factors, are also expected to boost market growth during the forecast period.

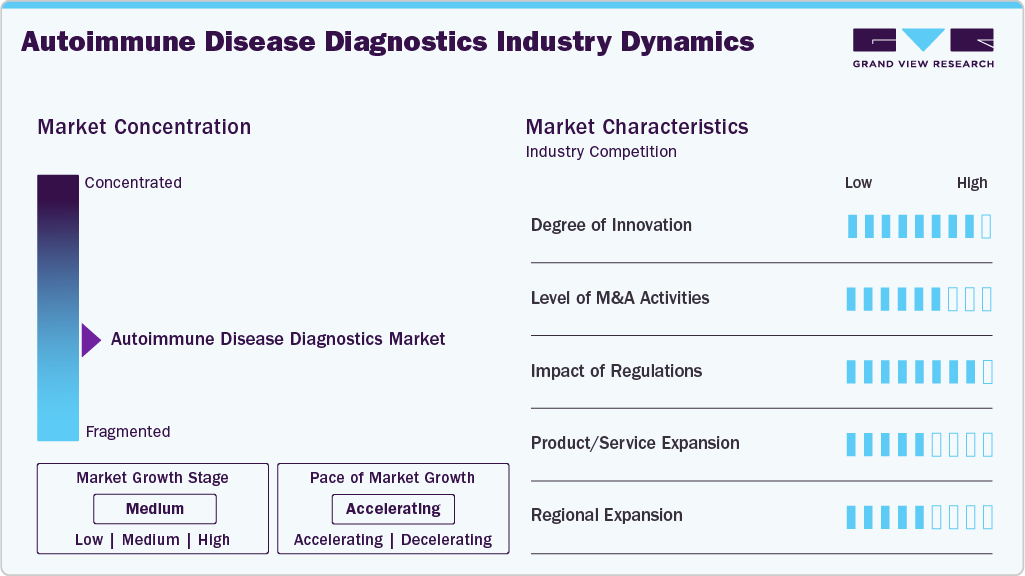

Market Concentration & Characteristics

The autoimmune disease diagnostics industry is witnessing a high degree of innovation as advancements in technology and increasing research efforts are driving the development of new diagnostic tools. The emergence of novel biomarkers, molecular diagnostics, and personalized medicine approaches is transforming the landscape of autoimmune disease diagnosis. The use of artificial intelligence and machine learning algorithms in diagnosis is also gaining traction, improving accuracy and reducing diagnostic errors. Furthermore, the integration of digital health technologies, such as wearables, mobile apps, and telemedicine platforms, is facilitating remote monitoring and early detection of autoimmune diseases, leading to improved patient outcomes and reduced healthcare costs.

The mergers and acquisitions (M&A) activity in the market is currently medium-high, as major players in the industry are actively seeking to expand their portfolios and strengthen their market positions through strategic acquisitions. In January 2025, OMNY Health partnered with Scipher Medicine for autoimmune disease treatment. The partnership aims to integrate Scipher’s PrismRA test transcriptomic data with OMNY Health’s EHR network.

Such acquisitions are aimed at enhancing the companies' capabilities in research and development, manufacturing, and sales and marketing, as well as expanding their geographic reach. The M&A activity is driven by the increasing prevalence of autoimmune diseases, growing demand for personalized medicine, and the need for more accurate and efficient diagnostic tools.

The impact of regulation on the market for autoimmune disease diagnostics is significant, as regulatory approval is a crucial step in introducing new diagnostic products to the market. The regulatory environment is complex and varies by region, with different requirements for clinical trials, data submission, and product approval. This can add high costs and time to the development process, which can impact the profitability and competitiveness of companies operating in the market. However, regulatory approval also provides a level of assurance regarding the safety, efficacy, and quality of diagnostic products, which can help build trust with healthcare providers, patients, and payers. Some recent regulatory developments in the industry include the approval of Roche's Elecsys Anti-MDA Plus assay for the diagnosis of systemic lupus erythematosus, and the approval of Quanterix' Simoa HD-1 Analyzer System, which uses single molecule array (Simoa) technology for the detection of autoantibodies.

Product expansion is a key strategy being adopted by major players, as companies seek new growth opportunities through the development of innovative diagnostic products. The market is highly competitive, with several large players as well as emerging players vying for market share. To differentiate themselves from competitors, companies are investing in research & development activities aimed at expanding their product portfolios. This includes the development of new diagnostic tests for emerging autoimmune diseases, as well as the expansion of existing diagnostic tests to cover a broader range of diseases. For instance, in August 2024, Progentec Diagnostics announced the launch of CareMGMT, an app that provides features tailored to the patient’s health journey, including comprehensive symptom tracking, personalized health insights, and research news & updates.

Regional expansion is another key growth strategy being adopted by major players in the autoimmune disease diagnostics market, as companies seek to expand their customer base and increase their market share in new geographic regions. The market is highly fragmented, with significant variations in diagnostic practices and healthcare infrastructure across different regions. To capitalize on these opportunities, companies are investing in regional expansion initiatives, such as setting up new manufacturing facilities, establishing distribution networks, and partnering with local healthcare providers.

Type Insights

The localized segment dominated the market and accounted for 63.84% of the global revenue in 2025, owing to factors including prevalence, diagnostic advancements, awareness, technological innovations, and research, which contribute to the growth and improvement of the localized and systemic autoimmune disorder diagnostics market. Technological advancements, such as antigen microarray and mass spectrometry, have significantly improved antibody profiling in autoimmune diagnostics. These advancements have demonstrated positive outcomes in terms of analytical sensitivity and reproducibility. With further refinement and validation, these practices have the potential to be integrated into routine clinical procedures.

Systemic disorders diagnostics are expected to depict the fastest growth rate over the forecast period. Systemic autoimmune diseases such as rheumatoid arthritis, systemic lupus erythematosus (SLE), psoriasis, and multiple sclerosis are significant contributors to the market. According to the reports from the National Center of Biotechnology Information (NCBI), the annual incidence of rheumatoid arthritis in countries such as the U.S. and certain nations in northern Europe is approximately 40 per 100,000 individuals. Further more, the prevalence of rheumatoid arthritis in the U.S. alone exceeds 1.3 million people, and this number is expected to increase in the future, owing to the increasing applications of the antinuclear antibody tests in the diagnosis of various autoimmune diseases is anticipated to support the market growth projection period.

Product Insights

The consumables & assays segment accounted for the largest revenue share of 70.70% in 2025. Every laboratory diagnostic test utilizes test kits, reagents, and antibodies. Advancements in novel biomarkers and specific assays for autoimmune diseases fuel the demand for specialized consumables. In addition, advancements in consumable technologies have led to the emergence of cost-effective alternatives to traditional diagnostic instruments, particularly in resource-constrained settings. Moreover, there are numerous types of autoimmune diseases, each requiring specific tests and assays. This translates to a wider range of consumables and assays required to diagnose such conditions, resulting in a higher market share for these products.

The instruments segment is expected to experience a significant CAGR during the forecast period. In contrast to consumables, instruments are typically used for multiple tests and have a longer lifespan, leading to a lower need for replacements. Instruments often run various tests, but may not be specific to autoimmune diseases. In addition, high-end diagnostic instruments are usually designed for long-term use with a high initial investment. With the emergence of new instrument models, the overall replacement cycle for these products is expected to be longer compared to consumables, resulting in a lower market share.

Test Insights

The antinuclear antibody tests dominated the market with a revenue share of 42.76% in 2025 and are expected to experience significant growth, driven by the increasing applications of the antinuclear antibody tests in the diagnosis of various autoimmune diseases. This is anticipated to support the market growth projection period. In January 2025, an article published by the Journal of Clinical Laboratory Analysis cited that the flow cytometry-based Coombs test detects antinuclear antibodies (ANA) bound to red blood cells in autoimmune patients. The method demonstrated high sensitivity and accuracy, revealing significant ANA agglutination in patients versus healthy controls (p < 0.0001) and stable serum results over ten days, highlighting its potential to improve autoimmune disease diagnostics in clinical laboratories.

The autoantibody tests are the second dominant segment in the market throughout the forecast period. The factors driving the growth of the segment include autoantibody testing, encompassing the need for accurate diagnosis and management of autoimmune diseases, advancements in diagnostic technologies, the adoption of personalized medicine, and ongoing research and development activities in the field.

End Use Insights

The hospital segment dominated the market in 2025 with a revenue share of 53.18%. The growth of the segment is driven by various factors, including the increasing number of hospitals and the rising rate of diagnosis and treatment of autoimmune diseases within these healthcare settings. For instance, a February 2024 article published by the Statistisches Bundesamt stated that Germany had a total of 1,887 hospitals. The significant presence of hospitals in key European countries indicates a substantial volume of testing procedures being performed within these institutions across Europe. This trend highlights the growing demand for autoantibody testing services in hospital settings and its potential impact on the market.

The diagnostic centers segment is expected to witness the fastest growth rate during the forecast period. The growth in autoantibody testing within diagnostic centers can be attributed to several factors, such as expanding diagnostic capabilities of these centers, which enables them to provide comprehensive testing services, including autoantibody testing, to their patients. In addition, diagnostic centers are often preferred by patients due to the availability of comprehensive care, encompassing diagnosis, treatment, surgical procedures, and physiotherapy. This preference for diagnostic centers contributes to the increased demand for autoantibody testing services within diagnostic centers settings.

Regional Insights

The autoimmune disease diagnostics industry in North America dominated the market with a share of 42.57% in 2025, primarily driven by the escalating burden of autoimmune disease and support from the government in the region. The growth of the market is propelled by increased healthcare spending and increased awareness among the general population.

U.S. Autoimmune Disease Diagnostics Market Trends

The U.S. autoimmune disease diagnostics industry is expected to experience a substantial impact on the market due to the high prevalence of these conditions. Although autoimmune diseases are rare, the National Institutes of Health (NIH) estimates that approximately 5% to 8% of the U.S. population is affected by these diseases. This expanding patient pool further strengthens the market prospects.

Europe Autoimmune Disease Diagnostics Market Trends

The autoimmune disease diagnostics industry in Europe is expected to grow at a significant rate during the forecast period, driven by factors such as increasing prevalence of autoimmune diseases, rising awareness about early diagnosis of these diseases, and growing demand for personalized medicine. In addition, advancements in diagnostic technologies are driving up healthcare expenditures, and collaborations between research institutes and diagnostic companies are further fueling market expansion in the region.

The UK autoimmune disease diagnostics industry is expected to grow over the forecast period, driven by factors such as increasing prevalence of autoimmune diseases, rising awareness about early diagnosis of these diseases, and growing demand for personalized medicine. According to a recent report by NHS Digital, around 4 million people in England are affected by autoimmune diseases, making it a major public health challenge in the country. A new population-based study of 22 million people in the UK reveals that these conditions now affect approximately one in ten individuals, which is higher than previous estimates, ranging from 3% to 9%, and often relied on smaller sample sizes and included fewer autoimmune diseases.

The autoimmune disease diagnostics industry in France is expected to grow significantly during the forecast period due to factors such as the increasing prevalence of autoimmune diseases in the country and the rising demand for personalized medicine. Besides, the aging population and a shift toward preventive healthcare are contributing to the increasing adoption of advanced diagnostic solutions across France. Moreover, advancements in diagnostic technologies, rising awareness about early disease detection, and supportive healthcare infrastructure are accelerating market growth in the region.

The Germany autoimmune disease diagnostics industry is expected to grow at a significant rate due to several factors, including the government initiatives and funding. For instance, the West German Genome Center received a two-year €8.3 million ($9.0 million) funding package from the government. The German government's funding for research and development of diagnostic tools for autoimmune diseases is expected to drive market growth. This funding is expected to enable the development of new diagnostic tools and technologies for autoimmune diseases and their commercialization in the marketplace through initiatives such as "Innovationsprogramm Medizintechnik" and "Zentrum für Innovationskompetenz Medizintechnik."

Asia Pacific Autoimmune Disease Diagnostics Market Trends

The autoimmune disease diagnostics industry in the Asia-Pacific region is expected to witness significant market growth during the forecast period, primarily due to the increasing burden of autoimmune diseases and the growing awareness regarding their diagnosis. In addition, inflammatory, autoimmune, and pulmonary diseases, including psoriasis, rheumatoid arthritis, and inflammatory bowel disease, are witnessing a notable increase in the Asia Pacific region. Moreover, the region already holds the distinction of having the world's highest burden of chronic obstructive pulmonary disease (COPD), along with the highest prevalence of systemic lupus erythematosus (SLE) in China and Southeast Asia. These concerning trends are expected to drive significant demand for diagnostics in the Asia Pacific region in the forthcoming years.

The China autoimmune disease diagnostics industry is expected to grow during the forecast period. The increasing prevalence of autoimmune diseases, such as rheumatoid arthritis and type 1 diabetes, is a major driver of market demand. Rapid urbanization, changing lifestyles, and environmental factors contribute to the rise of these chronic conditions. Moreover, growing awareness among patients and healthcare providers about the importance of early diagnosis and treatment options encourages the use of advanced diagnostic tools. Supportive government policies, increased investment in healthcare infrastructure, and growing collaborations between international and domestic diagnostic companies are further accelerating the adoption of innovative testing solutions across urban and rural healthcare settings in the country.

The autoimmune disease diagnostics industry in Japan is anticipated to grow considerably over the forecast period. Japan's elderly population has reached a record 36.25 million, comprising 29.3% of its total population, the highest proportion globally, according to an article by Al Jazeera in September 2024. This demographic trend has resulted in an increased prevalence of autoimmune diseases such as rheumatoid arthritis, systemic lupus erythematosus, and thyroid disorders among older individuals, driving demand for autoimmune disease diagnostics. This trend is expected to continue as Japan's population continues to age due to low birth rates and increasing life expectancy. As a result, the demand for autoimmune disease diagnostic services is expected to increase in Japan over the coming years.

Latin America Autoimmune Disease Diagnostics Market Trends

The autoimmune disease diagnostics industry in Latin America is expanding, driven by the rising prevalence of conditions such as Systemic Lupus Erythematosus (SLE) and Rheumatoid Arthritis (RA), increasing awareness among patients and healthcare professionals, and the strengthening of diagnostic infrastructure and services across key countries. Additionally, recent regulatory approvals of innovative diagnostic tests for lupus and RA underscore the growing availability of specialized assays in the region. Concurrently, advances in scientific research indicate that certain neurodegenerative disorders may have autoimmune etiologies, thereby broadening the scope of diagnostic needs. Increased investments by global diagnostics companies, along with the adoption of advanced immunoassay and multiplex technologies, are further improving test accessibility, reliability, and diagnostic accuracy across Latin American markets.

The Brazil autoimmune disease diagnostics industryis experiencing steady growth, supported by ongoing improvements in the national healthcare system and increased investment in laboratory services. Expanded government support for public health initiatives and autoimmune disease-focused research is strengthening the availability of diagnostic capabilities across hospitals and clinics. The increasing adoption of advanced technologies, such as high-sensitivity immunoassays and point-of-care testing, is enabling faster and more accurate identification of autoimmune disorders. In parallel, a growing number of collaborations between Brazilian research institutions and global diagnostics companies is accelerating the introduction of innovative testing solutions. Moreover, enhancements in both public and private health insurance coverage are improving patient access to diagnostic testing. Collectively, these factors are driving sustained market growth while supporting earlier diagnosis and more effective disease management across Brazil.

Middle East and Africa Autoimmune Disease Diagnostics Market Trends

The autoimmune disease diagnostics industry in the Middle East and Africa is experiencing steady growth, driven by increasing awareness of autoimmune disorders among healthcare professionals and patients, which encourages earlier diagnosis and timely intervention. The rising prevalence of conditions such as rheumatoid arthritis, lupus, and multiple sclerosis is fueling demand for accurate and reliable diagnostic solutions across the region. Ongoing investments in healthcare infrastructure, including the establishment of specialized laboratories and advanced diagnostic centers, are improving access to testing services. Technological advancements, such as biomarker-based assays and multiplex testing platforms, are further enhancing diagnostic accuracy while reducing turnaround times. In addition, supportive government initiatives and public health programs aimed at improving chronic disease management and screening are contributing to market expansion. Collectively, these factors are creating a favorable environment for the adoption of innovative autoimmune disease diagnostic technologies throughout the Middle East and Africa.

The UAE autoimmune disease diagnostics industry is experiencing robust growth, driven by the increasing burden of chronic conditions, heightened awareness among both the public & healthcare professionals, and a growing emphasis on early detection and disease monitoring. Sustained investments in healthcare infrastructure, including the development of advanced laboratories and diagnostic facilities, have significantly improved access to high-quality testing services. The adoption of innovative technologies-such as automated immunoassays, biomarker-based diagnostics, and AI-enabled diagnostic solutions-is enhancing testing accuracy, throughput, and turnaround times. Supportive government initiatives and favorable regulatory frameworks are further strengthening diagnostic capabilities across both public and private healthcare sectors. In parallel, the broader in vitro diagnostics (IVD) market, encompassing autoimmune testing, continues to expand, supported by medical tourism, rising demand for personalized medicine, and an increased focus on chronic disease screening across the population.

Key Autoimmune Disease Diagnostics Company Insights

Key players are undertaking various strategic initiatives to increase their share in the market. New product development, collaborations, and partnerships are some such endeavors. Building on these initiatives, companies are expanding their diagnostic offerings to encompass a broader range of autoimmune diseases, driven by the increasing global prevalence of chronic immune-mediated conditions. Numerous manufacturers are investing in high-throughput technologies, enhanced assay sensitivity, and automated systems to enable quicker turnaround times and more reliable clinical decision-making.

Key Autoimmune Disease Diagnostics Companies:

The following are the leading companies in the autoimmune disease diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers AG

- Abbott

- Beckman Coulter, Inc.

- Danaher Corporation

- Quest Diagnostics

- EUROIMMUN Medizinische Labordiagnostika AG

- Nova Diagnostics Pte Ltd.

- BIOMÉRIEUX

- Hemagen Diagnostics, Inc.

Recent Developments

-

In November 2025, Dr. Lal PathLabs launched India’s first dedicated laboratory for advanced autoimmune diagnostics to diagnose complex autoimmune & inflammatory diseases. The advanced facility expands access to globally benchmarked complement assays for patients in India, with several of these specialized tests being introduced in the domestic market for the first time.

-

In April 2025, Scipher Medicine collaborated with Kythera Labs to integrate real-world clinical and genomic data from Scipher’s PrismRA Test with Kythera’s high-fidelity multi-source EHR and claims data. The collaboration aims to advance precision medicine in rheumatology, enabling disease-specific insights, improved diagnostics, and accelerated development of personalized autoimmune therapies.

-

In March 2025, Savara Inc., announced the launch of aPAP ClearPath Dried Blood Spot (DBS) Test in the U.S. The test diagnoses Autoimmune Pulmonary Alveolar Proteinosis with only a simple finger-prick blood sample.

-

In February 2025, The Benaroya Research Institute is starting a new way to find autoimmune diseases early. They are adding a special blood test, called an autoantibody test, to regular checkups at the doctor’s office. This test can help spot diseases like type 1 diabetes and rheumatoid arthritis before any symptoms appear. Finding these diseases early can help doctors treat them sooner and possibly stop serious problems. Right now, pilot testing is underway.

-

In January 2025, Exagen Inc. received conditional approval from the New York State Department of Health for its new biomarker assays for lupus and rheumatoid arthritis, to be added to the AVISE CTD diagnostic platform. The T-Cell Lupus Profile assay enhances the detection of lupus by measuring biomarkers such as TC4d, TIgG, and TIgM, improving accuracy in complex cases.

-

In January 2025, RheumaGen, a biotechnology company based in Aurora, Colorado, secured $15 million in Series A financing co-led by SPRIM Global Investments and William Taylor Nominees. The funds will support Phase I trials of RG0401, a gene-editing therapy targeting treatment-resistant rheumatoid arthritis by modifying HLA genes to prevent autoimmune responses. The company aims to develop one-time, curative treatments for autoimmune diseases, including multiple sclerosis and type 1 diabetes.

Autoimmune Disease Diagnostics Market Report Scopes

Report Attribute

Details

Market size value in 2026

USD 6.44 billion

Revenue forecast in 2033

USD 9.58 billion

Growth rate

CAGR of 5.84% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, test, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Siemens Healthineers AG; Abbott; Beckman Coulter, Inc.; Danaher Corporation; Quest Diagnostics; EUROIMMUN Medizinische Labordiagnostika AG.; Nova Diagnostics Pte Ltd.; BIOMÉRIEUX; Hemagen Diagnostics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autoimmune Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global autoimmune disease diagnostics market report based on type, product, test, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Systemic autoimmune disease diagnostics

-

Rheumatoid arthritis

-

Ankylosing spondylitis

-

Systemic lupus erythematosus (SLE)

-

Others

-

-

Localized autoimmune disease diagnostics

-

Multiple sclerosis

-

Type 1 diabetes

-

Hashimoto's Thyroiditis

-

Idiopathic thrombocytopenic purpura

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables and Assays

-

-

Test Outlook (Revenue, USD Million, 2021 - 2033)

-

Antinuclear antibody tests

-

Autoantibody tests

-

C-reactive Protein (CRP)

-

Complete blood count (CBC)

-

Urinalysis

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players of this market include F. Hoffmann-La Roche Ltd; Siemens Healthineers; Abbott Laboratories; Beckman Coulter, Inc.; SQI Diagnostics; Quest Diagnostics; EUROIMMUN AG; AESKU.Diagnostics GmbH & Co. KG; INOVA Diagnostics, Inc.; Crescendo Bioscience, Inc.; bioMerieux SA; and Bio-Rad Laboratories, Inc.

b. The global autoimmune disease diagnostics market size was estimated at USD 6.07 billion in 2025 and is expected to reach USD 6.44 billion in 2026.

b. The global autoimmune disease diagnostics market is expected to witness a compound annual growth rate of 5.84% from 2026 to 2033 to reach USD 9.58 billion by 2033.

b. North America held the largest share of 42.57% in 2025, mainly due to the introduction of the Affordable Care Act, the presence of favorable regulations & initiatives undertaken by the AARDA, and high disease prevalence in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.