- Home

- »

- Medical Devices

- »

-

Autologous Wound Patches Market Size Report, 2030GVR Report cover

![Autologous Wound Patches Market Size, Share & Trends Report]()

Autologous Wound Patches Market Size, Share & Trends Analysis Report By Type (Platelet Rich Plasma), By Application (Chronic Wounds, Acute Wounds), By End Use (Hospitals, Clinics), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-920-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

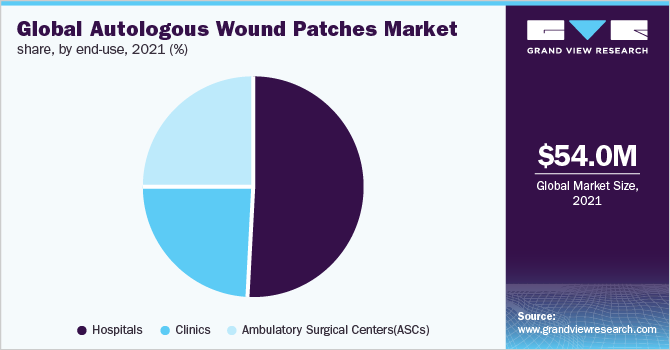

The global autologous wound patches market size was valued at USD 54.03 million in 2021 and is projected to register a compound annual growth rate (CAGR) of 9.05% from 2022 to 2030. The increasing number of chronic wounds such as diabetic foot ulcers, and venous leg ulcers, are major factors driving the autologous wound patches market. In addition, technological advancements, and the availability of favorable reimbursement policies, are other factors contributing to the market growth. The rising incidence rate of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers are likely to stimulate the market growth. For instance, as per Reapplix, around 60% of patients experience a wound that does not heal, whereas, 20% of such patients end up having an amputation. Similarly, venous leg ulcers are expected to affect about 1% of the total population, whose prevalence rate may increase up to 4% in people aged 65 and above.

Moreover, as per Wounds Canada, venous leg ulcers have a long healing trajectory, which leads to 30% of unhealed wounds at 24 weeks. Similarly, as per, The InDependent Diabetes Trust, at any given time, 115,000 people in the U.K. may develop a diabetic foot ulcer, whereas, 278,000 people are treated with venous leg ulcers every year. These wounds take on an average of 200 days to heal. Thus, the increase in the number of chronic wounds may impel the market during the forecast period.

Furthermore, technological advancements in the market are expected to help the market propel further. For instance, ActiGraft, an autologous wound patch, has ECM technology that treats chronic wounds. This technology enables health care professionals to create in vitro blood clots from patients’ own blood, which is used to initiate the wound healing process. The blood clot triggers tissue remodeling, thereby healing the wounds.

Moreover, the availability of favorable reimbursement policies is expected to increase the use of autologous wound patches. For instance, in October 2021, Reapplix received coding & reimbursement details from Medicare for its autologous wound patches, 3C Patch. This patch is reimbursed at a national average reimbursement rate of USD 1,715 per treatment, which was further expected to increase up to USD 1,759 from January 2022. Thus, with the availability of a suitable reimbursement policy, the market is anticipated to propel during the forecast period.

The COVID-19 pandemic was predicted to lower the use of autologous wound patches, thereby restraining the autologous wound patches market. However, as the cases of COVID-19 have reduced, and restrictions have been revoked, the market is anticipated to expand at a considerable growth rate. To capture the post-pandemic market, many companies are adopting various strategies such as a merger, partnerships, and geographic expansion.

For instance, in September 2020, RedDress, announced a distribution agreement in 12 European countries. This strategic distribution agreement is expected to support the company’s mission to expand access to ActiGraft in various European countries. Similarly, in March 2022, RedDress announced a purchasing agreement with Premier Inc. which will allow Premier members to access the company’s wound care product and ActiGraft system. Therefore, such strategies initiated by several other companies are anticipated to impel the autologous wound patches market post-COVID-19 pandemic.

Type Insights

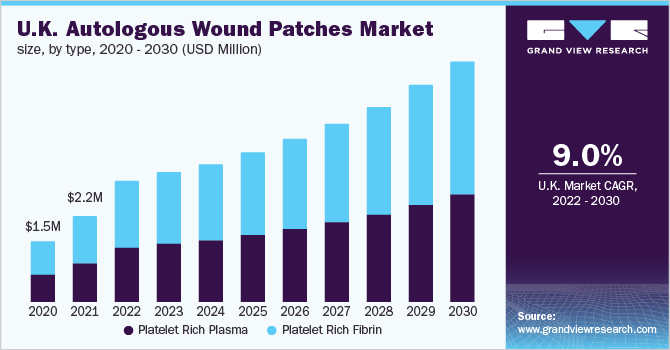

On the basis of type, platelet rich fibrin is expected to dominate the market with a market share of 55.33%. Platelet rich fibrin product is spun at a lower speed, which allows some of the white blood cells & stem cells to remain intact with the platelet layer, as a result, more healing factors are present in platelet rich fibrin patches, which supports faster healing of chronic wounds.

Moreover, platelet rich fibrin is expected to have the fastest growth rate as well. This can be attributed to simplified preparation, with no biochemical manipulation of blood. Furthermore, the PRF is a second-generation autologous wound patch that produces more predictable & consistent results. Therefore, the biological properties of PRF provide surgical versatility which supports faster tissue regeneration along with high-quality outcomes. Additionally, there has been product clearance by the FDA related to platelet rich fibrin autologous wound patches. For instance, in June 2021, RedDress received FDA 510 (k) clearance for its ActiGraft system which forms a PRF wound patch. Hence, due to the aforementioned factors, platelet rich fibrin is predicted to hold the major share & expand at the fastest growth rate during the forecast period.

Application Insights

On the basis of application, the acute wounds segment held the largest share of 59.87% in 2021. An increase in different traumatic wounds, and burn cases across the globe are the major factors anticipated to drive the segment growth. For instance, as per NCBI, 1.3 million people are estimated to get killed due to road accidents, whereas, 78.2 million people are injured. Moreover, as per a similar source, this number is predicted to increase by 65% in the coming 20 years. This may increase the need for autologous wound patches helping the market grow during the forecast period.

Moreover, there has been an increase in the number of surgeries performed. An increase in the number of surgical procedures may increase the risk of surgical site infections. For instance, as per a study by NCBI, Medicare costs for chronic & acute wounds treatment ranged from USD 28.1 billion to USD 96.8 billion, out of which the highest amount of expense was for surgical wounds. The autologous wound patches help reduce surgical site wounds, along with reduced hospital stay and better patient outcomes. Thus, due to the aforementioned factors, the acute wounds segment is anticipated to witness significant growth during the forecast duration.

The chronic wounds segment is anticipated to witness the fastest growth rate of CAGR of 9.18% during the forecast period. This growth can be attributed to an increase in the number of people suffering from diabetes, obesity, and pressure ulcers. For instance, as per CDC, 34.2 million people, which is 10.50% of the total U.S. population, has have diabetes. Similarly, according to the International Diabetes Federation, the prevalence rate of diabetes in Indian adults is 8.3%. The diabetic population promotes the risk of diabetic wounds such as diabetic foot ulcers. For instance, as per NCBI, the annual incidence rate of diabetes is expected to be 15 – 25% i.e., between 9.1 to 26.1 million people globally.

Moreover, the rise in number of obese people poses a threat of rise in number of venous leg ulcer patients. For instance, as per National Health Information Service, Scotland, obese people are more at risk of developing venous leg ulcers. The excess weight of obese people leads to increased pressure in veins, which may damage skin & cause venous leg ulcers. Additionally, there has been an increase in number of obese people globally. For instance, as per the National Institute of Diabetes and Digestive and Kidney Diseases, nearly 1 in 3 adults are overweight, 2 in 5 adults have obesity, whereas, 1 in 11 adults are estimated to have severe obesity.

Similarly, Canada is expected to spend up to USD 912 million annually to treat leg ulcers. Thus, with above-mentioned factors, the chronic wounds segment is expected to witness the fastest growth rate during the forecast period.

End-use Insights

On the basis of end-use, the hospitals segment held the largest share of 51.23% in 2021. The dominance can be attributed to increasing in the number of hospital admissions and a rising number of surgeries. For instance, according to a study published by American Hospital Association, 2022 edition, the number of hospitals in the U.S. was estimated to be 6,093 in 2020. Moreover, the total number of admissions in all the U.S. hospitals was calculated to be 33,356,853 in 2020.

Similarly, as per Institut Montaigne, India has a total of 43,486 private hospitals along with 25,778 public hospitals. Additionally, as per reports, more than 66 million surgical procedures were conducted in China in the year 2020. Thus, increase in the number of hospitals and rise in the number of surgical cases, the hospital segment is expected to witness considerable growth during the forecast period.

However, ambulatory surgical centers are expected to have the fastest growth rate of CAGR of 9.31% during the forecast period. This growth can be credited to an increase in the number of ambulatory surgical centers and a rise in the number of surgical procedures at ambulatory surgical centers. For instance, as per Agency for Healthcare Research & Quality, the volume of ambulatory surgeries performed in the U.S. has grown considerably. Reflective of this increase, the outpatient service accounted for 49% of community hospital revenue in 2018.

Additionally, as per Health Capital, there were about 5,600 Medicare-certified ASCs in the U.S. in 2017, where about 23 million procedures were performed annually as compared to 13.4 million in 1995. Thus, with the aforementioned factors ambulatory surgical center segment is expected to witness a lucrative growth rate during the forecast period, thereby impelling the autologous wound patches market.

Regional Insights

On the basis of region, North America dominated the market with a market share of 45.35% in 2021. This can be attributed to the availability of target patient population, the presence of market players, and the availability of reimbursement policies in this region. For instance, according to the American Podiatric Medical Association 2020, diabetes was the leading cause of non-traumatic lower body amputation in the U.S. Moreover, as per SingleCare, every 17 seconds, an American is diagnosed with diabetes. Furthermore, according to a similar source, 11% of the total American population has diabetes. It was also estimated that 14 – 24% of patients with diabetic foot ulcers required amputations.

Additionally, the presence of market players such as PRP Concepts and Nuo Therapeutics, along with favorable reimbursement policies for autologous wound patches such as 3C Patch is expected to boost the market in this region.

However, the Asia Pacific region is expected to witness the fastest growth rate of CAGR of 9.30% during the forecast duration. This growth can be credited to the presence of a patient population with chronic wounds in countries such as China, and India. For instance, as per a study by the BMJ, the total number of patients suffering from diabetes in China is estimated to be 129.80 million. The increase in a number of diabetic populations is expected to increase the number of diabetic leg ulcers patients in this region.

Moreover, the rise in number of obese people in Asia Pacific may further propel the market growth. For instance, according to a study published in the Indian Journal of Community Medicine, in India, about 135 million people were expected to be obese. Similarly, as per the estimates by NCBI, by the year 2030, 27.8% of the world’s total obese population will belong to India, which will comprise 5% of the total world population. The rise in obese people may lead to an increase in the number of people suffering from venous leg ulcers, thereby boosting the market in the Asia Pacific region during the forecast period.

Key Companies & Market Share Insights

The global market is highly consolidated in nature and does not have many market players. Competitive rivalry & degree of competition in the market may intensify to capture the available market across the globe. Moreover, to have an edge over the competitors, market players are entering into various strategic initiatives such as geographic expansion, partnerships, and awareness campaigns. For instance, in March 2022, RedDress began shipment of about 400 ActiGraft systems to the hospitals in Ukraine to help treat any casualties.

Similarly, Nuo Therapeutics is planning to re-launch its flagship product, AURIX in April 2022. Thus, with various strategies adopted by the market players, the market is predicted to impel during the forecast period. Some players in the autologous wound patches market include:

-

Reapplix

-

PRP Concepts

-

RedDress

-

Nuo Therapeutics

Autologous Wound Patches Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 76.41 million

Revenue forecast in 2030

USD 152.76 million

Growth Rate

CAGR of 9.05% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia, UAE.

Key companies profiled

Reapplix; PRP Concepts; RedDress; Nuo Therapeutics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global autologous wound patches market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Platelet Rich Plasma

-

Platelet Rich Fibrin

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Center

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global autologous wound patches market is expected to grow at a compound annual growth rate of 9.05% from 2022 to 2030 to reach USD 152.76 million by 2030.

b. North America dominated the autologous wound patches market with a share of 45.35% in 2021. This can be attributable to the high prevalence of chronic diseases, rising number of surgical procedures, and presence of market players in this region.

b. Key players in the autologous wound patches market are Reapplix, PRP Concepts, RedDress, Nuo Therapeutics

b. Key factors driving the global autologous wound patches market include global increase in prevalence of chronic diseases, increasing number of ambulatory surgical centers, and increasing number of traumatic accidents

b. The global autologous wound patches market size was estimated to be USD 53.03 million in 2021 and is expected to reach USD 76.41 million in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."