- Home

- »

- Automotive & Transportation

- »

-

Automated Fare Collection Market Size & Share Report, 2030GVR Report cover

![Automated Fare Collection Market Size, Share & Trends Report]()

Automated Fare Collection Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology, By System, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-508-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

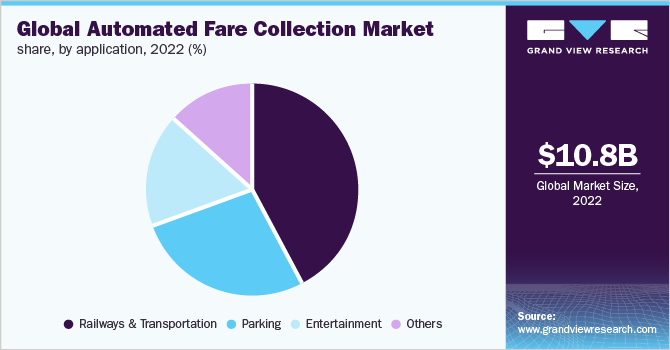

The global automated fare collection market size was evaluated at USD 10.81 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 14.1% from 2023 to 2030. Automated fare collection (AFC) reduces infrastructural costs by centrally managing the fare collection process thus, ensures transparency, and maintains key datasets & records. This reduces fraud, while simultaneously offering increased operational efficiency and ease of payment to customers. Furthermore, AFC reduces operational expenditures by minimizing manpower and other resources for fare collection and ensures a smooth flow of traffic during peak hours. Therefore, it is expected to drive the AFC industry growth during the forecast period.

The COVID-19 pandemic adversely affected the automated fare collection industry owing to the cancellation or postponement of various transportation projects in 2020 due to strict lockdowns imposed by various countries’ governments to curb the virus transmission. However, the market witnessed exponential growth since early 2021 due to supportive government initiatives in the transportation sector to accelerate the pandemic-affected economic growth. The rapid development of public infrastructure and transportation systems across developing economies along with the growing awareness for fast and reliable fare collection systems is driving the automated fare collection industry growth.

Furthermore, governments across developing economies are adopting various initiatives to promote automated fare collection systems. For instance, in June 2021, National Capital Region Transport Corporation (NCRTC), India announced the adoption of an automatic fare collection system for the Delhi-Ghaziabad-Meerut Regional Rapid Transit System (RRTS) corridor. This development aims to design an automated fare collection system build with QR Code based ticketing systems, vending machines, and pre-paid/credit/debit card readers. This will follow regulatory debit and credit card compliance for hassle-free cashless transactions along with ensuring a contactless entry and exit process for commuters.

Automated fare collection helps in avoiding fraud and minimizes revenue leakages by reducing the number of people from the system through the collection of fares and assigning tickets directly to the user. It helps eliminate practices such as unregistered tickets and black selling via real-time monitoring and tracking of operational processes. Furthermore, it also ensures the validity of the fare with the help of dynamic QR codes, and its design also embeds advanced AI algorithms and encryption to avoid duplication of tickets. These factors are expected to drive significant growth for the AFC industry during the forecast period.

Advancements in digital technologies such as big data analytics, Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), and cloud computing are creating new opportunities for players in the automated fare collection industry. These technologies ensure AI-based fraud detection techniques and offer a user-friendly interface on multiple devices and platforms for a seamless boarding process. These technologies also aggregate information and insights related to agencies, providers, media types, transaction types, routes, vehicle types, locations, and others. Along with the following features AFC offers flexible payment and settlement functionalities.

Advanced AFC includes features like voice recognition, biometric identification, facial recognition, fingerprinting, and one identity card for boarding and departure from different transportation platforms. Market players are focusing on mergers, partnerships, and acquisitions to enhance their service offerings and brand value, creating a favorable environment for the AFC industry. For instance, in November 2022, Masabi Ltd and Roaring Fork Transportation Authority (RFTA) announced the launch of the RFTA ticket mobile app, which offers flexibility for buying tickets, and ensures location, time, and platform flexibility. Hence, it will offer a convenient and easy traveling experience for passengers.

Component Insights

The hardware segment accounted for the largest market share of around 55.0% in 2022. The automated fare collection hardware system includes POS terminals, electronic validators, ticket vending machines, and fare gates. The growing transportation and infrastructure development across the developing region along with the rising government initiative to deploy smart and automated systems for fare collections is driving the growth of the segment. For instance, in May 2022, Indra Sistemas SA announced that the company will be designing, developing, and supplying ticketing systems, access control systems, and automatic ticket vending machines with technologies such as contactless cards, and QR codes, with seamless integration of devices like mobile phones for Cairo monorail in Egypt.

The software segment is anticipated to grow at a CAGR of 14.6% during the forecast period. Automatic fare collection systems provide transfer and handling of information by continuously processing shared information via a back-end panel. The growing adoption of advanced technologies such as AI, IoT, and machine learning in the development of robust fare collection systems is helping operators gain real-time operational insights, customer details, and fare collection activities. Thus, the aforementioned benefits will supplement the growth of the segment during the forecast period.

Technology Insights

The smart card segment accounted for a market share of around 30.0% in 2022. A smart card is a type of integrated digital payment option that offers flexibility to users in terms of location, platform, and mode of payment. It uses magnetic strips or chip technology which can be swiped or scanned on various platforms for payments of transportation tickets, restaurants and hotels, online shopping, and other related transactions. The centralized and single payment solution provides higher flexibility, offers ease of tracking payments, reduces complexities, and delivers a superior user experience. These factors are anticipated to propel the segment growth over the forecast period.

The Near-field communication (NFC) segment is anticipated to grow at a CAGR of 15.7% during the forecast period. NFC technology holds the data or special tokens of customers that can be linked to a passenger’s account. It establishes a smooth connection between NFC-enabled devices and the personal devices of customers such as mobile phones, tablets, laptops, and other wearables. It eliminates the need of carrying cards and cash by simply connecting a user’s virtual wallet stored in their NFC-enabled device to make faster payments. Further, NFC uses a tokenization system instead of storing cards and other personal account details therefore it offers higher security and privacy for transactions. These are some key factors expected to drive the segment growth during the forecast period.

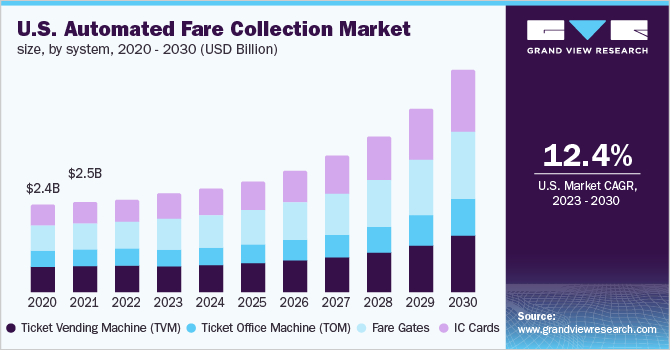

System Insights

The Ticket Vending Machine (TVM) segment accounted for a market share of around 30.0% in 2022. Modern ticket vending machines do not require any cash transactions. It also accepts payments via cards or e-wallets and offers to process hassle-free transactions for the purchase of tickets. TVMs reduce the time spent waiting for tickets and remain extremely convenient to operate while providing 24/7 availability. TVMs also, reduce operational costs on ticketing staff and offer flexible payment options. These are the factors propelling the growth of the following segment over the forecast period.

The Integrated Circuit (IC) card segment is anticipated to grow at a CAGR of 16.0% during the forecast period. IC cards are much superior to traditional cards as they use advanced methods such as powerful and large-capacity embedded IC chips to store a large amount of information. IC cards act as a multi-payment system by storing the user’s payment information on the card itself and allow cashless payments in convenience stores, retail stores, metros, and vending machines, among others. Thus, these advantages remain crucial in driving segment growth during the forecast period.

Application Insights

The railway & transportation segment accounted for the largest market share of 42.3% in 2022. The demand for automated fare collection (AFC) is growing in railway & transportation due to the rising number of travelers across the world, higher social distancing protocols, and surging demand for convenient and flexible payment options. Further, the growing spending on infrastructural development activities for building advanced rail transportation systems, metros, and light railways is creating a demand for advanced automated fare collection in the railway & transportation sector.

The entertainment segment is expected to grow at the highest CAGR of 16.3% owing to the factors such as the growing entertainment industry and rising customer participation in concerts, sports events, public fares, movies, and social gatherings. This factor is increasing the need for automated fare collection systems to minimize workloads on staff members while promoting cashless transactions. The system also gathers keen insights about sold and unsold tickets, reducing black sellings, theft, and duplications of tickets. These key benefits are expected to create significant growth opportunities for the application segment over the forecast period.

Regional Insights

The North American region held the major share of over 32.0% of the automated fare collection industry in 2022. This can be attributed to the advanced public transportation infrastructure in the region, higher expenditure for the adoption of advanced technologies, widespread internet penetration, superior connectivity, and a tech-savvy population. This along with the presence of key players are the major factors driving the growth of the automated fare collection industry. For instance, Cubic Transportation Systems (CTS) announced that it was awarded a contract from the Port Authority of New Jersey and New York to update and deliver a next-generation fare payment system for the Port Authority of Trans-Hudson in 2022.

Based on the agreement, CTS will provide contactless fare payment technologies by allowing commuters to “tap and go” using their mobile devices or smart cards. Asia Pacific is anticipated to rise as the fastest developing regional market at a CAGR of 16.1% owing to the presence of a large population of travelers, increasing spending on infrastructural projects, and higher government initiatives towards digitization. Furthermore, the growing emphasis on cashless transactions and rising adoption of advanced technologies such as AI, machine learning, IoT, and 5G also propel the growth of the AFC industry in the region.

Key Companies & Market Share Insights

The key players operating in the automated fare collection industry are investing resources in research & development activities to support growth and enhance their business operations. The report will include a thorough analysis of key market players based on their financial performance, product benchmarking, key business strategies, and recent strategic alliances. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market.

They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture more market shares. For instance, in October 2022, Masabi Ltd. a fare payment service provider, and TransLoc provider of transit orchestration solutions were selected by Eau Claire Transit in Wisconsin to provide a next-generation fare payment system. The collaboration will provide an innovative and comprehensive account-based ticketing system by serving convenience, transparency, and accessibility to passengers. Some prominent players in the global automated fare collection market include:

-

Advanced Card Systems Ltd.

-

Atos SE

-

Cubic Transportation Systems

-

GMV

-

Indra Sistemas SA

-

LECIP Holdings Corporation

-

LG Corporation

-

Siemens AG

-

Thales Group

-

Omron Corporation

-

Masabi Ltd.

-

Nippon Signal

-

Scheidt & Bachmann GmbH

-

Samsung SDS Co. Ltd.

Automated Fare Collection Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.48 billion

Revenue forecast in 2030

USD 28.88 billion

Growth rate

CAGR of 14.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Component, technology, system, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Advanced Card Systems Ltd.; Atos SE; Cubic Transportation Systems; GMV; Indra Sistemas SA; LECIP Holdings Corporation; LG Corporation; Siemens AG; Thales Group; Omron Corporation; Masabi Ltd.; Nippon Signal; Scheidt & Bachmann GmbH; Samsung SDS Co. Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Fare Collection Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automated fare collection market report based on component, technology, system, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Card

-

Magnetic Stripe

-

Near-field communication (NFC)

-

Optical Character Recognition (OCR)

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Ticket Vending Machine (TVM)

-

Ticket Office Machine (TOM)

-

Fare Gates

-

IC Cards

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Railways & Transportation

-

Parking

-

Entertainment

-

Others (Government, Retail)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automated fare collection market size was estimated at USD 10.81 billion in 2022 and is expected to reach USD 11.48 billion in 2023.

b. The global automated fare collection market is expected to grow at a compound annual growth rate of 14.1% from 2023 to 2030 to reach USD 28.88 billion by 2030.

b. North America dominated the automated fare collection market with a share of more than 30.0% in 2022. Factors, such as rising tech-savvy population, improved internet and communication network infrastructures, and high number of smartphone users are facilitating widespread deployment and usage of Automated Fare Collection (AFC) systems in the region.

b. Some key players operating in the automated fare collection market include Advanced Card Systems Ltd.; Atos SE; Cubic Transportation Systems; GMV; Indra Sistemas SA; LECIP Holdings Corporation; LG Corporation; Siemens AG; Thales Group; Omron Corporation; Masabi Ltd.; Nippon Signal; Scheidt & Bachmann GmbH; and Samsung SDS Co. Ltd

b. Key factors that are driving the market growth include the rising demand for hassle-free and efficient transportation systems. Increasing usage of plastic money, real-time payments, and digital payment gateways, such as debit card, credit card, and Near Field Communication (NFC) payment applications are also anticipated to drive market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.