- Home

- »

- Biotechnology

- »

-

Automated Liquid Handling Technologies Market Report, 2030GVR Report cover

![Automated Liquid Handling Technologies Market Size, Share & Trend Report]()

Automated Liquid Handling Technologies Market (2024 - 2030) Size, Share & Trend Analysis Report By Product (Workstations, Accessories ), By Application (Cancer & Genomic Research), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-618-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

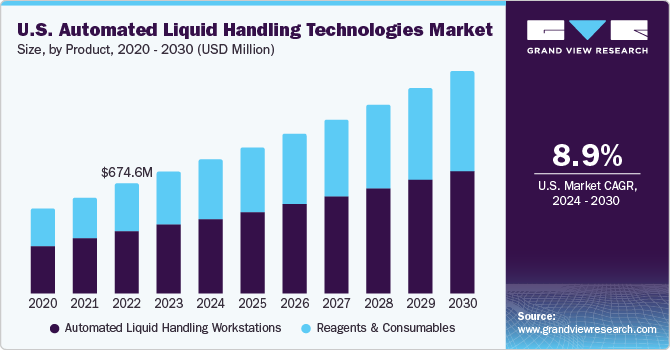

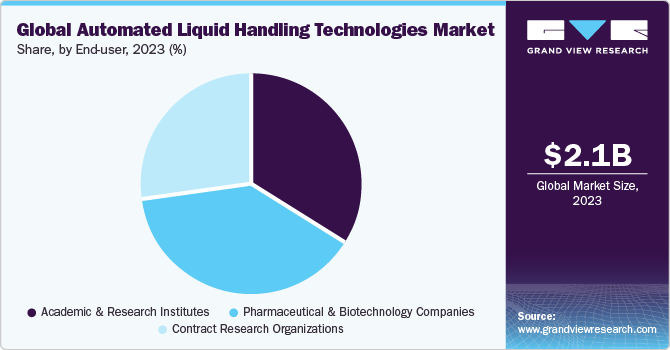

The global automated liquid handling technologies market size was estimated at USD 2.09 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.5% from 2024 to 2030. The growth is expected to be driven by the increased use of innovative automated liquid-handling workstations designed for non-contact dispensing. While contact dispensing gained widespread acceptance over the years due to its reliability, ease of use, and cost-effectiveness, changing liquid handling requirements, particularly with diminishing sample volumes, have necessitated new solutions.

The COVID-19 pandemic heightened the urgency for safe, accurate, and swift collection and preparation of virus samples. This put pressure on laboratories to meet the demand for high-throughput and large-scale testing.In scenarios where sample preservation and contamination risk reduction are paramount, the reliance on automated liquid handling systems has become a standard. These systems operate with minimal supervision, ensuring verifiable and repeatable results. Notably, solutions like PIPETMAX excel in handling large quantities for various applications, such as cell-based assays and qPCR, making it an indispensable laboratory assistant. PIPETMAX is characterized by its compact footprint and is equipped with validated, pre-developed protocols for added efficiency.

Manufacturers have devised workstations employing various technologies to dispense droplets from the dispensing tool by overcoming surface adhesion. These technologies encompass ultrasound, piezoelectric, and solenoid mechanisms. For instance, LABCYTE INC. integrates Echo acoustic liquid handling technology into its products for non-contact dispensing. Additionally, the efficient miniaturization of assay platforms reduces workflow expenses, thereby minimizing the use of costly reagents. Further, compact platforms are designed for precise liquid handling in various processes, including bulk dispensing, plate washing, and liquid transfer.

The incorporation of artificial intelligence (AI) into automated liquid handling, enabling control over different procedure stages and leveraging internet connectivity for remote interaction with handlers, has presented lucrative opportunities. Through reliance on machine learning, the software can provide advanced error control and adjust instrument activities to novel situations, such as responding to a defect in a disposable tip or compensating for nozzle blockages that may occur during sample handling.

The market is expected to experience growth through the introduction of new products. For instance,in July 2023, Revvity unveiled the Fontus Automated Liquid Handling Workstation, a cutting-edge liquid handler that integrates advanced technologies from Revvity's existing platforms. This workstation is specifically designed to enhance and expedite workflows for next-generation sequencing (NGS) and diagnostic research applications. Similarly, in December 2021, DISPENDIX unveiled the I.DOT DW, the latest addition to the I.DOT product range. This globally available instrument stands out as the first of its kind to integrate a built-in drop detection system, capable of discerning when operators deplete their source, all while simultaneously validating the dispensing volume.

Despite the deflation in sequencing technologies, there are still foremost hurdles in the human-led stages of this procedure. In clinical and research genomics laboratories, sample preparation is an obstacle to experiments, mostly when it comes to high-throughput NGS. The steps of sample preparation in the research laboratory are quite time-consuming, repetitive, and tedious. A study of the connection of genomic analysis to cancer diagnosis in the UK discovered that all-manual laboratory handling for next-generation sequencing results in a TAT of as much as 6 days, which is relatively long compared to automated handling systems. The benefits of automation have led many genomics laboratories to adopt liquid handling automation, aiming to optimize the cost-effectiveness and efficiency of sequencing workflows, thereby driving market growth.

Moreover, an analysis of the cost breakdown for genome sequencing indicated that in traditional clinical laboratories, 15% of the total cost is attributed to laboratory personnel. Laboratories equipped with a Hamilton Microlab STARlet for automated sample preparation experienced a decrease in the salaries of laboratory staff following the adoption of automated techniques. Beyond cost considerations, robots excel in performing repetitive and tedious tasks with precision and stamina, offering a significant advantage over manual processes.

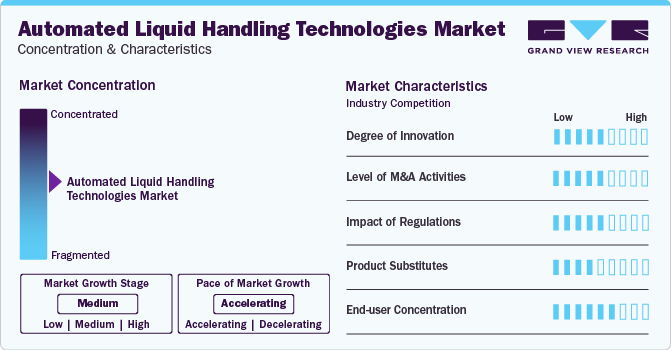

Market Concentration & Characteristics

The global automated liquid handling technologies market is characterized by a high degree of innovationwith the integration of advanced robotics, artificial intelligence, and precision engineering.

Several market players such as Merck KGaA; Thermo Fisher Scientific, Inc.; and Agilent Technologies, Inc. are involved in merger and acquisition (M&A) activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Stringent regulations in the automated liquid handling technologies industry are driving the development of compliant systems, ensuring accurate and traceable liquid handling in industries such as healthcare and life sciences. Adherence to regulatory standards enhances data integrity, reproducibility, and overall quality control in automated liquid handling processes.

In this market, solutions such as manual pipetting systems, traditional liquid handling methods, and emerging technologies like acoustic liquiddispensing serve as product substitutes for automated liquid handling. These alternatives may be considered based on specific application requirements, cost considerations, or preferences for different levels of automation.

The market exhibits varied end-user concentrations, with notable demand from pharmaceutical and biotechnology companies, research laboratories, and academic institutions. The concentration is influenced by specific needs of these sectors for efficient and precise liquid handling in drug discovery, genomics, and other scientific applications.

Product Insights

The automated liquid handling workstations segment held the largest revenue share of 56.9% in 2023. This segment is further differentiated based on product assembly and type. Based on their assembly, these devices are further divided into standalone and integrated workstations, and based on type, they are segmented into pipetting workstations, specialized liquid handlers, multipurpose workstations, and workstation modules.

Increasing competition among pharmaceutical companies and their quest for effective disease treatments are propelling the adoption of automated workstations. Compact size and the capability to seamlessly integrate with other devices, particularly those with nanoliter capabilities, are key factors contributing to the widespread market adoption of standalone pipettors.

The reagents and consumables segment is expected to showcase lucrative growth from 2024 to 2030. As the adoption of automated liquid handling systems increases across pharmaceutical, biotechnology, and research sectors, there is a corresponding rise in demand for compatible reagents and consumables. These essential components, including specialized pipette tips, plates, and liquid handling cartridges, play a crucial role in ensuring the accuracy and reliability of automated processes.

Application Insights

The drug discovery and ADME-Tox research segment accounted for the largest revenue share in 2023. In a single drug discovery experiment, screening over a million compounds is a common practice to identify potential drug candidates. Microarray technology is well-suited for managing the typical requirements of such experiments, including high throughput, low volume, and high accuracy and precision.

Automated liquid handling workstations play a crucial role in various applications within drug discovery and ADME-Tox, such as stepwise serial dilution across a broad concentration range, compound selection and transfer for retesting, and confirmatory and further analysis. Major applications in this domain involve plate replications, plate-to-plate dilutions, plate, and plate reformatting. A significant advantage of employing automated liquid handling platforms in drug discovery is their capability to seamlessly integrate various types of liquid handlers, and stackers, enhancing overall throughput.

The cancer & genomic research segment is estimated to register the fastest CAGR from 2024 to 2030.In cancer and genomic research, the precision dispensing of protein or DNA solutions onto substrates or microwells is crucial, and automated liquid handling plays a vital role. The complexity of subsequent synthesis and analysis stages often requires the addition of multiple solutions, making manual techniques impractical for these processes.

End-user Insights

The pharmaceutical and biotechnology companies segment dominated the market in 2023 with the largest revenue share. Automated liquid handlers were initially developed for drug discovery laboratories. The consistent requirement to dispense samples onto various substrates and transfer them to containers of varying sizes is fueling their rapid adoption in drug development and manufacturing. With the growing reliance on automation for drug screening and development, pharmaceutical and biotechnology companies are expected to sustain their prominence in the market in the foreseeable future.

The academic & research institutes segment is anticipated to showcase lucrative CAGR over the forecast period. Academic and research institutes engaged in scientific experiments, especially those encompassing antibody testing, gene sequencing, protein crystallization, and drug screening often contend with the challenge of handling very small sample volumes. Hence, there is anticipated growth in demand for automated approaches, including sensor-integrated robotic systems, which is expected to bolster revenue in the academic and research institutes sector.

Regional Insights

North America dominated the overall market for automated liquid handling technologies in 2023. This can be attributed to the well-established distribution network of key companies and higher adoption of advanced automation systems. The increased demand for small-volume proteomics and genomic analysis for research drives growth in North America. In 2023, the U.S. held for the largest revenue share in North America.A well-established distribution network of major market players and higher investment in research and development (R&D) are key contributors to this dominance.

The U.S. is home to key industry players, including major entities such as Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Danaher; and PerkinElmer, Inc. playing a significant role in the sector and contributing to advancements and innovation. These companies have a strong geographical foothold and are at the forefront of technological advancements, which has helped them maintain a high market position. Thus, the U.S.'s strong presence in the market, coupled with its focus on innovation and research, has led to its dominance.

Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030. Increasing investment in R&D activities, particularly in countries like China, Japan, and India, propel the demand for advanced liquid handling technologies. Supportive government initiatives, a burgeoning biopharmaceutical sector, and the presence of key market players further fuel the robust growth of the regional market.

In 2023, China held for the largest revenue share in Asia Pacific region, due to its strategic focus on advancing R&D capabilities, particularly in the pharmaceutical and biotechnology sectors. With a rapidly growing biopharmaceutical industry and supportive government initiatives, China has become a key market for automation solutions.

Key Companies & Market Share Insights

Some of the key players operating in the market include Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; and Merck KGaA

-

Thermo Fisher Scientific, Inc. offers a comprehensive range of automated liquid handling solutions, including robotic systems, pipetting tools, workstations, and software for precise and efficient laboratory tasks.

-

Agilent Technologies, Inc. offers space-saving and flexible automated liquid handling platforms that enable simplified sample preparation with consistently high accuracy.

Tecan Trading AG and Gilson, Inc. are some of the emerging players in the market

- Tecan offers tailored automation solutions for specific laboratory processes, ensuring consistent and reliable results. By automating routine tasks, Tecan's solutions free up skilled human resources to focus on more complex and strategic manual work within the laboratory environment.

Key Automated Liquid Handling Technologies Companies:

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Aurora Biomed, Inc.

- AUTOGEN, INC.

- Danaher

- BioTek Instruments, Inc.

- Analytik Jena AG

- Corning Incorporated

- Eppendorf AG

- Formulatrix, Inc.

- Gilson, Inc.

- Hamilton Company

- Hudson Robotics

- LABCYTE INC.

- Lonza

- PerkinElmer, Inc.

- QIAGEN

- Tecan Trading AG

- METTLER TOLEDO

Recent Developments:

-

In November 2023, SPT Labtech introduced Firefly for LDT, a solution aimed at streamlining liquid handling in Next-Generation Sequencing (NGS)-based lab-developed tests (LDTs).

-

In July 2023, Revvity unveiled the Fontus Automated Liquid Handling Workstation, a cutting-edge liquid handler that integrates advanced technologies from Revvity's existing platforms. This workstation is specifically designed to enhance and expedite workflows for next-generation sequencing (NGS) and diagnostic research applications.

-

In June 2023, Biosero, Inc. announced a partnership withAnalytik Jena have entered into a co-marketing agreement to promote the applications of their integrated laboratory automation technologies.

-

In May 2023, Biosero, Inc., a key developer in laboratory automation solutions, unveiled a strategic co-marketing collaboration with Hamilton, a worldwide leader in automated liquid handling workstations and laboratory automation technology. This partnership is designed to enhance and simplify automated liquid handling workflows in laboratories, offering scientists a comprehensive solution for seamless automation.

-

In February 2022, SPT Labtech, a prominent player in laboratory automation within the life sciences sector, introduced the apricot DC1, a highly adaptable automated liquid handling workstation, during the SLAS 2022 International Conference and Exhibition held in Boston.

-

In January 2022, Festo introduced a modular gantry robot platform designed for automated liquid handling systems in laboratory settings. This innovative solution empowers equipment designers to efficiently implement their unique solutions, providing a flexible and adaptable framework for automated processes.

Automated Liquid Handling Technologies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.30 billion

Revenue forecast in 2030

USD 4.20 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies; Aurora Biomed, Inc.; AUTOGEN, INC.; Danaher; BioTek Instruments, Inc.; Analytik Jena AG; Corning Incorporated; Eppendorf AG; Formulatrix, Inc.; Gilson, Inc.; Hamilton Company; Hudson Robotics; LABCYTE INC.; Lonza; PerkinElmer, Inc.; QIAGEN; Thermo Fisher Scientific, Inc.; Tecan Trading AG; METTLER TOLEDO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Automated Liquid Handling Technologies Market Report Segmentation

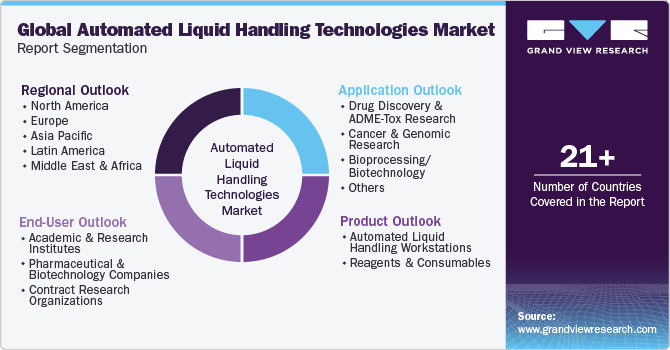

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automated liquid handling technologies market report based on product, application, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Liquid Handling Workstations

-

By Assembly

-

Standalone Workstations

-

Integrated Workstations

-

-

By Type

-

Multipurpose Workstation

-

Pipetting Workstation

-

Specialized Liquid Handler

-

Workstation Module

-

-

-

Reagents & Consumables

-

Reagents

-

Accessories

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & ADME-Tox Research

-

Cancer & Genomic Research

-

Bioprocessing/Biotechnology

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global automated liquid handling technologies market size was estimated at USD 2.09 billion in 2023 and is expected to reach USD 2.30 billion in 2024.

b. The global automated liquid handling technologies market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 4.20 billion by 2030.

b. North America dominated the automated liquid handling technologies market with a share of 39.60% in 2023. This is attributable to a well-established distribution network of major market players and higher usage of advanced automation solutions in the region.

b. Some key players operating in the automated liquid handling technologies market include Analytik Jena AG; Hamilton Company; Aurora Biomed Inc..; Eppendorf AG; Agilent Technologies; Labnet International, Inc.; Gilson, Inc.; Beckman Coulter, Inc.; and Tecan Trading AG.

b. Key factors that are driving the automated liquid handling technologies market growth include an increase in investment in drug development, clinical trials, and life sciences R & D, rapid adoption of automation, and ease of handling associated with the use.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.