- Home

- »

- Biotechnology

- »

-

Automated Sample Storage Systems Market Report, 2030GVR Report cover

![Automated Sample Storage Systems Market Size, Share & Trends Report]()

Automated Sample Storage Systems Market Size, Share & Trends Analysis Report By Product (Automated Compound Storage Systems, Automated Liquid Handling Systems, Others), By Sample Type, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-119-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

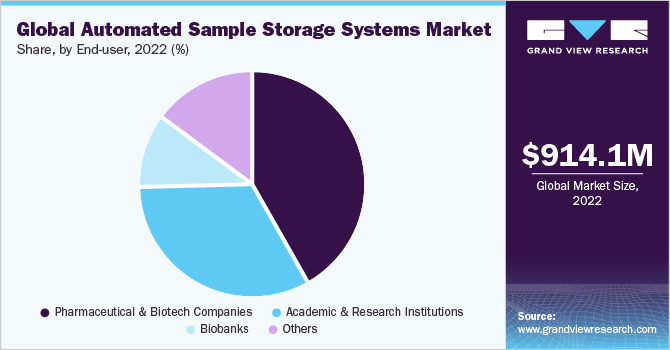

The global automated sample storage systems market size was valued at USD 914.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. Increasing investments in the pharmaceutical and biopharmaceutical sectors are expected to drive the global market for automated sample storage systems. Moreover, the rising demand for automation across industries to reduce labor cost and increase process efficiency are further fueling industry uptake. For instance, in June 2022, UK Robotics launched two liquid handlers to accelerate lab automation in healthcare.

Factors such as increasing application of automated sample storage systems across end-use industries, suitability in high-throughput laboratories, and capacity of managing large sample volumes are projected to support market expansion. Moreover, the wealth of benefits offered by automated sample storage systems is further contributing to market advancement. For instance, automated sample management solutions offered by Azenta Life Sciences can store samples at very cool temperatures and are convenient to configure at any stage of operation.

Moreover, the increasing demand for storing and managing large volumes of samples, including specimens and compounds, across the biopharmaceutical, pharmaceutical, and healthcare industries has driven the demand for systems that can process large sample volumes at a time. Such a high demand from industries has pushed market players to introduce advanced systems with advanced capabilities. For instance, in February 2022, SPT Labtech, a leader in lab automation, launched apricot DC1, a 4-in-1 automated liquid handling platform to handle large volumes of samples.

Moreover, there is a higher penetration of laboratory automation across sectors. Lab automation facilitates the efficiency of laboratory equipment for processes such as sample handling & storage, verifications, and labeling tubes and helps lower the physical strain due to manual processes. Thus, numerous benefits offered by automated processes are projected to facilitate small and medium-scale laboratories to use automated systems for enhanced productivity.

Furthermore, increasing drug discovery & development activities by pharmaceutical companies have created a notable demand for novel sample storage and handling facilities. Thus, such a strong demand from end-users has facilitated companies to develop robust solutions for catering to different sample processing requirements. For instance, in February 2022, Hamilton Company expanded its automated storage capability with the addition of two new systems to its Verso Q-Series automated sample storage system family. The new products offer compact, walkaway sample storage and access to reduce manual labor and increase overall laboratory efficiency.

Product Insights

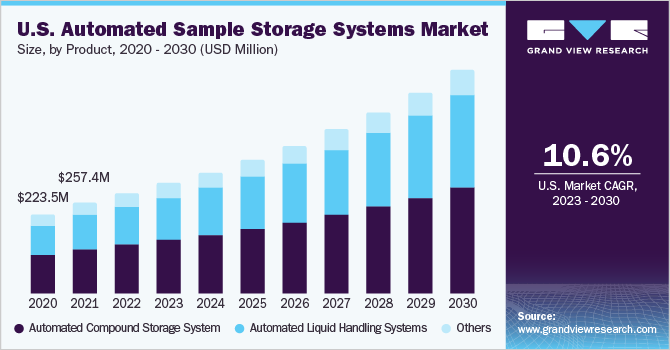

The automated compound storage system segment accounted for the largest market share of 48.9% in 2022 and is expected to witness significant growth during the forecast period. Factors such as rising demand from end-users such as the pharmaceutical and food industries, coupled with an ability to store large volumes of samples, are projected to drive segment growth through the forecast period. Moreover, a robust product portfolio capable of storing media at a range of temperatures and several benefits offered by compound handling systems are propelling market growth. Some benefits of this system include high sample integrity and storage capacity, and easy LIMS integration with the products.

The automated liquid handling system segment is projected to register the fastest growth rate throughout the projected period. Liquid handling is a crucial stage for the movement of liquid from one place to another. With scalable, versatile, and affordable solutions that cater to a wide range of applications, laboratories across the pharmaceutical and biotech industries are now automating their liquid handling and dispensing capabilities. In addition, the high throughput nature of the process & lower chances of cross-contamination have propelled their adoption across end-users.

Sample Type Insights

The sample type segment was dominated by compound samples in 2022, with a market share of 64.0%. The rising demand for compound sample management across biobanks and academic & research institutions drives segment growth. With the development of high-throughput screening techniques capable of analyzing a large number of agents in a single experimental run, the size and area of compound libraries have leveraged significantly, alongside the logistical requirements for compound management. The higher demand from pharmaceutical industries to automate compound management with the help of advanced storage devices and robotic instruments has pushed segment uptake forward.

Whereas the biological samples segment is projected to exhibit the fastest growth rate throughout the forecast period. The increasing demand for high-quality biological samples for various research purposes, such as genomics, proteomics, drug discovery, and personalized medicine, has driven the need for efficient and automated sample storage systems. Also, rising research activities have created a significant demand for this system to store biological specimens. Biological samples such as cells, tissues, and DNA need to be stored under controlled conditions to maintain their viability and integrity over time. These tools offer necessary environmental controls to ensure long-term preservation.

End-user Insights

The pharmaceutical and biotech companies segment captured the largest market share of 41.6% in 2022. Biotech and pharmaceutical companies require precise, automation-based storage solutions to support high-throughput drug discovery efforts. These systems allow the storage, retrieval, and management of large numbers of samples, improving the speed and efficiency of the drug development process. Moreover, increasing emphasis on R&D by pharmaceutical companies to accelerate their drug discovery efforts is another factor fueling segment expansion.

The higher demand for advanced storage solutions has facilitated companies to develop products that can cater to the requirements of pharmaceutical companies. For instance, Verso, an automated sample management system from Hamilton Company, has been installed in a large number of pharmaceutical facilities across Europe. Verso is configured according to laboratory needs and can process specimens of negative temperatures as well.

On the other hand, the biobanks segment is projected to register the fastest growth in the coming years in the automated sample storage systems market. Automated sample storage in biobanks improves the biobank workflow in qualitative and quantitative ways, including traceability of samples, sample preservation, secure storage, and quicker retrieval of samples. Also, automation in biobank specimen storage offers several benefits as compared to manual storage methods.

As an example, it helps in the bio-storage of DNA/RNA, protein & antibiotics, plasma, and serum. Furthermore, increasing developments in bio-banking storage space have given significant growth momentum to the industry. For instance, in August 2022, Vanderbilt University Medical Center opened an advanced automated biobanking system to store large amounts of biospecimens at temperatures down to -80 degrees Celsius.

Regional Insights

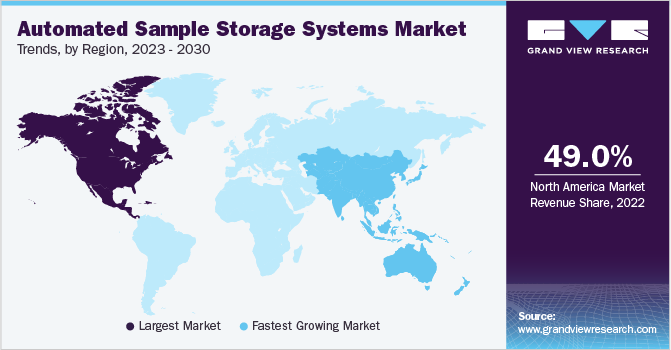

North America dominated the industry with a revenue share of 36.74% in 2022. The presence of a large number of market players, supportive government legislation, and high demand for laboratory automation are the major factors driving the North American market. Moreover, the easy availability of technologically advanced products and a strong network of suppliers are projected to drive the regional market. In recent times the North American region has witnessed a higher demand for automation-based liquid handling systems to speed up the process and reduce the possibility of cross-contamination.

On the other hand, Asia Pacific is likely to exhibit the fastest growth rate in coming years, owing to the presence of emerging startups, a large patient pool for target diseases, and significant investments from market players, thus supporting regional expansion. For instance, market players like Azenta US, Genepoint Biological Technology (China), and others offer automated sample storage system solutions in the Asia Pacific region.

Key Companies & Market Share Insights

The key players in the market are undertaking various strategic initiatives to maintain their market presence. In addition, various strategic initiatives help market players to bolster their business avenues. For instance, in February 2023, Azenta, Inc. launched Cryo Store Pico, a new automated cryogenic storage system for storing high-value biological samples. This launch has helped the company to strengthen its position in automated cryogenic technology. Some of the key players in the global automated sample storage systems market include:

-

Thermo Fisher Scientific, Inc.

-

Beckman Coulter, Inc. (Danaher)

-

Hamilton Company

-

Azenta US, Inc.

-

MEGAROBO

-

SPT Labtech Ltd

-

LiCONiC AG

-

MICRONIC

-

ASKION GmbH

-

Haier Biomedical

Automated Sample Storage Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,007.6 million

Revenue forecast in 2030

USD 2.12 billion

Growth rate

CAGR of 11.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sample type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Beckman Coulter, Inc. (Danaher); Hamilton Company; Azenta US, Inc.; MEGAROBO; SPT Labtech Ltd.; LiCONiC AG; MICRONIC; ASKION GmbH; Haier Biomedical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

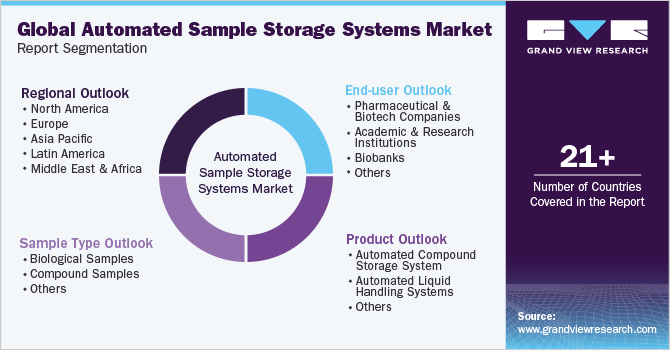

Global Automated Sample Storage Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global automated sample storage systems market report on the basis of product, sample type, end-user, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Compound Storage System

-

Automated Liquid Handling Systems

-

Others

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biological Samples

-

Compound Samples

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotech Companies

-

Academic and Research Institutions

-

Biobanks

-

Others

-

-

RegionalOutlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global automated sample storage systems market size was estimated at USD 914.1 million in 2022 and is expected to reach USD 1,007.6 million in 2023.

b. The global automated sample storage systems market is expected to grow at a compound annual growth rate of 11.2% from 2023 to 2030 to reach USD 2.12 billion by 2030.

b. North America dominated the automated sample storage systems market with a share of 36.74% in 2022. This is attributable to the increasing demand for sample storage systems from academic institutions within the region

b. Some key players operating in the automated sample storage systems market include Thermo Fisher Scientific, Inc., Beckman Coulter, Inc. (Danaher), Hamilton Company., Azenta US, Inc., MEGAROBO, SPT Labtech Ltd, LiCONiC AG, MICRONIC, ASKION GmbH , Haier Biomedical.

b. Key factors that are driving the market growth include increasing demand for bio-banking and compound management, technological advancements in sample storage systems, and increasing demand from various end-user industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."