- Home

- »

- Automotive & Transportation

- »

-

Automated Storage And Retrieval Systems Market Size, 2030GVR Report cover

![Automated Storage And Retrieval Systems Market Size, Share & Trends Report]()

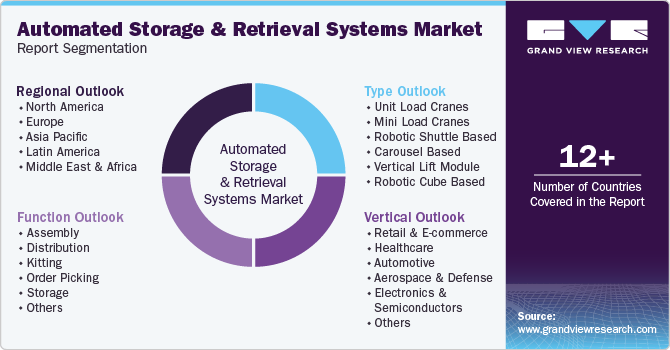

Automated Storage And Retrieval Systems Market (And Segment Forecasts 2025 - 2030) Size, Share & Trends Analysis Report By Function (Assembly, Distribution), By Vertical (Healthcare, Automotive), By Type, By Region

- Report ID: GVR-4-68040-084-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Storage And Retrieval Systems Market Summary

The global automated storage and retrieval systems market size was estimated at USD 6.52 billion in 2024 and is projected to reach USD 10.31 billion by 2030, growing at a CAGR of 8.0% from 2025 to 2030. Automated storage and retrieval systems (AS/RS) include hardware and software for automating the storage function.

Key Market Trends & Insights

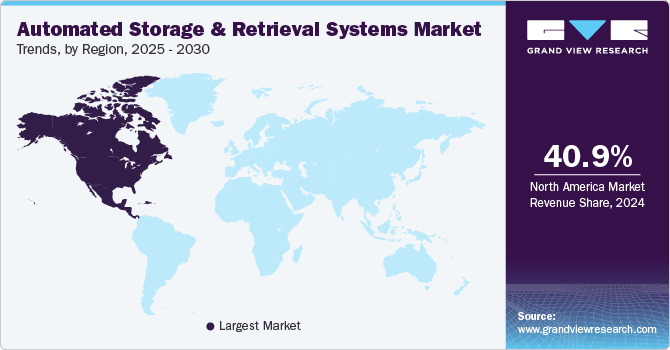

- North America led the target market in 2024, with a market share of 40.9%.

- Based on type, the unit load cranes segment market share was 21.8% in 2024.

- Based on function, the storage function segment dominated the market in 2024, with a revenue share of 25.6%.

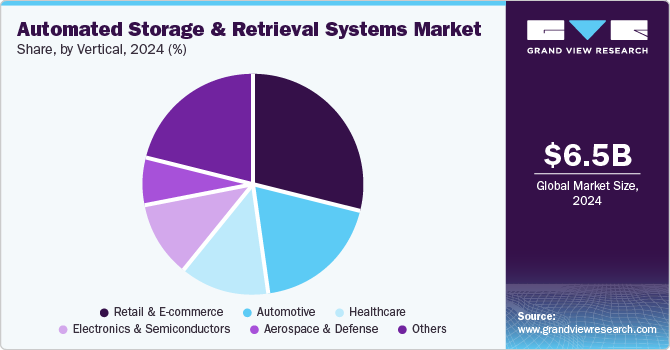

- Based on vertical, the retail and e-commerce segment dominated the market in 2024, with a revenue share of 29.3%.

Market Size & Forecast

- 2024 Market Size: USD 6.52 Billion

- 2030 Projected Market Size: USD 10.31 Billion

- CAGR (2025-2030): 8.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The AS/RS provides high-density storage and saves about 85% of the space by racking and shelving. AS/RS systems reduce labor costs by about 60% compared to manual shelving. The several benefits offered by AS/RS are improving its adoption and are further expected to boost the demand during the forecast duration significantly.

The market penetration of AS/RS in warehouses is only about 15-20%, which presents a tremendous growth opportunity to tap the pending 80-85% of the untapped market. AS/RS provides 99.9% pick accuracy for the desired item or product from the storage. The high pick accuracy ensures smooth warehouse operations for any functions, including storage, order picking, and assembly. It also helps in avoiding any possible delays in product retrieval. Different types of systems are deployed depending on the load or weight of the product, volume of storage, and industry vertical.

Automated storage and retrieval systems have certain disadvantages, including vulnerability to power outages, mechanical breakdowns, the need for regular maintenance, and occasional misplacing of items. Due to their complex nature, automated systems such as AS/RS require expertise to operate and manage. Inadequacy of skilled labor, especially in nations such as India and China, is a restraining factor for the growth of the target market. Moreover, the rapidly changing technologies and nature of end-use markets such as retail and healthcare create a challenge to developing flexible, adaptable, and scalable systems.

The growing focus on labor cost reduction and efficiency and the increasing demand for warehouse automation are driving the growth of the global market. According to the International Federation of Robotics (IFR)’s 2024 World Robotics report, in 2023, over 4 million units were operating in factories globally, an increase of about 10% from 2022. Labor shortages and rising labor costs are prompting companies to automate repetitive tasks. ASRS allows for greater operational efficiency and optimizes space utilization, helping cut down labor requirements, reduce human error, and minimize long-term costs.

The integration of Artificial Intelligence (AI), the Internet of Things (IoT), and machine learning within ASRS is enhancing system intelligence and flexibility. Technologies like machine vision and robotics enable systems to adapt to dynamic inventory needs, while data analytics allows for predictive maintenance and better inventory tracking.

The push for faster last-mile delivery is encouraging the development of micro-fulfillment centers, often located in urban areas. AS/RS supports these facilities by providing compact, high-density storage and rapid retrieval capabilities, essential for meeting same-day or next-day delivery demands.

Type Insights

Based on type, the market is segmented into unit load cranes, mini load cranes, robotic shuttle-based, carousel based, vertical lift module, and robotic cube based. The unit load cranes segment market share was 21.8% in 2024. Unit load cranes are suitable for big/bulky loads and freezer environments, thus finding application in cold storage facilities along with regular warehousing. Unit load cranes can manage weights between 550 kg to 2,500 kg. Unit load cranes are known for their robust design and reliability in moving heavy loads with precision. This speed and reliability make them essential for industries where quick access to inventory is crucial for smooth production or order fulfillment.

The robotic shuttle-based AS/RS segment is anticipated to grow at the fastest CAGR from 2025 to 2030. The shuttle AS/RS runs on a specific track. One shuttle is dedicated to one level each, or one moves across different levels on the storage racks. Elevators are used to move the shuttles across different levels. The Carousel based AS/RS segment is also among one of the fastest-growing segments. In a carousel-based system, bins move vertically or horizontally around a track. These systems provide high storage density and are primarily suitable for small items.

Function Insights

Based on function, the market is segmented into assembly, kitting, distribution, storage, order picking, and others. The storage function segment dominated the market in 2024, with a revenue share of 25.6%. It is anticipated to grow at a significant CAGR from 2025 to 2030. Storage is vital for products that are slow or medium movers that need to be stored for a longer duration. AS/RS provides increased storage capacity and maximum space utilization and ensures safety for storage function and is thus being adopted extensively for long-term buffer storage. AS/RS systems offer high-density storage solutions, enabling vertical and compact storage configurations that allow businesses to store more inventory in a smaller footprint, reducing costs associated with facility expansion.

The order-picking function segment is expected to grow at the fastest CAGR from 2025 to 2030. The AS/RS aids in picking multiple items simultaneously. It provides faster access to the products with 99.9% pick accuracy and thus enables faster order fulfillment. Efficient and error-free order picking is critical for faster fulfillment in the e-commerce sector. The robust growth of e-commerce has led to increased demand for AS/RS from e-commerce fulfillment centers and even hub warehouses.

Vertical Insights

Based on vertical, the market is segmented into healthcare, retail & e-commerce, electronics & semiconductors, aerospace & defense, automotive, and others. The retail and e-commerce segment dominated the market in 2024, with a revenue share of 29.3%. The retail & e-commerce sector uses automated storage and retrieval systems solutions to meet the robustly changing demands of online and brick & mortar retail and quickly adapt to new industry trends. According to Desku Inc, a U.S.-based business messaging platform, in 2024, omnichannel strategies are fueling substantial growth, with retailers implementing these approaches experiencing purchase rates up to 287% higher than those using single-channel methods. The retail sector is increasingly adopting an omnichannel distribution strategy to stay competitive, which adds to the complexity of logistics. To manage the complexities, retail companies are increasingly adopting automated solutions.

The healthcare vertical segment is anticipated to grow at a significant CAGR from 2025 to 2030. Healthcare products, especially pharmaceuticals, require the highest standards of storage. Hygiene, quality assurance, and process reliability are given utmost importance in the healthcare sector. AS/RS provides FDA-compliant storage solutions along with the function of batch traceability. AS/RS systems also aid healthcare facilities in maintaining the everyday inventory in compliance with the regulations in a hygienic manner.

Regional Insights

North America led the target market in 2024, with a market share of 40.9%. The region's growth can be attributed to the high technology adoption rate across industries in North America. In addition, the speedy implementation of new technologies and the existing modern infrastructure in the region further supports the growth of the target market. The U.S. is the dominant market in the region owing to the presence of retail giants such as Walmart, Target, The Home Depot, Costco, Best Buy, and Amazon.com, among others, who are rapidly adopting AS/RS across its warehouses spread across the country.

U.S. Automated Storage And Retrieval Systems Market Trends

The automated storage and retrieval systems market growth in the U.S. is driven by labor shortages and rising wages in the country. This is pushing companies to automate their storage and retrieval processes. ASRS helps reduce reliance on manual labor, cuts operational costs, and mitigates the impact of workforce limitations. Moreover, the need for supply chain efficiency and sustainability drives the market’s growth in the U.S.

Asia Pacific Automated Storage And Retrieval Systems Market Trends

Asia Pacific automated storage and retrieval systems market is expected to grow at the fastest CAGR from 2025 to 2030. Asia Pacific is witnessing continued economic growth, especially in India and ASEAN countries. These countries are enjoying a growing presence of international manufacturing companies. Also, local/regional companies are investing massively in automated warehouse systems. The systematic and strategic investments in the regions are expected to significantly boost the growth of the AS/RS market in Asia Pacific countries.

Key Automated Storage And Retrieval Systems Company Insights

Some of the key players operating in the market include Dematic (KION GROUP AG), Daifuku Co., Ltd., and SSI SCHAEFER Group, among others.

- Daifuku Co., Ltd. is a Japan-based designing, engineering, manufacturing, installation, consultation, and after-sales service company for logistics systems and material handling equipment. The company caters to various industries, including transportation & warehousing, automobile, and commerce & retail. It has operations in 24 countries across Asia Pacific, Europe, and North America.

Exotec and Attabotics are some of the emerging market participants in the target market.

- Exotec is a France-based robotics company that has gained global recognition in the field of warehouse automation, particularly for its advanced Automated Storage and Retrieval Systems (ASRS). The company serves various industries, including e-commerce, retail, and healthcare. It has a global presence across the U.S., France, Germany, Japan, and South Korea.

Key Automated Storage And Retrieval Systems Companies:

The following are the leading companies in the automated storage and retrieval systems market. These companies collectively hold the largest market share and dictate industry trends.

- Dematic (KION GROUP AG)

- Daifuku Co., Ltd.

- Kardex

- Murata Machinery, Ltd.

- SSI SCHAEFER Group

- TGW

- Mecalux, S.A.

- KNAPP AG

- BEUMER Group

- KUKA AG

- Bastian Solutions, LLC

- System Logistics S.p.A.

Recent Developments

-

In April 2024, TGW and OPEX Corporation announced a strategic partnership to expand into new markets in the U.S. and Europe. In this collaboration, TGW planned to leverage its expertise to enhance OPEX Corporation's Infinity automated storage and retrieval system (ASRS), which will also be integrated into TGW's new LivePick order-fulfillment system, combining the strengths of both companies to deliver comprehensive solutions for customers.

-

In March 2024, BEUMER Group announced the launch of a new customer diagnostic center that offers logistics and e-commerce clients data-driven support to enhance system performance, prevent downtime, and optimize maintenance through advanced diagnostics and 24/7 expert assistance. With services in system improvement, proactive security, and emergency response, the Center enables customers to leverage machine learning and AI insights to continuously improve operational efficiency and secure a competitive edge.

Automated Storage And Retrieval Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.00 billion

Revenue forecast in 2030

USD 10.31 billion

Growth Rate

CAGR of 8.0% from 2025 to 2030

Historic year

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, function, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, UK, China, India, Japan, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Dematic (KION GROUP AG), Daifuku Co., Ltd., Kardex, Murata Machinery, Ltd., SSI SCHAEFER Group, TGW, Mecalux, S.A., KNAPP AG, BEUMER Group, KUKA AG, Bastian Solutions, LLC, System Logistics S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Storage And Retrieval Systems Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automated storage and retrieval systems market report based on type, function, vertical, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Unit Load Cranes

-

Mini Load Cranes

-

Robotic Shuttle Based

-

Carousel Based

-

Vertical Lift Module

-

Robotic Cube Based

-

-

Function Outlook (Revenue, USD Million, 2017 - 2030)

-

Assembly

-

Distribution

-

Kitting

-

Order Picking

-

Storage

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Healthcare

-

Automotive

-

Aerospace & Defense

-

Electronics & Semiconductors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America led the target market in 2024, with a market share of 40.9%. The region's growth can be attributed to the high technology adoption rate across industries in North America. Additionally, the speedy implementation of new technologies and the existing modern infrastructure in the region further supports the growth of the target market.

b. Some key players operating in the automated storage and retrieval systems market include Kardex Group, Daifuku Co., Ltd., Murata Machinery, Ltd., SSI Schaefer AG, TGW Logistics Group GmbH, Dematic Corp. (Kion Group AG), and Mecalux, S.A..

b. The major factors attributing to the growth of the automated storage and retrieval systems market are the rapid growth of the e-commerce sector, which has led to a surge of e-commerce fulfillment centers; increasing adoption of automation solutions for warehousing; and supportive government initiatives to build a robust logistics infrastructure.

b. The global automated storage and retrieval systems market size was estimated at USD 6.53 billion in 2024 and is expected to reach USD 7.00 billion in 2025.

b. The global automated storage and retrieval systems market is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2030 to reach USD 10.31 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.