- Home

- »

- Medical Devices

- »

-

Automated Suturing Devices Market Size, Share Report 2030GVR Report cover

![Automated Suturing Devices Market Size, Share & Trends Report]()

Automated Suturing Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Cardiac, Orthopedic, Gastrointestinal, Ophthalmic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-803-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Suturing Devices Market Trends

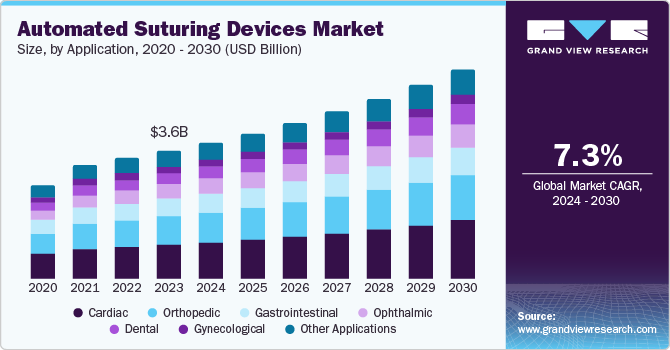

The global automated suturing devices market size was valued at USD 3.63 billion in 2023 and is expected to expand at a CAGR of 7.3% from 2024 to 2030. The market growth worldwide is driven by the increasing prevalence of chronic diseases and the adoption of minimally invasive surgeries, which requires precise suturing techniques. Automated suturing devices, a critical component in open and minimally invasive procedures, enhance efficiency and accuracy in various medical fields, including orthopedics, gynecology, ophthalmology, and cardiovascular procedures.

The WHO anticipates that, by 2050, 80% of older adults will be residing in low and middle-income countries. This demographic trend indicates an increase in geriatric population, leading to rising demand in the industry. The rise in chronic conditions such as cardiovascular diseases, diabetes, and obesity necessitates more surgical interventions, thereby boosting the demand for automated suturing devices. Furthermore, the shift towards minimally invasive surgical techniques, which offer reduced recovery times, lower risk of infection, and less postoperative pain, is also driving the market.

Every year, approximately 1.19 million people die due to road traffic crashes, and between 20 and 50 million more suffer non-fatal injuries globally, according to WHO estimates. Industry growth is driven by cost efficiency and growing surgical volume. Automated suturing devices streamline the suturing process, reducing overall surgical time and hospital costs, making them an attractive option for healthcare providers seeking to optimize resources and improve patient throughput. This trend is expected to drive significant growth in various medical fields.

Regulatory and reimbursement support is also a key driver of the automated suturing devices market. Favorable reimbursement policies and regulatory approvals for automated suturing devices are encouraging their adoption in surgical practices. This support helps mitigate financial barriers for hospitals and clinics, facilitating market growth. Furthermore, rising awareness among healthcare professionals regarding the benefits of automated suturing devices, including enhanced patient outcomes and reduced complication rates, is driving their acceptance in surgical settings.

Product Insights

The segment of reusable automated suturing devices dominated the market in 2023, capturing the highest revenue share of 56.4%. This can be attributed to the devices’ exceptional infection resistance during procedures and their efficient sterilization methods, which significantly reduce tissue injury. Moreover, these devices are highly affordable and easily accessible in the market, further fueling the growth of this segment in the forecast period.

The disposable segment is projected to exhibit the fastest CAGR of 7.5% over the forecast period. The global surge in surgical procedures, driven by an aging population and chronic diseases, has created a demand for efficient and effective suturing solutions. Disposable automated suturing devices are gaining popularity due to their ability to minimize hospital-acquired infections, eliminating concerns related to sterilization processes. This trend is reinforced by the heightened awareness of infection control, post-COVID-19 pandemic.

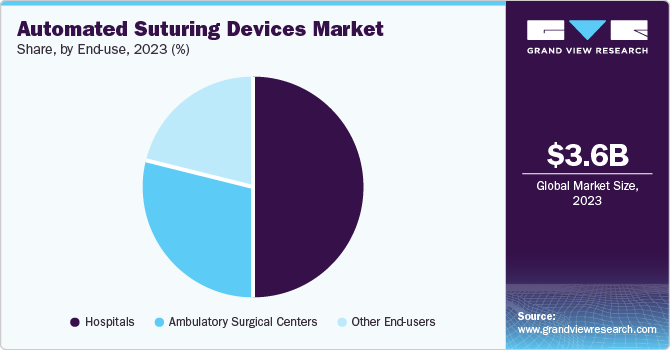

End-use Insights

Hospitals led the market with a revenue share of approximately 50.0% in 2023. The rise in hospital admissions is a key factor driving the demand for this segment. Moreover, the easy accessibility of hospitals, along with favorable reimbursement policies, is anticipated to further propel market growth. Handheld automated suturing devices are crucial for closing wounds in confined spaces, leading to quicker recovery and shorter hospital stays.

The ambulatory surgical centers segment is projected to exhibit the fastest CAGR of 7.5% over the forecast period. The preference for automatic suturing devices in ambulatory care centers and clinics is increasing due to their ability to reduce turnaround time and promote quick recovery. These devices are widely available and extensively used in emergency care, contributing to the anticipated market growth.

Application Insights

The cardiac segment accounted for the largest revenue share of 26.8% in 2023, driven by the increasing prevalence of cardiovascular disorders and rising surgical procedures. The American Heart Association forecasts a 46% increase in heart failure cases by 2030. The orthopedic market is also growing, fueled by the aging population and rising sports-related injuries and trauma cases.

The dental segment is projected to exhibit the fastest CAGR of 8.7% over the forecast period. Automated suturing devices streamline the suturing process, reducing intervention time and improving patient outcomes. Precise automation minimizes human error, while integration of advanced technologies such as robotics and computer-assisted systems facilitates adoption.

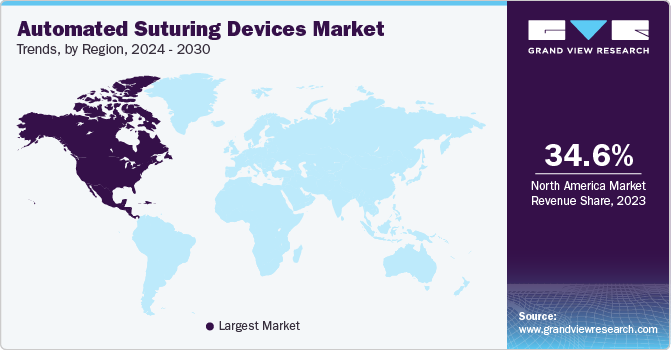

Regional Insights

North America automated suturing devices market emerged as the dominant player in the global automated suturing devices market, accounting for the largest revenue share of 34.6%. The regional market is driven by the growing elderly population and increasing surgical procedures. In addition, the preference for robot-assisted minimally invasive surgeries and continuous technological advancements in automated suturing devices are expected to boost demand.

U.S. Automated Suturing Devices Market Trends

The automated suturing devices market in the U.S. dominated the North America automated suturing devices market with 71.5% of the total revenue share in 2023. Market growth is driven by the high prevalence of chronic diseases such as cardiovascular disease, diabetes, and obesity, resulting in increased demand for surgeries. The well-established healthcare system and favorable reimbursement policies for cutting-edge medical technologies also contribute to market growth, making these devices more accessible to healthcare facilities and enhancing their adoption.

Europe Automated Suturing Devices Market Trends

Europe automated suturing devices market is a lucrative region, driven by factors such as the development of surgical instruments, increasing minimally invasive surgeries, and aging population. Investments in healthcare infrastructure enhancement, including surgery upgrades and technology adoption, are also contributing to market growth.

The automated suturing devices market in the UK is poised for significant growth, driven by rising surgical procedure volumes across general surgery, gynecology, and orthopedics. Minimally invasive surgeries also contribute to demand, as automated suturing devices improve precision and reduce operation time, critical factors in enhancing patient outcomes.

Asia Pacific Automated Suturing Devices Market Trends

The Asia Pacificautomated suturing devices market region is projected to experience the the fastest growth of 8.1% from 2024 to 2030. The region is experiencing a surge in chronic diseases, including cardiovascular disorders, diabetes, and cancer, driving a corresponding increase in surgical procedures. The aging population and growing demand for minimally invasive surgeries, which offer benefits such as reduced recovery time and lower risk of complications, are also contributing to market growth.

The automated suturing devices market in India is expected to grow at a significant CAGR during forecast period. The rise in surgical procedures, particularly in the fields of orthopedics, cardiology, and general surgery, is expected to propel the adoption of automated suturing devices. Moreover, the growing prevalence of chronic diseases increases the demand for efficient surgical interventions, thereby boosting market demand. Government initiatives aimed at improving healthcare infrastructure and increasing investments in medical technology are also contributing to the market growth.

Key Automated Suturing Devices Company Insights

Some key companies in ambulance stretchers market include Medtronic; Boston Scientific Corporation; BD; and others. The industry is marked by a diverse landscape of established multinational corporations and emerging companies, each seeking to innovate and gain market share through cutting-edge technologies and strategic partnerships.

-

Medtronic specializes in developing and manufacturing a range of medical devices, including automated suturing devices. The company is committed to research and development, introducing advanced technologies to facilitate minimally invasive surgeries, improving surgical outcomes and enhancing patient safety.

-

Boston Scientific Corporation is dedicated to developing innovative solutions across various medical fields, including endoscopy, urology, and cardiology. Its automated suturing devices enhance surgical efficiency and patient outcomes through precise and rapid suturing during minimally invasive procedures.

Key Automated Suturing Devices Companies:

The following are the leading companies in the automated suturing devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- BD

- LSI Solutions, Inc

- Smith+Nephew

- Sutrue

- Medical Device Business Services, Inc.

Recent Developments

-

In November 2023, Ethicon, a company under Johnson & Johnson, introduced ETHIZIA, a hemostatic patch, clinically proven to stop bleeding in 30 seconds, 80% faster than the leading fibrin sealant patch.

-

In August 2023, Healthium Medtech launched TRUMAS, a pioneering range of sutures, addressing challenges in minimal access surgeries and providing surgeons with innovative solutions to enhance patient care and improve outcomes.

Automated Suturing Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.86 billion

Revenue forecast in 2030

USD 5.90 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Boston Scientific Corporation; BD; LSI Solutions, Inc; Smith+Nephew; Sutrue; Medical Device Business Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Suturing Devices Market Report Segmentation

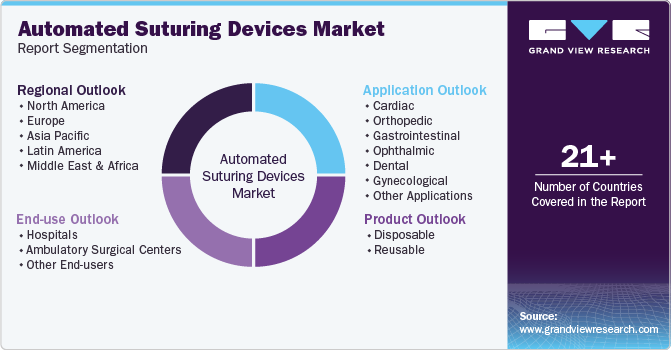

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For the purpose of this study, Grand View Research has segmented the global automated suturing devices market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac

-

Orthopedic

-

Gastrointestinal

-

Ophthalmic

-

Dental

-

Gynecological

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.