- Home

- »

- Bulk Chemicals

- »

-

Automotive Appearance Chemicals Market, Industry Report, 2014-2025GVR Report cover

![Automotive Appearance Chemicals Market Report]()

Automotive Appearance Chemicals Market Analysis, By Product (Waxes, Polishes, Protectants, Wheel & Tire Cleaners, Windshield Washer Fluids), By Application, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-635-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Research

Industry Insights

The global automotive appearance chemicals market size was estimated at USD 1,057.5 million in 2016. The growing automotive industry, notably in the emerging economies of the world, coupled with the rising demand for appearance enhancement products for use in cars, is expected to fuel product demand over the forecast period.

Luxury cars and sports utility vehicles are the major end users of appearance enhancement products. Automotive appearance chemicals such as waxes and polishes are used to give a new-like look and add shine to vehicles. Protectants and cleaners are used to maintain the condition of vehicles. The market is mainly driven by the demand from vintage and luxury car segments as they require additional maintenance.

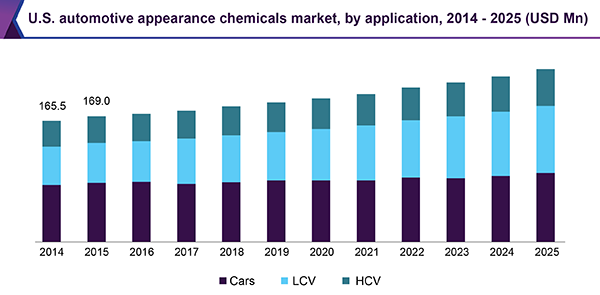

The U.S. automotive appearance chemicals market was valued at USD 172.7 million in 2016 and is anticipated to progress at an estimated CAGR of 3.5% from 2017 to 2025. Various types of products, such as waxes, polishes, surface protectants, tire cleaners, and windshield cleaners, are marketed in the industry worldwide. The product demand in applications such as cars, LCVs, and HCVs has increased over the years and is expected to expand in major markets such as China and India.

The use of the products for the maintenance and repair of vehicles is gaining popularity. Various types of products produced by major industry players prove useful for different end-use industries. This, in turn, has helped in augmenting the product demand over the last few years. The product use is increasing on account of the growing automotive industry. These appearance chemicals are crucial products that are used to maintain vehicles. The products help in improving the gloss and shine and enhancing the durability of vehicles. In addition, they protect and retain visual appeal. As a result, their demand is expected to increase over the forecast period.

A large number of research agencies are carrying out R&D investments in the field for a long time. The research has helped in discovering various applications of the products, thus widening their scope. Technological innovations have led to the use of the technology in a variety of waxes for specific applications such as to add shine and protect the surface of vehicles from scratches and swirls. These factors together are expected to fuel the product demand over the forecast period.

The product use has been approved by various governing bodies. The manufacturers of automotive appearance chemicals are required to strictly adhere to the regulations pertaining to the storage and use of the products as stated by the Toxic Substances Control Act (TSCA), Control of Substances Hazardous to Health Regulations (COSHH), and the European Union (EU). These regulations vigorously enforce safety regulations for the storage and use of the products and related raw materials.

Product Insights

Automotive appearance chemicals include waxes, polishes, protectants, wheel & tire cleaners, windshield washer fluids, carpet & fabric care products, and leather care products in the others segment. Waxes and polishes are used to add shine to the surface of the car as it starts fading and losing shine.

Waxes are used to add a protective layer to the surface for protection against minor scratches and dents. In addition to protecting the surface, they impart shine to the vehicle body. The wax segment is expected to witness a CAGR of 5.1% over the forecast period, in terms of revenue.

Polishes are used to remove very fine layers of the topcoat protection and give a flattened look at the surface. The flattened surface ensures equal reflection of light and gives a polished look to vehicles. The polish segment dominated the overall industry, accounting for a market share of 35% in 2016. The trend is expected to continue over the forecast period.

Carnauba wax, silicone, and Teflon are among the major raw material sources used for the production of automotive appearance chemicals. The crude carnauba wax prices are expected to have a significant impact on the production cost, which is, in turn, expected to affect the cost of carnauba car wax. Various types of products, which are used for commercial and industrial functions, are manufactured by major players in the industry.

The widening application scope of the products has increased awareness among consumers regarding the benefits and uses of the products. The applications are expected to increase with the help of research and development.

Application Insights

Cars was the largest application segment for automotive appearance chemicals, accounting for over 75% of the global market revenue in 2016. The use of the products by all types of automobiles, especially luxury and vintage cars, has led to increasing demand.

LCV was the second-largest segment, accounting for nearly 15% of the global revenue share in 2016. Automotive appearance chemicals are majorly used to maintain the appearance of vehicles while protecting the exterior and interior surface from damage. The cars and LCV segments are expected to be the highest revenue-generating segments owing to the increasing demand for cars by the young population in countries such as India and China. In addition, with the growing need for logistic vehicles, the demand for LCVs is expected to grow.

Regional Insights

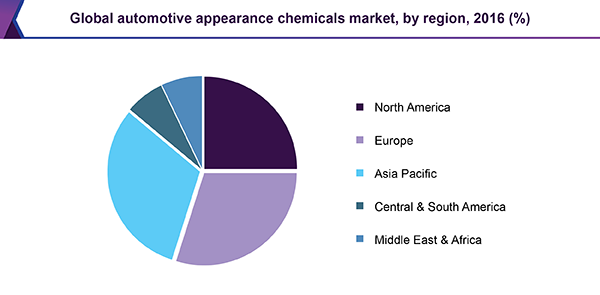

Europe led the industry in terms of revenue in 2016 with the regional segment estimated at around USD 360 million and the trend is expected to continue over the forecast period. Increasing demand for automotive appearance chemicals in countries such as Germany is expected to propel the market growth over the forecast period. Automotive appearance chemicals are witnessing a rise in the region owing to the large-scale manufacturing of luxury and other passenger cars.

Asia Pacific was the largest segment in 2016 in terms of volume and is predicted to ascend at a CAGR of 5.5% over the forecast period. In countries, such as India and China, the growing youth and working population that used cars is on the rise. Rising demand for automotive is projected to fuel the demand for automotive appearance chemicals in the cars application segment over the forecast period. In addition, the rising need for vehicles that can transport goods from one place to another is expected to fuel the demand for LCVs and HCVs.

Competitive Insights

Some of the key players in this industry include 3M Company, Inc.; The Dow Corning Chemical Company; The Clorox Company; Valvoline, Inc.; Norton Abrasives; and Illinois Tool Works, Inc. The companies are emphasizing new product developments, geographic expansions, partnerships, and acquisitions with key players likely to increase market share and strengthen their position in the industry.

Report Scope

Attributes

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Volume in tons, revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Mexico, Germany, U.K., Germany, China, India, Japan, Brazil, South Africa

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global automotive appearance chemicals market on the basis of application, end use, and region.

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

Waxes

-

Polishes

-

Protectants

-

Wheel & tire cleaners

-

Windshield washer fluids

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

Cars

-

LCV

-

HCV

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."