- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Automotive Chromium Market Size, Industry Report, 2030GVR Report cover

![Automotive Chromium Market Size, Share & Trends Report]()

Automotive Chromium Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Decorative, Functional), By End Use (Two-wheelers, Passenger Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-722-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Chromium Market Size & Trends

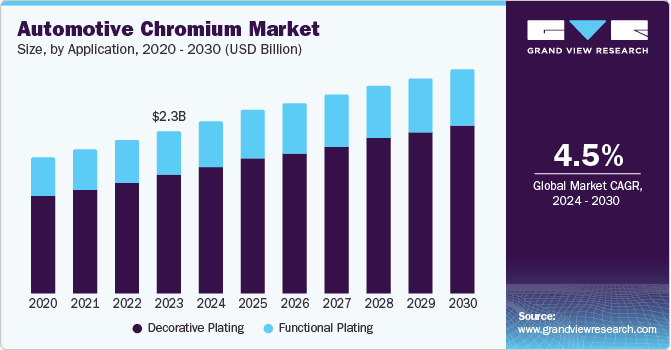

The global automotive chromium market size was valued at USD 2.25 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. Rising demand for decorative plating in the automotive sector, the rising need for lightweight vehicle parts to enhance automobile service life and performance, and significant technological advancements and the establishment of smart automobile production facilities are the factors driving the automotive chromium market.

The demand for chromium plating is poised to experience significant growth worldwide, driven by the material’s exceptional corrosion resistance properties. Automotive manufacturers increasingly utilize chrome plating to enhance the performance and service life of various components, including bumpers, grills, mirror covers, and door handles. This trend is driven by the need for high-quality coatings that can withstand corrosion and environmental factors while minimizing weight and environmental impact.

The continuous rise in global vehicle production, combined with consumer emphasis on aesthetics and customization, drives the need for chromium-based coatings. Chrome’s corrosion-resistant properties enhance the durability and appearance of automotive components, such as trims, bumpers, and wheels. Furthermore, advancements in manufacturing technologies, including establishing smart automobile production facilities, have contributed to the market growth. These innovations enable manufacturers to reduce operational costs while meeting increasing demand for decorative chrome plating.

The Asia Pacific region is expected to be a key driver of growth in the automotive chromium market, driven by substantial growth in automotive production in countries such as China and India. The strategic reconfiguration of production hubs to these emerging economies is expected to enhance demand for chrome plating as manufacturers seek cost-effective solutions. The increasing need for chromium plating in the passenger vehicles sector, driven by its excellent ability to resist corrosion, is also expected to boost market growth.

Application Insights

Decorative plating led the market with a revenue share of 72.6% in 2023 as it is a high-performance coating used in various industries, including automotive, to enhance part durability and functionality. Its unique characteristics include toughness, long-lasting quality, and resistance to corrosion, providing good lubricity, chemical resistance, and corrosion resistance.

Functional plating is expected to grow significantly with a CAGR of 3.1% during the forecast period. The growth of the commercial and passenger vehicle industries is driving the demand for functional chrome plating. Commercial vehicles require increased durability and improved operations, while functional plating prevents rust and enhances durability, extending the lifespan and efficiency of car components in harsh environments.

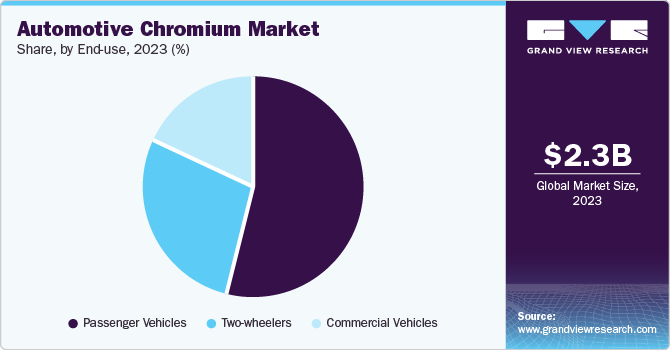

End Use Insights

Passenger vehicles accounted for the largest market revenue share of 53.5% in 2023. In the automotive sector, chromium is used in passenger vehicles to enhance aesthetics and design through chrome plating on exterior parts such as grilles, door handles, and mirrors. Moreover, chromium protects vehicle components from rust and deterioration, extends the lifespan of exterior parts, and improves the durability of high-wear components such as bumpers and trims.

Two-wheelers are projected to grow at the fastest CAGR of 4.3% over the forecast period. The increasing popularity of motorcycles and scooters, particularly in developing countries, is driving the demand for chrome finishing applications in the two-wheeler industry. Manufacturers are recognizing the importance of aesthetic appeal, and the smaller size of components makes them more cost-effective to chromate, propelling growth in this segment.

Regional Insights

In 2023, Asia Pacific automotive chromium market dominated the global with a revenue share of 54.5% driven by China, Japan, and South Korea’s thriving car manufacturing sectors, which require high-quality chrome-plated parts for aesthetic appeal and durability. The region’s strong manufacturing presence and growing demand for trendy vehicles further fuel growth in this market.

China Automotive Chromium Market Trends

The automotive chromium market in China dominated the Asia Pacific market in 2023, driven by a strategic shift in production centers towards developing economies in China. The shift is attributed to the cost advantages offered by these markets, which has led to a significant increase in demand for chrome plating. This trend illustrates the complex dynamics of global trade and business strategies.

North America Automotive Chromium Market Trends

The North America automotive chromium market was identified as a lucrative region in the global automotive chromium market in 2023. Consumers prioritize vehicle aesthetics, driving demand for chrome-plated parts. The region’s luxury car market presents a significant opportunity for chromium usage. Advancements in chromium plating technology have improved efficiency and reduced environmental impact. The development of new chromium alloys enhances their properties, expanding their applications in the automotive industry and fostering growth.

The automotive chromium market in the U.S. is expected to grow rapidly in the coming years. The country is home to top-tier car manufacturers. A robust supply chain for car parts, including chromium-containing products, fuels market growth. American consumers’ emphasis on vehicle aesthetics drives demand for chrome-plated parts, particularly in the significant luxury car market.

Europe Automotive Chromium Market Trends

Europe automotive chromium market is anticipated to witness significant growth in the global market driven by rising demand for luxury vehicles. The use of chrome plating to enhance visual appeal has boosted high-end vehicle sales, fueled by increasing demand from wealthy individuals with high and super high net worth.

The automotive chromium market in Germany held a substantial market share in 2023. Germany’s strong automotive manufacturing presence has driven the market growth, with the country emerging as a prominent competitor in passenger and commercial vehicle production. Strategically incorporating chromium to create high-quality components that meet industry standards is expected to positively impact the market, highlighting Germany’s significant manufacturing capabilities.

Key Automotive Chromium Company Insights

Some key companies in the automotive chromium market are Chromium Plating Company; Macdermid Enthone (Element Solutions Inc); MICRO METAL FINISHING; Chem Processing, Inc.; and others. Companies have intensified focus on competitive pricing and product quality differentiation, driving investment in research and development to maintain market share and achieve sustainable growth.

-

Macdermid Enthone provides a diverse range of compounds, including chromium plating solutions, for various applications. The company prioritizes innovative, sustainable technologies to meet evolving customer demands. Its comprehensive product portfolio features solutions for decorative and functional plating, enhancing the performance and aesthetics of automotive components.

-

Chem Processing, Inc. is a provider of chromium plating, anodizing, and other surface treatments for the automotive, aerospace, and defense industries. The company prioritizes customer satisfaction and adheres to industry standards, offering environmentally compliant processes that meet stringent regulations.

Key Automotive Chromium Companies:

The following are the leading companies in the automotive chromium market. These companies collectively hold the largest market share and dictate industry trends.

- Chromium Plating Company

- Macdermid Enthone (Element Solutions, Inc.)

- MICRO METAL FINISHING

- Chem Processing, Inc.

- MVC Holding

- American Electroplating Company

- Borough Ltd

- Custom Chrome Plating, Inc.

- Kakihara Industries Co., Ltd.

- Rotorua Electroplaters

- SARREL

- Okawa Asia Co., Ltd.

- Atotech

- African Electroplating

- Allied Finishing, Inc.

Recent Developments

-

In September 2023, MacDermid Enthone expanded its presence in Japan by opening a second facility in Nagoya, offering technical services to Tier 1s, Tier 2s, and other companies, enhancing business continuity and sustainability.

Automotive Chromium Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.39 billion

Revenue forecast in 2030

USD 3.12 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Spain, China, India, Japan, South Korea, Brazil, South Africa

Key companies profiled

Chromium Plating Company; Macdermid Enthone (Element Solutions Inc); MICRO METAL FINISHING; Chem Processing, Inc.; MVC Holding; American Electroplating Company; Borough Ltd; Custom Chrome Plating, Inc.; Kakihara Industries Co.,Ltd.; Rotorua Electroplaters; SARREL; Okawa Asia Co., Ltd.; Atotech; African Electroplating; Allied Finishing, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Chromium Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive chromium market report based on application, end use, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Decorative Plating

-

Functional Plating

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Two-wheelers

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.