- Home

- »

- Automotive & Transportation

- »

-

Automotive Connectors Market Size & Share Report, 2025GVR Report cover

![Automotive Connectors Market Size, Share & Trends Report]()

Automotive Connectors Market Size, Share & Trends Analysis Report By Product, By Connectivity, By Application, By Vehicle Type (Passenger Car, Commercial Vehicle), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-572-4

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2016

- Forecast Period: 2018 - 2025

- Industry: Technology

Report Overview

The global automotive connectors market size was valued at USD 15.58 billion in 2017 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2018 to 2025. Growth can be attributed to rising demand for connectivity, convenience, and safety features in passenger cars as well as commercial vehicles. Technological advancements have resulted in many features that enhance driving experience and provide better safety.

Safety and security features such as adaptive cruise control, anti-theft alarm system, lane departure warning, keyless entry, and auto emergency braking help in avoiding fatal accidents as well as provide greater levels of security. Such advanced features are integrated within a vehicle using a considerable number of electronic components. Connectors play an essential role in delivering proper power distribution to these components. Furthermore, connectors are manufactured to withstand harsh operating conditions such as high/low temperature, wear and tear, and dirt.

Increasing vehicle electrification among different vehicle segments has boosted demand for connectors. Furthermore, growing awareness regarding eco-friendly mobility has plunged sales of electric vehicles, thereby driving demand for automotive connectors. It is anticipated that over 127 hybrid electric car models will be launched over the next five years, which is expected to create immense opportunity for makers of automotive connectors.

Regulations also play a crucial part in shaping the market. The proposed ban on internal combustion engine (ICE) vehicles in different countries has led to increasing adoption of electric vehicles, driven by availability of lucrative schemes. For instance, Norway has set 2025 as the target year for banning ICE vehicles; similarly China and India have announced to ban ICE vehicles by 2030. This amplifies the scope of vehicle electrification, thereby generating higher demand for connectors.

From distribution of power to running GPS navigation-based features, connectors play a crucial role in smooth functioning of any vehicle and the many electronic devices it features. Any malfunctioning in connectors could lead to severe functional failure. Thus, manufacturers are primarily focused on research and development initiatives for producing high-quality connectors that offer uninterrupted functioning.

Product Insights

The market can be segmented on the basis of product into printed circuit board (PCB), integrated circuit, radio frequency, fiber optic, and others. The others segment includes various application-specific connectors, heavy-duty connectors, and rectangular I/O connectors. The fiber optic segment is anticipated to exhibit the highest CAGR of 10.6% from 2018 to 2025.

Any enhancement in vehicle features significantly increases the use of electronic components. As these components require various types of connectors for efficient functioning, quality of the product is an essential prerequisite for vehicle manufacturers. Printed circuit board is a core component for all electronic devices. Various devices connected in any vehicle electrical systems need to be attached to these PCB boards and this is achieved using multiple types of connectors.

Application Insights

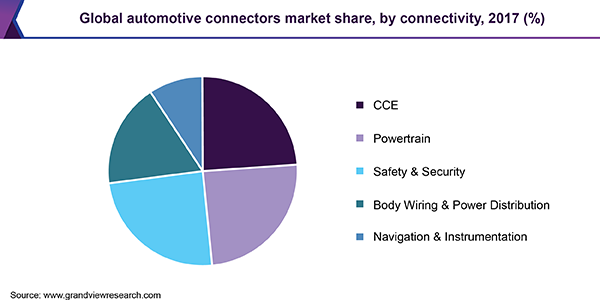

By application type, the automotive connectors market can be segmented into comfort, convenience, and entertainment (CCE), powertrain, safety and security, body wiring and power distribution, and navigation and instrumentation. The safety and security segment dominated the market with a share of over 26.0% in 2017. Advancements in technology have introduced many new safety features in vehicles, such as adaptive cruise control, adaptive front lighting, lane departure warning, and park assistance. Such functions require a high number of sensors, electronic components, and ECUs. Various types of connectors are used to establish reliable connectivity between these components. Moreover, the introduction of machine learning and V2V communication has enhanced vehicle safety.

The navigation segment is anticipated to exhibit the highest CAGR of 9.8% from 2018 to 2025. Increasing accuracy of GPS-enabled devices and implementation of advanced software such as Apple Carplay and Android Auto has fostered the use of navigational applications in both commercial and passenger vehicles.

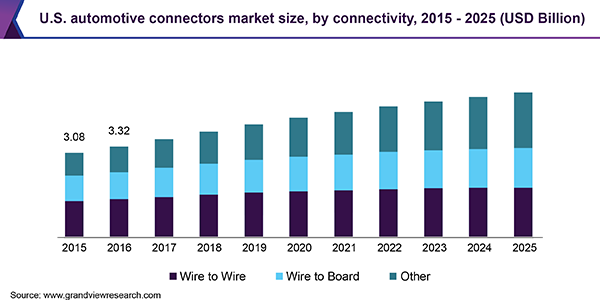

Connectivity Insights

The market can be segmented on the basis of connectivity into wire to wire, wire to board, and others. The wire to wire segment amounted to USD 5.44 billion in 2017. These connectors are widely used to establish a connection between two wires for functions such as power distribution and data transmission.

The wire to board segment is expected to register a CAGR of 6.3% over the forecast period. These are used for transfer of commands from electronic devices to PCB and vice versa. The others segment includes board to board connectors and are used to connect two or more printed circuit boards.

Vehicle Type Insights

By vehicle type, the market can be segmented into passenger cars and commercial vehicles. The passenger car segment dominated the market and was valued at USD 11.55 billion in 2017. Increasing sales of cars in developing countries such as India and China is anticipated to boost market growth.

The commercial vehicles segment includes large trucks, buses, and light commercial vehicles. This segment is expected to witness exponential growth by 2025 fueled by increased stringency in safety regulations for commercial vehicles. For instance, the European Union has mandated the installation of safety features such as lane departure warning and cruise control in commercial vehicles by 2020.

Regional Insights

Asia Pacific dominated the global market with a share of 36.0% in 2017. Asian countries such as China, Taiwan, and Japan are leading manufacturers of electronic components for both passenger cars as well as commercial vehicles. The region is an export hub for various types of automotive parts, owing to availability of low-cost labor, enhanced manufacturing facilities, and ready availability of raw material.

Europe is the second largest market, driven by rising inclusion of advanced driver assistant systems (ADAS) in commercial vehicles. The European Union has made the inclusion of ADAS features such as lane departure warning signal and autonomous breaking mandatory in heavy commercial vehicles. North America is a hub for vehicle electrification. The region accounted for a share of more than 25.0% in 2017.

Key Companies & Market Share Insights

The market is highly competitive, with top five companies accounting for a maximum share in the global revenue in 2017. Technologically advanced, reliable, and durable products are expected to be the key parameters for being competitive in this market. Prominent market players have, as a result, enhanced their R&D capabilities as an attempt to diversify product portfolio and gain market share. Some of the prominent players in the automotive connectors market include:

-

TE Connectivity

-

YAZAKI Corporation

-

Delphi Technologies

-

JAE

-

Sumitomo Corporation

Recent Developments

-

On January 2023, Mouser Electronics,Inc., an authorized global distributor of the rearmost semiconductors and electronic factors, announced a new distribution agreement with YAZAKI Corporation North America, a leading manufacturer of connectors, and numerous other quality products for the automotive assiduity.

-

On September 2022, TE Connectivity (TE), a world leader in connectivity and sensors, has developed the PicoMQS small automotive connector system. The PicoMQS connector is designed for tight signal connections that require automotive durability, optimized performance.

-

On march 2022, Amphenol, a major producer of electronic & fiber optic connectors has added more innovative, robust interconnect solutions. The FlexLock 2.54mm FPC-to-Board are USCAR-2 automotive grade connectors designed to meet the need for reliable battery management systems in EVs.

Automotive Connectors Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 20.2 billion

Revenue forecast in 2025

USD $28.3 billion

Growth Rate

CAGR of 7.4% from 2018 to 2025

Base year for estimation

2017

Historical data

2015 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD million and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, connectivity, vehicle type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Sweden; China; India; Japan; South Korea; Taiwan; Brazil; Mexico; Kingdom of Saudi Arabia; United Arab Emirates

Key companies profiled

TE Connectivity; YAZAKI Corporation; Delphi Technologies; JAE; Sumitomo Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global automotive connectors market report on the basis of product, connectivity, vehicle type, application, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

PCB

-

IC

-

RF

-

Fiber Optic

-

Other

-

-

Connectivity Outlook (Revenue, USD Million, 2015 - 2025)

-

Wire to Wire

-

Wire to Board

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million, 2015 - 2025)

-

Passenger Car

-

Commercial Vehicle

-

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

CCE

-

Powertrain

-

Safety & Security

-

Body Wiring & Power Distribution

-

Navigation & Instrumentation

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

United Arab Emirates

-

-

Frequently Asked Questions About This Report

b. The global automotive connectors market size was estimated at USD 18.7 billion in 2019 and is expected to reach USD 20.2 billion in 2020.

b. The global automotive connectors market is expected to grow at a compound annual growth rate of 7.4% from 2019 to 2025 to reach USD 28.3 billion by 2025.

b. The Asia Pacific dominated the automotive connectors market with a share of 38.2% in 2019. This is attributable to the presence of leading manufacturers of electronic components for both passenger cars as well as commercial vehicles.

b. Some key players operating in the automotive connectors market include TE Connectivity; YAZAKI Corporation; Delphi Technologies; JAE; and Sumitomo Corporation amongst others.

b. Key factors that are driving the market growth include the rising demand for connectivity, convenience, and safety features in passenger cars as well as commercial vehicles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."