- Home

- »

- Automotive & Transportation

- »

-

Automotive Data Logger Market Size, Share Report, 2030GVR Report cover

![Automotive Data Logger Market Size, Share & Trends Report]()

Automotive Data Logger Market Size, Share & Trends Analysis Report, By Connection Type (USB, SD Card, Wireless), By Application (ADAS & Safety), By End Use (OEMs, Aftermarket), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-170-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Automotive Data Logger Market Trends

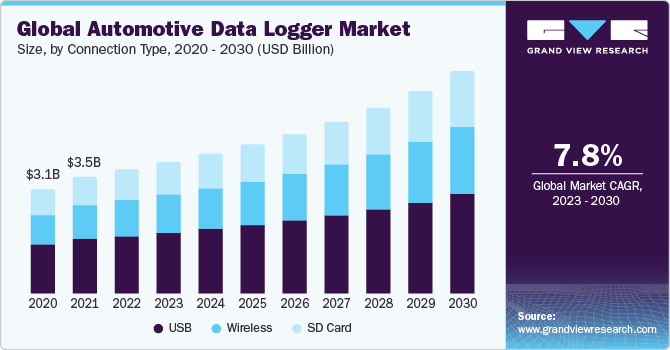

The global automotive data logger market size was valued at USD 3,687.3 million in 2022 and is anticipated to grow at a CAGR of 7.8% over the forecast period. Vehicle safety has been a paramount concern for consumers, manufacturers, and regulatory bodies. Automotive data loggers play a crucial role in collecting data related to vehicle behavior, enabling manufacturers to analyze and improve safety features. Data loggers record information during crash tests, helping engineers understand how a vehicle behaves under different impact scenarios, leading to the development of safer car designs.

The development of autonomous and connected vehicles demands extensive data collection and analysis. Data loggers provide real-time insights into vehicle performance, enabling developers to enhance autonomous driving algorithms and connectivity features. Furthermore, Automotive companies use data loggers to collect information on real-world driving scenarios, helping autonomous vehicle systems learn from varied situations, such as different weather conditions and traffic patterns.

The integration of advanced sensors and Internet of Things (IoT) devices in vehicles has led to an exponential increase in data volume. Automotive data loggers are essential in handling and making sense of this vast amount of data. Data loggers can collect data from various sensors like LiDAR, radar, and cameras, providing a comprehensive view of the vehicle’s surroundings. This data is crucial for the development of advanced driver-assistance systems (ADAS) and smart city initiatives. For instance, in March 2023, Hyundai Motor Company, a Korean automobile manufacturer, launched the next generation of its sedan Verna. The new model features advanced driver assistance systems safety technology, including adaptive cruise control, autonomous emergency braking, and lane keep assist.

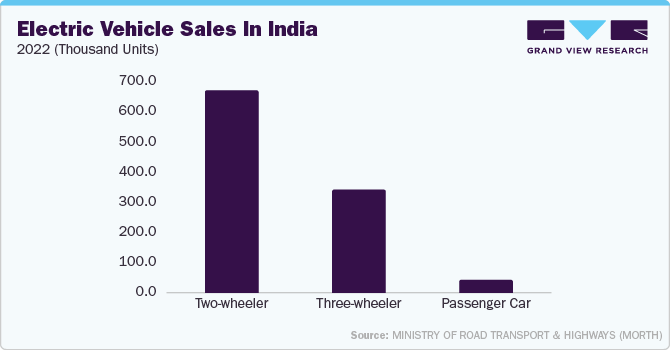

Predictive maintenance has gained traction in the automotive industry. Data loggers collect information about various components and systems, enabling predictive analysis to identify potential issues before they escalate. Moreover, the growing adoption of electric vehicles is expected to drive the growth of the automotive data logger as it is used to monitor energy consumption, battery performance, overall vehicle efficiency, and charging patterns.

Connection Type Insights

Based on the connection type, the automotive data logger market is segmented into USB, SD card, and wireless. The USB segment dominated the market in 2022. USB data loggers are compact and easy to install. They can be carried around and used in different vehicles without requiring complex setups. USB data loggers are compatible with a wide range of sensors and software applications. For instance, they can be integrated with third-party software for advanced data analysis. This compatibility ensures that automotive engineers can use their preferred analysis tools seamlessly.

Application Insights

On the basis of application, the market is segmented into on-board diagnostics, ADAS & safety, fleet management, and automotive insurance. The ADAS & safety segment dominated the market in 2022. Adaptive Cruise Control (ACC) systems require precise data about surrounding vehicles, speeds, and distances to operate effectively. Data loggers provide real-world data for testing these systems under various conditions. Consumers are increasingly aware of safety features and demand vehicles equipped with advanced ADAS technologies. The demand for features such as lane-keeping assistance and automatic emergency braking systems has driven automakers to invest in data loggers to test and refine these features before mass production. For instance, in February 2023, Continental AG, a manufacturer of automotive parts, announced that it has been working with Tata Motors Limited and Maruti Suzuki India Limited to develop advanced driving assistance systems technologies, including emergency brake assist, blind spot detection, and rear cross-traffic alert.

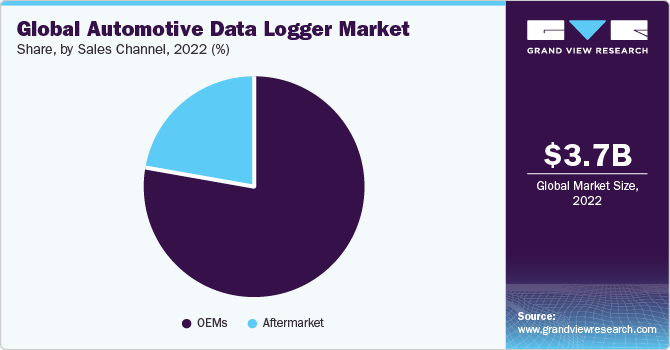

Sales Channel Insights

On the basis of sales channel, the market is segmented into OEMs and aftermarket. The OEM segment held the largest market share in 2022. OEM-fitted data loggers are seamlessly integrated into the vehicle's electronic systems during the manufacturing process. This integration ensures that the data logger works harmoniously with other vehicle components, leading to accurate and reliable data collection. OEM-fitted data loggers follow industry standards and regulations. Standardized data collection methods ensure consistency and compatibility, enabling easier analysis and comparison across different vehicle models and brands.

Regional Insights

North America region dominated the market in 2022. The increasing use of safety systems in standard vehicles and the increasing installation of electronic systems in passenger cars, light commercial vehicles, and SUVs are further anticipated to drive regional growth. Moreover, the growing demand for energy vehicles and government regulations to reduce carbon emissions bode well for market growth. The growing preference for connected cars also contributes to the expansion of the regional market. For instance, in August 2022, the Californian government set a goal of producing 1.5 million zero-emission vehicles by 2035.

Competitive Insights

Key players operating in the market include Robert Bosch GmbH; Vector Informatik GmbH; Continental AG; National Instruments Corp.; Danlaw, Inc.; Keysight Technologies; Racelogic; HORIBA, Ltd.; Xylon; Influx Technology; and IPETRONIK GmbH & Co. KG; among others. The market players are adopting strategic initiatives such as mergers & acquisitions, collaborations, and new product developments to gain a competitive edge.

In April 2023, Xylon, a provider of automotive data logging and HIL solutions, launched a 4th generation data logger and HIL system named XYLON QUATTRO. The data logger is used for vision- based ADAS and testing, development, and validation of autonomous driving.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."