- Home

- »

- Next Generation Technologies

- »

-

Automotive Electric Fuel Pumps Market Size Report, 2030GVR Report cover

![Automotive Electric Fuel Pumps Market Size, Share & Trends Report]()

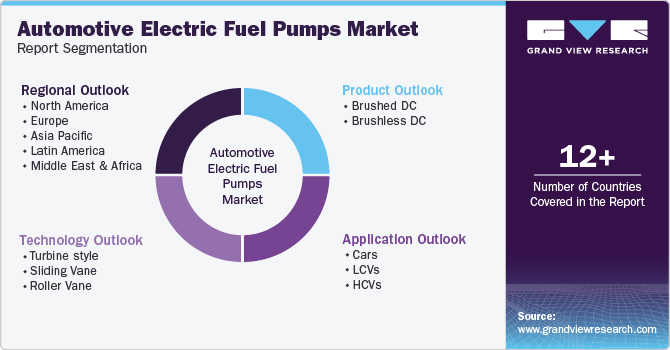

Automotive Electric Fuel Pumps Market Size, Share & Trends Analysis Report By Product (Brushed DC, Brushless DC), By Technology (Turbine Style, Sliding Vane, Roller Vane) By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-037-8

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global automotive electric fuel pumps market size was valued at USD 18.17 billion in 2022 and is anticipated to grow at a CAGR of 6.1% from 2023 to 2030. An electric fuel pump is used to inject gasoline from the tank to the vehicle engine and, thus, is considered one of the essential components in automobiles. Rapid production and demand for passenger vehicles across developing countries such as India, China, and Indonesia are anticipated to stimulate market growth during the forecast period.

Over the years, automotive electric fuel pumps have evolved from simple, mechanically functional to electrically controlled. There has been a considerable increase in the usage of electrical injectors compared to their mechanical counterparts, owing to increased fuel efficiency and the implementation of advanced technologies for better vehicular performance.

The market has also witnessed the replacement of carburetor-based engines by fuel injection engines, thus substituting mechanical pumps. Besides, electric fuel pumps have numerous benefits over mechanical fuel pumps, such as higher fuel efficiency, high durability, reliability, and body born noise reduction capabilities.

The burgeoning importance of electric pumps due to their ability to effectively push gasoline to the engine is estimated to stir up its demand over the coming years. A well-functioning pump delivers the right quantity of oil, considering the engine's operating conditions and maintaining optimal pressure between the carburetor and pump to minimize overheating and prevent vapor lock. The abovementioned factors are expected to escalate the demand for automotive electric fuel pumps over the forecast period.

The lower risk of explosion further drives the global market due to pumps being protected from gasoline vapor, less electrical load, enhanced pump life, and lowered risk of boiling. Furthermore, evolving technologies are likely to transform the landscape of the global automotive industry. Changing consumer preferences, increasing focus on eco-friendly products, and growing safety concerns are poised to play a vital role in the evolution of automotive technologies.

Surging demand for reducing vehicle weight and enhanced efficiency is projected to provide a thrust to the market. Additionally, the growing production of counterfeit products and high production costs are anticipated to hinder market growth over the forecast period.

During the pandemic, the automotive industry faced numerous challenges, including supply chain disruptions, production shutdowns, and declining consumer demand. These factors directly influenced the market of automotive electric fuel pumps and critical vehicle components. The supply chain disruptions caused by COVID-19 led to a shortage of raw materials and components required for manufacturing electric fuel pumps. This scarcity resulted in production delays and increased manufacturing costs, reducing the availability of these pumps in the market.

Product Insights

Based on the product, the global market of automotive electric fuel pumps is sub-segmented into brushed DC and brushless DC. The brushed DC segment accounted for the largest revenue share of 63.8% in 2022, owing to its significant adoption in heavy commercial and passenger vehicles to prevent abnormal wear due to high spark discharges.

The brushless DC segment is expected to grow at the fastest CAGR of 6.9% during the forecast period. Brushless DC motor used in automotive electric fuel pumps has numerous benefits over its counterpart, such as high torque to weight ratio, better product longevity and reliability, and higher electricity conducting efficiency. Thus, brushless DC motors are expected to witness the fastest growth rate over the forecast period.

Technology Insights

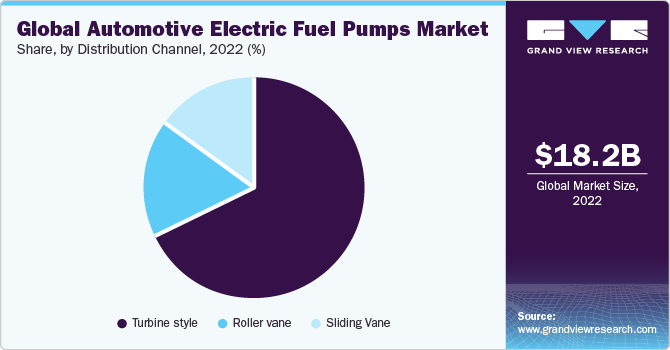

Based on the technology, the global automotive electric fuel pumps market is segmented into turbine style, sliding vane, and roller vane. The turbine style segment dominated the market with a revenue share of 67.8% in 2022 and is also expected to grow at the fastest CAGR of 6.3% during the forecast period. The segment's growth is attributed to its increasing adoption in most newly manufactured ICE vehicles due to its enhanced operating capabilities at very high speeds of approximately 7000 rpm and lesser current drawing capabilities than the older version of the pumps. Moreover, additional benefits of turbine electric fuel pumps, such as accurate pressure measurement to deliver high performance, low noise emission, and ease of installation, have led to the dominance of the segment in the global market.

The sliding vane segment is expected to grow at a significant CAGR of 5.9% during the forecast period. The rising trend of electric vehicle (EV) charging infrastructure drives the sliding vane segment growth in the market. As EV adoption increases, there is a need for efficient and reliable fuel delivery solutions in charging stations.

Application Insights

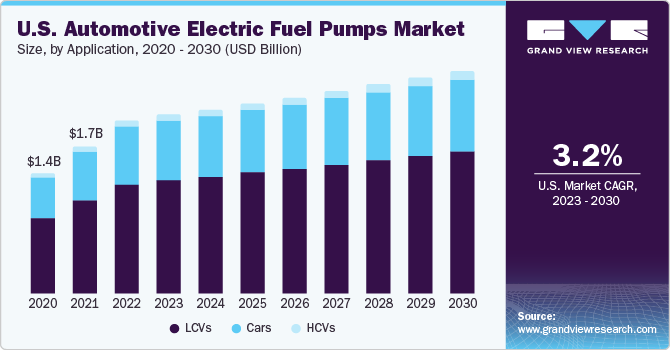

Based on application, the market is segmented into cars, LCVs, and HCVs. LCVs segment accounted for the largest revenue share of 63.3% in 2022 and is expected to grow at the fastest CAGR of 6.3% during the forecast period. The growing e-commerce sector and last-mile delivery services have propelled the demand for LCVs. The rise of online shopping and same-day deliveries has increased the number of LCVs on the road, requiring reliable and efficient fuel pumps to support their operations. Furthermore, the increasing adoption of hybrid vehicles in the commercial sector has increased the demand for electric fuel pumps.

The HCVs segment is expected to grow at a significant CAGR of 6.3% during the forecast period. Stringent emission regulations imposed by various governments and environmental agencies worldwide have also contributed to the increased adoption of electric fuel pumps in HCVs. For instance, in April 2023, U.S. Environmental Protection Agency announced a proposal to modify current laws to minimize greenhouse gases released from heavy-duty vehicles in 2027 and implement new, more rigorous laws for model years 2028 through 2032. Its proposed Phase 3 greenhouse gas program would apply to heavy-duty commercial vehicles such as freight trucks, public utility vehicles, transit, school buses, etc.

Regional Insights

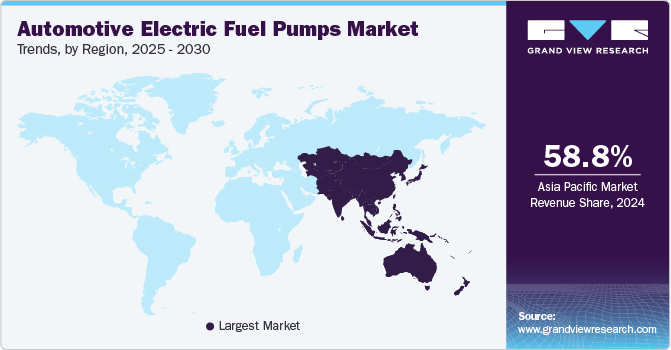

Asia Pacific dominated the market and accounted for the largest revenue share of 57.5% in 2022. and is expected to grow at the fastest CAGR of 7.3% during the forecast period. Strong demand for passenger cars and heavy commercial vehicles among consumers and industrial applications across key developing countries, such as India, China, and Korea, is one of the primary growth stimulants for the regional market. Moreover, key automobile manufacturers such as Toyota, Hyundai, Honda, and Suzuki have established their manufacturing plants in APAC, reducing overall vehicle prices and increasing passenger vehicle adoption across the region.

Central South America is expected to grow at a significant CAGR of 5.1% during the forecast period. The increasing disposable income and improving living standards in the region have led to a rise in consumer purchasing power. As a result, there is a growing demand for premium and high-performance vehicles that utilize advanced technologies, including electric fuel pumps. This trend is further driving the growth of the automotive electric fuel pump market in Central South America.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in September 2022, Stanadyne launched the Electrified GDI (Gasoline Direct Injection) fuel pump. This fuel pump incorporates Stanadyne's patented controller and software, offering a compact and versatile design. It is suitable for various motor applications and can be expanded to accommodate fuel systems operating at pressures ranging from 250 to 500 bars. The Electrified GDI fuel pump marks the first of a series of electric products developed by Stanadyne to facilitate clean propulsion for electric applications.

-

In April 2023, the Indian government introduced Real Driving Emissions or RDE standards, new and stricter driving emission norms. These emission standards are governmental regulations that restrict the amount of pollutants released by cars while they are in use. These regulations are in place to mitigate the adverse effects of automotive pollution on public health and the environment. The Indian government has been gradually imposing stringent vehicle emission regulations to enhance air quality while decreasing the health risks caused by vehicle emissions.

-

In December 2022, BorgWarner Inc. launched 142 new components to its core product range and 21 new Sparta fuel pump components. These newly released components provide repair decisions for roughly 6.4 million vehicles in the U.S. and 600,000 vehicles in Canada. They serve various clients, including Hyundai, Mercedes-Benz, Chrysler, GM, and Honda. The product line has been expanded to include fuel tank sending components, fuel pump strainers, mechanical and electric fuel pumps, and check valves.

Key Automotive Electric Fuel Pumps Companies:

- Aptiv

- Continental AG

- General Motors

- Pricol Limited

- Robert Bosch GmbH

- Visteon Corporation

- Tenneco Inc.

- Daewha

Automotive Electric Fuel Pumps Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.28 billion

Revenue forecast in 2030

USD 29.10 billion

Growth Rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in thousand units, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific,; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

DENSO CORPORATION; Aptiv; Continental AG; Continental AG; General Motors;Pricol Limited; Robert Bosch GmbH; Federal-Mogul Corporation; Visteon Corporation; Visteon Corporation; Tenneco Inc.; Daewha

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Electric Fuel Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive electric fuel pumps market on the basis of product, technology, application, and region:

-

Product Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

Brushed DC

-

Brushless DC

-

-

Technology Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

Turbine style

-

Sliding Vane

-

Roller vane

-

-

Application Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

Cars

-

LCVs

-

HCVs

-

-

Regional Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive electric fuel pumps market size was estimated at USD 18.17 billion in 2022 and is expected to reach USD 19.28 billion in 2023.

b. The global automotive electric fuel pumps market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 29.10 billion by 2030.

b. Asia Pacific dominated the automotive electric fuel pumps market with a share of 57.5% in 2022. This is attributable to strong demand for passenger cars and heavy commercial vehicles in the region.

b. Some key players operating in the automotive electric fuel pumps market include Denso Corporation, Delphi Automotive PLC, Continental AG, General Motors Company, Robert Bosch, Federal-Mogul Corporation, Visteon Corporation, Daewha Fuel Pump Ind., Ltd, and ACDelco.

b. Key factors that are driving the market growth include rising demand for passenger vehicles and superior benefits offered by electric variants in terms of fuel efficiency, durability, reliability, and noise reduction capabilities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."