- Home

- »

- Automotive & Transportation

- »

-

Automotive Interior Ambient Lighting Market Report, 2030GVR Report cover

![Automotive Interior Ambient Lighting Market Size, Share & Trends Report]()

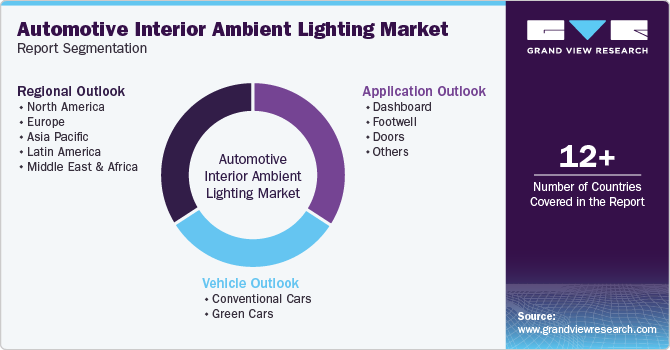

Automotive Interior Ambient Lighting Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Dashboard, Footwell, Doors, Others), By Vehicle, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-120-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Interior Ambient Lighting Market Summary

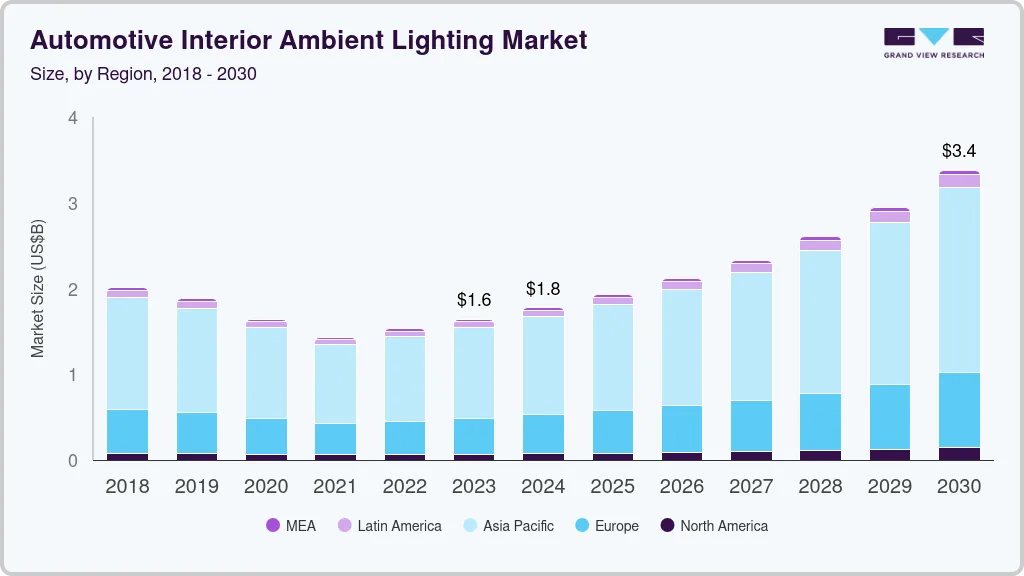

The global automotive interior ambient lighting market size was estimated at USD 1.64 billion in 2023 and is projected to reach USD 3.38 billion by 2030, growing at a CAGR of 11.3% from 2024 to 2030. Ambient lighting allows car manufacturers to create unique and attractive interiors customized to reflect the personal preferences of the driver and passengers.

Key Market Trends & Insights

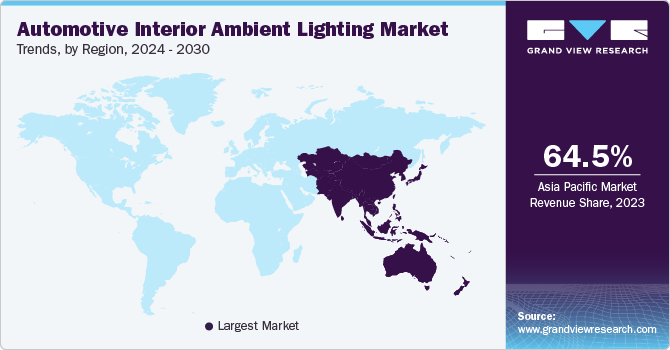

- Asia Pacific region accounted for the largest revenue share of 64.5% in 2023.

- The India automotive interior ambient lighting market is expected to witness significant growth over the forecast period.

- By application, the footwell segment dominated the market and accounted for a market revenue share of 61.9% in 2023.

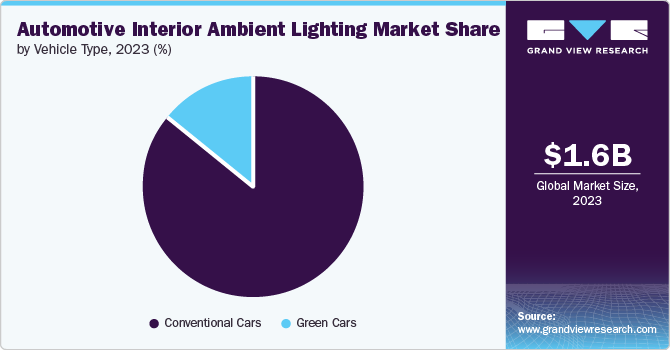

- By vehicle, conventional cars segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.64 Billion

- 2030 Projected Market Size: USD 3.38 Billion

- CAGR (2024-2030): 11.3%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

This customization extends to the lighting's color, intensity, and positioning, enabling a more personalized driving experience. The trend toward personalization in the automotive industry drives demand for ambient lighting. Innovations such as LED and OLED technologies have enabled more efficient, versatile, and cost-effective lighting solutions. These technologies offer several advantages, including lower power consumption, longer lifespan, and the ability to produce a wider range of colors. Additionally, integrating ambient lighting with vehicle infotainment and safety systems has enhanced its functionality, increasing overall driving comfort and safety.

Automakers and lighting technology companies increasingly collaborate to leverage or exchange technology, combining advanced lighting innovations with automotive design and manufacturing expertise. These partnerships facilitate the development of advanced, integrated lighting solutions that enhance vehicle safety and overall user experience. By working together, companies accelerate the adoption of ambient lighting technologies, reduce development costs, and bring innovative products to market, meeting the growing consumer demand for customizable interior lighting options. For instance, in February 2024, Motherson partnered with Valeo to develop automotive interior lighting systems. This collaboration aims to integrate the Valeo lighting system into Motherson's cabin interior modules and surfaces. Interior components such as instrument panels, door panels, and center consoles are redesigned using this technology.

Application Insights

The footwell segment dominated the market and accounted for a market revenue share of 61.9% in 2023. Footwell area illumination aids drivers and passengers in locating items such as bags, footwear, and personal belongings. It reduces the risk of accidents caused by searching for objects while driving. Additionally, targeted lighting ensures drivers are able to see and access the pedals, reducing the risk of missteps and increasing overall safety, especially during night driving. To cater to these demands, manufacturers install new vehicle accessories. For instance, in October 2023, Skoda launched the Monte Carlo variant of the Kushaq in India. It has an illuminated footwell area and front-powered seats available in two powertrain options.

The dashboard segment is expected to register the fastest CAGR during the forecast period. Illuminated dashboards provide clear visibility of important information such as speed, fuel levels, and navigation prompts, especially during night-time driving. Ambient lighting around the dashboard highlights critical controls and displays, ensuring drivers easily and quickly access vital information without distraction. Additionally, well-designed dashboard lighting ensures the area is free of shadows and dark spots, contributing to a safer and more comfortable driving experience. This improved visibility aids in reducing driver fatigue and minimizing the chances of errors, thereby enhancing overall driving safety.

Vehicle Insights

Conventional cars segment accounted for the largest market revenue share in 2023. The rising popularity of customization options drives the demand for ambient lighting in conventional cars. Consumers increasingly want to personalize their vehicles to reflect their preferences and lifestyles. Ambient lighting offers a simple yet effective way to achieve this customization, with options for changing colors, brightness, and lighting patterns. This trend towards personalization is encouraging automakers to offer more flexible and customizable lighting solutions in their vehicle models.

The green cars segment is anticipated to register the fastest CAGR over the forecast period. Ambient lighting in these vehicles is integrated with other high-tech components, such as infotainment systems, navigation, and driver assistance technologies. This integration allows for dynamic lighting that responds to various driving conditions, user preferences, and interactive commands. For instance, in October 2023, Tesla launched an updated version of the Model Y crossover in China with several design and feature updates. It features new design wheels and ambient lighting LED strips that cover the entire dashboard.

Regional Insights

North America is expected to witness the fastest CAGR over the forecast period. Consumers in this region strongly prefer vehicles that offer enhanced comfort, luxury, and advanced technology. Ambient lighting is a premium feature that enhances the driving experience by providing a customizable interior. This high demand for advanced features drives automakers to incorporate ambient lighting in a wider range of vehicles, from luxury to mid-range cars. Additionally, several leading global automotive companies have significant operations in the region, fostering a competitive environment that encourages innovation and the adoption of new technologies.

U.S. Automotive Interior Ambient Lighting Market Trends

The U.S. automotive interior ambient lightingmarket is expected to witness significant growth over the forecast period. The U.S. market is witnessing a growing interest in electric vehicles. The sale of electric vehicles rose from 1 million in 2022 to 1.6 million in 2023, accounting for 9.7% of all new EV registrations worldwide in 2022. Electric vehicles (EVs) often feature modern and futuristic designs, with ambient lighting playing a key role in creating a high-tech cabin environment. The rise of electric vehicles is driving the country's demand for innovative ambient lighting solutions.

Europe Automotive Interior Ambient Lighting Market Trends

The Europe automotive interior ambient lightingmarket is expected to witness significant growth over the forecast period. Advanced lighting technologies such as LED and OLED are extensively developed and adopted in Europe, offering more efficient, versatile, and customizable lighting solutions. European consumers expect advanced vehicle technology and ambient lighting systems to be integrated with other smart car technologies to enhance the overall driving experience.

The UK automotive interior ambient lighting market is expected to witness significant growth over the forecast period. Effective marketing and increased consumer awareness about ambient lighting's benefits drive its adoption in the UK automotive market. Automakers and dealerships highlight the advantages of ambient lighting through advertisements, showroom demonstrations, and online content. Manufacturers educate consumers and influence their purchasing decisions by showcasing how ambient lighting enhances safety and comfort. These marketing strategies and awareness are driving demand for interior lighting.

Asia Pacific Automotive Interior Ambient Lighting Market Trends

Asia Pacific region accounted for the largest revenue share of 64.5% in 2023. Ambient lighting contributes to enhanced safety by improving visibility inside the vehicle, especially in low-light conditions. Properly designed ambient lighting illuminates critical areas such as dashboards, footwells, and door handles, reducing driver distraction and errors. Ambient lighting around the dashboard illuminates essential controls and displays, aiding drivers in easily and quickly accessing necessary information without getting distracted. This increased convenience and visibility are driving demand in the Asia Pacific Market.

The India automotive interior ambient lighting market is expected to witness significant growth over the forecast period. Many car owners want to upgrade their vehicles with advanced features, including ambient lighting. The availability of aftermarket ambient lighting kits and professional installation services allows consumers to enhance their vehicle interiors without purchasing a new car. This trend is rising among automotive enthusiasts who enjoy customizing their vehicles, contributing to the overall demand for ambient lighting solutions. The rising availability of customization and advanced features drives the market's demand for automotive interior lighting.

Key Automotive Interior Ambient Lighting Company Insights

Some key companies in the automotive interior ambient lighting market include VALEO SERVICE, TOSHIBA CORPORATION, EVERLIGHT ELECTRONICS CO., LTD., OSRAM GmbH, and others.

-

Toshiba Corporation offers an extensive range of products and services across various industries. These include energy systems and solutions, infrastructure systems, and building facilities. It also offers a range of advanced electronic components and solutions designed to enhance vehicle interiors, including high-efficiency LEDs and OLEDs for lighting applications.

-

Valeo Service, a division of the Valeo Group, provides automotive aftermarket solutions and original equipment. The company specializes in various products that enhance vehicle performance, safety, and comfort. Valeo Service's offerings include advanced systems for lighting, wiper systems, thermal systems, electrical systems, and more.

Key Automotive Interior Ambient Lighting Companies:

The following are the leading companies in the automotive interior ambient lighting market. These companies collectively hold the largest market share and dictate industry trends.

- VALEO SERVICE

- HELLA GmbH & Co. KGaA

- OSRAM GmbH

- LSI Industries

- EVERLIGHT ELECTRONICS CO., LTD.

- TOSHIBA CORPORATION

- DRÄXLMAIER Group

- Oshino Lamps America Ltd

- Innotec

- Antolin

Recent Developments

-

In July 2023, OSRAM launched an intelligent RGB LED, OSIRE E3731i, for interior automotive lighting. It features a digital core that allows low-latency transmission over a standard serial bus interface with any microcontroller. Up to 1,000 LEDs can be connected in a daisy chain and controlled through one microcontroller. The OSP is available for any car or microcontroller manufacturer.

-

In April 2024, Hyundai launched the Grand i10 Nios Corporate Edition in India. It includes features such as footwell lighting, front room lamp, driver seat height adjustment, front passenger seat back pocket, 8.89 cm Speedometer with multi-information display, 17.14 cm touchscreen display, and others.

Automotive Interior Ambient Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.78 billion

Revenue forecast in 2030

USD 3.38 billion

Growth Rate

CAGR of 11.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, vehicle, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan China, India, Australia, South Korea, Brazil, South Africa, South Arabia, and UAE

Key companies profiled

VALEO SERVICE, HELLA GmbH & Co. KGaA, OSRAM GmbH, LSI Industries, EVERLIGHT ELECTRONICS CO., LTD., TOSHIBA CORPORATION, DRÄXLMAIER Group, Oshino Lamps America Ltd, Innotec, Antolin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Interior Ambient Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive interior ambient lighting market report based on application, vehicle type and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dashboard

-

Footwell

-

Doors

-

Others

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional Cars

-

Green Cars

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.