- Home

- »

- Advanced Interior Materials

- »

-

Automotive NVH Materials Market Size & Share Report, 2030GVR Report cover

![Automotive NVH Materials Market Size, Share & Trends Report]()

Automotive NVH Materials Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Molded Rubber, Metal, Foam & Film Laminates, Molded Foam, Engineering Resins), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-1-68038-438-3

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive NVH Materials Market Summary

The global automotive noise, vibration & harshness (NVH) materials market size was estimated at USD 9.84 billion in 2022 and is projected to reach USD 15.16 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Globally, increasing production and use of heavy commercial vehicles in different end-use verticals is expected to be a key factor driving automotive noise, vibration & harshness materials growth.

Key Market Trends & Insights

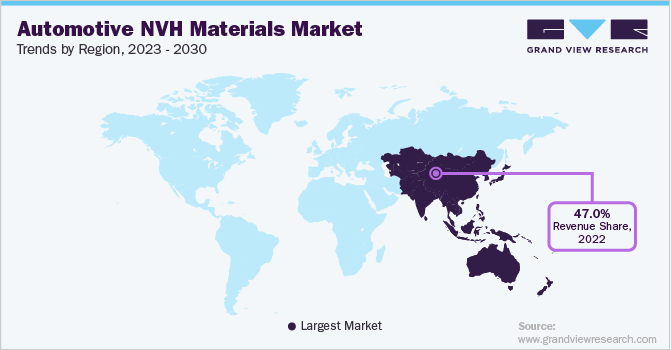

- Asia Pacific was the leading region in automotive noise, vibration and harshness materials industry, having accounted for nearly 47.0% of the overall market revenues in 2022.

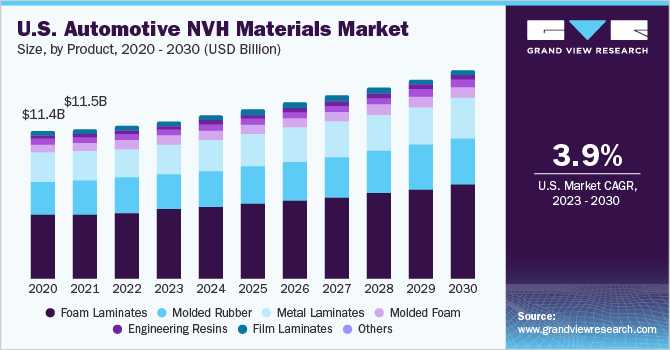

- North America witnessed nearly 5% growth in production stats in the automotive industry over the past few years.

- Based on end-use, the automotive noise, vibration, and harshness materials industry and accounted for approximately 64.8% of the overall revenue share in 2022.

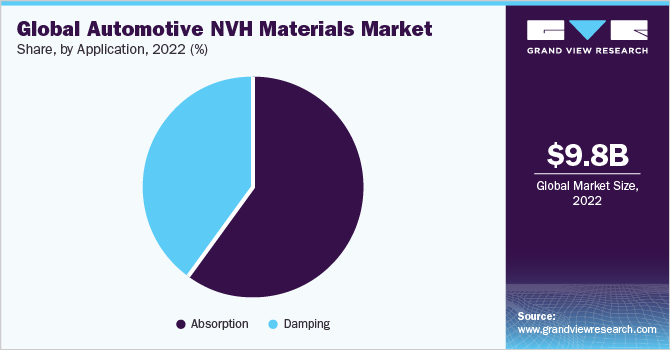

- In terms of application, noise and friction absorption emerged as the largest application segment and accounted for around 51.6% of the overall revenue share in 2022.

- Based on product, foam laminates emerged as the leading product category in the automotive noise, vibration, and harshness materials market and accounted for revenue of USD 4.30 billion in 2022.

Market Size & Forecast

- 2022 Market Size: USD 9.84 Billion

- 2030 Projected Market Size: USD 15.16 Billion

- CAGR (2023-2030): 5.6%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

Noise, vibration and harshness in automobiles due to structure-borne and air-borne noises can lead to passenger discomfort and hamper vehicle durability. The use of noise, vibration & harshness reduction materials in automobiles helps reduce these NVH and improve ride quality. This has increased the demand for noise, vibration and harshness materials in the automotive industry. The growing focus of automotive manufacturers on acoustic management, vibration, harshness & noise control in passenger and commercial vehicles helps enhance the fuel economy, reduce cabin sounds, and improve durability. In addition to the aforementioned benefits of noise, vibration, and harshness materials, the changes in consumer preferences are further expected to drive industry growth.

The U.S. automotive industry contributes a substantial amount to the GDP, and the presence of robust automobile manufacturers around the country are the key driver for the increasing automobile production. The rapid growth for automotive noise, vibration & harshness reduction materials is attributed to the growing automotive sector on account of increasing production and technological advancements.

The increasing demand for automobiles in emerging economies on account of rapid urbanization, increasing disposable incomes, and changing lifestyles directly impacts the demand for noise, vibration and harshness materials in vehicles.

The aftermarket services, including replacement parts, repairs & maintenance, accessorization, and customization, have witnessed rapid growth over the past few years. The growing market for replacement auto parts and accessorization for soundproofing is anticipated to augment the demand for automotive noise, vibration and harshness materials over the forecast period.

The introduction of active noise control systems in cars; catering to the changing consumer preferences towards comfort and safety, and changing regulatory frameworks are driving the growth of the noise, vibration & harshness materials in the automotive industry.

The value chain of the automotive noise, vibration and harshness materials market includes raw material suppliers, manufacturers, converters, distributors, and end users. The converters play a significant role in industry dynamics, responsible for furnishing final products such as foam laminates, and molded rubber components, among others. The industry participants either sell the automotive noise, vibration & harshness materials directly to the consumers through their brands or supply them to third-party dealers.

Product Insights

Foam laminates emerged as the leading product category in the automotive noise, vibration, and harshness materials market and accounted for revenue of USD 4.30 billion in 2022 and is anticipated to witness the highest growth with a CAGR of 6.0% over the forecast period. The increasing use of foam laminates for floor and door insulation in various products of the automotive industry such as passenger and commercial vehicles is anticipated to be a key driving factor for the growth of this segment. In addition, the growing use of foam laminates for the roof lining and cushioning in vehicles, on account of the light-weight and flexibility of the product, is expected to benefit the segment growth.

Molded rubber product category for noise, vibration & harshness reduction in automotive, is also expected to grow in terms of market revenue. This segment witnessed substantial growth on account of excessive use of the product for sealing and lining solutions. The increasing application of synthetic rubber products in noise, vibration and friction absorption and damping on account of higher strength, flexibility, density and chemical stability acts as the key driver for growth in this segment over the forecast period.

The film laminates product category in the automotive noise, vibration & harshness materials industry is expected to witness a considerable growth rate of 5.1% over the forecast period. The increasing use of film laminates on windows and glass for air-borne NVH damping is expected to drive segment growth. In addition, the growing demand for accessorization for soundproofing the car and enhancement of car aesthetics have a positive impact on the growth of this segment.

The use of lightweight materials in the automotive industry helps in the reduction of the overall vehicle weight, which further enhances the vehicle's durability and fuel efficiency. The presence of stringent regulations and standards regarding maintaining specific vehicle weights, especially for commercial vehicles in North America and Europe, is anticipated to drive the automotive noise, vibration, and harshness materials demand for light-weight and thin foam laminates, films, molded rubber, and molded foam products for NVH reduction in automobiles.

Application Insights

The demand for automotive noise, vibration, and harshness material products has witnessed a paradigm shift due to rising awareness among consumers. Noise and friction absorption emerged as the largest application segment and accounted for around 51.6% of the overall revenue share in 2022.

The growing importance of noise, harshness & vibration free as well as comfortable ride experiences by way of reduction in cabin sounds and frictions increased the use of noise absorption products in the automotive industry.

In addition, the shifting consumer preferences towards accessorization by way of entertainment systems in cars increases the demand for noise absorption and damping solutions in vehicles to enhance the performance of the entertainment systems. The aforementioned factors are expected to drive segment demand growth over the coming years.

China and India are projected to account for higher consumption of absorption products in the automotive industry due to growing vehicle production; increasing demand for affordable passenger cars as a result of rapid urbanization and rising living standards; production cost benefits; high overseas demand; and population-induced domestic demand.

End-use Insights

Passenger cars were the leading end-use segment in the automotive noise, vibration, and harshness materials industry and accounted for approximately 64.8% of the overall revenue share in 2022. The increasing use of noise and vibration-reduction materials in passenger cars on account of increasing demand for affordable and comfortable passenger cars has propelled segment growth in recent years.

The automotive noise, vibration and harshness materials are further witnessing increased demand from the automotive industry to comply with government regulations and requirements to produce safer and quieter cars is further increasing the noise, vibration & harshness materials demand in the cars segment.

Additionally, customers are now focusing more on their driving experience, thus manufacturers are working to enhance the quality of vehicles by employing various materials to decrease vibration, harshness and noises, thus propelling automotive noise, vibration & harshness materials demand.

The products for light and heavy commercial vehicles, including delivery vans, pickup trucks, haulage trucks, and tipper trucks, have witnessed significant growth in demand over the past few years. The increasing use of LCVs and HCVs for logistics and transportation has led to the growing need for acoustic management and noise reduction in heavy vehicles. HCVs are used for the transportation of heavy commodities over longer distances, which makes it necessary to enhance ride quality, comfort and safety.

Regional Insights

Asia Pacific was the leading region in automotive noise, vibration and harshness materials industry, having accounted for nearly 47.0% of the overall market revenues in 2022. Emerging economies in the region, including India, China, and Indonesia, have been experiencing strong economic growth in recent years.

Additionally, the increasing population and rising living standards have spurred the automotive industry in the region. Growing disposable incomes is now triggering consumer preference toward vehicles with enhanced ride quality, comfort, safety, and customization. These factors are further boosting the growth of automotive noise, vibration & harshness materials in the region.

China is the largest producer of automobiles in the world and has been witnessing significant urbanization, on account of high industrial and economic growth, over the past few years. In recent times, the rural-to-urban migration of people in the country, with higher earnings, has been a growing trend. This trend, along with the changing lifestyles and increasing disposable incomes, has resulted in a rapid increase in demand for passenger cars, which in turn is expected to propel the growth of automotive noise, vibration & harshness materials.

North America witnessed nearly 5% growth in production stats in the automotive industry over the past few years. The presence of key domestic manufacturers, along with stringent regulations regarding the fuel economy of vehicles, is expected to be a major driving factor for the industry’s growth. The abundant availability of raw materials such as engineering plastics and rubber is also expected to have positive impacts on the automotive noise, vibration & harshness materials demand during the forecast period.

Key Companies & Market Share Insights

The global automotive noise, vibration & harshness materials market is highly competitive on account of a large number of sellers in the industry, along with a high potential for product and price differentiation.

Application development and customized materials are the key strategies adopted by the key industry players to remain competitive. In addition, mergers and acquisitions are also being executed by these players with the objective of diversifying their product portfolios for reducing vibration and harness and thereby gaining competitive shares. Some prominent players in the global automotive noise, vibration & harshness (NVH) materials market include:

-

Creative Foam Corporation

-

BRC Rubber & Plastics Inc.

-

Wolverine Advanced Materials

-

ElringKlinger AG

-

Hoosier Gasket Corporation

-

Industry Products Co.

-

Interface Performance Materials

-

Hematite

-

Plastomer Corporation

-

Rogers Foam Corporation

-

Swift Components Corp

-

Unique Fabricating Inc.

-

Avery Dennison

-

KKT Holding GmbH

-

Nicholson Sealing Technologies Ltd.

-

W. KOPP GmbH & Co. KG

-

Janesville Acoustics

Global Automotive Noise, Vibration & Harshness (NVH) Materials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.28 billion

Revenue forecast in 2030

USD 15.16 billion

Growth Rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated in

April 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Regional scope

North America; Europe; Asia Pacific; Central & South America; Rest of the World

Country scope

U.S.; U.K.; Germany; India; China; Japan; Brazil

Key companies profiled

Creative Foam Corporation; BRC Rubber & Plastics Inc.; Wolverine Advanced Materials; ElringKlinger AG; Hoosier Gasket Corporation; Industry Products Co.; Interface Performance Materials; Hematite; Plastomer Corporation; Rogers Foam Corporation; Swift Components Corp; Unique Fabricating Inc.; Avery Dennison; KKT Holding GmbH; Nicholson Sealing Technologies Ltd.; W. KOPP GmbH & Co. KG; Janesville Acoustics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

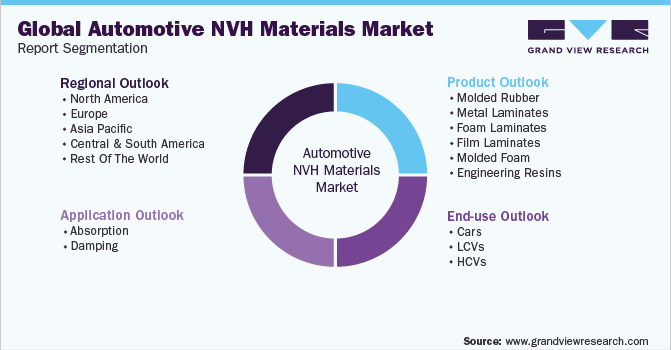

Global Automotive NVH Materials Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive NVH materials market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Molded Rubber

-

Metal Laminates

-

Foam Laminates

-

Film Laminates

-

Molded Foam

-

Engineering resins

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Absorption

-

Damping

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cars

-

LCVs

-

HCVs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global automotive noise, vibration & harshness materials market size was estimated at USD 9.84 billion in 2022 and is expected to reach USD 10.28 billion in 2023.

b. The automotive noise, vibration & harshness materials market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 15.16 billion by 2030.

b. Foam laminates accounted for the largest market share of automotive noise, vibration & harshness materials market with the revenue share of 37.6% in 2022 owing to the rising usage of the product in door and floor insulations in commercial as well as passenger vehicles.

b. Some of the key players operating in the automotive noise, vibration & harshness materials market include Creative Foam Corporation, BRC Rubber & Plastics Inc., Wolverine Advanced Materials, ElringKlinger AG, Hoosier Gasket Corporation, Industry Products Co., Interface Performance Materials, Hematite, Plastomer Corporation, and Rogers Foam Corporation.

b. The key factors that are driving the automotive noise, vibration & harshness materials market includes rising investment by automotive industry in the development of new and improved methods & technologies to lower NVH levels in various vehicles around the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.