- Home

- »

- Advanced Interior Materials

- »

-

Automotive Polymer Composites Market Size Report, 2030GVR Report cover

![Automotive Polymer Composites Market Size, Share & Trend Report]()

Automotive Polymer Composites Market (2024 - 2030) Size, Share & Trend Analysis Report By Material, By Product, By Application, By End Use, By Manufacturing Process, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-288-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Polymer Composites Market Summary

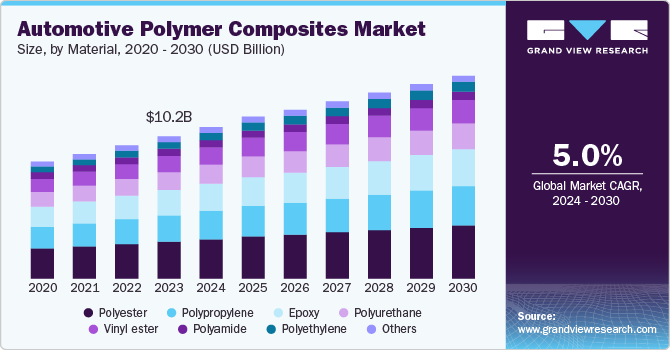

The global automotive polymer composites market size was valued at USD 10.20 billion in 2023 and is projected to reach USD 14.55 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. The market is experiencing growth driven by rising demand for lightweight vehicles, increased adoption of electric vehicles, and advancements in manufacturing processes. This trend is fueled by the need for reduced vehicle weight, improved fuel efficiency, and enhanced safety features.

Key Market Trends & Insights

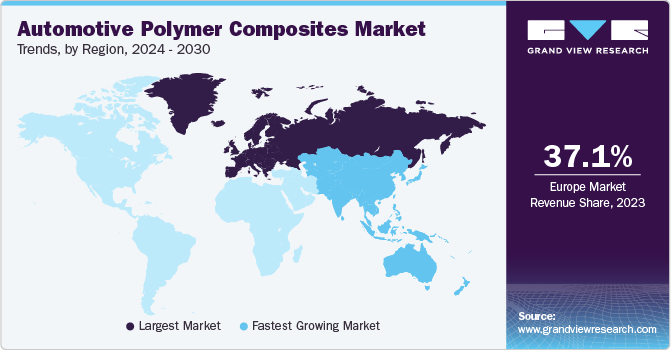

- Europe dominated the global automotive polymer composites market with a revenue share of 37.1% in 2023.

- Germany dominated the Europe automotive polymer composites market with a share of 21.6% in 2023.

- By material, Polyester led the market and accounted for a share of 25.8% in 2023.

- By product, Glass fiber reinforced polymer composite segment accounted for the largest market revenue share of 65.6% in 2023.

- By application, Exterior components led the market and accounted for a share of 33.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.20 Billion

- 2030 Projected Market Size: USD 14.55 Billion

- CAGR (2024-2030): 5.0%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

The automotive industry is undergoing a significant transformation, with a strong emphasis on lightweight materials to enhance fuel efficiency and performance. As a result, polymers are playing a leading role in this shift, gradually replacing traditional materials such as steel and aluminum in lightweight vehicles.

Car manufacturers are leveraging prepregs, a type of polymer composite, to substitute metals in both interior and exterior components, thereby reducing weight and improving performance and safety. The increasing adoption of electric vehicles is also driving the demand for lightweight materials. By reducing the weight of the vehicle body, electric cars can use smaller batteries without compromising driving range. Moreover, decreasing the weight of the vehicle body and battery pack has a cumulative impact on reducing overall vehicle weight, enabling the downsizing of other components such as the brake system and drivetrain. In internal combustion engine vehicles, reduced weight leads to lower emissions and improved performance with the same power and torque levels.

Advancements in polymer composite production technology have also contributed to their growth, as the cost of manufacturing polymer composites has decreased, making them more economical compared to traditional materials. Furthermore, governments worldwide are implementing stricter regulations on automakers regarding emissions and fuel efficiency, which is driving the adoption of lightweight materials such as polymer composites. As a result, the use of polymer composites is expected to continue to grow in the automotive industry, enabling manufacturers to meet evolving regulatory requirements while improving vehicle performance and safety.

Material Insights

Polyester led the market and accounted for a share of 25.8% in 2023 due to its lightweight, high-strength, and durable properties, which enhance fuel efficiency and reduce emissions. Advancements in manufacturing processes have made polyester composites more cost-effective and suitable for various automotive applications, driving demand for sustainable materials.

Vinyl ester is expected to register the fastest CAGR of 5.5% over the forecast period, aided by its unique combination of properties, including high strength, corrosion resistance, and durability. Vinyl ester resins offer excellent adhesion to reinforcements, enabling the creation of lightweight yet strong composite materials, making them a popular choice for automotive applications.

Product Insights

Glass fiber reinforced polymer composite segment accounted for the largest market revenue share of 65.6% in 2023. Glass fiber composites are a staple in the automotive polymer industry, boasting high strength, stiffness, flexibility, and chemical resistance. With the focus on lightweight materials to improve fuel efficiency and meet emission regulations, glass fiber composites are a popular choice due to their affordability compared to carbon and natural fibers, making them a widespread application in the automotive industry.

Carbon fiber reinforced polymer composite is projected to grow at the fastest CAGR of 5.4% over the forecast period due to its strength and thickness. Carbon fibers are manufactured through the precise alignment of carbon atoms along the fiber’s length, requiring specialized equipment and skilled labor. Despite their high production costs, carbon fibers offer exceptional durability and are often preferred for automotive applications. Crashworthiness is a critical consideration in material selection for lightweight automotive components.

Application Insights

Exterior components led the market and accounted for a share of 33.5% in 2023. Automotive composites are widely used in exterior components, including headlamps and heat shielding parts. OEMs are increasingly incorporating composites into car bodies, with recent advancements showcasing the potential of reinforced thermoplastics. Notably, BMW’s i3 is the first mass-produced car to feature thermoplastic composites, particularly in exterior components, marking a significant milestone in the industry.

Interior components are expected to grow significantly with a CAGR of 5.3% during the forecast period. Composites offer a comprehensive solution to industry challenges, including lightweighting, design versatility, safety, cost efficiency, sustainability, and regulatory compliance. By providing enhanced design flexibility, composites enable the creation of complex and customized interior components, allowing for unique shapes and textures that enhance the overall visual appeal of vehicles.

End Use Insights

Conventional vehicles accounted for the largest market revenue share of 49.3% in 2023. The growing demand for fuel-efficient, stylish, and safe vehicles aligns with the benefits of composite materials. As the automotive sector prioritizes innovation and sustainability, composites emerge as a compelling choice for car manufacturers. With technological advancements and shifting consumer preferences, the widespread adoption of composites in traditional vehicles is expected to increase.

Electrical vehicles segment is expected to register the fastest CAGR of 5.5% during the forecast period. Electric vehicles, incorporating cutting-edge automotive technologies and lightweight components, rely heavily on composites in their manufacturing process. The electric vehicle sector demands distinctive features such as lightweight crash safety and seamless integration with the Internet of Things, making composites a crucial element in meeting these exacting requirements.

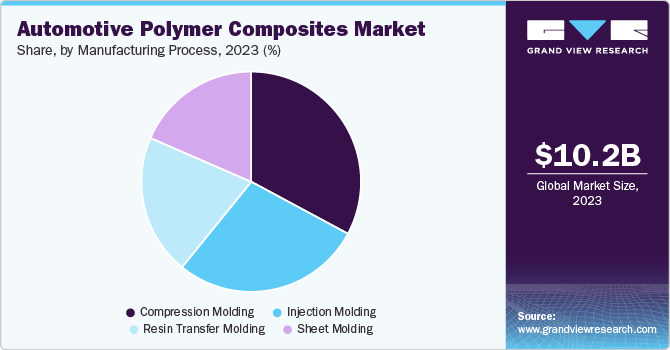

Manufacturing Process Insights

Compression molding dominated the market in 2023, generating a revenue share of 32.8%. Compression molding is a prominent manufacturing process for shaping complex and robust fiberglass reinforcements in large volumes under high pressure. This technique provides the benefit of producing intricate and sizable components, with fewer knit lines and reduced fiber degradation compared to injection molding, making it a preferred method for industrial applications.

Injection molding segment projected to grow at the fastest CAGR of 5.5% over the forecast period. The process involves injecting hot plastic materials into a mold, allowing them to solidify and produce molded items. Primary raw materials include polyethylene, polypropylene, polyurethane, and others, which are used to create lightweight automotive components, offering significant advantages in terms of reduced weight and increased fuel efficiency.

Regional Insights

Europe automotive polymer composites market dominated the global automotive polymer composites market with a revenue share of 37.1% in 2023. The European automotive industry is a significant sector, accounting for a substantial share of global production. The European Union’s member states collectively rank among the world’s top motor vehicle manufacturers, with the industry investing heavily in research and development. The need for automotive polymer composites has arisen due to the increasing demand for fuel-efficient and lightweight vehicles.

Germany Automotive Polymer Composites Market Trends

Automotive polymer composites market in Germany dominated the Europe automotive polymer composites market with a share of 21.6% in 2023. Germany’s automotive polymer composites market is expected to remain robust, driven by growing consumer awareness of eco-friendly options. The market’s growth prospects are fueled by the increasing adoption of automotive composites, which are environmentally sustainable. German OEMs are also aligning with government initiatives by focusing on natural composites.

North America Automotive Polymer Composites Market Trends

North America automotive polymer composites market was identified as a lucrative region in the global automotive polymer composites market in 2023. Market growth in the region is driven by increased vehicle production, demand for lightweight materials, and growth in the electric vehicle sector. Technological innovations and government initiatives promoting sustainable materials also contribute to the market’s growth, creating a favorable environment for expansion.

Automotive polymer composites market in the U.S. is expected to grow rapidly in the coming years. The country’s automotive sector’s significant vehicle production demands substantial materials, including polymer composites. The presence of leading OEMs and suppliers fosters research and development in composite materials and applications. The US is at the forefront of innovating composite materials and manufacturing techniques, such as CFRTP and AFP, driving industry advancements.

Asia Pacific Automotive Polymer Composites Market Trends

Asia Pacific automotive polymer composites market is anticipated to witness the fastest growth of 5.3% over the forecast period. The Asia-Pacific region is driving market growth, with China, India, and Thailand leading the way due to their large vehicle populations. India and China are expected to dominate the four-wheeler market, fueling further growth. The North American market is also experiencing government support for energy-efficient automotive composites, particularly natural fiber composites.

Automotive polymer composites market in China held a substantial market share in 2023. China is the world’s largest automotive market, with a substantial volume of vehicle production, driving demand for materials such as polymer composites. The growing Chinese middle class fuels demand for new vehicles, while China’s competitive labor costs attract component manufacturers, including those producing polymer composites. A well-established supply chain network ensures efficient sourcing of raw materials and components.

Key Automotive Polymer Composites Company Insights

Some key companies in the automotive polymer composites market include BASF; Covestro AG; DuPont; Gurit Services AG; Hexcel Corporation; and others. Companies are focusing on expanding their customer base to gain a competitive edge, driving strategic initiatives such as mergers, acquisitions, and collaborations with industry leaders.

-

Plasan is a provider of vehicle protection solutions, serving the defense and security industries. The company offers a comprehensive range of products, including survivability and personal protection, lightweight ballistic protection, composite armor, and vetronics solutions, designed to enhance the safety and performance of military and security vehicles.

-

Hexcel Corporation is a provider of advanced composites, offering a diverse range of products, including carbon fibers, reinforcements, prepregs, and matrix materials. Its solutions cater to the commercial aerospace, space and defense, and industrial sectors, enhancing the performance, efficiency, and reliability of various applications.

Key Automotive Polymer Composites Companies:

The following are the leading companies in the automotive polymer composites market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Covestro AG

- DuPont

- Gurit Services AG

- Hexcel Corporation

- Johns Manville. A Berkshire Hathaway Company

- KOLON Corp.

- Mitsubishi Chemical Group Corporation

- Owens Corning

- Plasan

Recent Developments

-

In May 2024, BASF unveiled a sustainable photovoltaic frame solution, co-created with Worldlight, at the CHINAPLAS 2024, replacing aluminum with a PU composite and water-borne coating solution, resulting in an 85% reduction in product carbon footprint.

-

In February 2024, Mitsubishi Chemical Group Corporation announced the creation of a heat-resistant ceramic material, CMC, utilizing carbon fibers derived from pitch. The CMC, suitable for aerospace applications, boasts heat resistance up to 1,500°C.

Automotive Polymer Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.87 billion

Revenue forecast in 2030

USD 14.55 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, end use, manufacturing process, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

BASF; Covestro AG; DuPont; Gurit Services AG; Hexcel Corporation; Johns Manville. A Berkshire Hathaway Company; KOLON Corp.; Mitsubishi Chemical Group Corporation; Owens Corning; Plasan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Polymer Composites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive polymer composites market report based on material, product, application, end use, manufacturing process, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethane

-

Polyamide

-

Polypropylene

-

Polyethylene

-

Polyester

-

Vinyl Ester

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Fiber Reinforced Polymer Composite

-

Natural Fiber Reinforced Polymer Composite

-

Carbon Fiber Reinforced Polymer Composite

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Interior Components

-

Exterior Components

-

Structural Components

-

Powertrain Components

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Vehicles

-

Electrical Vehicles

-

Trucks & Buses

-

-

Manufacturing Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Compression Molding

-

Injection Molding

-

Sheet Molding

-

Resin Transfer Molding

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.