- Home

- »

- Advanced Interior Materials

- »

-

Global Automotive Sunroof Market Size, Industry Report, 2018-2025GVR Report cover

![Automotive Sunroof Market Size, Share & Trends Report]()

Automotive Sunroof Market Size, Share & Trends Analysis Report By Product (Glass, Fabric), By Vehicle (Premium & Luxury, Mid-Segment), By Region, Competitive Landscape, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-122-1

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Advanced Materials

Industry Outlook

The global automotive sunroof market size was valued at USD 6.2 billion in 2016. It is expected to expand at a CAGR of 6.9% over the forecast period. The demand for automotive sunroofs is increasing in line with shifting consumer preference towards enhanced driving experience. Growing trend among automakers to offer automotive sunroofs as an optional feature in majority of passenger cars is also one of the key trends benefiting the growth of the market. Rising automobile production and spiraling sales of premium & luxury vehicles are anticipated to provide a fillip to the market.

Automakers and vendors are jointly trying to improve safety factors of various systems implemented in automobiles. For instance, Hyundai Mobis introduced a panorama sunroof airbag system, the first of its kind in the world, which can prevent passengers from getting thrown out of the automobile through the roof in event of an accident or a rollover. Automakers have also managed to integrate rain sensors within these systems. As a result, automotive sunroofs can be closed automatically as soon as it starts raining. Such innovations are estimated to bolster the growth of the market over the forecast period.

Initially, sunroofs were limited only to luxurious cars. However, they got immensely popular owing to their ability to maintain optimum levels of sunlight and ensure better visibility within the automobile, and eventually enhance the driving experience. Besides, the youth particularly found sunroofs appealing. This prompted automaker to install sunroofs in other segments as well.

However, sunroofs have several drawbacks. Sunroofs are highly costly to integrate and expensive to repair in case of a failure. They add extra weight, reduce the headroom, and obstruct the laminar airflow over the automobile. They also require regular maintenance. These factors are acting as roadblocks for rapid growth of the market.

Product Type Insights

On the basis of the product type, the market has been segmented into glass and fabric. The glass sunroof segment held the leading share in the market in 2016 and it is poised to expand at a phenomenal CAGR over the forecast period. The growth of the segment can be attributed to advancements in technology, which have made it possible to manufacture various types of glasses, such as tempered glass, laminated glass, and glass that can protect from ultraviolet rays.

Unlike fabric sunroofs found commonly on convertible automobiles, glass sunroofs offer the flexibility to better control natural light and enjoy natural air ventilation instead of car’s air conditioner. Owing to such benefits, the segment will continue to dominate the market until 2025.

On the contrary, demand for fabric types is likely to plummet over the coming years in line with dwindling sales of convertible automobiles.

Vehicle Type Insights

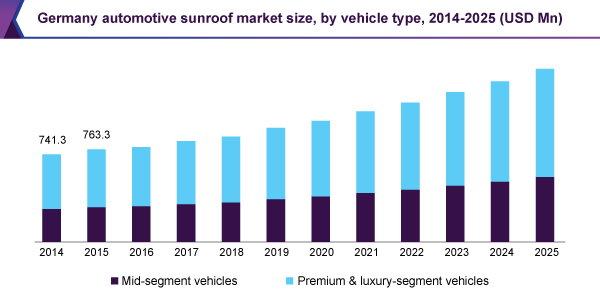

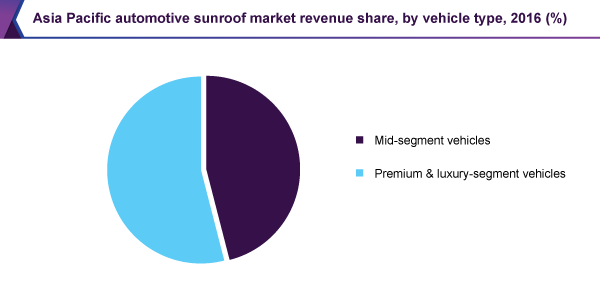

Premium & luxury-segment vehicles dominated the market in 2016, and the segment is projected to reach USD 6.6 billion by 2025. The segment is expected to continue dominating the automotive sunroof market over the forecast period owing to rising spending power of consumers.

The demand for hatchback automobiles is rising, particularly in emerging economies, such as India and China. As a result, the mid-segment vehicles segment is rapidly catching up with the premium & luxury-segment vehicles segment. Furthermore, with increasing demand for comfort and convenience features, OEMs are trying hard to differentiate themselves from their competitors. As a result, the market size of the mid-segment vehicles is anticipated to expand at the highest CAGR over the forecast period.

Regional Insights

Asia Pacific is estimated to hold the largest share by 2025. Demand for premium vehicles in emerging economies, such as India and China, is surging in line with rising disposable incomes of the populace. At the same time, automobile production in the region is increasing as automakers are investing aggressively to expand their production capacity.

Europe accounted for approximately 26% of the global passenger car production in 2016. The region is home to leading luxury carmakers, such as Daimler AG, BMW AG, and AUDI AG. All these vendors are also at the forefront when it comes to technological innovations. For instance, Audi AG of Germany has reportedly launched a prototype glass roof system with integrated solar cells. All such developments are poised to bode well for the European market.

Automotive Sunroof Market Share Insights

Automotive sunroofs are being offered as an optional feature at present. Thus, the number of market players dominating the market is currently limited. Webasto Group; Inalfa Roof Systems Group B.V.; Inteva Products; Magna International Inc.; AISIN SEIKI Co., Ltd.; Yachiyo Industry Co., Ltd.; and CIE Automotive are some of the leading companies operating in the market.

The majority of market players are focusing on production capacity and product portfolio expansion. For instance, in May 2016, Inteva Products opened a new manufacturing facility in Oradea, Romania. This is company’s second manufacturing plant, and has been dedicated to supply sunroof systems to its European customers. Similarly, in September 2017, Webasto Group developed a new convertible roof system for two Mercedes-AMG models, GT and GT C Roadster.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 & 2015

Forecast period

2017-2025

Market representation

Revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, and South America

Country scope

U.S., Canada, Mexico, U.K., Germany, India, Japan, China, and Brazil

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global automotive sunroof market report based on product types, vehicle types, and regions:

-

Product Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Glass sunroof

-

Fabric sunroof

-

-

Vehicle Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Mid-segment vehicles

-

Premium & luxury-segment vehicles

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."