- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Textiles Market Size, Industry Report, 2030GVR Report cover

![Automotive Textiles Market Size, Share & Trends Report]()

Automotive Textiles Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Woven, Composites), By Application (Upholstery, Safety Devices), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-904-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Textiles Market Summary

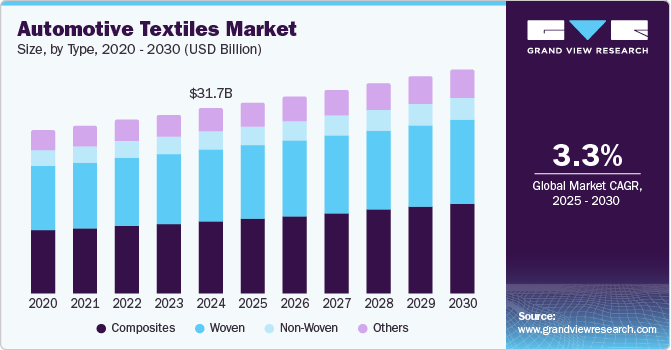

The global automotive textiles market size was estimated at USD 31.75 billion in 2024 and is projected to reach USD 38.47 billion by 2023, growing at a CAGR of 3.3% from 2025 to 2030. Growth in automobile production, coupled with the increasing focus on safety devices, is expected to propel the market growth.

Key Market Trends & Insights

- Asia Pacific led the global automotive textiles market with the largest revenue share of 48.4% in 2024.

- The automotive textiles industry in China led Asia Pacific with the largest revenue share in 2024.

- By type, the composite textiles led with the largest revenue share of 39.2% in 2024.

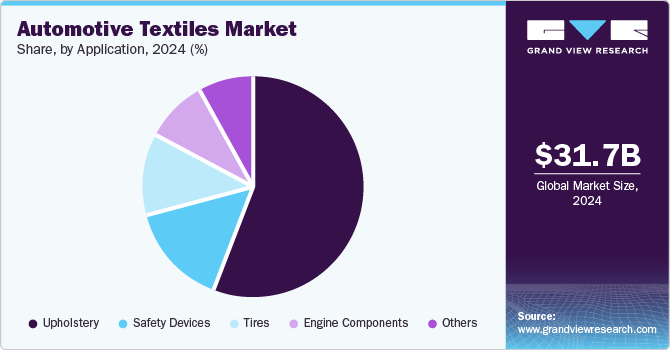

- By application, the upholstery segment led with the largest revenue share of 55.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.75 Billion

- 2030 Projected Market Size: USD 38.47 Billion

- CAGR (2025-2030): 3.3%

- Asia Pacific: Largest market in 2024

In addition, increased vehicle production, rising disposable incomes, and urbanization is further expected to drive the markets growth.

Automotive textiles refer to the materials used in the interior and exterior components of vehicles, including seating, upholstery, and safety systems like airbags and seat belts. As consumers' disposable income and living standards continue to rise, there is a growing demand for advanced safety features in vehicles, such as airbags and seat belts. This demand is one of the key drivers behind the expansion of the automotive textiles market.

In addition, government-imposed safety regulations, which mandate the inclusion of airbags, seat belts, and anti-lock braking systems (ABS) in all vehicles, have also significantly benefited the automotive sector. These regulations, particularly in developing regions, have made safety features standard in vehicles, further boosting the need for automotive textiles. With the rise in consumer awareness of vehicle safety, the demand for textile materials required for various safety components continues to grow.

Furthermore, the automotive textiles market is the increasing preference for eco-friendly materials. Fabrics such as recyclable polyester are gaining popularity due to their cost-effectiveness and sustainability. Moreover, the demand for nonwoven fabrics, especially for applications such as vehicle floor coverings and carpets, is on the rise. The use of recycled polyethylene terephthalate (PET) for manufacturing nonwoven carpets helps reduce environmental impact, supports sustainability, and enhances resource efficiency. This growing focus on eco-friendly solutions is expected to significantly drive the market's revenue growth in the coming years.

Type insights

Composite textiles led the global automotive textiles industry with the highest revenue share of 39.2% in 2024. This growth can be attributed to their better mechanical properties in comparison to other automotive textiles. Their ability to enhance vehicle performance, reduce weight, and provide design flexibility further contributes to their increasing adoption in automotive components such as interiors and exterior parts.

Non-woven segment is expected to grow at a CAGR of 3.2% over the forecast period, owing to their cost-effectiveness, versatility, and ability to meet automotive requirements for noise reduction, insulation, and interior aesthetics. In addition, they are lightweight, offer excellent durability, and can be used in a variety of applications such as upholstery, insulation, and soundproofing. Furthermore, the growing demand for more sustainable and efficient materials is also fueling the adoption of non-woven in automotive textiles.

Application Insights

The upholstery application segment led the market and accounted for the largest revenue share of 55.7% in 2024. Upholstery dominated the North American automotive textiles application market, owing to higher market penetration, which is related to the growing popularity of automotive textiles in the upholstery application. Furthermore, the demand for automotive textiles in tire applications, as a result of the rising production and sales of autonomous vehicles with highly automated driving capabilities for tire manufacturing, is predicted to fuel the growth of the upholstery application category.

The safety devices application segment is expected to grow at a CAGR of 3.8% over the forecast period, owing to the increase in the amount of textile used in in-vehicle safety standards. In addition, safety rules requiring the installation of airbags, seat belts, and anti-lock brake systems in every vehicle have a favorable impact on the automobile business. Furthermore, key automotive textile applications include safety devices and engine components.

Regional Insights

Asia Pacific automotive textiles market dominated the global market and accounted for the largest revenue share of 48.4% in 2024, primarily driven by increased population, urbanization, and the expansion of key players’ operations in these regions. Furthermore, there have been stricter vehicular rules and standards regarding the use of airbags and safety belts.

China Automotive Textiles Market Trends

The automotive textiles market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its large population and continued economic development. Growing demand for safety devices, such as airbags, is significantly contributing to market expansion. In addition, increased construction spending is also expected to positively influence market growth as it supports the overall economy and related industries. Furthermore, changes in family size and an aging population are impacting related sectors and indirectly affecting the need for automotive textiles through broader economic shifts.

North America Automotive Textiles Market Trends

The North America automotive textiles market is expected to grow at a CAGR of 3.1% over the forecast period, owing to increased vehicle production and sales. In addition, growing urbanization also supports market expansion in the region. Furthermore, the popularity of using automotive textiles in upholstery is a key element, driving demand within this application. Moreover, the consistent demand for vehicles and the increasing urbanization of the region creates consistent demand for the market to grow.

The automotive textiles market in the U.S. led the North American market with the highest revenue share in 2024, driven by the Increased car sales in the U.S. in addition, the consistent demand and sales in upholstery applications also contribute, due to the growing popularity of these materials. Furthermore, safety regulations that mandate the implementation of airbags and seat belts are expected to positively influence market growth as manufacturers adhere to these standards.

Europe Automotive Textiles Market Trends

Europe region is anticipated to grow significantly over the forecast period owing to the increasing gains from rising usage of automotive textiles in upholstery applications with growing industrialization and urbanization. In addition, the expansion is expected to be encouraged by the massive manufacture of automobiles. Furthermore, consumer preference for safer and more comfortable vehicles also drives market growth.

Key Automotive Textiles Company Insights

Key companies in the global automotive textiles industry include Johnson Controls, Acme Mills, Aunde SA, and others. The market is characterized by the presence of various small- and large-scale players, resulting in a moderate level of concentration in the market. To serve a larger customer base, they are also trying to expand their product portfolio by focusing on developing cost-effective composites with enhanced properties. A large number of manufacturers are focused on backward integration to keep the product quality under control. The industry participants emphasize expanding their product portfolio by developing innovative solutions and cheaper products with superior properties to cater to the increasing consumer demand.

-

Lear Corporation manufactures a wide range of products, including seats, seat structures, and electrical components such as wiring harnesses. The company also provides advanced textile solutions for automotive applications, focusing on fabric technology for seat covers, trims, and interior upholstery. Lear’s expertise in automotive textiles helps enhance vehicle comfort, safety, and aesthetic appeal.

-

Borgers AG manufactures high-quality textile-based solutions for vehicle interiors, combining functionality with design. The company also focuses on advanced materials to enhance noise reduction and comfort within automobiles, serving a wide range of global automotive manufacturers. Their textiles contribute to improved passenger experience and vehicle performance.

Key Automotive Textiles Companies:

The following are the leading companies in the automotive textiles market. These companies collectively hold the largest market share and dictate industry trends.

- Lear Corporation

- Johnson Controls

- Acme Mills

- Aunde SA

- Toyota Boshoku Corporation

- International Textile Group

- Autoneum Holding AG

- Dupont

- Autotech Nonwovens

- Suminoe Textile Co. Ltd.

- CMI Enterprises Inc.

- ASGLAWO Technofibre GmbH

- Sage Automotive Interiors, Inc.

- Baltex Inc.

- Reliance Industries Limited

- Auto Textiles S.A.

- Global Safety Textile GmbH

- SMS Auto Fabrics

- Autoliv Inc.

Recent Developments

-

In January 2023, Autoneum announced the acquisition of Borgers Automotive. This acquisition strengthens Autoneum's position in the market, with Borgers' product lines, including automotive textiles such as wheelhouse outer liners, trunk trim, and sustainable products, complementing Autoneum's portfolio. The deal was expected to generate positive earnings per share from the start, with renegotiated commercial agreements ensuring sustained profitability.

Automotive Textiles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.77 billion

Revenue forecast in 2030

USD 38.47 billion

Growth Rate

CAGR of 3.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Germany, France, Spain, China, Japan, and Brazil

Key companies profiled

Lear Corporation; Johnson Controls; Acme Mills; Aunde SA; Toyota Boshoku Corporation; International Textile Group; Borgers AG; Dupont; Autotech Nonwovens; Suminoe Textile Co. Ltd.; CMI Enterprises Inc.; ASGLAWO Technofibre GmbH; Sage Automotive Interiors, Inc.; Baltex Inc.; Reliance Industries Limited; Auto Textiles S.A.; Global Safety Textile GmbH; SMS Auto Fabrics; Autoliv Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Textiles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global automotive textiles market report based on type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Woven

-

Non-Woven

-

Composites

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Upholstery

-

Tires

-

Safety Devices

-

Engine Components

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.