- Home

- »

- Advanced Interior Materials

- »

-

Automotive Tire Market Size & Share, Industry Report, 2030GVR Report cover

![Automotive Tire Market Size, Share & Trends Report]()

Automotive Tire Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Radial and Bias), Application (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Region, And Segment Forecasts

- Report ID: 978-1-68038-836-7

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Tire Market Summary

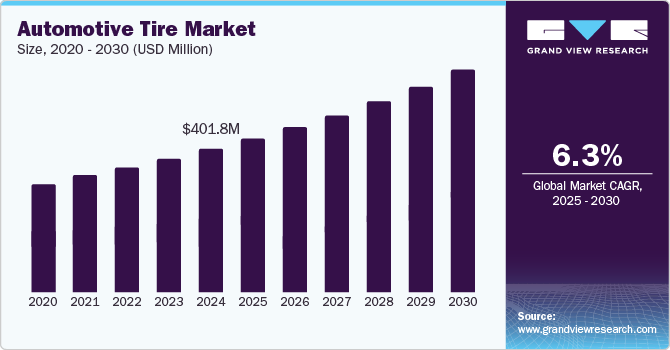

The global automotive tire market size was estimated at USD 401.8 million in 2024 and is projected to reach USD 620.3 million by 2030, growing at a CAGR of 6.3% from 2025 to 2030, attributed to increased vehicle production and sales, along with a rising demand for retreaded tires. As more vehicles hit the roads, the need for original and replacement tires escalates.

Key Market Trends & Insights

- Asia Pacific dominated the automotive tire industry in 2024.

- The U.S. held a remarkable position in the automotive tire industry in 2024.

- By type, the radial segment captured a noteworthy share in 2024.

- Based on application, the passenger cars segment secured a notable share in 2024.

- Based on season type, the all-season tire segment garnered a significant share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 401.8 Million

- 2030 Projected Market Size: USD 620.3 Million

- CAGR (2025-2030): 6.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

As more vehicles hit the roads, the need for original and replacement tires escalates. Retreaded tires, offering cost-efficiency and sustainability, further boost the market by providing a viable option for commercial and fleet vehicles. This dual demand fuels continuous market expansion, reflecting the critical role of both new and retreaded tires in meeting the evolving needs of a growing global automotive industry.

In addition, the adoption of smart technologies and the rise of electric vehicles (EVs) are poised to drive the size of the automotive tire industry significantly. Smart tires, equipped with sensors to monitor pressure, temperature, and wear, offer enhanced performance and safety, fueling demand for high-tech products. In addition, the growing EV market is increasing the need for specialized tires designed to handle the unique demands of electric vehicles, such as higher torque and weight. These trends are prompting tire manufacturers to innovate, expanding the market for both advanced tire technologies and EV-specific tires.

Type Insights

The automotive tire market is segmented into radial and bias tires. The radial segment captured a noteworthy share in 2024, propelled by its superior performance and durability. Radial tires, featuring innovative construction, offer improved fuel efficiency, enhanced handling, and longer tread life than traditional bias-ply tires. These advantages have made them the preferred choice for various vehicles, from passenger cars to commercial trucks. The rising demand for better ride quality and increased vehicle safety has further cemented the importance and growth of radial tires in the industry.

Moreover, the bias segment is projected to grow significantly from 2025 to 2030 due to its cost-effectiveness and robust durability. Known for their strong sidewalls and capability to handle heavy loads, bias tires are becoming increasingly popular, especially in commercial and agricultural sectors. The expansion of transportation and logistics industries further boosts demand for these tires. Moreover, recent advancements in bias tire technology are improving performance and extending their lifespan, making them an attractive option for various vehicles.

Application Insights

Based on application, the market is divided into passenger cars, LCVs, HCVs, and two-wheelers. The passenger cars segment secured a notable share in 2024 due to the significant number of vehicles in this category. With growing urbanization and increasing disposable incomes, more individuals are buying personal vehicles, which fuels the demand for passenger car tires. Besides, advancements in tire technology that improve safety, fuel efficiency, and performance have made these tires highly attractive to consumers, emphasizing the segment's critical role in the market.

The LCV segment is expected to register a substantial CAGR over the forecast period. As e-commerce and logistics industries expand, the demand for LCVs, such as delivery vans and small trucks, is growing. These vehicles require specialized tires that offer durability, fuel efficiency, and load-carrying capacity, driving innovation in tire design. In addition, with the rise of last-mile delivery services and increased urbanization, LCVs are becoming essential for businesses, further boosting the demand for LCV-specific tires and contributing to market growth in this segment.

Season Type Insights

Based on season type, the market is segregated into summer tires, winter tires (studded and non-studded), and all-season tires. The all-season tire segment garnered a significant share in 2024, attributed to its versatility and year-round performance. These tires are designed to provide a balanced blend of traction, comfort, and durability, making them suitable for various weather conditions, including dry, wet, and light winter conditions. As consumers increasingly seek convenience and cost-effectiveness, all-season tires eliminate the need for seasonal tire changes. This demand for low-maintenance, multi-purpose tires has significantly contributed to the segment's dominance in the market.

The summer tire segment is set to witness a significant CAGR over the forecast period, spurred by increasing consumer demand for improved performance and fuel efficiency, especially in regions with warmer climates. Summer tires offer superior handling, enhanced braking, and better traction in dry and wet conditions, making them ideal for performance and luxury vehicles. With advancements in tire technology and growing consumer awareness of their benefits, such as reduced rolling resistance and better fuel economy, the summer tire segment is poised for substantial growth and market dominance in the coming years.

Rim Size Insights

Based on rim size, the market is classified into less than 15 inches, 15 to 20 inches, and more than 20 inches. The 15 to 20-inch segment established a strong foothold in 2024 due to its widespread use in passenger vehicles, especially in mid-range and premium car models. These tire sizes balance performance, comfort, and fuel efficiency, making them highly preferred by consumers. In addition, the growing demand for versatile and durable tires that can handle diverse road conditions has driven the popularity of this segment. With increasing vehicle sales and the shift toward higher-performance models, the 15 to 20-inch tire segment continues to uphold a prominent share of the industry.

The more than 20-inch tire segment is projected to secure a significant share of the automotive tire market as consumer preferences shift towards larger, high-performance vehicles such as SUVs, crossovers, and luxury cars. These tires offer enhanced handling, stability, and performance, particularly for high-speed and off-road driving, making them increasingly popular in premium vehicle segments as automakers focus on offering larger wheels for aesthetic appeal and improved driving experience.

Regional Insights

North America is expected to witness the fastest growth rate over the forecast period, fueled by the region's robust automotive industry, increasing demand for passenger and commercial vehicles, and growing consumer preference for high-performance tires. Rising vehicle production and advancements in tire technologies, such as eco-friendly materials and improved fuel efficiency, further boost market growth. In addition, the region's strong infrastructure, high disposable income, and emphasis on safety and vehicle performance create a favorable environment for the tire market, ensuring North America's notable market share in the coming years.

U.S. Automotive Tire Market Trends

The U.S. held a remarkable position in the automotive tire industry in 2024, propelled by its robust automotive industry and high vehicle ownership rates. With a strong presence of leading tire manufacturers, the U.S. benefits from extensive research, innovation, and advanced manufacturing techniques. The diverse climate across the country also drives the demand for various types of tires, from all-season to specialized winter and off-road tires. Moreover, the emphasis on vehicle safety and performance has led to increased consumer preference for high-quality tires, reinforcing the dominant position of the U.S.

Canada is anticipated to record a noteworthy market share throughout 2030 due to its growing automotive sector, rising vehicle sales, and increasing demand for original equipment and replacement tires. The country’s expanding electric vehicle (EV) market is also driving demand for specialized tires designed to handle the unique needs of EVs. Furthermore, harsh weather conditions, particularly in winter, fuel the demand for high-performance and all-season tires. With a strong focus on sustainability and innovation, Canada automotive tire market is expected to grow substantially in the coming years.

Europe Automotive Tire Market Trends

Europe's prominence in the automotive tire industry is attributed to the region’s well-established automotive industry, a high rate of vehicle ownership, and a growing demand for eco-friendly tire solutions. The region is home to leading tire manufacturers such as Michelin, Continental, and Pirelli, who are at the forefront of tire innovation, particularly in terms of performance, safety, and sustainability. The rise of electric vehicles (EVs) has further spurred demand for specialized tires. In addition, stringent environmental regulations and consumer preferences for low-rolling resistance and energy-efficient tires continue solidifying Europe’s global tire market dominance.

The UK automotive tire market is expected to experience a significant growth rate over the forecast period, fueled by increasing vehicle sales, the rise of electric vehicles (EVs), and growing demand for eco-friendly tire solutions. With the UK’s commitment to reducing carbon emissions, there is a shift towards energy-efficient, low-rolling resistance tires. The expanding EV market, in particular, is creating a demand for specialized tires designed to handle the unique requirements of electric vehicles. Moreover, the country’s high vehicle fleet and replacement cycles further fuel growth in the tire market, positioning the UK for continued market expansion.

Germany is likely to witness a significant CAGR over the forecast period, driven by its strong automotive industry and increasing demand for high-performance and sustainable tires. As a hub for leading automakers such as Volkswagen, BMW, and Mercedes-Benz, the automotive tire market in Germany benefits from robust vehicle production and sales. The rise of electric vehicles (EVs) in the country further boosts demand for specialized tires that cater to EV needs. In addition, stringent environmental regulations and a focus on innovation in tire technology are propelling the growth of eco-friendly and energy-efficient tire solutions in Germany.

Asia Pacific Automotive Tire Market Trends

Asia Pacific dominated the automotive tire industry in 2024, driven by rapid industrialization, high vehicle production, and strong demand in countries such as China, India, and Japan. With a growing middle class and increasing vehicle ownership, tire consumption in the region has surged. Asia Pacific is home to major tire manufacturers such as Bridgestone, Michelin, and Goodyear, who have established extensive production facilities to meet local and global needs. Besides, the rising demand for electric vehicles (EVs) and light commercial vehicles (LCVs) further strengthens the region’s dominance in the global tire market.

Asia Pacific automotive tire market witnessed a substantial rise in 2024 due to the region's booming automotive industry, vast manufacturing infrastructure, and rising demand for vehicles in countries such as China, India, and Japan. The region, particularly China, India, and Japan, is home to major automotive manufacturing hubs, driving high demand for tires. The increasing number of vehicles on the road, coupled with rising disposable incomes and urbanization, fuels tire consumption. Besides, Asia Pacific's cost-effective manufacturing capabilities and investments in innovative tire technologies, such as fuel-efficient and eco-friendly options, have solidified its leading position in the global automotive tire industry.

China is expected to grow significantly over the forecast period, attributed to its vast automotive industry and increasing vehicle production. As the world’s largest vehicle manufacturer and consumer, the demand for tires in China is surging, driven by the rapid increase in passenger and commercial vehicles. In addition, the rise of electric vehicles (EVs) and government initiatives supporting infrastructure development further stimulate tire demand. The government's push for electric vehicles and advancements in tire technologies, such as eco-friendly and fuel-efficient options, further bolster China’s prominence in the global market.

Japan held a considerable revenue share in 2024, spurred by its advanced automotive industry, innovation in tire technology, and focus on sustainability. As a major hub for automakers such as Toyota, Honda, and Nissan, Japan drives high demand for high-performance and eco-friendly tires. The growing adoption of electric vehicles (EVs) further spurs the need for specialized tires. Japan’s commitment to cutting-edge tire designs, improved fuel efficiency, and reduced environmental impact positions it as a crucial contributor to global tire market growth.

Key Automotive Tire Company Insights

Some of the key companies in the automotive tire market include Continental Group, Cooper & Rubber Company, Hankook Co. Ltd., Goodyear & Rubber Company, Michelin Group, Pirelli, Sumitomo Rubber Industries Ltd., The Bridgestone Group, Toyo & Rubber Co Ltd., and Yokohama Rubber Co. Ltd, and others.

- Continental Group offers many products and solutions, including premium car, truck, and motorcycle tires and advanced automotive technologies for safety, autonomous driving, and connectivity.

- Cooper & Rubber Company, now part of Goodyear, provides a comprehensive portfolio of replacement tires for automobiles and commercial vehicles, known for their quality and performance.

Key Automotive Tire Companies:

The following are the leading companies in the automotive tire market. These companies collectively hold the largest market share and dictate industry trends.

- Continental Group

- Cooper & Rubber Company

- Hankook Co. Ltd.,

- Goodyear & Rubber Company

- Michelin Group

- Pirelli

- Sumitomo Rubber Industries Ltd.

- The Bridgestone Group

- Toyo & Rubber Co Ltd.

- Yokohama Rubber Co. Ltd

Recent Developments

-

In June 2023, Continental introduced the UltraContact NXT, its most sustainable tire series, designed to deliver optimal safety and performance while incorporating 65% renewable, recycled, and mass balance certified materials.

-

In June 2023, Michelin introduced the Air X SkyLight tire for commercial aviation, offering a 10-20% reduction in weight compared to previous generations. This lighter design contributes to a 15-20% improvement in long-term performance and lifespan.

Automotive Tire Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 430.9 million

Revenue forecast in 2030

USD 620.3 million

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, season type, rim size, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, Brazil, Saudi Arabia

Key companies profiled

Continental Group, Cooper & Rubber Company, Hankook Co. Ltd., Goodyear & Rubber Company, Michelin Group, Pirelli, Sumitomo Rubber Industries Ltd., The Bridgestone Group, Toyo & Rubber Co Ltd., and Yokohama Rubber Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Tire Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive tire market report on the basis of type, application, season type, rim size, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Radial

-

Bias

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger cars

-

LCV

-

HCV

-

Two-wheelers

-

-

Season Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Summer Tire

-

Winter Tire (Studded and Non-studded)

-

All-season Tire

-

-

Rim size Outlook (Revenue, USD Million, 2018 - 2030)

-

Less Than 15 Inches

-

15 to 20 Inches

-

More than 20 Inches

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.