- Home

- »

- Next Generation Technologies

- »

-

Autonomous Data Platform Market Size & Share Report 2030GVR Report cover

![Autonomous Data Platform Market Size, Share, & Trends Report]()

Autonomous Data Platform Market (2025 - 2030) Size, Share, & Trends Analysis Report By Component (Platform, Services), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-980-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Data Platform Market Summary

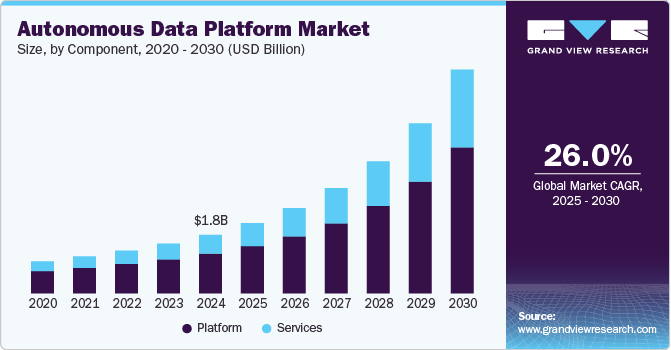

The global autonomous data platform market size was estimated at USD 1.82 billion in 2024 and is projected to reach USD 6.91 billion by 2030, growing at a CAGR of 26.0% from 2025 to 2030. The increasing digitization and automation across industries, alongside the growing demand for real-time data and the integration of advanced technologies such as Machine Learning (ML) and Artificial Intelligence (AI), are key drivers of market expansion.

Key Market Trends & Insights

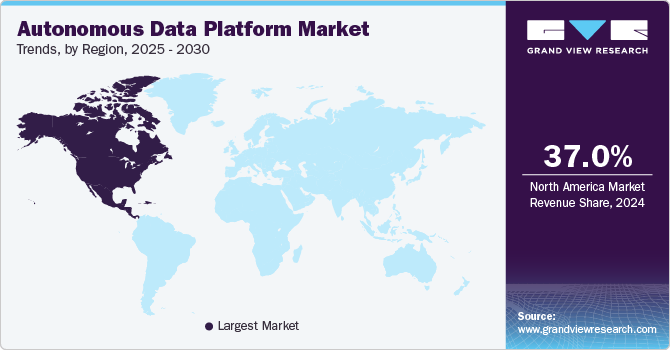

- The autonomous data platform market in North America held a revenue share of nearly 37% in 2024.

- Based on component, the platform segment accounted for the largest market share of over 68% in 2023.

- Based on deployment, the on-premise segment accounted for the largest market share of over 52% in 2023.

- Based on enterprise size, the large enterprises segment accounted for the largest market share of over 64% in 2023.

- Based on end-use, the BFSI segment accounted for the largest market share of over 20% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 1.82 Billion

- 2030 Projected Market USD 6.91 Billion

- CAGR (2025-2030): 26.0%

- North America: Largest market in 2024

Enterprises are making substantial investments in autonomous data platform solutions to enhance operational efficiency and streamline processes. These advancements are accelerating the market growth, as businesses seek to leverage data-driven insights for improved decision-making and competitive advantage.

The rising adoption of cloud platforms among new businesses, coupled with the increasing retention of enterprise data in hybrid and public clouds, is driving the growing use of autonomous data platforms in cloud-based environments. These platforms offer unparalleled flexibility, allowing companies to scale resources based on their needs and convenience. Unlike traditional database solutions, autonomous data platforms enable faster, more secure evaluation, distribution, and integration of critical data. This enhanced data management capability empowers businesses to improve operational efficiency and drive growth. These factors are expected to fuel the market's expansion in the coming years.

The market is poised for growth due to the increasing adoption of cognitive computing and advanced analytics technologies. The rapid expansion of social media and connected devices has led to a surge in unstructured data generated by businesses. As a result, the demand for autonomous database platforms, particularly among small and medium-sized enterprises, is expected to rise. These platforms offer advanced capabilities such as data encryption, workload monitoring, and real-time tracking of entities attempting to access data. By leveraging autonomous data platforms, businesses can efficiently navigate their big data environments, address critical operational challenges, and optimize database performance for enhanced decision-making and resource management.

Automation within autonomous databases minimizes the need for manual intervention in data installation and processing, enabling decision-makers to access valuable insights more quickly. These platforms leverage machine learning to ensure continuous, optimized performance aligned with business requirements. For example, while the system is in operation, machine learning can automatically handle tasks such as patching, upgrading, tuning, and backing up, all with minimal human involvement. This automation significantly reduces the risk of errors or security breaches caused by human negligence or malicious actions, enhancing both efficiency and security in database management.

Component Insights

The platform segment accounted for the largest market share of over 68% in 2023, driven by advancing technologies such as digital and cloud-based platforms, along with the rising demand for analytics solutions. Autonomous data tools play a critical role in assessing a company’s big data architecture to tackle key business challenges and ensure optimal database performance. These platforms help organizations enhance and scale their data processing capabilities while providing comprehensive security assessments, including configuration analysis, protection of sensitive data, monitoring of abnormal database activities, and user access control. These factors are expected to propel further growth in the segment.

The services segment is expected to grow at a significant CAGR during the forecast period. The threat of data loss due to malware and the presence of highly sensitive organizational information has heightened the need for robust data protection strategies. To address this challenge, businesses are increasingly adopting data backup and restore platforms, fueling the growth of the database backup and restore services market. The rising demand from large and medium-sized enterprises to securely store, backup, and recover vast volumes of critical data is a key driver of the expansion of this service segment over the forecast period. This trend underscores the growing importance of data security and reliability in today’s digital landscape.

Deployment Insights

The on-premise segment accounted for the largest market share of over 52% in 2023. Organizations that prioritize data privacy and security tend to prefer on-premises installations. These deployments are often seen as more secure than cloud alternatives and offer the flexibility to customize solutions quickly to meet specific business needs, providing greater control over software and infrastructure. By retaining data and IP addresses within their own network, companies minimize the risk of transmitting sensitive information online and reduce dependency on third-party providers for data management and security. These advantages are expected to fuel the growth of the on-premises segment during the forecast period.

The cloud segment is expected to grow at a significant CAGR during the forecast period. The flexibility and cost-effectiveness of cloud-based solutions are driving their growing adoption among users. Cloud computing platforms offer superior scalability, reduced implementation costs, and continuous innovation, making them an attractive choice for businesses. With a virtual environment that allows seamless access to information across interconnected devices anytime, cloud-based solutions simplify service delivery. Instead of storing data locally, users can securely upload and access it via network-connected devices. These advantages of cloud deployment are fueling significant growth in the segment, as more organizations recognize its benefits for efficiency and scalability.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 64% in 2023. The large enterprise segment is anticipated to grow significantly over the forecast period, driven by the ongoing shift towards digitalization and the effective use of technologies to automate and enhance business processes. With greater financial resources, large companies can invest in various solutions, resulting in the generation of substantial volumes of structured and unstructured data that require efficient management and maintenance. As a result, autonomous data platform solutions are expected to gain considerable traction in the coming years. This segment has already embraced autonomous data platforms at a rapid pace, presenting lucrative opportunities for growth and innovation.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. The rise in investments in advanced technologies like machine learning and the growing adoption of AI are driving the expansion of digital payment systems. As small and medium-sized enterprises (SMEs) generate larger volumes of data, their demand for integrated data solutions is expected to increase significantly. The enhanced deployment of machine learning and AI will further improve decision-making capabilities for these businesses, contributing to robust growth in the autonomous data platform market overall. As SMEs seek to leverage these technologies for competitive advantage, the demand for autonomous data platforms will continue to rise.

End Use Insights

The BFSI segment accounted for the largest market share of over 20% in 2023. The adoption of autonomous data platforms is rapidly gaining traction in the BFSI sector. Financial institutions are increasingly challenged to deliver personalized services while ensuring the security of customer data amidst changing consumer behaviors. To build a comprehensive consumer profile, these organizations collect and consolidate first-party data that reflects client interactions across various channels. Further, data analytics significantly enhances a bank's marketing capabilities, allowing for more targeted outreach and improved service offerings. Moreover, several critical operational areas such as risk management, compliance, fraud detection, and value-at-risk assessment stand to benefit immensely from analytics. By utilizing data-driven insights, financial institutions can maintain optimal performance and make informed decisions swiftly, thereby enhancing their overall effectiveness in a competitive landscape.

The retail segment is expected to grow at a significant CAGR during the forecast period. The retail industry is increasingly adopting autonomous data platforms for analytics in various areas, including advertising optimization, product development, and customer relationship management (CRM). As digital platforms gain traction, retailers are becoming more customer-centric, adapting to rapid shifts in consumer behavior driven by technological advancements. These platforms enable retailers to track customer purchasing activities in real-time, providing deeper insights into customer preferences and helping them meet evolving needs more effectively. Such capabilities are fueling significant growth in this segment throughout the forecast period, as retailers leverage data-driven strategies to enhance customer engagement and drive sales.

Regional Insights

The autonomous data platform market in North America held a revenue share of nearly 37% in 2024. The demand forautonomous data platforms Market in North America is driven by increasing demand for AI-powered data management solutions across industries, such as healthcare, finance, and retail. Companies are adopting autonomous data platforms to manage large volumes of data efficiently and reduce operational costs. The region's strong technological infrastructure, combined with a growing need for real-time analytics and compliance with data regulations (such as GDPR and CCPA), creates significant opportunities for market growth. Major tech companies, including Google and Microsoft, are enhancing their cloud offerings, further fueling adoption.

U.S. Autonomous Data Platform Market Trends

The autonomous data platform market in the U.S. is growing significantly at a CAGR of 26% from 2025 to 2030. In the U.S., the market is seeing rapid expansion due to the increasing implementation of cloud-based solutions and advanced data analytics. Organizations are looking to streamline data integration and enhance decision-making capabilities. The federal government’s initiatives to promote data-driven innovation and digital transformation, particularly in sectors such as healthcare and defense, provide lucrative opportunities. Additionally, the US leads in AI research, creating a strong foundation for the adoption of autonomous platforms.

Asia Pacific Autonomous Data Platform Market Trends

The autonomous data platform market in Asia Pacific is growing significantly at a CAGR of 27.7% from 2025 to 2030. The Asia Pacific segment is witnessing significant growth driven by rapid industrialization and digital transformation across emerging economies like China, India, and Southeast Asia. The increasing adoption of AI and machine learning technologies in sectors such as manufacturing, retail, and BFSI is driving demand for autonomous data platforms. Governments in the region are also investing heavily in smart city initiatives and digital infrastructure, presenting substantial growth opportunities for data management solutions. The rise of cloud computing and expanding IoT networks are further accelerating the market expansion in this region.

The China autonomous data platform market is growing rapidly, supported by the country’s aggressive digital infrastructure development and widespread adoption of AI and big data technologies. Major drivers include the rise of smart city projects, e-commerce expansion, and the need for efficient data management in sectors like manufacturing, healthcare, and finance.

The autonomous data platform market in Japan is expanding as businesses seek to automate data management processes and enhance operational efficiency amid a shrinking workforce.

The India autonomous data platform market is witnessing rapid growth due to the expanding digital economy, government initiatives promoting digital transformation, and the rise of startups in tech-driven sectors. In India there is a significant demand for autonomous data platforms that offer scalability, real-time data processing, and integration with AI-driven applications, particularly in sectors such as financial services, e-commerce, and healthcare.

Europe Autonomous Data Platform Market Trends

The autonomous data platform market in Europe is growing significantly at a CAGR of 25% from 2025 to 2030. The Europe segment is primarily driven by stringent data privacy laws such as the General Data Protection Regulation (GDPR), which compel organizations to invest in advanced data management platforms. European industries are focusing on automation to enhance operational efficiency, particularly in manufacturing, banking, and telecom sectors. The push towards digital transformation and Industry 4.0 initiatives creates ample opportunities for autonomous data platforms to gain traction in this market. Moreover, the European Union’s investment in AI and data-driven technologies is set to boost growth.

The UK autonomous data platform market is experiencing strong growth, driven by increasing demand for data automation and AI-driven analytics across industries such as finance, healthcare, and retail.

The autonomous data platform market in Germany is advancing due to the country’s robust industrial sector and emphasis on Industry 4.0 initiatives. Enterprises in the country are adopting autonomous platforms to improve operational efficiency, enhance manufacturing processes, and manage large-scale data from IoT devices.

Key Autonomous Data Platform Company Insights

The companies operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2023, Accenture and NVIDIA expanded their partnership, forming a new NVIDIA Business Group to help enterprises scale AI adoption. Leveraging Accenture’s AI Refinery and NVIDIA’s full AI stack, the collaboration aims to drive process reinvention, AI-powered simulations, and sovereign AI. With investment worth USD 3 billion in generative AI-driven, Accenture aims to focus on laying the foundations for AI functionality, advancing autonomous data platforms with NVIDIA’s cutting-edge technology.

-

In September 2024, Salesforce and IBM Corporation announced a strategic partnership to address the growing demand for AI-driven sales and service process transformations. Targeting organizations and regulated industries, the collaboration focuses on harnessing untapped enterprise data to automate processes within autonomous data platforms. Together, both companies will offer pre-built AI agents and tools, enabling companies to integrate AI into their IT environments while maintaining full control of their data and systems, driving innovation and efficiency.

Key Autonomous Data Platform Companies:

The following are the leading companies in the autonomous data platform market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle Corporation

- Teradata

- IBM Corporation

- Amazon Web Services, Inc.

- Hewlett Packard Enterprise Development LP

- Qubole, Inc.

- Cloudera, Inc.

- Gemini Data

- Denodo Technologies

- Alteryx, Inc.

Autonomous Data Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.17 billion

Revenue forecast in 2030

USD 6.91 billion

Growth rate

CAGR of 26.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Oracle Corporation; Teradata; IBM Corporation; Amazon Web Services, Inc.; Hewlett Packard Enterprise Development LP; Qubole, Inc.; Cloudera, Inc.; Gemini Data; Denodo Technologies; Alteryx, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Data Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For the purpose of this study, Grand View Research has segmented the global autonomous data platform market report based on component, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue; USD Billion, 2018 - 2030)

-

Platform

-

Services

-

Advisory

-

Integration

-

Support and Maintenance

-

-

-

Deployment Outlook (Revenue; USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue; USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue; USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail

-

Manufacturing

-

IT and Telecom

-

Government

-

Others

-

-

Regional Outlook (Revenue; USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.