- Home

- »

- Next Generation Technologies

- »

-

Autonomous Mobile Robots Market, Industry Report, 2033GVR Report cover

![Autonomous Mobile Robots Market Size, Share & Trends Report]()

Autonomous Mobile Robots Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Type, By Battery Type, By Application (Sorting, Transportation, Assembly), By Payload Capacity, By Navigation Technology, By End-use, By Region And Segment Forecasts

- Report ID: GVR-4-68039-281-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Mobile Robots Market Summary

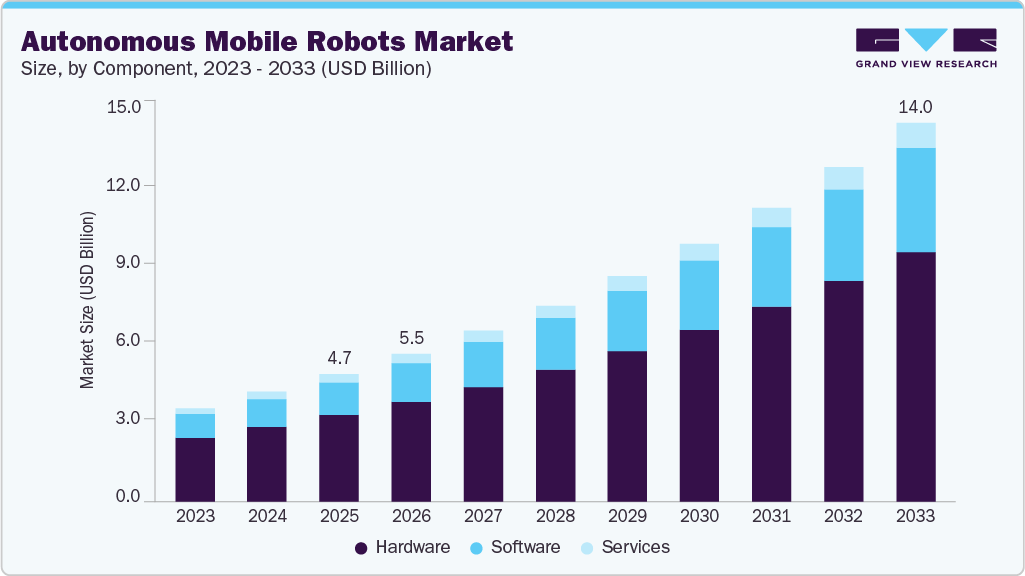

The global autonomous mobile robots market size was estimated at USD 4.74 billion in 2025 and is projected to reach USD 14.04 billion by 2033, growing at a CAGR of 14.4% from 2026 to 2033. The market is driven by the rapid expansion of e-commerce and omnichannel retail, which is increasing demand for automated warehouse and logistics operations.

Key Market Trends & Insights

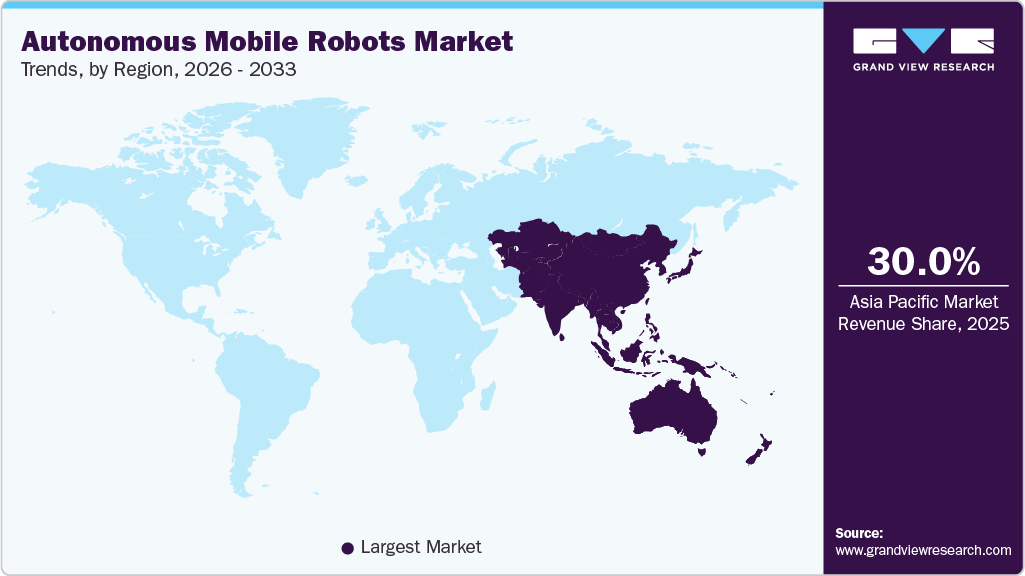

- Asia Pacific is expected to hold the largest share of the global autonomous mobile robots market, with a revenue share of over 30% by 2025.

- The autonomous mobile robots market in China led the Asia Pacific market and held the largest revenue share in 2025.

- By component, the hardware segment led the market and held the largest revenue share of over 67% in 2025.

- By battery type, the lead battery segment accounted for the significant market revenue share in 2025.

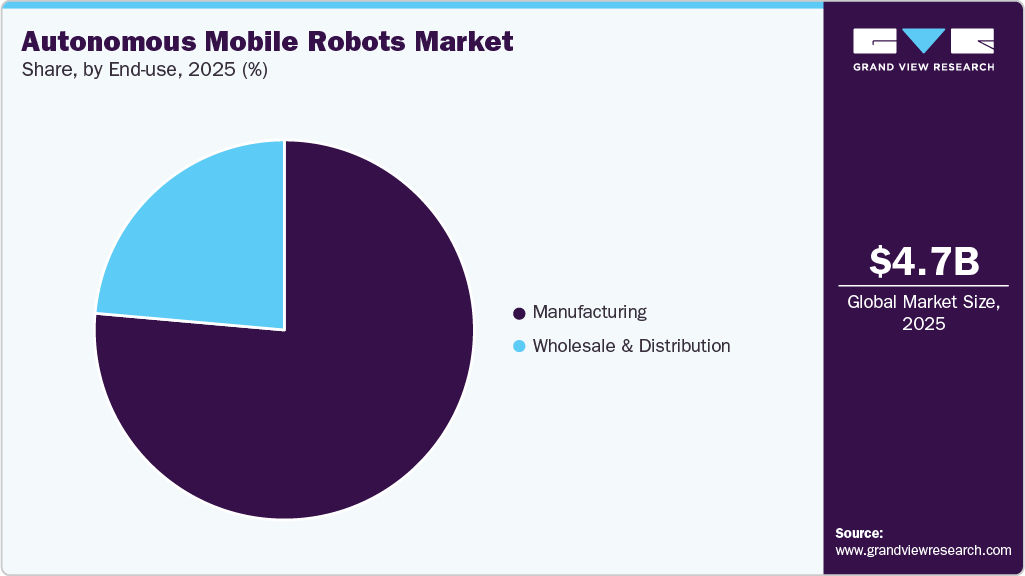

- By end-use, the manufacturing segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.74 Billion

- 2033 Projected Market Size: USD 14.04 Billion

- CAGR (2026-2033): 14.4%

- Asia Pacific: Largest Market in 2025

Advancements in artificial intelligence, machine learning, and sensor technologies are significantly improving autonomous mobile robots navigation, flexibility, and operational efficiency. In addition, rising labor shortages, increasing labor costs, and the need to enhance workplace safety are accelerating AMR adoption across manufacturing, healthcare, and logistics industries.The autonomous mobile robots market is driving strong momentum across logistics, manufacturing, and industrial environments by significantly improving productivity and operational efficiency. Rapid growth in e-commerce and omnichannel fulfillment is accelerating demand for flexible and scalable AMR deployments in warehouses and distribution centers. Advancements in artificial intelligence, machine learning, and sensor technologies are strengthening autonomous mobile robots navigation, autonomy, and real-time decision-making capabilities. Rising labor shortages and increasing labor costs are pushing enterprises to accelerate automation investments to sustain throughput and service levels. In addition, heightened focus on workplace safety and seamless integration with digital warehouse and factory systems continues to reinforce sustained market growth.

The rising focus on flexible manufacturing is strongly driving demand for autonomous mobile robots that can adapt to dynamic production workflows. Manufacturers are increasingly deploying autonomous mobile robots (AMRs) to support just-in-time material delivery and efficient line-side replenishment, improving production continuity. Unlike fixed automation, AMRs enable rapid layout reconfiguration without significant infrastructure investment, supporting evolving manufacturing requirements. This flexibility helps reduce production cycle times and improves responsiveness to product customization and shorter batch runs. As factories prioritize agility and efficiency, autonomous mobile robots are becoming a core enabler of smart manufacturing strategies.

The increasing emphasis on workplace safety is accelerating the deployment of AMRs equipped with advanced collision avoidance and safety technologies. By automating material transport, AMRs significantly reduce accidents linked to manual handling and forklift operations. Improved safety performance supports regulatory compliance while lowering insurance, downtime, and operational risk costs. In parallel, autonomous mobile robots enhance operational resilience by maintaining consistent performance during labor shortages or demand fluctuations. These combined safety and reliability benefits are reinforcing long-term investment in AMRs across industrial and logistics environments.

Component Insights

The hardware segment accounted for the largest market revenue share of over 67% in 2025, driven by the rapid expansion of autonomous mobile robot deployments across warehouses, manufacturing plants, and logistics centers. Strong demand for core components such as robot platforms, LiDAR, cameras, sensors, controllers, and onboard computing systems continues to fuel hardware investments. Advancements in sensing technologies and edge processing are improving navigation accuracy, reliability, and real-time responsiveness. Enterprises are prioritizing robust and scalable hardware to support higher payloads, longer operating hours, and demanding industrial environments. As AMR adoption scales globally, sustained investment in advanced hardware platforms remains a primary growth driver for the autonomous mobile robots market.

The software segment is expected to experience significant growth during the forecast period, driven by the accelerating demand for intelligent navigation, fleet management, and real-time decision-making capabilities. Rapid advancements in artificial intelligence, machine learning, and cloud-based platforms are strengthening AMR autonomy and operational efficiency. Enterprises are increasingly prioritizing software-driven optimization to improve robot utilization, coordination, and scalability across large fleets. Software enables faster deployment, continuous upgrades, and seamless adaptation to changing operational requirements. As automation strategies mature, software is becoming a core growth driver shaping the long-term evolution of the autonomous mobile robots market.

Type Insights

The goods-to-person picking robots segment accounted for the largest market revenue share in 2025, owing to the rapid expansion of e-commerce and the growing need for high-speed order fulfillment. These robots significantly improve picking accuracy and throughput by bringing items directly to workers, reducing travel time and labor intensity. Rising pressure to shorten delivery timelines and handle higher order volumes is accelerating adoption across warehouses and distribution centers. Goods-to-person systems also support better space utilization and scalable operations, making them well suited for high-density fulfillment environments. As retailers and logistics providers prioritize efficiency and productivity, this segment continues to act as a major growth driver in the autonomous mobile robots market.

The unmanned aerial vehicles (UAV) segment is expected to experience significant growth during the forecast period, owing to increasing demand for fast, flexible, and autonomous operations across logistics, surveillance, inspection, and monitoring applications. Advancements in navigation, imaging, and communication technologies are enhancing UAV performance and reliability. Organizations are increasingly adopting UAVs to improve operational efficiency, reduce manual intervention, and access hard-to-reach areas. Supportive regulatory frameworks and rising investments in autonomous technologies are further accelerating adoption. As enterprises seek scalable and cost-effective automation solutions, the UAV segment is emerging as a strong growth driver within the autonomous systems market.

Battery Type Insights

The lead battery segment accounted for the significant market revenue share in 2025. The growth can be attributed to the widespread adoption of AGVs in cost-sensitive industries, where the affordability and reliability of lead-acid batteries align with operational and budgetary priorities. Lead-acid batteries have a stable power source, which is essential for the consistent performance and longevity of AGVs. Their technology ensures robust performance under varying operational conditions, making them useful for industries that rely heavily on AGVs for vital tasks. Moreover, the lower upfront cost of lead-acid batteries, compared to alternative technologies, makes them valuable for businesses seeking to manage capital expenditures while still achieving efficient automation.

The lithium-ion battery segment is expected to experience significant growth during the forecast period, primarily driven by rising demand for high-energy-density, fast-charging, and long-cycle power solutions in autonomous mobile robots. Lithium-ion batteries support longer operating hours and reduced downtime compared to conventional battery technologies. Their declining costs and improved safety features are accelerating adoption across warehouse, manufacturing, and logistics applications. In addition, compatibility with opportunity charging and energy management systems enhances operational efficiency. As AMR deployments scale, lithium-ion batteries are becoming a key enabler of reliable and continuous autonomous operations.

Application Insights

The assembly segment accounted for the significant market revenue share in 2025, driven by the accelerating shift toward automated and highly efficient production environments. Growing reliance on autonomous mobile robots for line-side material delivery and component movement is strengthening assembly line productivity. AMRs are enabling just-in-time workflows that reduce delays, optimize inventory flow, and support continuous operations. Their ability to operate in flexible layouts allows manufacturers to adapt quickly to changing production requirements. As factories prioritize speed, precision, and scalability, the assembly segment remains a key driver of sustained autonomous mobile robots market growth.

The sorting segment is expected to experience significant growth during the forecast period. The rising demand for faster, more accurate order processing in warehouses and distribution centers is strongly driving adoption of autonomous mobile robots. Expanding e-commerce and omnichannel retail operations require scalable sorting solutions capable of handling high and fluctuating volumes. AMR-based sorting systems improve throughput, reduce error rates, and minimize dependency on manual labor. As logistics operators prioritize speed, efficiency, and operational flexibility, automated sorting continues to emerge as a key growth driver in the autonomous mobile robots market.

Payload Capacity Insights

The 100 kg to 500 kg segment accounted for the largest market revenue share in 2025, driven by its versatility across warehouse, manufacturing, and logistics operations. AMRs within this payload range effectively handle core material transport and order fulfillment tasks while maintaining high maneuverability in constrained spaces. Strong demand from e-commerce and industrial facilities is accelerating deployment of these robots at scale. Their cost-effective design and ease of integration allow organizations to expand automation without significant infrastructure investment. As automation adoption deepens, this payload segment is reinforcing long-term demand momentum and accelerating overall market uptake.

The more than 500 kg segment is expected to experience significant growth during the forecast period, driven by the growing demand for heavy-duty material handling and high-payload transport in industrial and logistics environments. These AMRs are increasingly deployed to move large components, pallets, and bulk materials across manufacturing plants and distribution centers. Expansion of automotive, heavy manufacturing, and large-scale warehousing operations is accelerating adoption of high-payload autonomous robots. Their ability to improve safety, reduce manual handling, and maintain consistent performance under heavy loads is strengthening investment interest. As industries scale automation for complex operations, demand for high-capacity AMRs is gaining strong growth momentum.

Navigation Technology Insights

The laser guidance segment accounted for the largest market revenue share in 2025, owing to its high navigation accuracy, reliability, and proven performance in structured industrial environments. Laser-guided AMRs deliver precise positioning and stable movement, making them well suited for warehouses, manufacturing plants, and logistics facilities. Strong demand for predictable and repeatable operations is driving widespread adoption of this guidance technology. Laser guidance systems also support efficient fleet coordination and reduced operational errors. As industries prioritize accuracy and uptime, laser-guided AMRs continue to attract strong deployment momentum.

The natural navigation segment is expected to experience significant growth during the forecast period, driven by rising demand for flexible and infrastructure-free automation solutions. Natural navigation enables AMRs to operate using onboard sensors, cameras, and AI without relying on fixed markers or reflectors. This capability reduces deployment time and lowers installation and maintenance costs. Growing adoption in dynamic environments such as e-commerce warehouses and mixed human-robot workplaces is accelerating demand. As organizations seek scalable and adaptable automation, natural navigation is emerging as a key growth catalyst in the autonomous mobile robots market.

End-use Insights

The manufacturing segment accounted for the largest market revenue share in 2025, driven by the accelerating adoption of autonomous mobile robots across production facilities to optimize internal logistics and material handling operations. Manufacturers are increasingly investing in AMRs to reduce labor dependency while improving productivity, throughput, and operational consistency. The flexible and scalable nature of AMRs enables seamless integration into existing production lines, supporting both small-scale and large-scale manufacturing environments. AMRs also play a critical role in improving workplace safety by automating hazardous and repetitive tasks, reducing human exposure to operational risks. Furthermore, advancements in navigation accuracy, artificial intelligence, and system reliability are strengthening the value proposition of AMRs as essential tools in modern manufacturing.

The wholesale and distribution segment is expected to experience significant growth during the forecast period, supported by rising demand for high-efficiency and sustainable automation solutions. Distribution centers are increasingly adopting advanced AMR systems powered by high-performance energy technologies to maintain continuous and reliable operations. Improved energy density and longer operating cycles enable robots to support high-volume material movement with minimal downtime. Faster charging capabilities further enhance operational flexibility, allowing robots to operate efficiently in peak-demand environments. As wholesale and distribution networks scale to meet rising order volumes, automation investments are accelerating to improve efficiency, reliability, and overall throughput.

Regional Insights

The Asia Pacific autonomous mobile robots industry has held the highest market revenue share of over 30% in 2025, supported by rapid industrialization and expanding automation initiatives. Countries including China, India, and Japan are investing heavily in smart manufacturing and digital infrastructure to improve productivity and reduce reliance on manual labor. The region’s fast-growing e-commerce sector is significantly increasing demand for advanced warehouse automation and material handling solutions. Moreover, the presence of emerging local robotics manufacturers and rising foreign investments is accelerating AMR innovation and adoption across the region.

China Autonomous Mobile Robot Market Trends

China’s autonomous mobile robot industry is expected to experience significant growth in 2025, driven by the localization of key components, including controllers, sensors, and navigation software. This shift reduces reliance on imports and strengthens supply chains. The growing demand for orchestrating multi-robot fleets and centralized control platforms enables the scalable deployment of AMRs across large facilities. An enhanced focus on operational safety and compliance is accelerating the adoption of AMRs, which feature improved obstacle avoidance and real-time monitoring. Hybrid automation models that combine AMRs with conveyors, robotic arms, and AS/RS systems are accelerating the deployment of integrated smart factories and warehouses across China.

North America Autonomous Mobile Robots Market Trends

The North America autonomous mobile robots industry has a significant market revenue share in 2025, supported by a well-established technology ecosystem and the presence of leading AMR developers. Strong demand from e-commerce and third-party logistics providers continues to accelerate AMR deployment for warehouse automation, including sorting, material transport, and inventory management. The region benefits from advanced digital infrastructure and early adoption of AI- and software-driven automation solutions. In addition, sustained government funding and private investments in robotics and artificial intelligence strengthen North America’s leadership position in the global autonomous mobile robots industry.

The U.S. autonomous mobile robots industry is expected to maintain steady growth in 2025, driven by rapid advancements in artificial intelligence, machine learning, and sensor technologies. Large-scale fulfillment centers and omnichannel retail operations increasingly rely on AMRs to improve throughput, accuracy, and order fulfillment speed. Strong private and public sector investments continue to support innovation across manufacturing, healthcare, and logistics applications. Furthermore, ongoing labor shortages and the need to improve workplace safety are encouraging enterprises to accelerate AMR adoption.

Europe Autonomous Mobile Robots Market Trends

The Europe autonomous mobile robots industry is projected to experience significant growth over the forecast period, driven by increasing automation across manufacturing, logistics, and healthcare sectors. High labor costs and strict regulatory standards are pushing organizations to adopt robotic solutions that enhance efficiency and compliance. Countries such as Germany and France are actively investing in Industry 4.0 initiatives, strengthening the integration of robotics and digital manufacturing technologies. In addition, government-backed funding programs and urban logistics challenges are boosting demand for compact and flexible AMR systems.

Key Autonomous Mobile Robots Company Insights

Some key players in the autonomous mobile robot industry, such as ABB, Daifuku Co., Ltd., KUKA AG, Jungheinrich AG, and Boston Dynamics., and among others.

-

ABB is a prominent player in the market, offering AMRs designed for intralogistics, manufacturing, and industrial automation environments. The company leverages its strong portfolio in robotics, drives, and control systems to deliver integrated AMR solutions that seamlessly connect with factory automation platforms. ABB specializes in AI-enabled navigation, fleet management, and flexible material transport across dynamic shop-floor operations. Its solutions are widely adopted in automotive, electronics, and general manufacturing facilities to improve productivity and operational efficiency.

-

Daifuku is a player in material handling and intralogistics automation, with a strong presence in the AMR and AGV market. The company provides advanced mobile robot solutions tailored for warehouses, airports, cleanrooms, and large-scale manufacturing facilities. Daifuku specializes in high-throughput automation systems that integrate AMRs with conveyors, sorters, and warehouse management systems. Its expertise lies in delivering reliable, scalable automation for complex, high-volume logistics environments.

Key Autonomous Mobile Robots Companies:

The following are the leading companies in the autonomous mobile robots market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- BALYO

- Bastian Solutions, LLC.

- Bleum

- Boston Dynamics

- Clearpath Robotics, Inc.

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- GreyOrange

- Harvest Automation

- Hyster-Yale Materials Handling, Inc.

- IAM Robotics

- inVia Robotics, Inc.

- John Bean Technologies Corporation (JBT)

- Jungheinrich AG

- KUKA AG

- Rocla AGV Solutions (Mitsubishi Logisnext Europe)

- Teradyne Inc.

- Third Wave Automation

- Toyota Material Handling, Inc.

- VisionNav Robotics USA INC

Recent Developments

-

In December 2025, Chang Robotics partnered with OTTO by Rockwell Automation to advance industrial automation through integrated AMR solutions. The collaboration combines Chang Robotics’ expertise in complex robotic system deployment with OTTO’s autonomous mobile robot technology. This partnership aims to improve productivity, flexibility, and safety across manufacturing, logistics, and e-commerce operations. The initiative reflects growing demand for scalable and customized automation solutions to address labor constraints and operational efficiency challenges.

-

In December 2025, Aptiv partnered with Vecna Robotics to jointly develop next-generation autonomous mobile robots for warehouse and factory automation. The partnership combines Aptiv’s advanced perception, compute, and machine learning capabilities with Vecna Robotics’ autonomy and workflow orchestration technologies. This integration is designed to enhance AMR safety, navigation accuracy, and performance in complex and dynamic industrial environments. The collaboration reflects a broader market shift toward intelligent, scalable, and cost-efficient AMR solutions supporting advanced intralogistics operations.

-

In June 2025, ABB expanded its autonomous mobile robot portfolio by enhancing the Flexley Mover with AI-powered 3D Visual SLAM navigation and the AMR Studio programming platform. This upgrade enables infrastructure-free navigation, faster deployment, and improved adaptability across dynamic industrial environments. The solution allows robots to autonomously map facilities and share data across fleets, improving scalability and operational efficiency. This development highlights ABB’s focus on advancing intelligent, flexible, and easy-to-integrate AMR solutions to support modern intralogistics and manufacturing operations.

Autonomous Mobile Robots Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.49 billion

Revenue forecast in 2033

USD 14.04 billion

Growth rate

CAGR of 14.4% from 2026 to 2033

Base year

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Payload capacity, navigation technology, application, end-use, component, type, battery type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ABB; BALYO; Bastian Solutions, LLC.; Bleum; Boston Dynamics; Clearpath Robotics, Inc.; Crown Equipment Corporation; Daifuku Co., Ltd.; GreyOrange;

Harvest Automation; Hyster-Yale Materials Handling, Inc.; IAM Robotics;

inVia Robotics, Inc.; John Bean Technologies Corporation (JBT); Jungheinrich AG; KUKA AG; Rocla AGV Solutions (Mitsubishi Logisnext Europe); Teradyne Inc.; Third Wave Automation; Toyota Material Handling, Inc.; VisionNav Robotics USA INC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Mobile Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global autonomous mobile robots market report based on component, type, battery type, application, payload capacity, end-use, navigation technology, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Goods-To-Person Picking Robots

-

Self-Driving Forklifts

-

Autonomous Inventory Robots

-

Unmanned Aerial Vehicles

-

-

Battery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lead Battery

-

Lithium-Ion Battery

-

Nickel-based Battery

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Sorting

-

Transportation

-

Assembly

-

Inventory Management

-

Others

-

-

Payload Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 100 kg

-

100 kg - 500 kg

-

More than 500 kg

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Automotive

-

Aerospace

-

Electronics

-

Chemical

-

Pharmaceuticals

-

Plastics

-

Defense

-

FMCG

-

Others

-

-

Wholesale & Distribution

-

E-commerce

-

Retail Chains/Conveyance Stores

-

Others

-

-

-

Navigation Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Laser Guidance

-

Magnetic Guidance

-

Vision Guidance

-

Inductive Guidance

-

Natural Navigation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous mobile robots market size was estimated at USD 4.74 billion in 2025 and is expected to reach USD 5.49 billion in 2026.

b. The global autonomous mobile robots market is projected to grow at a compound annual growth rate (CAGR) of 14.4% from 2026 to 2033, reaching USD 14.04 billion by 2033.

b. The Asia Pacific dominated the autonomous mobile robots market, accounting for over 30% of the market share in 2025, driven by rapid industrial automation, strong manufacturing activity, expanding e-commerce logistics, rising labor costs, and supportive government initiatives promoting smart factories.

b. Some key players operating in the autonomous mobile robots market include ABB, BALYO, Bastian Solutions, LLC., Bleum, Boston Dynamics, Clearpath Robotics, Inc., Crown Equipment Corporation, Daifuku Co., Ltd., GreyOrange, Harvest Automation, Hyster-Yale Materials Handling, Inc., IAM Robotics, inVia Robotics, Inc., John Bean Technologies Corporation (JBT), Jungheinrich AG, KUKA AG, Rocla AGV Solutions (Mitsubishi Logisnext Europe), Teradyne Inc., Third Wave Automation, Toyota Material Handling, Inc., and VisionNav Robotics USA INC

b. Key factors driving the autonomous mobile robots market growth include the rapid integration of artificial intelligence technologies that enhance navigation, decision-making, and autonomy, the high adoption of robots across manufacturing and warehouse logistics operations to improve efficiency and reduce labor dependency, and the growing emphasis on improving safety in high-risk workplaces by minimizing human exposure to hazardous tasks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.