- Home

- »

- Next Generation Technologies

- »

-

Autonomous Ships Market Size, Industry Report, 2030GVR Report cover

![Autonomous Ships Market Size, Share & Trends Report]()

Autonomous Ships Market (2024 - 2030) Size, Share & Trends Analysis Report By Autonomy Level (Semi-Autonomous, Fully Autonomous), By Solutions (Systems & Software, Structures), By End Use, And Segment Forecasts

- Report ID: GVR-3-68038-944-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Ships Market Summary

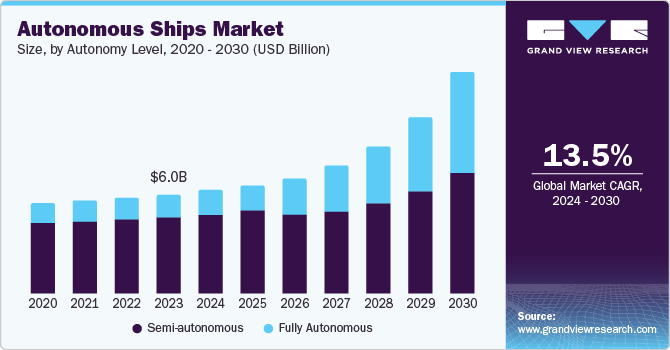

The global autonomous ships market was valued at USD 6.04 billion in 2023 and is projected to reach USD 13.41 billion by 2030, growing at a CAGR of 13.5% from 2024 to 2030. Technologies such as artificial intelligence (AI), machine learning (ML), and sensor fusion enable the development of navigation and control systems that allow ships to operate with minimal human intervention.

Key Market Trends & Insights

- Asia Pacific accounted for the largest regional market share of 33.9% in 2023.

- Europe autonomous ships market is expected to witness the fastest CAGR over the forecast period.

- By autonomy level, the semi-autonomous segment dominated the market in 2023, accounting for a revenue share of 77.1%.

- By end use, the defense segment is expected to witness significant growth over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 6.04 Billion

- 2030 Projected Market Size: USD 13.41 Billion

- CAGR (2024-2030): 13.5%

- Asia Pacific: Largest market in 2023

Integrating AI and ML enables autonomous ships to process vast amounts of data from various sensors, such as radar, LiDAR, and cameras, to make real-time decisions.

Autonomous ships reduce the need for a large crew, lowering labor costs, fewer human errors, and enhanced operational efficiency. The reduction in crew size also leads to smaller living spaces and facilities on board, allowing for more cargo space and optimized ship designs. Additionally, autonomous ships are expected to have lower fuel consumption due to optimized routing and speed management, contributing to overall cost efficiency. This potential for significant cost savings drives the demand in the market.

Governments worldwide are increasingly partnering with private companies, research institutions, and international organizations to drive the development of autonomous ship technologies. These collaborations are essential for collecting resources, expertise, and infrastructure to advance this innovative sector. These collaborative efforts are accelerating the commercialization of autonomous ships and positioning participating nations in the future of maritime transport. For instance, in March 2024, the Indian Register of Shipping (IRS) partnered with Garden Reach Shipbuilders & Engineers Ltd (GRSE) to develop autonomous and green energy vessels. The Memorandum of Understanding (MoU) between IRS and GRSE aims to ensure that the ship designed and developed by GRSE complies with evolving safety standards, design specifications, rule requirements, and mandatory compliances for autonomous and green energy vessels.

Autonomy Level Insights

The semi-autonomous segment dominated the market and accounted for a revenue share of 77.1% in 2023. Semi-autonomous ships combine advanced automation with human oversight, enhancing safety without completely eliminating human decision-making. Critical functions such as navigation, collision avoidance, and system monitoring are automated while humans are still present to intervene in complex or unexpected situations. This human-machine collaboration reduces errors and improves emergency response times, leading to safer maritime operations. Shipping companies are interested in this model as it allows them to leverage the reliability of automation while maintaining human operator's flexibility and decision-making abilities.

The fully autonomous segment is expected to witness the fastest CAGR over the forecast period. Autonomous systems are developed to operate consistently and predictably, following programmed protocols and responding to inputs from their environment without the variability that comes with human judgment. These systems are also equipped with advanced safety features, such as collision avoidance and automatic emergency response, activated faster and more precisely than humans. By minimizing the potential for human mistakes, fully autonomous ships enhance overall safety at sea, leading to fewer accidents.

Solutions Insights

The systems & software segment accounted for the largest revenue share in 2023. The systems and software used in autonomous ships are resilient against cyber threats and capable of protecting sensitive data from breaches and attacks. Robust cybersecurity solutions are essential to safeguard navigation systems, communication links, and onboard networks from potential vulnerabilities. The need for comprehensive cybersecurity measures drives developing and implementing advanced security protocols, encryption technologies, and real-time threat detection systems. Companies offering cybersecurity solutions are essential players in ensuring autonomous ship's safe and secure operation, driving growth in this market segment.

The structures segment is anticipated to witness the fastest growth over the forecast period. The structures of autonomous ships are designed and optimized to accommodate the unique requirements of autonomous operations. Autonomous ships don't require extensive crew quarters, living facilities, or manual control areas, allowing for more streamlined and efficient ship designs. This increases opportunities to maximize cargo space, improve hydrodynamics, and enhance fuel efficiency. The structural design of autonomous ships also incorporates advanced materials and construction techniques that reduce weight while maintaining strength and durability, which is necessary for optimizing performance and reducing operational costs.

End Use Insights

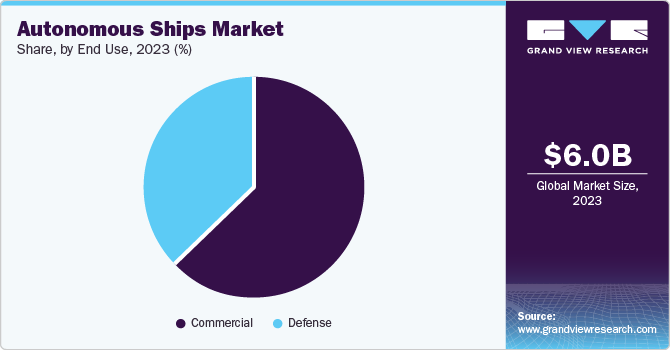

The commercial segment accounted for the largest market revenue share in 2023. The demand for efficient and reliable logistics solutions rises as global trade expands. With their potential for consistent and uninterrupted operations, autonomous ships are suitable to meet this demand. These vessels optimize shipping routes, reduce transit times, and improve the overall reliability of cargo delivery, which is essential in the just-in-time logistics model. The ability of autonomous ships to streamline logistics and reduce bottlenecks in global supply chains, driving their adoption in the commercial sector.

The defense segment is expected to witness significant growth over the forecast period. Defense organizations are increasingly adopting autonomous ships to reduce the risk to human personnel in dangerous or high-stakes operations. Military missions involve navigating through mine-infested waters, conducting anti-submarine warfare, or engaging in other activities that pose significant risks to crew members. By deploying autonomous ships for such missions, defense forces minimize the exposure of human operators. Autonomous vessels are remotely controlled or operate independently, performing tasks that require a human presence, enhancing the safety of military personnel, and reducing the potential for casualties.

Regional Insights

North America autonomous ships market is expected to witness significant growth over the forecast period. The region's strong presence in sectors such as artificial intelligence (AI), machine learning (ML), robotics, and advanced manufacturing provides a stable foundation for developing autonomous systems. Tech giants, defense contractors, and specialized startups in the U.S. and Canada are at the forefront of creating advanced navigation systems, sensors, and communication technologies essential for autonomous ship operations. This innovation hub fuels the growth of the autonomous ships market in North America.

U.S. Autonomous Ships Market Trends

The U.S. autonomous ships market accounted for the largest revenue share in 2023. The U.S. Navy and other divisions develop and deploy autonomous ships for various military purposes, including surveillance, reconnaissance, mine countermeasures, and uncrewed combat missions. These investments are part of a wider strategy to modernize the U.S. military’s capabilities, reduce reliance on human-crewed vessels, and enhance operational efficiency. This focus on defense applications ensures a steady demand for autonomous ships in the U.S., driving innovation and advancements in this sector.

Europe Autonomous Ships Market Trends

Europe autonomous ships market is expected to witness the fastest CAGR over the forecast period. Autonomous vessels are increasingly used for offshore exploration, drilling support, maintenance, and environmental monitoring. These ships operate in remote and hazardous environments, performing seabed mapping, pipeline inspection, and underwater construction with greater precision and lower risk than human-crewed vessels. The ability to conduct continuous operations without the limitations of crew fatigue or safety concerns makes autonomous ships a reliable option for companies looking to optimize their offshore operations.

The UK autonomous ships market is expected to witness significant growth over the forecast period. The country has a well-established maritime industry, including shipbuilding, marine engineering, and shipping services, which are increasingly incorporating autonomous technologies. The government and private sector are investing in technologies to enhance the capabilities of autonomous vessels, with a focus on maintaining the UK's competitive edge in global maritime operations. Additionally, developing several testing and innovation hubs dedicated to autonomous ship technologies facilities controlled environment for testing new systems, conducting trials, and refining autonomous vessel operations.

Asia Pacific Autonomous Ships Market Trends

Asia Pacific autonomous ships market accounted for the largest revenue share of 33.9% in 2023. Asia Pacific is a prominent region for global maritime trade, with some of the world's busiest shipping lanes and ports located in countries such as China, Japan, South Korea, and Singapore. The region's economic growth and manufacturing units drive a high volume of cargo traffic, necessitating more efficient and reliable shipping solutions. Autonomous ships offer the potential to optimize shipping operations, reduce transit times, and lower costs, making them an optimal option for the region's shipping companies. The increasing demand for improved maritime logistics drives the adoption of autonomous ships in the Asia Pacific region.

China autonomous ships market is expected to witness significant growth over the forecast period. The private sector in China is increasingly investing in autonomous ship technologies due to their potential to revolutionize maritime operations. Commercial shipping companies, offshore energy operators, and logistics providers are exploring using autonomous vessels to improve efficiency, reduce operational costs, and enhance safety. The growing interest from the private sector is driven by the potential for autonomous ships to optimize supply chains, reduce human error, and provide a competitive edge in the market.

Key Autonomous Ships Company Insights

Key players in autonomous ships market include Siemens, KONGSBERG, Honeywell International Inc., Rolls-Royce plc and others.

-

Honeywell International Inc. is a diversified global technology and manufacturing company that operates across various industries, including aerospace, building technologies, performance materials, and safety and productivity solutions. The company offers various products and services, such as avionics systems, turbochargers, process automation solutions, industrial safety equipment, and advanced materials.

-

Siemens AG is a global company that offers a broad range of products and services in industries such as industrial automation, energy, healthcare, and infrastructure. The company provides solutions across several sectors, including industrial automation and digitalization, building technologies, power generation and distribution, mobility solutions for rail and road, and advanced medical imaging and diagnostics.

Key Autonomous Ships Companies:

The following are the leading companies in the autonomous ships market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Siemens

- KONGSBERG

- L3Harris Technologies, Inc.

- Honeywell International Inc.

- HD Hyundai Heavy Industries Co., Ltd

- Marlink B.V.

- Rolls-Royce plc

- Wärtsilä

- DNV AS

Recent Developments

-

In March 2024, South Korea launched a 172-meter-long container ship, Pos Singapore, registered in Liberia, to enable autonomous shipping operations. The government allocated over USD 120 million to research and development for the autonomous shipping project, established in 2020. Hyundai Mipo and Pan Ocean finished preparing to install the autonomous navigation system, including communication, autonomous navigation, advanced digital agency monitoring systems, and security technologies.

-

In December 2023, Dalian Maritime University launched a dual-purpose ship for intelligent research and practical training. It includes functions such as autonomous navigation, remote control, and autonomous operation. It has a service speed of 17.5 knots and is 69.83 meters long and 10.9 meters wide. It is powered by three diesel-electric units of 1,520 kW, propelled by two all-electric pods of 1,500 kW, and is staffed by 50 people.

Autonomous ShipsMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.26 billion

Revenue forecast in 2030

USD 13.41 billion

Growth rate

CAGR of 13.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Autonomy level, solutions, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, UK, Germany, France, China, India, , Japan, Brazil and Mexico

Key companies profiled

ABB; Siemens; KONGSBERG; L3Harris Technologies, Inc.; Honeywell International Inc.; HD Hyundai Heavy Industries Co., Ltd; Marlink B.V.; Rolls-Royce plc; Wärtsilä; DNV AS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Ships Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the autonomous ships market report based autonomy level, solutions, end use, and region.

-

Autonomy Level Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-autonomous

-

Fully Autonomous

-

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems & Software

-

Structure

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Passenger Cruise

-

Bulk Carrier & Container Ships

-

Tankers

-

Others

-

-

Defense

-

Submarines

-

Aircraft Carriers

-

Destroyers

-

Frigates

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.