- Home

- »

- Clothing, Footwear & Accessories

- »

-

Baby Products Market Size & Share, Industry Report, 2030GVR Report cover

![Baby Products Market Size, Share & Trends Report]()

Baby Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cosmetics & Toiletries, Baby Food), By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-751-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Products Market Summary

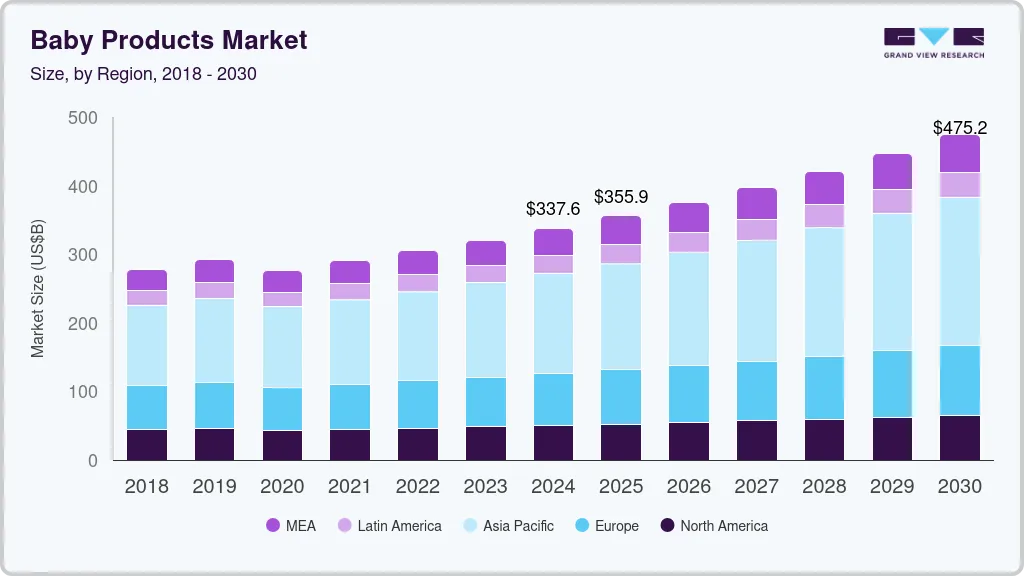

The global baby products market size was estimated at USD 320.65 billion in 2023 and is projected to reach USD 475.15 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. One of the primary factors driving market expansion is the shift in consumer preferences toward high-quality, utility-driven, and premium baby products.

Key Market Trends & Insights

- Asia Pacific held a market share of 43.1% in 2023 and is further expected to witness a CAGR of 6.6% from 2024 to 2030.

- India has a large and growing population, including a significant number of young parents.

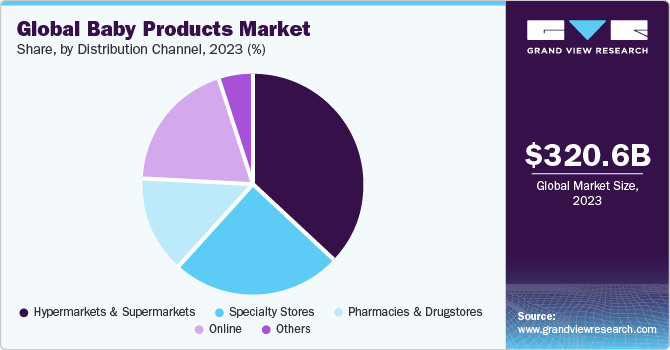

- By distribution channel, hypermarkets & supermarkets held a share of 36.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 320.65 Billion

- 2030 Projected Market Size: USD 475.15 Billion

- CAGR (2024-2030): 5.9%

- Asia Pacific: Largest market in 2023

In addition, the significant increase in awareness among parents about baby health and hygiene is also driving market expansion. Many medical practitioners recommend parents to use baby personal care products regularly to nourish their baby's skin, which is also boosting market growth.

Parents around the world have become more cautious when selecting any baby-related products, such as baby food, baby cosmetics and toiletries, or baby safety and convenience products. The demand for chemical-free and harmless baby care toiletries has been mounting due to the rising awareness of health-related issues, such as fungal and bacterial infections, caused by synthetic baby products and toiletries. This has led to an increase in the demand for skin, bathing, and other toiletries products, for which consumers are willing to pay premium prices depending on their quality. In addition, innovative packaging and the incorporation of specific organic ingredients with multiple health benefits are likely to boost market growth.

The rise in the population of working women, particularly in emerging countries such as India, China, and South Africa, is contributing to the growth of the baby care products sector. The demand for baby products has seen significant growth due to the increased disposable income and spending power of the population on superior quality products that ensure improved baby health. Rising awareness of the health benefits of consuming baby food that has fewer pesticide residues and is specifically formulated for infants to toddlers, approximately between six months to two years of age, is also driving demand for these products.

Infants and toddlers are more prone to foodborne illness as their immune systems are not fully developed to combat infections. Therefore, factors such as premium quality products and their safety are amongst the most important criteria influencing the buyer’s decision. Moreover, the growing demand for gluten-free versions of baby food products is uplifting the industry growth of baby products. Health organizations such as FDA, have set strict guidelines for baby foods and the use of chemicals owing to their side effects on the human body. These factors in turn are likely to supplement the market growth.

The online availability of baby care products and the increase in internet penetration consolidate the market expansion across the globe. The rising number of smartphone users, easy access to internet connectivity, and the rise in the use of e-banking systems are projected to aid in the sales of baby products through online platforms. Owing to hectic lifestyles, consumers opt for the convenience of online shopping instead of visiting physical stores, which not only offer instant doorstep delivery but multiple discounts and offers at the same time. The use of mobile wallets is anticipated to increase in the years to come.

Market Characteristics

The baby products industry has seen significant innovation in recent years, driven by factors such as increased awareness of safety and health, advancements in technology, and changing consumer preferences. Innovation in materials, such as the use of BPA-free plastics and organic fabrics, has been a key focus in the industry to address concerns about chemical exposure.

Merger and acquisition (M&A) activities have been notable in the baby products market, with companies seeking strategic partnerships and acquisitions to strengthen their market positions. Established baby products manufacturers often acquire emerging companies specializing in niche technologies or innovative designs. These activities aim to broaden product portfolios, tap into new consumer segments, and leverage complementary expertise.

While the market is driven by technological advancements, there is a relatively low impact of stringent regulations. Regulatory frameworks typically focus on product safety standards rather than restricting innovation. Manufacturers must comply with industry-specific safety regulations to ensure consumer protection, especially concerning products.

The market faces limited direct substitutes due to the specialized and unique functionalities of different baby products. There are several product substitutes that consumers may consider based on their preferences, values, and specific needs in the market.

Distribution Channel Insights

Hypermarkets & supermarkets held a share of 36.8% in 2023. These retail formats offer a wide range of baby products, catering to the diverse needs of parents. They provide a convenient one-stop shopping experience, allowing parents to find everything they need in one place. Moreover, hypermarkets and supermarkets often offer competitive pricing, making baby products more affordable for consumers. They have the advantage of economies of scale, allowing them to negotiate lower prices from suppliers and pass on the cost savings to customers. For instance, in September 2022, PROUDLY, the baby brand dedicated to meeting the needs of Black and brown babies, and also known for offering affordable baby products is expanding into retail through a partnership with Target in response to the growing demand for affordable baby products and to make its products more accessible to more communities, parents, and caretakers.

Baby product sales through online channels are expected to grow at a CAGR of 7.7% from 2024 to 2030. Online shopping allows parents to browse and purchase baby products from the comfort of their own homes, eliminating the need to travel to physical stores. Furthermore, online retailers offer a vast selection of baby products, providing parents with access to a wide range of brands, styles, and options. This allows them to compare products, read reviews, and make informed purchasing decisions. These factors would lead to the growth of sales of baby products through online channels during the forecast period. For instance, in April 2022, Kane Quinn brand announced that their adopted strategy of selling their baby products directly to customers only through online channels has helped them cut the prices of the baby products and resulted in increased revenue for the brand. The company has hired a dozen employees in the last few years due to the increased number of orders.

Regional Insights

Asia Pacific held a market share of 43.1% in 2023 and is further expected to witness a CAGR of 6.6% from 2024 to 2030. The market in this region is primarily driven by the number of working mothers and the increase in the birth rate in developing countries including India and China. According to the EPRA International Journal of Economic and Business Review, the female workforce participation rate has increased by 4.1% over the last three decades, which in turn is providing a boost for various baby-related products such as baby food, baby cosmetics & toiletries, and baby safety & convenience. In addition, a rise in disposable income triggered the spending power of consumers, thereby uplifting product demand.

India has a large and growing population, including a significant number of young parents. The increasing number of babies being born in India contributes to the overall demand for baby products. According to UNICEF statistics, India accounts for nearly one-fifth of the world's annual childbirths, with the birth of 25 million children each year. Furthermore, the market is also driven by the rising awareness among parents about the importance of nutrition and health for babies, coupled with a rising focus on breastfeeding and organic/natural products in the country. Moreover, parents are placing greater importance on baby safety, leading to increased demand for safety-oriented baby products, which is driving the market in the country.

Economic growth in ASEAN countries has led to an increase in disposable income among households. This allows parents to spend more on high-quality baby products and provide better care for their children. Furthermore, rapid urbanization and changing lifestyles have resulted in an increased awareness of and demand for baby products. Urban parents are more likely to prioritize the health, safety, and well-being of their babies, leading to higher product demand. Parents in the ASEAN region are becoming more conscious of the health and safety aspects of baby care. They are seeking products that are safe, non-toxic, and environmentally friendly, which has driven the demand for organic and natural baby products and thereby driving the overall baby products market in the region.

Consumers in countries such as the U.S. and Canada are willing to pay a high price that concerns their baby’s lives and health. Technological advancement, working parents, government initiatives for infant safety, and early adoption of advanced products have been contributing to the growth of the market in North America. According to TABS Industry Report, consumers with an income of more than USD 150,000 presented an increase in penetration for baby products. Moreover, the presence of established manufacturers such as Johnson & Johnson Limited, and Kimberly-Clark Corporation in the region has positively impacted the market growth.

There is a growing awareness among parents in the Middle East and Africa of the importance of good baby care. This is due to a number of factors, such as the increasing availability of information about baby care, the growing number of healthcare professionals who are trained in baby care, and the increasing number of government initiatives that promote good baby care are expected to drive the sales of baby products in the region during the forecast period.

Product Insights

Baby food held a share of 25.3% in 2023 in the market. The baby food segment is further expected to grow at a CAGR of 6.5% from 2024 to 2030. Baby food is formulated in such a manner that can be easily consumed and digested by infants and toddlers. It is available in several varieties, tastes, and forms. Baby food can be table food that has been mashed or can be readily available and purchased from a manufacturer. Rapidly growing urbanization, busy work schedules of the working class, and changing lifestyles are propelling demand for packaged foods for babies. An increase in parental concerns regarding baby nutrition has been a primary aspect of driving the growth of the segment.

New food technologies have been enabling food product manufacturers to provide good quality products added with nutritional benefits. The increasing demand, particularly for infant formula, is triggering the growth of the market. For instance, Nestle SA, with its products, such as Nestle Cerelac fortified baby cereal with milk multi grain & fruits, caters to the demand for fortified baby food in India. Nutrients used in fortifying baby food include calcium, iron, zinc, and multiple vitamins such as A, B, E, K, C, and B. Since, iron deficiency is the most common nutritional deficiency found amongst Indian children, manufacturers are introducing new products in the market that are rich in iron and folic acid for the baby’s physical and mental growth.

Baby cosmetics and toiletries held a share of 33.5% in 2023. Under the baby cosmetics, baby diapers & wipes are expected to grow at a CAGR of 6.1% from 2024 to 2030. Diapers and wipes are essential for maintaining proper hygiene and cleanliness for babies. Parents are increasingly aware of the importance of keeping their babies clean, and dry. These products offer a convenient and hygienic solution, gaining greater acceptance among parents. According to statistics released by the National Diaper Bank Network in September 2022, babies in the U.S. consume between 6 and 12 diapers per day during their first year. In addition, the American Academy of Pediatrics reports that families in the U.S. spend an average of USD 936.0 per year on diapers, approximately USD 18 per week. The above statistics highlight the substantial market demand for diapers and the significant expenditure made by families in purchasing them will further drive the market during the forecast period.

The baby safety and convenience segment is expected to grow at a CAGR of 2.9% from 2024 to 2030. A noticeable inclination toward nuclear families and a rising need for infant protection, along with an increasing number of government initiatives to control the rising death incidents among babies have been driving the market. The government is taking preventive initiatives by introducing new rules and safety standards, as the number of child deaths has been increasing. For instance, in Europe, the United Nations Economic Commission of Europe (UNECE) Regulation No. 129 and Regulation No. 44 have set the standards for child restraint systems and every baby car seat must meet these standards.

Type Insights

Mass baby products held a share of 76.0% in 2023. Mass baby products refer to affordable, value-oriented products that are accessible to a larger consumer base. The affordability of these products is a key driver behind their consumption. They are competitively priced, appealing to price-sensitive consumers who prioritize both quality and cost-effectiveness. Furthermore, mass baby products are widely available in supermarkets, discount stores, and online retail platforms, ensuring easy accessibility for parents. In a recent development, Walmart introduced a new line of economical baby products in July 2022, including diapers made in the U.S. These diapers use materials sourced primarily from the U.S., comprising up to 75% of the overall product composition. Moreover, in August 2021, Pipette, the clean-baby care brand owned by Amyris Inc., is reducing its pricing and pivoting its brand positioning to reach a larger, mass customer base. The company is making these changes in response to the growing demand for clean baby care products at more affordable price points.

Furthermore, premium baby products are expected to grow at a CAGR of 7.0% from 2024 to 2030. With the increase in disposable income, many parents are willing to spend more on premium baby products. They prioritize quality, advanced features, and superior materials over cost savings, seeking the best possible products for their babies. Moreover, premium baby products often emphasize superior quality, safety, comfort, and innovative features. They may incorporate advanced materials, eco-friendly options, specialized designs, and enhanced functionality, appealing to consumers who value these attributes, thereby driving the premium baby products segment during the forecast period. Burberry, Polo Romper, and Ralph Lauren are among the premium baby clothing brands, while brands such as SOPHIE LA GIRAFE, Dr. Barbara Sturm, Little Aurelia, and CHANTECAILLE BEAUTÉ offer premium baby cosmetics.

Key Companies & Market Share Insights

The market includes both international and domestic participants.Manufacturers of baby products are investing in research and development to develop new and innovative baby products. This includes products that are more effective, safer, and more convenient for parents to use. Furthermore, manufacturers are launching new product lines to meet the changing needs of parents. This includes products that are designed for specific stages of baby development, such as newborn, infant, and toddler.

-

In February 2023, Walmart announced the launch of an exclusive line of soft and organic baby apparel called M + A by Monica + Andy. The apparel is made from 100% organic cotton and features soft, comfortable designs for babies from newborn to 24 months. The apparel is made available online and in more than 1,100 Walmart stores in the U.S.

-

In October 2022, Nature's One added an organic infant formula to its Baby's Only Formula range, making it the first of its kind. The Baby's Only Organic Premium Infant Formula is specially formulated to meet all FDA nutrient requirements, ensuring it fulfills the nutritional needs of infants from birth as a complete source of nourishment or as a supplement alongside breastfeeding.

-

In July 2022, Danone, a French multinational food-products corporation based in Paris, launched a new baby formula called "Aptamil," which is a blend of dairy and plant-based ingredients. The formula contains soy proteins and vegetable oils, such as sunflower, coconut, and rapeseed. It also contains fibers derived from chicory roots.

-

In April 2022, Gerber, a brand of Nestlé, launched its first plant-based baby food line called "Plant-Tastic." The line features a full range of organic plant-based toddler foods, from pouches to snacks to bowls. The products are created using nutrient-dense beans, whole grains, and vegetables to provide an adequate source of plant protein.

-

In September 2021, Personal care Johnson & Johnson launched its new range of ‘Cottontouch” baby care products that include lotion, oil, wash, and cream as it experiences increased demand in the Indian market. The company plans to sell these products through multiple channels such as stores and multi-brand e-commerce platforms such as Flipkart, Nykaa, Amazon India, BigBasket, and FirtstCry, among others.

Key Baby Products Companies:

- Johnson & Johnson

- Kimberly-Clark Corporation

- The Procter & Gamble Company

- Unilever

- Britax

- Chicco

- Dorel Industries

- Beiersdorf AG

- Fujian Hengan Group

- Nestlé S.A.

Baby Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 337.61 billion

Revenue forecast in 2030

USD 475.15 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

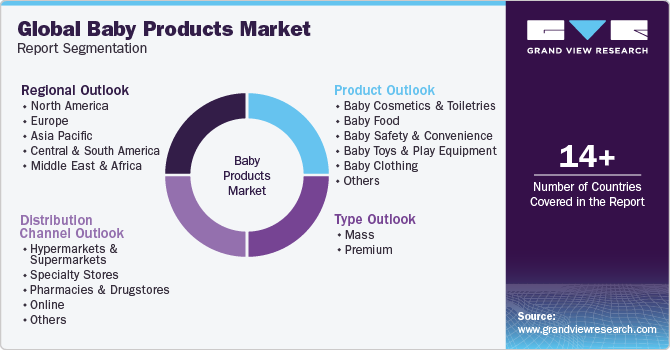

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand, ASEAN, South Korea; Brazil; Argentina; Saudi Arabia, South Africa, UAE.

Key companies profiled

Johnson & Johnson; Kimberly-Clark Corporation; The Procter & Gamble Company; Unilever; Britax; Chicco; Dorel Industries; Beiersdorf AG; Fujian Hengan Group; Nestlé S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby products market report based on product, type, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Baby Cosmetics & Toiletries

-

Baby Skin Care Products

-

Bath Product

-

Baby Hair Care Products

-

Baby Diapers & Wipes

-

Other Cosmetics & Toiletries

-

-

Baby Food

-

Baby Milk Products

-

Frozen Baby Food

-

Baby Juice

-

Baby Food Snacks

-

Baby Food Cereals

-

Other Baby Food

-

-

Baby Safety & Convenience

-

Baby Strollers

-

Baby Car Seats

-

Baby Monitors

-

Baby Proofing Products

-

Others

-

-

Baby Toys and Play Equipment

-

Rattles & Teethers

-

Stuffed Animals & Plush Toys

-

Baby Walkers

-

Others

-

-

Baby Clothing

-

Bodysuits

-

Tops

-

Bottoms

-

Others

-

-

Baby Nursery & Furniture

-

Cribs & Coats

-

Bassinets

-

High Chairs

-

Others

-

-

Baby Feeding & Nursing

-

Bottles & Nipples

-

Breast Pumps

-

Bottle Warmers & Sterilizers

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

ASEAN

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global baby products market size was estimated at USD 320.65 billion in 2023 and is expected to reach USD 331.67 billion in 2023.

b. The global baby products market is expected to grow at a compounded growth rate of 5.9% from 2024 to 2030 to reach USD 475.15 billion by 2030.

b. Baby cosmetics & toiletries dominated the baby products market with a share of33.5% in 2023 This is attributed to the increased purchase of products that contain anti-bacterial, anti-fungal, and antioxidant properties that are beneficial to baby skin driving the growth of the segment.

b. Some key players operating in the baby products market include Johnson & Johnson Services, Inc., Kimberly-Clark Corporation, Procter & Gamble, Unilever, Britax, Chicco, Dorel Industries, and Beiersdorf AG.

b. Key factors that are driving the market growth include the shift in consumer preferences toward high-quality, utility-driven, and premium baby products. Additionally, the significant increase in awareness among parents about baby health and hygiene is also driving market expansion.

b. U.K. baby products market size was valued at USD 4.26 billion in 2023 and is projected to grow at a CAGR of 4.0% over the forecast period. Influencer marketing and social media play a significant role in shaping consumer perceptions and purchasing decisions in the UK baby products market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.