- Home

- »

- Beauty & Personal Care

- »

-

Baby Wipes Market Size And Share, Industry Report, 2030GVR Report cover

![Baby Wipes Market Size, Share & Trends Report]()

Baby Wipes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dry Wipes, Wet Wipes), By Distribution Channel (Hypermarkets & Supermarkets, E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-838-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Wipes Market Summary

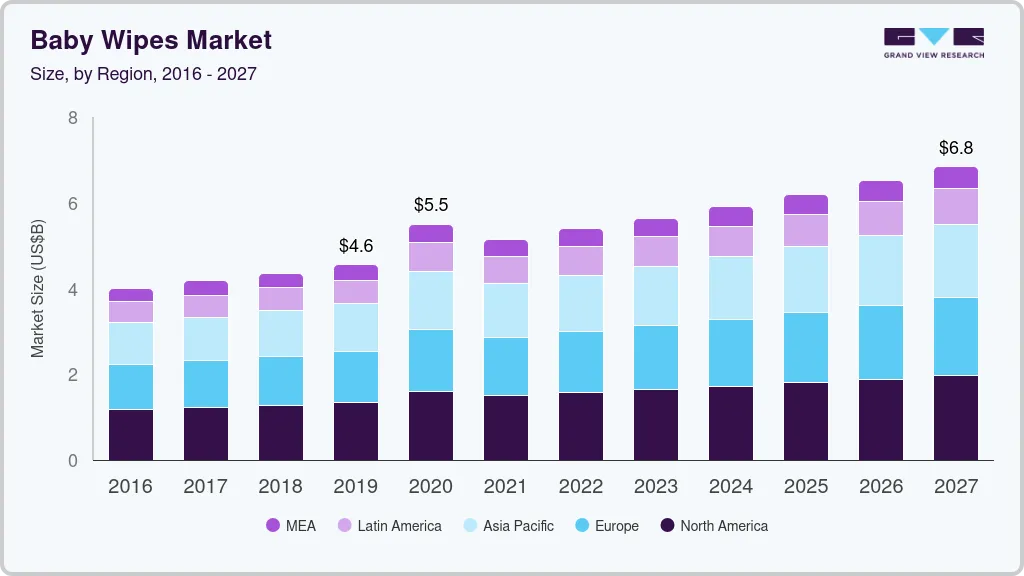

The global baby wipes market size was estimated at USD 5.91 billion in 2024 and is projected to reach USD 7.99 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The market growth is attributed to the rising awareness among parents about the importance of hygiene and health for their infants, leading to increased demand for convenient and effective baby wipes.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The region boasts a high awareness of infant hygiene and health among parents, which drives the demand for convenient and effective baby wipes.

- In terms of product, dry wipes dominated the market with the largest revenue share of 58.8% in 2024.

- Wet wipes are the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5.91 Billion

- 2030 Projected Market Size: USD 7.99 Billion

- CAGR (2025-2030): 5.2%

- North America: Largest market in 2024

The growing disposable incomes and spending power of consumers also contribute to the market expansion, as parents are willing to invest in quality baby care products. Furthermore, increasing consumer expenditure on baby care products and the rising number of women’s workforce globally are expected to drive market growth.

The trend towards natural and organic products has led to innovations in baby wipes, with manufacturers developing hypoallergenic, chemical-free, and dermatologically tested wipes to cater to the needs of health-conscious consumers. In addition, the expansion of product variety and availability through various distribution channels, including supermarkets, hypermarkets, and online stores, has made it easier for consumers to access and purchase baby wipes.

Shifting consumers’ preference toward eco-friendly and biodegradable baby wipes, which are alcohol-free and do not contain synthetic fragrances, artificial colors, or harsh chemicals, has been encouraging the manufacturers to produce wipes with more natural ingredients. For instance, the earth-friendly baby wipes company manufactures earth-friendly aloe vera wipes, which are popular among green consumers and reviewed as super soothing and gentle for newborn babies because of ingredients, such as aloe vera, chamomile, and calendula extracts, which keep the skin healthy and nourished.

The industry is witnessing a major rise in investment to boost manufacturing capacities across the globe. For instance, in May 2019, Kimberly-Clark, a U.S.-based personal care company, invested in its manufacturing facility in Tuas, Singapore, with over USD 25 Million, which aims to double export volume and value capacity by the end of 2022.

Product Insights

The dry wipes segment dominated the market with the largest revenue share of 58.8% in 2024. Dry wipes are versatile and used for various purposes, including cleaning, wiping, and general hygiene, making them a preferred choice for many parents. Their convenience and ease of use, especially during travel and outdoor activities, contribute to their popularity. Additionally, dry wipes are often perceived as more economical and have a longer shelf life compared to wet wipes, which appeals to cost-conscious consumers. The increasing awareness about the benefits of using gentle and chemical-free products on infants' sensitive skin has also boosted the demand for dry wipes. Furthermore, manufacturers are continually innovating and introducing products with enhanced features, such as hypoallergenic materials and eco-friendly options, catering to the evolving needs of health-conscious and environmentally aware parents.

The wet wipes segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. Wet wipes are highly convenient for parents due to their ready-to-use nature, making them ideal for quick and efficient cleaning during diaper changes and on-the-go hygiene. The increasing awareness about the importance of maintaining hygiene for infants, especially during the early years, has significantly boosted the demand for wet wipes. Additionally, wet wipes are often enriched with gentle and moisturizing ingredients, making them suitable for infants' sensitive skin, which appeals to health-conscious parents. The rise of eco-friendly and biodegradable wet wipes has attracted environmentally conscious consumers, contributing to market growth. Furthermore, the expanding product variety, including wipes with natural and organic ingredients, caters to the diverse preferences of modern parents.

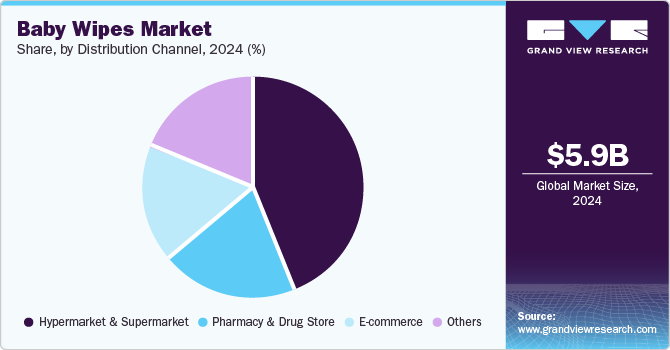

Distribution Channel Insights

Hypermarkets/supermarkets dominated the market with the largest revenue share in 2024. These retail channels offer a wide range of baby care products under one roof, making it convenient for parents to purchase all their baby essentials in a single trip. The extensive availability and accessibility of baby wipes in hypermarkets and supermarkets and frequent promotions and discounts make these retail outlets an attractive shopping destination. Additionally, the ability for consumers to physically examine and compare products in-store enhances their shopping experience and builds trust in the quality of the products. The strong presence of well-known brands and the availability of various product options cater to the diverse needs and preferences of parents, further solidifying the market position of hypermarkets and supermarkets in the baby wipes market.

The e-commerce segment is expected to grow at the fastest CAGR over the forecast period. The convenience and ease of online shopping have become increasingly appealing to parents, allowing them to purchase baby wipes and other essentials from the comfort of their homes. E-commerce platforms offer a wide range of products, enabling parents to compare brands, read reviews, and make informed decisions. The rise of digital marketing and targeted advertising has significantly boosted the visibility and attractiveness of baby wipes sold online. Additionally, subscription services and bulk purchase options available through e-commerce platforms provide added convenience and cost savings for consumers. The ability to access a variety of eco-friendly and specialized baby wipes online caters to the evolving preferences of health-conscious and environmentally aware parents.

Regional Insights

North America baby wipes market dominated the global industry with the largest revenue share of 29.0% in 2024. The region boasts a high awareness of infant hygiene and health among parents, which drives the demand for convenient and effective baby wipes. The increasing number of dual-income households and the growing disposable incomes in the region have further contributed to the market expansion, as parents are more willing to invest in premium baby care products. The presence of well-established brands and a wide range of product offerings, including natural and organic options, cater to the diverse preferences of North American consumers. Additionally, the robust retail infrastructure, encompassing supermarkets, hypermarkets, and a rapidly growing e-commerce sector, ensures wide accessibility and availability of baby wipes.

U.S. Baby Wipes Market Trends

The U.S. baby wipes industry is expected to grow significantly over the forecast period owing to the increasing awareness of hygiene and health among parents, the rising disposable incomes, and the growing preference for convenient and effective baby care products. The trend towards natural and organic products, along with innovations in product formulations, has also contributed to the market expansion.

Europe Baby Wipes Market Trends

Europe baby wipes industry was identified as a lucrative region in 2024. The region's stringent regulations on using chemicals in baby care products have prompted manufacturers to develop more natural and organic wipes, which are increasingly favored by health-conscious parents. European consumers are also highly environmentally conscious, leading to a growing demand for biodegradable and eco-friendly baby wipes. The influence of educational campaigns and initiatives promoting the importance of infant hygiene has further boosted market growth. Additionally, well-established brands and a robust retail infrastructure, including supermarkets, hypermarkets, and online stores, ensure wide accessibility and availability of baby wipes. The trend towards sustainable living and the increasing use of natural ingredients in baby wipe formulations align with the preferences of European consumers, driving the market's growth in the region.

Asia Pacific Baby Wipes Market Trends

Asia Pacific baby wipes industry is expected to grow at a significant CAGR of 5.5% over the forecast period. The region’s growth is attributed to the increasing urbanization, rising disposable incomes, and a growing middle class. The expanding awareness of infant hygiene and health among parents in countries such as China, India, and Japan has significantly expanded the market. The region's diverse consumer base, ranging from highly urbanized areas to rural communities, presents a wide range of opportunities for market penetration. The influence of social media and digital marketing has enhanced the visibility and appeal of baby wipes, particularly among younger parents who prioritize convenience and quality. The availability of various baby wipes, including natural and hypoallergenic options, caters to the specific needs and preferences of the region's consumers. Additionally, the expansion of e-commerce platforms has made it easier for consumers to access and purchase baby wipes, further supporting market growth. Local manufacturers are also innovating with plant-based and eco-friendly ingredients to meet the growing demand for sustainable and safe baby care products in the Asia Pacific region.

Key Baby Wipes Company Insights

Some key companies in the baby wipes market include Johnson & Johnson Services, Inc., KCWW, Unicharm Corporation, BABISIL, Farlin-Global and others.

-

Johnson & Johnson Services, Inc. is a leading player in the baby wipes industry, offering a range of high-quality and trusted products. Its Johnson's Baby Wipes are designed to keep babies' skin clean, soft, and healthy. These wipes are made with gentle, soap-free, and alcohol-free formulas, making them suitable for even the most sensitive skin.

-

Procter & Gamble is another major player in the baby wipes market. It offers a variety of baby care products, including diapers, wipes, training pants, and laundry products, making it a one-stop solution for parents' baby care needs.

Key Baby Wipes Companies:

The following are the leading companies in the baby wipes market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- KCWW

- Procter & Gamble

- Unicharm Corporation

- BABISIL

- Cotton Babies, Inc.

- Farlin-Global

- Hengan International Group Company Ltd.

- Himalaya Wellness Company

- Pigeon Corporation

Recent Developments

-

In May 2024, Cugo, a baby care solutions company, launched eco-friendly baby wipes, emphasizing its commitment to high-quality, sustainable baby essentials. The wipes are crafted with 99.9% water and made from 100% biodegradable plant-based materials, ensuring safety for infants and the environment.

-

In March 2024, Baby2Baby, in partnership with Huggies, launched a program timed for Mother's Day 2024 to provide essential support to new mothers and infants.

-

In June 2023, Ginni Filaments Ltd. introduced ‘paaniwipes,’ the first ultra-pure water wipes tailored to the baby care segment in India. Comprising 99.9% water, these wipes are designed to be exceptionally gentle on infants’ skin, featuring minimal ingredients that prioritize safety. Made from soft, skin-friendly, nonwoven spun lace fabric, they aim to prevent rashes and redness. Enriched with aloe vera, these wipes also provide hydration and help reduce skin inflammation, offering a soothing experience during clean-up sessions.

Baby Wipes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.20 billion

Revenue forecast in 2030

USD 7.99 billion

Growth Rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Johnson & Johnson Services, Inc.; KCWW; Procter & Gamble; Unicharm Corporation; BABISIL; Cotton Babies, Inc.; Farlin-Global; Hengan International Group Company Ltd.; Himalaya Wellness Company; Pigeon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Wipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby wipes market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Wipes

-

Wet Wipes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarket

-

Pharmacy & Drug Store

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.