- Home

- »

- Clothing, Footwear & Accessories

- »

-

Back To College Market Size & Share, Industry Report, 2033GVR Report cover

![Back To College Market Size, Share & Trends Report]()

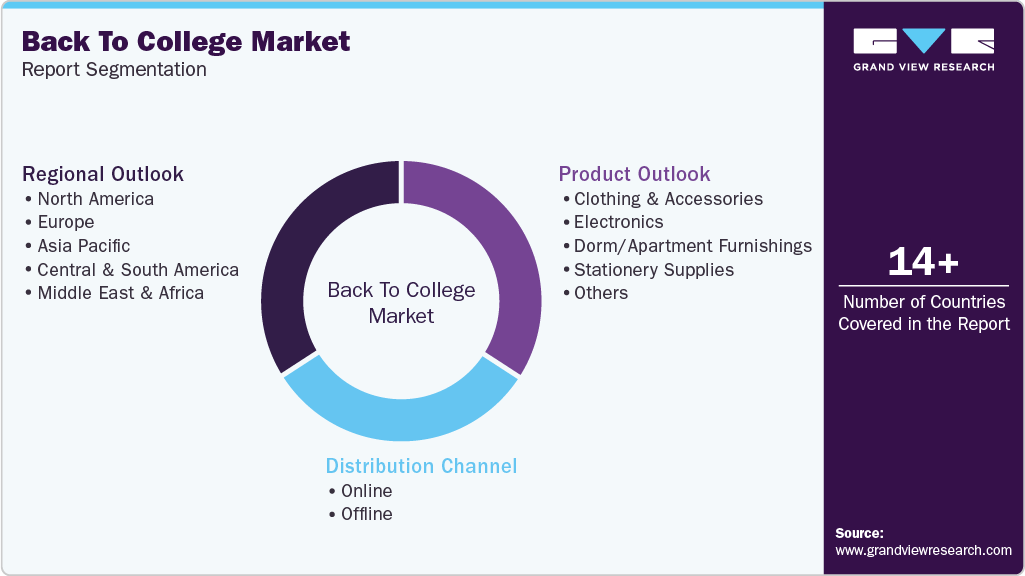

Back To College Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Clothing & Accessories, Electronics, Dorm/Apartment Furnishings, Stationery Supplies), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-926-4

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Back To College Market Summary

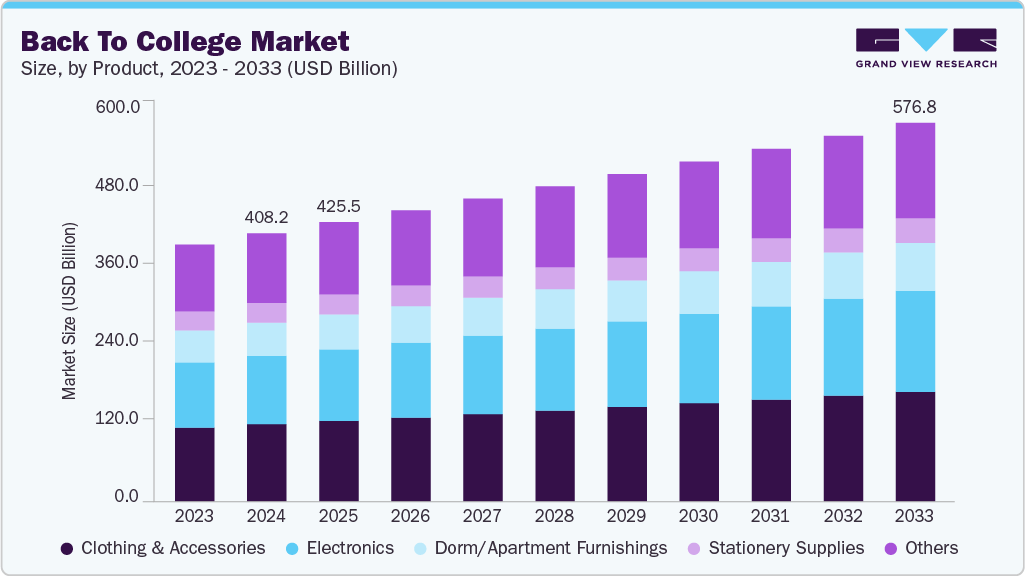

The global back to college market size was estimated at USD 408.19 billion in 2024 and is projected to reach USD 576.78 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The market is driven by evolving consumer behavior, technological advancements, and shifting educational paradigms.

Key Market Trends & Insights

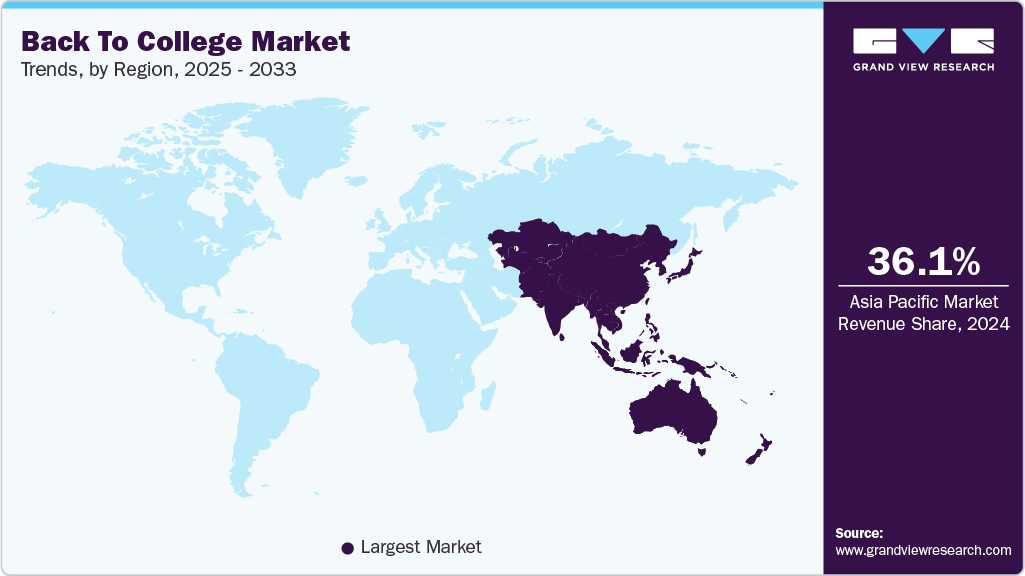

- Asia Pacific held the largest share of 36.07% in the back to college market in 2024.

- The back to college market in China is expected to grow at a significant CAGR over the forecast period.

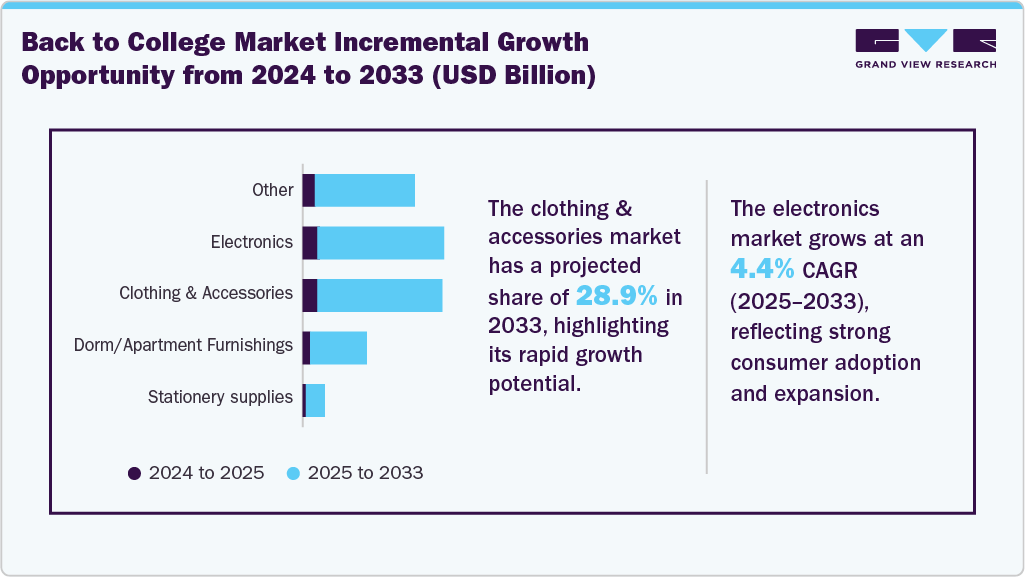

- By product, the clothing & accessories market held the largest share of 28.8% in 2024.

- By product, the electronics market is experiencing a single-digit growth, exhibiting a CAGR of 4.4% over the forecast period.

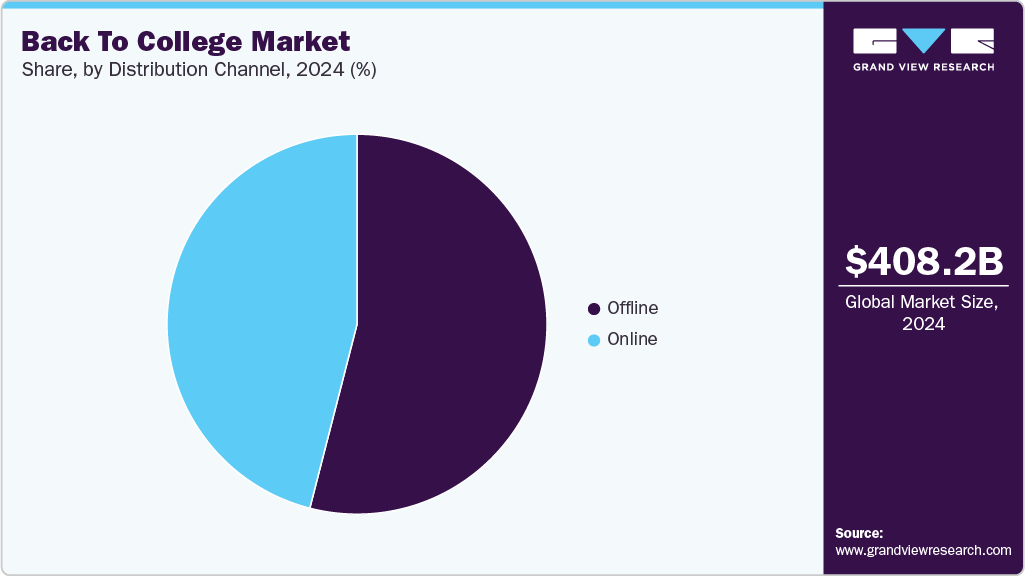

- By distribution channel, the offline back to college distribution channel led the market and accounted for a share of 54.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 408.19 Billion

- 2033 Projected Market Size: USD 576.78 Billion

- CAGR (2025-2033): 3.9%

- Asia Pacific: Largest market in 2024

As more students pursue higher education, through traditional or online formats, the demand for essential supplies and services continues to rise. A heightened focus on academic performance further fuels the surge. The integration of technology in education and the expansion of online learning platforms also contribute to market growth. Students are increasingly seeking not only traditional school supplies but also innovative products, such as tech gadgets, smart accessories, and digital resources that enhance their overall learning experience.Moreover, one of the key trends shaping the back to college market is the growing focus on mental well-being and overall wellness. With a heightened emphasis on maintaining a balanced lifestyle, colleges and universities are encouraging students to prioritize self-care and stress management. In response, retailers are expanding their back to college assortments to include not only academic necessities but also wellness products that support students’ holistic needs. In July 2025, Apparel Group launched its “Back to Style” campaign across the UAE, offering a mix of apparel, footwear, accessories, and beauty essentials to mark the return to school and campus life.

Furthermore, sustainability is becoming a major driver of consumer choices in the back to college industry. Today's students are increasingly environmentally conscious and are seeking products that align with their values. This growing demand has prompted companies to adopt sustainable practices, from offering eco-friendly stationery to sourcing materials ethically for college gear and apparel. In August 2024, Nautica’s Fall 2024 “Back to Campus” collection debuted, celebrating classic American collegiate style with polos, sweaters, jackets, and shirts highlighted by athletes Livvy Dunne and Luther Burden III. The collection also prioritizes sustainability, incorporating durable, responsibly sourced materials built for longevity.

In addition, convenience and accessibility remain top priorities, driving the growth of e-commerce as students increasingly choose online shopping over navigating crowded physical stores. Features such as virtual try-on for clothing, the ability to bundle supplies with tech gadgets, and efficient delivery services have simplified the back to college shopping experience. Retailers are also using data analytics to gain deeper insights into consumer preferences, allowing them to tailor their offerings to meet the needs of a digitally savvy student population.

Evolving college living arrangements are shaping back to college consumer preferences. With more students living off-campus or in shared spaces, demand is rising for versatile, space-saving products, such as modular furniture, smart storage, and adaptable décor. Retailers are responding by offering curated collections that balance functionality, style, and affordability, making it essential for businesses to align with these trends to capture market share.

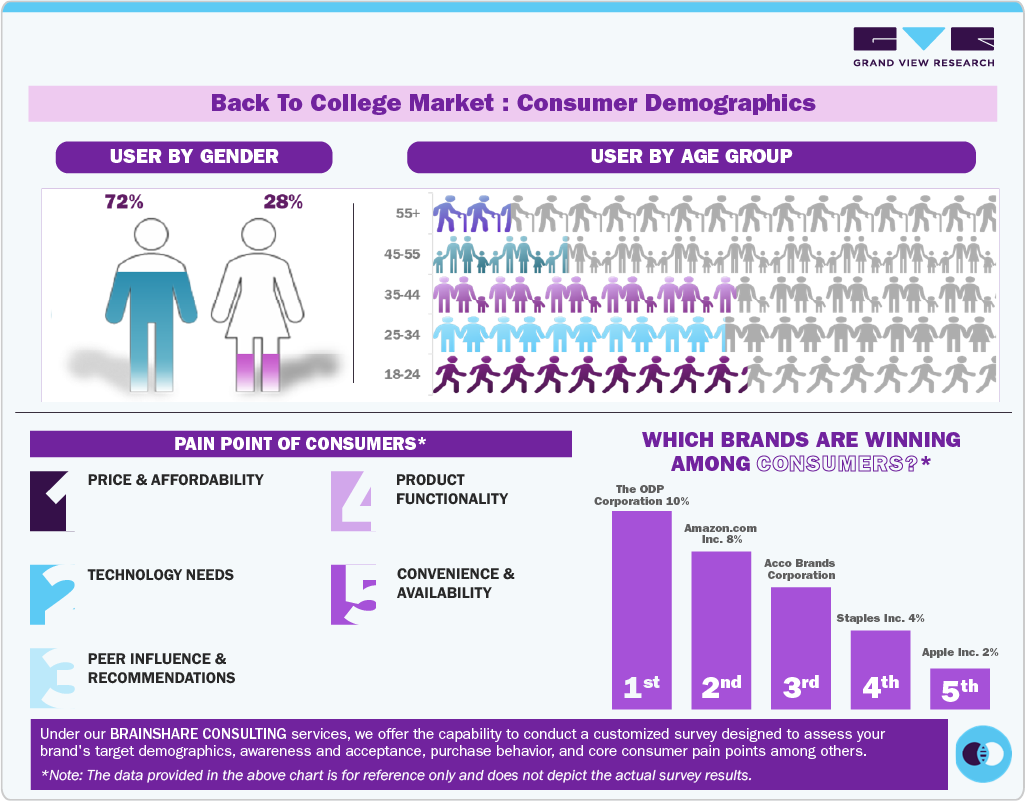

Consumer Insights for Back to College

Product Insights

The clothing & accessories segment accounted for a share of 28.8% of the global revenue in 2024. The segment is driven by a mix of fashion trends, personal expression, and practicality. Students are increasingly seeking versatile, stylish, and comfortable outfits that are suitable for both campus life and social activities. The rise of athleisure and casual wear reflects the rising demand for multifunctional clothing. Accessories, including backpacks, tech-friendly bags, and wearable gadgets, are gaining popularity for their convenience and style. Seasonal trends, influencer-driven fashion, and social media exposure further fuel the demand in this segment.

The electronics market is expected to grow at a CAGR of 4.4% from 2025 to 2033. The growth is driven by the increasing reliance on technology for learning, communication, and entertainment. Laptops, tablets, and smartphones are essential for online classes, research, and collaborative projects. Accessories such as headphones, smartwatches, and portable chargers enhance convenience and productivity. The rise of digital learning platforms and hybrid education models has further increased demand for tech devices. Additionally, students are influenced by brand trends, performance features, and affordability when selecting electronics. In 2025, Lenovo launched a “Back‑to‑College” campaign offering student discounts on laptops, gaming PCs, and accessory bundles. Deals include the Yoga Aura Ultra 7 OLED laptop, Legion gaming PCs, Slim 5 AI workstations, and the IdeaPad 5 2‑in‑1 series.

Distribution Channel Insights

The sales of back to college products through offline channels accounted for a revenue share of 54.3% in 2024. The offline distribution channel is driven by students’ preference for a tactile shopping experience, which allows them to see, touch, and try products before making a purchase. Physical stores offer immediate availability of essential items, from apparel to electronics and stationery. Seasonal promotions, discounts, and in-store events attract students looking for value deals. The convenience of nearby retail locations and personalized customer service further enhances appeal. Besides, brand visibility and merchandising in brick-and-mortar stores play a key role in influencing purchasing decisions.

The sales of back to college through online channels are expected to grow at a CAGR of 4.5% from 2025 to 2033. The online distribution channel is strengthened by convenience, time-saving, and wide product availability. Students prefer e-commerce platforms for their ease of use, home delivery options, and access to exclusive online deals. Features such as virtual try-ons, bundle offers, and customizable products enhance the shopping experience. The growing use of mobile apps and digital wallets further facilitates seamless transactions. Additionally, personalized recommendations and data-driven marketing help retailers target digitally savvy students effectively.

Regional Insights

The North America back to college market accounted for a revenue share of over 22.2% in 2024. The regional market is driven by high college enrollment rates and a strong culture of campus life. Technological integration in classrooms and widespread adoption of e-learning tools fuel demand for electronics and study aids. Students increasingly prioritize wellness, convenience, and lifestyle-oriented products. Seasonal promotions and brand loyalty significantly influence purchasing behavior. Furthermore, diverse campus activities drive demand for clothing, accessories, and multifunctional dorm essentials. For instance, Amazon Canada launched its 2025 Back-to-School & University deals, with discounts on laptops, dorm-room gear, bedding, school supplies, and more. It’s also offering a Prime Young Adults plan: 6 months free, then $4.99/month (or $49/year) for students aged 19-24 or enrolled in college/university.

U.S. Back To College Market Trends

The U.S. back to college industry led the North American market in 2024, holding the largest market share with 88.6% of the region’s total revenue. Affordability and value-driven shopping are major factors, with students seeking budget-friendly options and discounts. The rise of hybrid learning models has boosted demand for laptops, tablets, and online learning subscriptions. Social media and influencer trends heavily impact fashion and accessories choices. College-specific partnerships and loyalty programs encourage brand engagement. Urbanization and the prevalence of off-campus housing increase demand for compact, functional dorm products.

Europe Back To College Market Trends

The back to college industry in Europe is expected to grow at a CAGR of 3.9% from 2025 to 2033. Sustainability and eco-friendly products are key drivers, as students increasingly prefer ethically sourced clothing, reusable stationery, and energy-efficient electronics. Multi-purpose living solutions are in demand due to the increasing trend of smaller dorm and apartment sizes. Digitalization in education promotes the use of online resources and e-learning tools. Cultural diversity across countries shapes regional preferences in fashion and lifestyle products. Local retail experiences, pop-up stores, and seasonal fairs further influence purchasing patterns.

The Germany back to college industry has gained ground due to the demand for quality, durability, and efficiency. Students prefer high-quality, functional products such as ergonomic furniture, reliable electronics, and long-lasting study supplies. Eco-consciousness is particularly strong, driving demand for sustainable and locally produced goods. University infrastructure and campus support services encourage purchases of practical tools and accessories. In addition, structured retail networks and seasonal promotions play a key role in shaping consumer choices.

The back to college industry in the UK is witnessing a transformative shift, particularly in light of the recent push towards online and hybrid learning models. The surge in enrollment numbers has rejuvenated the demand for educational materials, technology, and focused learning resources. Moreover, the emphasis on student well-being and mental health has become paramount, leading institutions to provide more comprehensive support systems. With student loans and tuition fees being a significant concern, there is an increasing preference for budget-conscious shopping habits that encompass second-hand books, shared tech resources, and multi-use products that cater to students' varying needs.

Asia Pacific Back To College Market Trends

The Asia Pacific back to college industry is projected to grow at the fastest CAGR of 4.5% from 2025 to 2033. Rapid urbanization and rising disposable incomes are driving increased spending on premium technology, apparel, and lifestyle products. The expansion of online learning platforms and edtech solutions has fueled the demand for electronics and digital subscriptions. Brand-conscious youth have shown a preference for trendy, high-quality clothing and accessories. Family involvement in purchasing decisions also impacts buying patterns. Furthermore, seasonal festivals and regional promotions strongly influence back to college sales.

The back to college industry in China is experiencing rapid growth, primarily driven by the increasing number of students pursuing higher education. As the country continues to undergo significant economic development, there has been a surge in enrollment rates, especially in Science, Technology, Engineering, and Mathematics. This rising demographic has led to heightened demand for not only educational materials and supplies but also technology products that cater to academic needs. E-commerce platforms play a crucial role in facilitating access to a diverse range of products, allowing students to shop conveniently and efficiently, aligning with their tech-savvy lifestyles.

The India back to college industry is driven by a burgeoning youth population, with a significant increase in enrollments across universities and vocational institutions. Factors such as globalization and technological advancements have transformed educational pathways, allowing students greater access to global resources and courses. The demand for affordable educational supplies, technology, and supplementary learning materials is rapidly expanding, catering to both traditional college students and a growing populace leaning toward online education. Moreover, the popularity of competitive academic programs has led to an increase in preparatory tutoring and coaching services, influencing the purchasing decisions of students and their families.

Central & South America Back To College Market Trends

The back to college industry in Central and South America is experiencing revitalization, particularly as educational institutions adapt to new modes of learning in the wake of the pandemic. The demand for educational materials, particularly digital resources and online courses, has surged as students seek flexible learning options. Governments and private organizations are increasingly investing in technology to bridge the educational gap, leading to significant growth in the market for laptops, tablets, and educational software. The rise of affordable tech solutions and internet accessibility is allowing more students to engage in higher education, further stimulating the market.

Middle East & Africa Back To College Market Trends

The back to college industry in the Middle East & Africa is witnessing steady growth owing to a diverse set of socio-economic factors and rapid educational reform initiatives. Higher education is increasingly viewed as a vital pathway for social mobility, particularly in emerging economies within the region. This increased awareness drives demand for educational products and services, including textbooks, technology solutions, and supplementary learning materials. With government initiatives aimed at enhancing educational access and quality, there has been a substantial investment in infrastructure and resources that support the back to college market, particularly in urban areas.

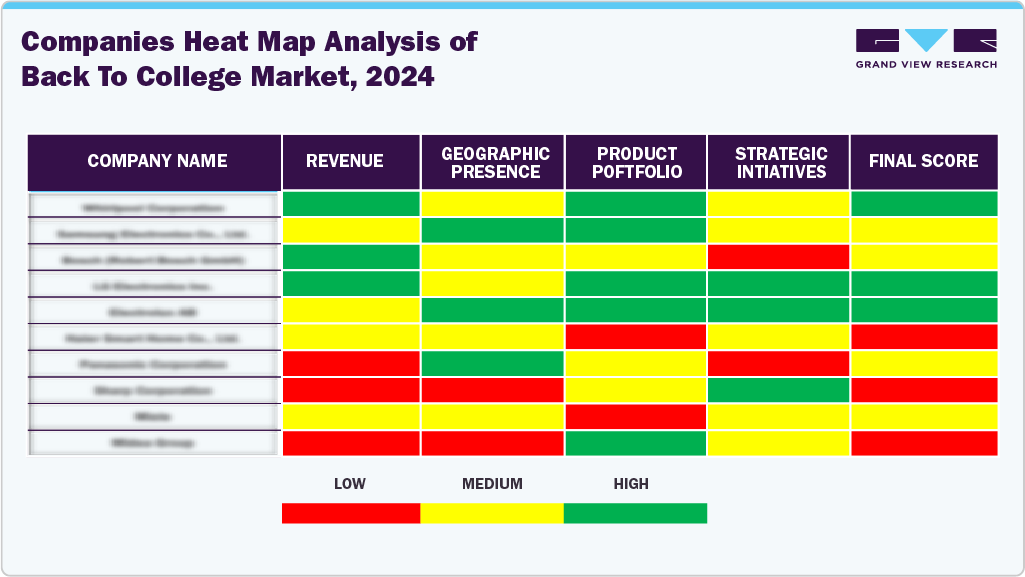

Key Back To College Company Insights

Brands are seizing growth opportunities by introducing innovative products, offering personalized options, and tailoring marketing strategies to evolving student preferences. By targeting niche segments and emerging trends—such as wellness products, tech gadgets, and sustainable supplies, they aim to increase market share and strengthen their competitive positioning globally.

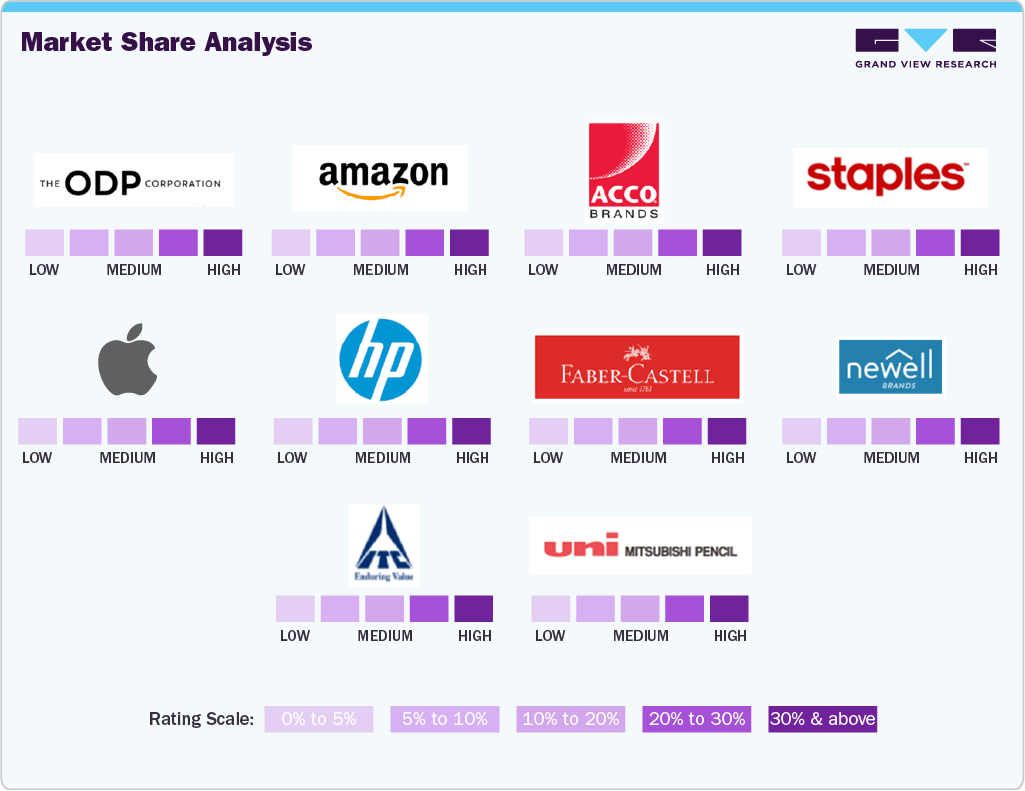

Key Back To College Companies:

The following are the leading companies in the back to college market. These companies collectively hold the largest market share and dictate industry trends.

- The ODP Corporation

- Amazon.com, Inc.

- Acco Brands Corporation

- Staples Inc.

- Apple Inc.

- HP Inc.

- Faber Castell AG

- Newell Brands Inc.

- ITC Ltd.

- Mitsubishi Pencil Co. Ltd.

Recent Developments

-

In August 2025, Lenovo launched a “Back‑to‑College” campaign offering student discounts on laptops, gaming PCs, and accessory bundles. Deals include its Yoga Aura Ultra 7 OLED laptop, Legion gaming PCs, Slim 5 AI workstations, and the IdeaPad 5 2‑in‑1 series.

-

In September 2024, Linc Ltd, a stationery products manufacturer, announced a joint venture with Mitsubishi Pencil Company of Japan, with Mitsubishi holding a 51% stake. This partnership aims to leverage advanced Japanese technology to produce high-quality, affordable writing instruments specifically designed for the Indian market. The collaboration is expected to enhance Linc's product offerings, improve production efficiency, and meet the growing demand for premium stationery among Indian consumers.

-

In June 2024, Office Depot LLC entered into a partnership with Dormify, an online retailer specializing in dorm décor, to expand its selection of college dorm necessities and school supplies. This collaboration enables Office Depot to leverage Dormify's robust online presence and niche focus, making it more attractive to Gen Z students. By joining forces, the partnership fosters product innovation, extends market reach, and enhances customer engagement, providing a comprehensive one-stop solution for back-to-school shopping.

Back To College Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 425.50 billion

Revenue forecast in 2033

USD 576.78 billion

Growth rate

CAGR of 3.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million units and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

The ODP Corporation; Amazon.com, Inc.; Acco Brands Corporation; Staples Inc.; Apple Inc.; HP Inc.; Faber Castell AG; Newell Brands Inc.; ITC Ltd.; Mitsubishi Pencil Co. Ltd.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Back To College Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global back to college market report based on product, distribution channel, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Clothing & Accessories

-

Electronics

-

Dorm/Apartment Furnishings

-

Stationery Supplies

-

Others

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global back to college market size was estimated at USD 408.2 billion in 2024 and is expected to reach USD 425.5 billion in 2025.

b. The global back to college market is expected to grow at a compound annual growth rate (CAGR) of 3.9 % from 2025 to 2033 to reach USD 576.8 billion by 2033.

b. The clothing & accessories market accounted for a revenue share of 28.8% in 2024, driven by back-to-college season, the clothing and accessories market is fueled by students’ demand for trendy, affordable, and versatile fashion.

b. Some key players operating in the back to college market include The ODP Corporation; Amazon.com, Inc.; Acco Brands Corporation; Staples Inc.; Apple Inc.; HP Inc.; Faber Castell AG; Newell Brands Inc.; ITC Ltd.; and Mitsubishi Pencil Co. Ltd.

b. Key factors driving growth in the back-to-college market include increasing student enrollment and the rising demand for trendy, budget-friendly clothing and accessories. Seasonal promotions, targeted marketing campaigns, and social media influence play a significant role in shaping purchase decisions. Additionally, the growing emphasis on personalization and lifestyle-oriented products enhances consumer engagement and boosts overall market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.