- Home

- »

- Plastics, Polymers & Resins

- »

-

Bakelite Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Bakelite Market Size, Share & Trends Report]()

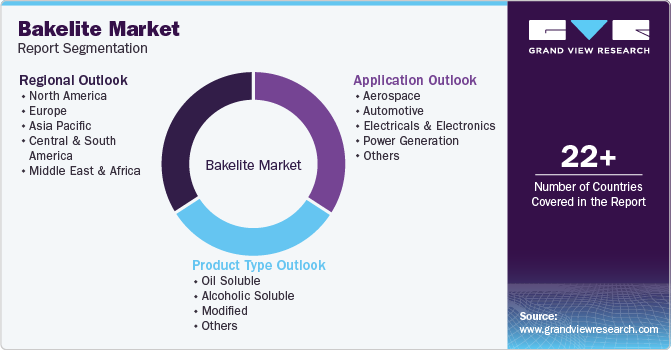

Bakelite Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Oil Soluble, Alcoholic Soluble, Modified), By Application (Automotive, Aerospace, Electricals & Electronics, Power Generation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-535-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bakelite Market Size & Trends

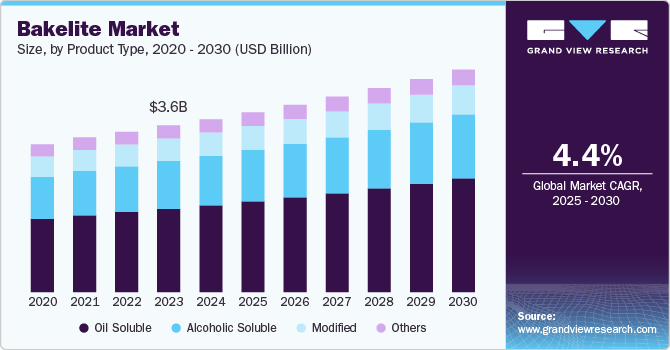

The global Bakelite market size was estimated at USD 3.68 billion in 2024 and expected to grow at a CAGR of 4.35% from 2025 to 2030. The growing demand for fire-resistant product types in the construction and automotive industries is driving the use of Bakelite, as it offers excellent thermal stability and flame-retardant properties.

The Bakelite industry is witnessing a resurgence in demand due to the growing preference for high-performance, heat-resistant, and electrically insulating materials across multiple industries. In sectors like electronics, automotive, and aerospace, Bakelite’s superior mechanical strength and thermal stability make it an attractive alternative to conventional plastics and metals. Additionally, as industries push for lightweight and durable components, Bakelite’s ability to replace heavier materials in electrical housings, brake pads, and circuit boards is driving its relevance. Moreover, with the increasing adoption of phenolic resins in sustainable product designs, manufacturers are investing in advanced Bakelite formulations to enhance performance while aligning with environmental regulations.

Drivers, Opportunities & Restraints

The rapid expansion of the electrical and electronics industry is a key driver for the Bakelite market, as its exceptional insulating properties and high resistance to heat make it indispensable in switchboards, circuit breakers, and electrical panels. With the rise in global electrification projects, smart grid development, and the proliferation of consumer electronics, the need for thermosetting plastics like Bakelite is on an upward trajectory. Furthermore, industries are shifting toward more durable and low-maintenance materials, increasing the adoption of Bakelite in high-voltage insulation systems and precision engineering applications. Its cost-effectiveness and longevity compared to other polymers also add to its competitive advantage in industrial applications.

The push for sustainable material innovation presents a significant opportunity for the market, especially with advancements in bio-based phenolic resins. As regulatory frameworks tighten around hazardous chemicals and carbon-intensive manufacturing, there is a growing incentive for companies to develop eco-friendly alternatives to traditional Bakelite formulations. By integrating renewable feedstocks and improving recyclability, manufacturers can cater to sustainability-focused industries such as green electronics and renewable energy infrastructure. Additionally, expanding industrial applications in emerging markets, particularly in Asia-Pacific and Latin America, provide new revenue streams for market players looking to capitalize on increasing manufacturing activity and infrastructure development.

Despite its industrial advantages, the Bakelite industry faces constraints due to environmental concerns and regulatory limitations regarding formaldehyde-based resins. The production process involves hazardous chemicals that raise safety and environmental compliance challenges, especially in regions with strict emission standards. Additionally, the material’s brittle nature limits its use in applications requiring high impact resistance, reducing its competitiveness against advanced polymers and composites. Furthermore, as industries increasingly adopt alternative thermosetting resins with enhanced flexibility and sustainability profiles, Bakelite’s growth potential may be hindered unless innovations in formulation and processing technology address these limitations.

Product Type Insights

Oil soluble dominated the market across the product segmentation in terms of revenue, accounting for a market share of 50.09% in 2024 driven by the increasing use of oil soluble Bakelite in industrial lubrication and high-performance coatings. As industries seek materials that enhance thermal resistance and mechanical durability in extreme operating conditions, oil soluble phenolic resins are gaining traction in applications like heavy-duty machinery components and corrosion-resistant coatings. Additionally, with the rising demand for advanced lubricants in sectors such as marine, energy, and manufacturing, Bakelite’s ability to improve viscosity stability and wear resistance in lubricant formulations is positioning it as a critical material in industrial maintenance solutions.

The alcoholic-soluble Bakelite segment is witnessing growth due to its expanding role in adhesives, varnishes, and specialty coatings where fast curing and high chemical stability are essential. Industries such as electronics, furniture, and wood processing are increasingly adopting these resins to enhance surface durability and adhesion strength in high-performance finishes. Moreover, as the demand for solvent-based, quick-drying protective coatings rises in applications such as metal fabrication and decorative laminates, manufacturers are innovating with advanced phenolic resin formulations to improve resistance against moisture, heat, and chemicals while maintaining efficiency in production processes.

Application Insights

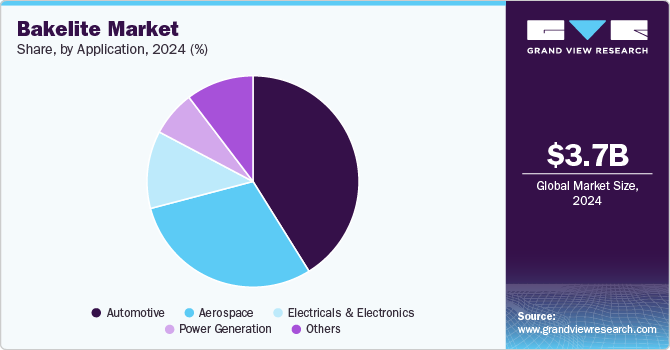

Automotive dominated the Bakelite market and accounted for a revenue share of 41.14% in 2024. In the automotive industry, the shift toward lightweight yet high-strength materials is fueling the demand for Bakelite in critical components such as brake pads, clutch plates, and ignition systems. As electric vehicles (EVs) gain momentum, Bakelite’s superior electrical insulation and heat resistance make it a preferred choice in battery enclosures, power distribution systems, and sensor housings. Furthermore, stringent fuel efficiency and emission regulations are pushing automakers to integrate durable, thermally stable materials that can replace heavier metals without compromising safety or performance, further strengthening Bakelite’s role in modern vehicle manufacturing.

The aerospace sector is driving the increased adoption of Bakelite due to its exceptional heat resistance, lightweight nature, and ability to withstand high mechanical stress, making it ideal for interior panels, insulation components, and structural reinforcements. With the aviation industry prioritizing fuel efficiency and sustainability, aircraft manufacturers are integrating advanced phenolic resin composites to reduce overall weight while maintaining high safety standards. Additionally, the growing need for non-conductive, fire-resistant materials in avionics and cabin interiors is pushing innovation in Bakelite formulations, ensuring compliance with stringent aerospace safety regulations and performance expectations.

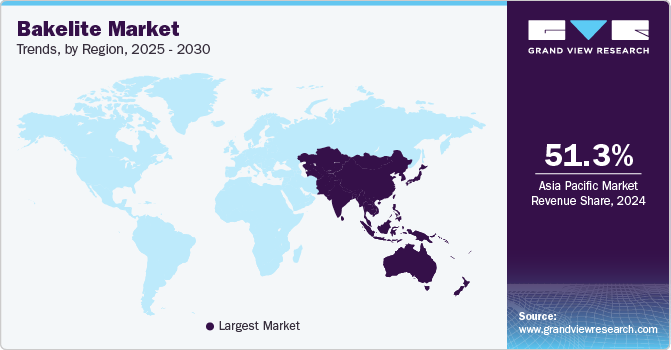

Regional Insights

The Bakelite industry in North America is driven by the rapid expansion of the electronics and electrical insulation industries, where high-performance thermosetting resins are essential for advanced circuitry, switchgear, and protective casings. As the region continues to invest in modernizing electrical grids and expanding renewable energy infrastructure, the demand for durable, heat-resistant materials is increasing. The rise of Industry 4.0 and automation in manufacturing is fueling the need for high-precision components that can withstand mechanical and thermal stress, positioning Bakelite as a key material for next-generation industrial applications.

U.S. Bakelite Market Trends

In the U.S., the growing emphasis on defense, aerospace, and automotive manufacturing is a major driver for the Bakelite industry. With increasing federal investments in military-grade equipment and aircraft production, there is a rising need for lightweight, heat-resistant, and electrically insulating materials that can enhance operational efficiency and safety. Additionally, the rapid growth of electric vehicles (EVs) in the U.S. is boosting demand for Bakelite in battery enclosures, circuit boards, and high-voltage insulation systems. As sustainability regulations tighten, manufacturers are also exploring advanced phenolic resins with improved environmental profiles, further driving innovation in the domestic Bakelite industry.

Asia Pacific Bakelite Market Trends

Asia Pacific dominated the global Bakelite industry and accounted for largest revenue share of 51.27% in 2024. In the broader Asia Pacific region, the market is gaining momentum due to the rapid growth of automotive and construction industries in emerging economies such as India, Indonesia, and Vietnam. As governments in the region invest in large-scale infrastructure projects, the demand for fire-resistant and chemically stable materials in insulation, paneling, and industrial applications is on the rise.

China’s Bakelite market’s growth is driven by the country’s dominance in manufacturing and industrial production, particularly in sectors such as electronics, consumer goods, and heavy machinery. As the country continues its push for self-sufficiency in semiconductor manufacturing and high-tech electronics, the need for durable, heat-resistant phenolic resins is growing. Moreover, China’s rapid urbanization and expansion of electrical infrastructure are increasing demand for Bakelite in circuit breakers, switchboards, and insulation materials. Government initiatives to improve fire safety standards and industrial efficiency are further encouraging the adoption of high-performance thermosetting resins across multiple industries.

Europe Bakelite Market Trends

Europe's Bakelite industry is being propelled by stringent environmental regulations and the push for sustainable, high-performance materials in industrial applications. With the European Union enforcing strict restrictions on carbon emissions and hazardous substances, manufacturers are increasingly turning to phenolic resins with lower environmental impact for applications in construction, automotive, and electronics. The rise of energy-efficient buildings and the adoption of fire-resistant materials in infrastructure projects are also contributing to higher demand for Bakelite.

Key Bakelite Company Insights

The market for Bakelite is highly competitive, with several key players dominating the landscape. Major companies include Elkor, Hengshui Chemical Plant, Hexion, Krishna Hylam Bakelite Products, Nimrod Plastics, Bakelite Synthetics, Sumitomo Bakelite Co., Ltd., and Fuji Bakelite Co., Ltd. The market is characterized by a competitive landscape with several key players driving innovation and growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Bakelite Companies:

The following are the leading companies in the Bakelite market. These companies collectively hold the largest market share and dictate industry trends.

- Elkor

- Hengshui Chemical Plant

- Hexion

- Krishna Hylam Bakelite Products

- Nimrod Plastics

- Bakelite Synthetics

- Sumitomo Bakelite Co., Ltd.

- Fuji Bakelite Co., Ltd.

Recent Developments

-

In August 2023, Bakelite Synthetics finalized its acquisition of LRBG Chemicals, a company specializing in resins and related products for various sectors like construction and transportation. This move allows Bakelite Synthetics to broaden its product range, customer base, and overall growth strategy. Additionally, the acquisition gives Bakelite Synthetics a foothold in Canada, improving service to customers in both the northeastern U.S. and Canada.

-

In January 2024, Bakelite Synthetics announced a partnership with Women in Chemicals, a non-profit organization focused on empowering women within the chemical industry. Bakelite's commitment includes an annual corporate sponsorship and sponsoring Women in Chemicals' inaugural conference in Houston.

Bakelite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.82 billion

Revenue forecast in 2030

USD 4.74 billion

Growth rate

CAGR of 4.35% from 2024 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Elkor; Hengshui Chemical Plant; Hexion; Krishna Hylam Bakelite Products; Nimrod Plastics; Bakelite Synthetics; Sumitomo Bakelite Co., Ltd.; Fuji Bakelite Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bakelite Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Bakelite market report based on product type, application, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil Soluble

-

Alcoholic Soluble

-

Modified

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Automotive

-

Electricals & Electronics

-

Power Generation

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Bakelite market size was estimated at USD 3.68 billion in 2024 and is expected to reach USD 3.83 billion in 2025.

b. The global Bakelite market is expected to grow at a compound annual growth rate of 4.35% from 2025 to 2030 to reach USD 4.74 billion by 2030.

b. Oil soluble dominated the bakelite market across the product segmentation in terms of revenue, accounting for a market share of 50.09% in 2024 driven by the increasing use of oil soluble bakelite in industrial lubrication and high-performance coatings.

b. Some key players operating in the Bakelite market include Elkor, Hengshui Chemical Plant, Hexion, Krishna Hylam Bakelite Products, Nimrod Plastics, Bakelite Synthetics, Sumitomo Bakelite Co., Ltd., and Fuji Bakelite Co., Ltd.

b. The growing demand for fire-resistant product types in the construction and automotive industries is driving the use of Bakelite, as it offers excellent thermal stability and flame-retardant properties.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.