- Home

- »

- Homecare & Decor

- »

-

Bamboo Furniture Market Size, Share & Growth Report, 2030GVR Report cover

![Bamboo Furniture Market Size, Share & Trends Report]()

Bamboo Furniture Market Size, Share & Trends Analysis Report By Type (Chair & Tables, Stools, Beds), By End Use (Residential, Commercial), By Region (Europe, APAC, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-388-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Bamboo Furniture Market Size & Trends

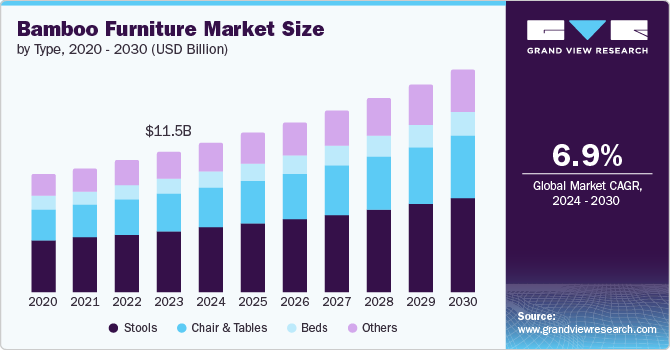

The global bamboo furniture market size was valued at USD 11.5 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. This growth is attributed to a combination of environmental awareness, versatility, and the durable nature of bamboo and its use across various businesses. In addition, the growing demand for durable and aesthetically pleasing furniture that can withstand daily use is fueling the adoption of bamboo, which is known for its inherent strength and natural beauty. Furthermore, Government initiatives promoting the use of eco-friendly materials, along with innovations in bamboo processing and manufacturing techniques, are further expanding the market opportunities for bamboo furniture globally.

The durability of the natural green material bamboo, its lightweight, and its bending strength make it hard and flexible. Hence, designers are currently promoting it widely as a green material for creating and designing furniture. Moreover, consumers are becoming more aware of their health and environment. In addition, rising consumer awareness and demand for sustainable furniture options is a significant driver. Bamboo's eco-friendly properties, rapid growth rate, and renewability make it an attractive alternative to traditional wood. Heightened deforestation and climate change concerns have increased consumer preference for bamboo furniture to reduce their environmental impact.

Companies are focusing on innovative decisions and inducing green practices in their products and organizations to sustain the market on the path towards sustainability and meet the demands. Many customers have opted for eco-friendly furniture materials, and bamboo is one of the most versatile, green, and renewable natural resources to meet the requirements; combining factors is expected to lead to market expansion over the forecast years.

Type Insights

Stools dominated the market and accounted for the largest revenue share of 43.5% in 2023. Favorable consumer trends and behavior are observed in the stool segment. Bamboo stools, with their portability, compactness, and lightweight design, have gained popularity in today's society. These stools have become a must-have furniture item for small living spaces or as a convenient seating option for gatherings.

The chairs and tables are expected to grow at a CAGR of 7.5% over the projected years. This growth is attributed to the increasing awareness regarding the benefits of durable, lightweight, and sustainable materials resistant to shrinking, fueling the creation of craft bamboo-based interior decor designs. Innovative designs are a substantial factor in the growing popularity of bamboo furniture. The furniture can be created in various designs and styles to fulfill customers' requirements and preferences.

End Use Insights

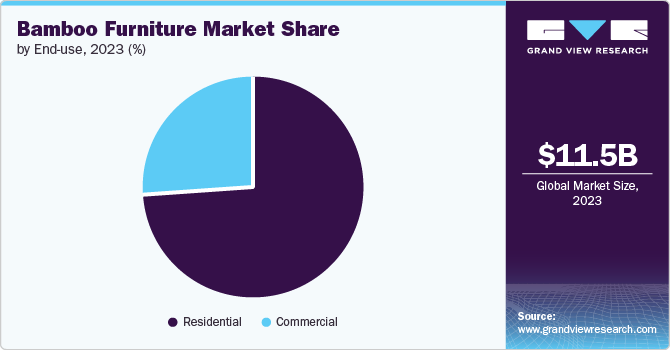

The residential segment led the market and registered the largest revenue share of 74.3% in 2023. Residential living has rapidly embraced and has demand for sophisticated furniture to enhance the living room and bedroom decor. Furthermore, with the increasing environmental awareness among individuals, bamboo furniture has become a popular choice for every part of the house, ranging from the living room to the bedroom, which in turn is driving the segment’s growth in the market.

Furthermore, commercial is expected to grow at a CAGR of 7.1% over the forecast years. The commercial sector plays a vital role in influencing the market for bamboo furniture. Bamboo furniture's durability, lightweight, rough use, and low maintenance cost make it ideal for heavy adoption in hotels, cafes, restaurants, industries, and office spaces. Organizations are increasingly adopting eco-friendly and sustainable practices globally, and bamboo furniture aligns with customers' requirements.

Regional Insights

The North America bamboo furniture marketwitnessed significant growth owing to rising consumer awareness and preference for sustainable, eco-friendly products.Bamboo is increasingly considered a viable alternative to traditional materials such as wood and plastic. Furthermore, the growing demand for bamboo products across various end-use industries, such as furniture, construction, and textiles, coupled with supportive government initiatives and investments in infrastructure development, are further propelling the market expansion in the region.

U. S. Bamboo Furniture Market Trends

The bamboo furniture market in the U.S. is expected to grow significantly over the forecast years. This market is driven by rising demand for eco-friendly products, increasing consumer awareness of environmental concerns, and government initiatives promoting sustainable materials. Furthermore, bamboo's durability, aesthetic appeal, and versatility in design make it a popular choice for residential and commercial sectors.

Asia Pacific Bamboo Furniture Market Trends

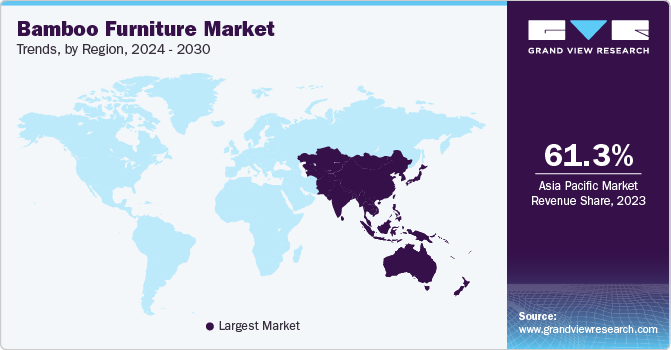

The Asia Pacific bamboo furniture market dominated the global market, with a revenue share of 61.3% in 2023. A significant trend shapes the bamboo furniture market in China, India, and Indonesia. In addition, customers are looking for diverse, intricately designed, high-quality, and tailored furniture pieces, further driving the market's growth in the region.

The bamboo furniture market in China led the Asia Pacific market owing to the availability of sufficient raw materials for manufacturing the best quality furniture and the country's cultural preferences. In addition, the country's principles emphasize a balanced and harmonious life, which leads to bamboo-crafted furniture that is durable and flexible when creating designs. Generally, there is a high demand for outdoor furniture items such as chairs, rattan chairs, tables, and beach beds, which further fuels the growth of the country's market.

India bamboo furniture market is expected to experience rapid growth over the forecast years. This growth is attributed to various factors, such as a rich tapestry of culture, signified by magnificent carvings, a combination of vibrant colors, and multiple materials, i.e., wood, brass, and textiles. Another significant reason for market growth is the attractive and eye-catching craftsmanship and cultural touch in diversified furniture aesthetic designs, which appealed to customers.

Europe Bamboo Furniture Market Trends

The bamboo furniture market in Europe is expected to grow at a CAGR of 6.4% over the projected years. This growth is driven by rising consumer awareness about sustainable products and increasing disposable incomes. In addition, heightened concerns about environmental issues drive demand for eco-friendly furniture options such as bamboo, which is renewable and durable. Innovations in bamboo processing and manufacturing are also expanding market opportunities in Europe.

The UK bamboo furniture market is anticipated to grow significantly over the forecast years owing to a new trend of hybrid design emerging in the market. This new trend involves joining bamboo with glass, fabrics, and metal materials. This innovative approach improves the furniture's quality and overall aesthetics, further driving the market growth.

The bamboo furniture market in France is expected to grow substantially due to hybrid designs that have been found to increase its strength and sustainability. Furthermore, combinations of bamboo and metal, for instance, have been found to produce more durable furniture resistant to extreme weather conditions. Many bamboo furniture manufacturers are employing this method as hybrid designs become increasingly popular with customers, thereby driving the growth of the market.

Key Bamboo Furniture Company Insights

Some of the key companies in the bamboo furniture market are Greenington, Zhenghe Ruichang Industrial Art Co., Ltd, MOSO Bamboo, Tine K Home A/S, Haiku Designs, Zoco Home, BAMBOO VILLAGE COMPANY Ltd., which are focusing on strategies such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches to enhance their market presence and gain a competitive edge.

-

Greenington crafts, innovates, designs, and manufactures high-quality furniture with sustainable and eco-friendly bamboo items and a line of quality solid bamboo furniture with a lucrative modern touch.

-

MOSO Bamboo offers attractive, stylish, and well-designed bamboo products, generally for interior and exterior designs, while maintaining a high-quality level. Their category includes bamboo outdoor flooring, panels, and veneer, mainly for vehicles such as car interiors, and unlimited solutions for the customized requirements of the project.

Key Bamboo Furniture Companies:

The following are the leading companies in the bamboo furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Greenington.

- Zhenghe Ruichang Industrial Art Co., Ltd

- MOSO Bamboo

- Tine K Home A/S

- Haiku Designs

- Zoco Home

- BAMBOO VILLAGE COMPANY Ltd.

- Lene Bjerre Design INT

- IKEA Systems B. V.

Recent Developments

-

In 2024, MOSO actively participated in Architect@Work events and renowned construction trade shows, such as Material District Utrecht, to showcase its innovative bamboo products for indoor and outdoor use. The company leveraged these platforms to engage with architects, designers, and industry stakeholders, reinforcing its position as a leading provider of eco-friendly bamboo solutions. MOSO's strong trade show presence enabled it to connect with new customers, forge strategic partnerships, and stay updated on industry trends.

Bamboo Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.2 billion

Revenue forecast in 2030

USD 18.2 billion

Growth Rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Greenington., Zhenghe Ruichang Industrial Art Co., Ltd, MOSO Bamboo, Tine K Home A/S, Haiku Designs, Zoco Home, BAMBOO VILLAGE COMPANY Ltd., Lene Bjerre Design INT, IKEA Systems B. V.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bamboo Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bamboo furniture market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chair & Tables

-

Stools

-

Beds

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."