- Home

- »

- Consumer F&B

- »

-

Banana Bread Market Size & Share Report, 2020-2027GVR Report cover

![Banana Bread Market Size, Share & Trends Report]()

Banana Bread Market Size, Share & Trends Analysis Report By Product (Unflavored, Flavored), By Distribution Channel (Hypermarket & Supermarket, Convenience Stores, Online), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-994-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The global banana bread market size was valued at USD 1.07 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2020 to 2027. Shifting consumer preference for healthy and nutritious bakery products with added medicinal properties is expected to be a crucial factor for market growth. Banana is very beneficial for keeping the heart and digestive system healthy and it also helps in weight management. These medicinal properties are expected to fuel product demand over the forecast period. Over the past few years, consumers have become more conscious of their health, which has propelled the demand for nutritious and healthy diets to achieve health and wellness. Bread is a staple food that is present in almost all the kitchens in the world and is widely consumed in breakfast.

This food product is also used for making several dishes that take less cooking time and offer a tummy fill meal. With the addition of banana in bread, it helps the customer eat more nutritious and healthier bakery items than simple bakery bread. Banana is an excellent source of potassium, vitamin B6, vitamin C, carbs, and lots of fiber. All the above nutrients offer various health benefits, such as the right amount of fiber helps improve the digestive system. Vitamin C helps boost the immunity system, potassium is essential for heart health, and carbs help in weight management. Such nutritious bread has been gaining popularity among consumers across the globe, which is anticipated to boost market growth over the forecast period.

Product Insights

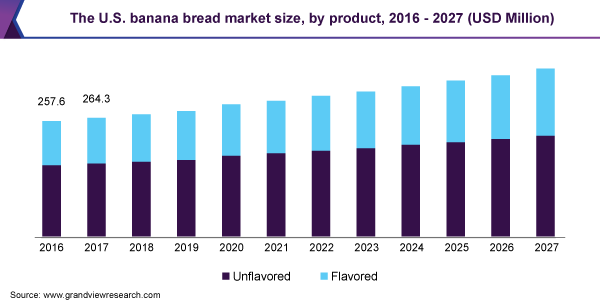

The unflavored segment was the largest product segment with a share of more than 65.0% in 2019. This segment is expected to maintain the lead over the forecast period owing to the availability of a comprehensive range of products at the global level. Manufacturers are offering various new products, including gluten-free, low sugar, and vegan banana bread. These product variants are attracting customers around the globe.

Flavored variants are anticipated to register the fastest CAGR of 4.2% from 2020 to 2027. Consumers across the globe are increasingly adopting a healthy lifestyle without hampering their taste buds. Manufacturers are offering a number of flavors in these bread, such as peanut butter, strawberry, blueberry, peach, pineapple, oats, vanilla, chocolate, cheese cream, and apple. The availability of a number of flavors enhanced the taste of these bread and all age groups can easily consume them.

Distribution Channel Insights

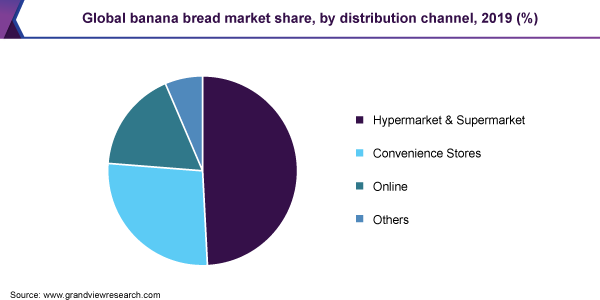

Hypermarket and supermarket was the largest distribution channel with a share of more than 45.0% in 2019. Bakery products are widely purchased from large supermarkets owing to the availability of a wide range of products. Major players such as Walmart, 7Eleven, Aldi, Tesco, Sainsbury's, Apar, and Auchan are deep-pocket market giants that offer a wide range of grocery products and a large chain of stores for the maximum customer engagement.

The online segment is anticipated to be the fastest-growing distribution channel with a CAGR of 4.4% from 2020 to 2027. This growth is attributed to a high degree of convenience associated with the sales channel. Moreover, increasing social distancing and rising COVID-19 pandemic across the globe are boosting the purchase of these bakery products through e-commerce. Major players in the offline market or hypermarket and supermarket are entering the e-commerce sector as customers are increasingly adopting e-commerce due to its discounts, doorstep delivery, and availability of a wide range of products.

Regional Insights

North America was the largest regional market for banana bread with a share of more than 30.0% in 2019. The U.S. is one of the largest consumers of all kinds of bread, which offers growth opportunities for this product in the regional market. Such products are widely used in making various dishes, such as cheese bread and sandwiches. Customers are eagerly looking for new products, such as banana-based variants, with enhanced flavor, taste, and nutritional properties.

Asia Pacific is anticipated to be the fastest-growing regional market with a CAGR of 4.5% from 2020 to 2027. These bread is quite popular in Australia owing to its enhanced taste as compared to the regular counterparts. The adoption of these products is on the rise among consumers as the customers are increasingly adopting healthy bakery products. Moreover, improving living standards, increasing disposable income, and western food influence are opening new avenues for the market in the country. These trends are expected to boost the demand for this product over the forecast period.

Key Companies & Market Share Insights

The market is highly fragmented across the globe as many small players are also offering quality products in their respective regional markets. Moreover, the adoption of these products is high among the major players. Famous bakeries are also offering a number of flavored and high-quality products, which is increasing the competitive rivalry in the market. With the growing trend of healthy bakery products among consumers, manufacturers are launching a number of flavored products as well as gluten-free and vegan products. For instance, in January 2020, Woolworths Supermarkets launched a new banana bread product with two varieties, including original and Cadbury chocolate chip, in Australia. These product launches are expected to fuel the demand for these products in the foreseeable future. Some of the prominent players in the banana bread market include:

-

General Mills, Inc.

-

Banana Bread Co

-

Mama Ka'z

-

King Arthur Baking Company, Inc.

-

Papa Joe's Bakehouse

-

Big Banana Bread

-

Dank Banana Bread

-

The Essential Baking Company

-

Simple Mills

-

Havana Banana Breads

Banana Bread Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.13 billion

Revenue forecast in 2027

USD 1.46 billion

Growth Rate

CAGR of 3.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

The U.S.; The U.K.; Germany; France; China; Australia; Brazil

Key companies profiled

General Mills, Inc.; Banana Bread Co; Mama Ka'z; King Arthur Baking Company, Inc.; Papa Joe's`; Bakehouse; Big Banana Bread; Dank Banana Bread; The Essential Baking Company; Simple Mills; Havana Banana Breads

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global banana bread market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Unflavored

-

Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Hypermarket & Supermarket

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global banana bread market size was estimated at USD 1.07 billion in 2019 and is expected to reach USD 1.13 billion in 2020.

b. The global banana bread market is expected to grow at a compound annual growth rate of 3.9% from 2020 to 2027 to reach USD 1.46 billion by 2027.

b. North America dominated the banana bread market with a share of 30.0% in 2019. This is attributable as the U.S. is one of the largest consumers of all kinds of healthy bakery products in the U.S.

b. Some key players operating in the banana bread market include General Mills, Inc., Banana Bread Co, Mama Ka'z, King Arthur Baking Company, Inc., Papa Joe's`, Bakehouse, Big Banana Bread, Dank Banana Bread, The Essential Baking Company, Simple Mills, Havana Banana Breads.

b. Key factors that are driving the market growth include shifting consumer preferences towards health & wellness among the millennial and rising awareness towards premium bakery products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."