Barbiturate Drugs Market Size & Trends

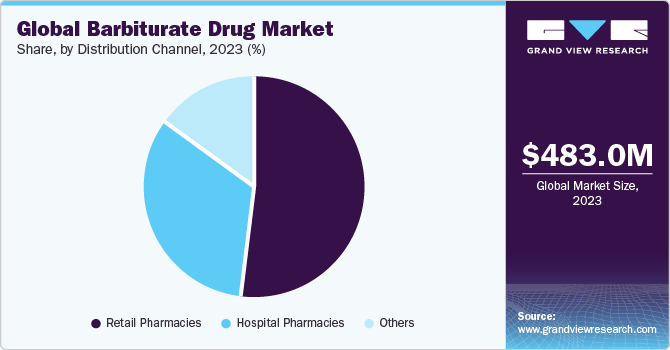

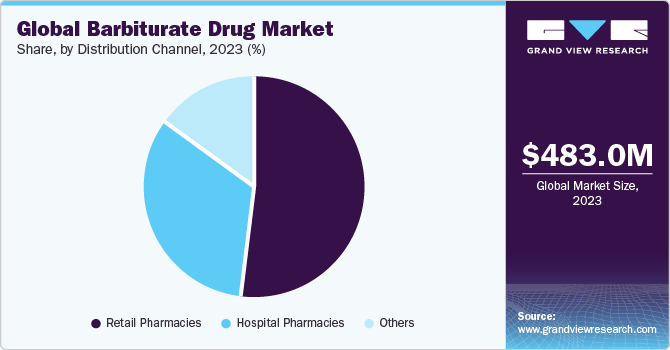

The global barbiturate drugs market size was valued at USD 483 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.12% from 2024 to 2030. Barbiturate drugs are a class of drugs that primarily act on the central nervous system. They were historically used for a variety of medical purposes, including as sedatives, hypnotics, and anticonvulsants. Barbiturates depress the activity of the central nervous system, leading to effects such as sedation and relaxation.

The outbreak of the COVID-19 pandemic negatively impacted the growth of the barbiturate drugs market in 2020. Healthcare facilities faced challenges in providing routine medical care, including the management of chronic conditions such as epilepsy. This disruption affected individual’s access to and continuity of barbiturate medications. Furthermore, the pandemic led to disruptions in global supply chains, affecting the availability of various medications, including antiepileptic drugs such as barbiturate drugs.

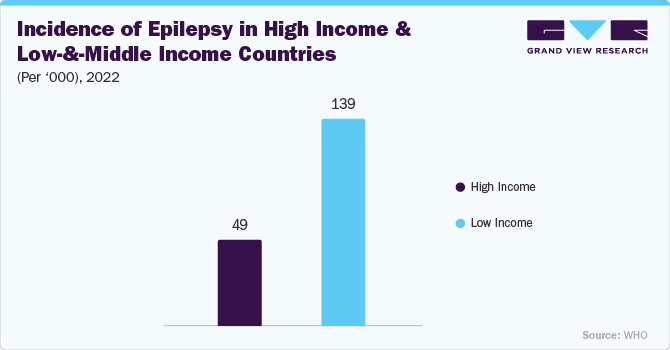

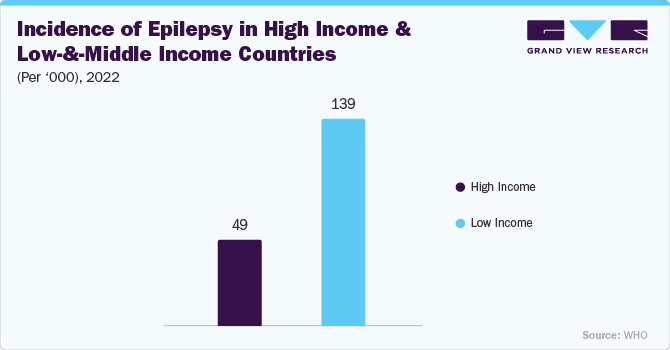

The global barbiturate drug market is expected to experience growth over the forecast period due to several factors, including the rising prevalence of conditions like insomnia, epilepsy, and anxiety, as well as the growing geriatric population. For instance, data from the World Health Organization in 2022 revealed that epilepsy is a prevalent neurological disorder worldwide, impacting approximately 50 million individuals. Diagnosis rates vary by region, with high-income countries reporting around 49 diagnoses per 100,000 people annually, while low- and middle-income countries may see rates as high as 139 diagnoses per 100,000 individuals. Furthermore, the growing cases of insomnia in key countries drive market growth. For instance, in April 2020, the American Journal of Managed Care released a study underscoring the widespread nature of insomnia, marking it as a significant challenge for the U.S. healthcare system. The comprehensive financial impact of insomnia, which covers both direct and indirect expenses, surpasses a yearly total of over USD 100 billion in the U.S.

Drug Type Insights

Based on the drug type, the barbiturate drug market is segmented into ultra-short, short-acting, long-acting, and combination drugs. The long-acting segment held the largest market share in 2023. Long-acting barbiturates, such as phenobarbital, have been used in the management of epilepsy. Their dominance is factored by their sustained seizure control and relatively fewer dosing requirements. However, the use of barbiturates in epilepsy treatment has declined over the years due to concerns about side effects and the development of newer, safer antiepileptic drugs.

Disease Type Insights

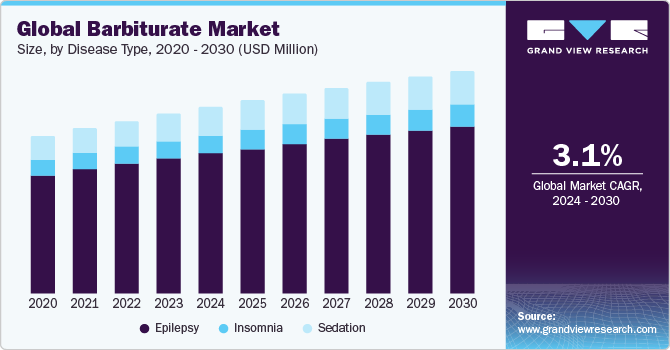

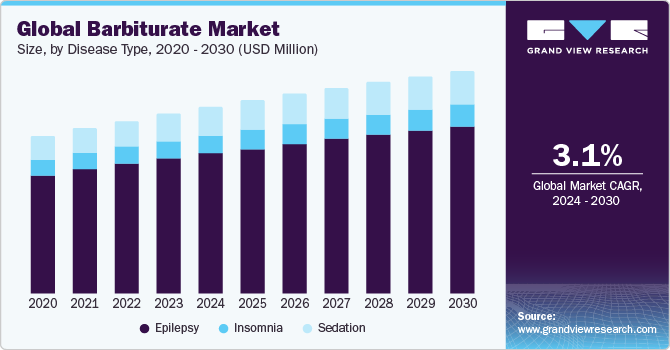

On the basis of disease type, the barbiturate drug market is segmented into epilepsy, insomnia, and sedation. The epilepsy segment dominated the market in 2023. Barbiturate drugs are considered 1st generation antiepileptic medications. They were among the earliest medications used to treat epilepsy. Moreover, phenobarbital has been used for many years to control seizures in people with epilepsy. However, its use has declined over the years due to concerns about side effects, sedation, and the potential for dependence.

Distribution Channel Insights

Based on distribution channels, the barbiturate drug market is segmented into retail pharmacies, hospital pharmacies, and others. The retail pharmacy segment held a dominant revenue share in 2023. Long-acting barbiturates, such as phenobarbital, are used in the management of chronic conditions like epilepsy. Patients with these conditions obtain their prescriptions from retail pharmacies for ongoing use, which drives the segment’s growth.

Regional Insights

North America dominated the market in 2023 and is anticipated to grow at a significant rate over the forecast period. The region's largest market share can be attributed to significant product launches, cooperative agreements between manufacturers, and advantageous reimbursement policies. The U.S. has one of the largest and most developed pharmaceutical markets in the world. This creates a substantial demand for medications, including barbiturate drugs, used in various healthcare applications. On the other hand, Asia Pacific is expected to witness a lucrative growth rate over the coming years owing to increasing burden of disorders in economies such as India and China.

Key Companies & Market Share Insights

Key players operating in the market are Par Pharmaceuticals, Akorn Operating Company LLC, Samarth Life Science Pvt. Ltd, Ethypharm, Abbott, and others. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In April 2021, Ethypharm opened its new facility in Italy to gain direct access to the country’s pharmaceutical market.

-

In June 2021, Ethypharm acquired Altan Pharma, a key manufacturer of hospital injectables. This acquisition is anticipated to allow the company to gain market access in Spain.