- Home

- »

- Next Generation Technologies

- »

-

Bare Metal Cloud Market Size & Share, Industry Report 2033GVR Report cover

![Bare Metal Cloud Market Size, Share & Trends Report]()

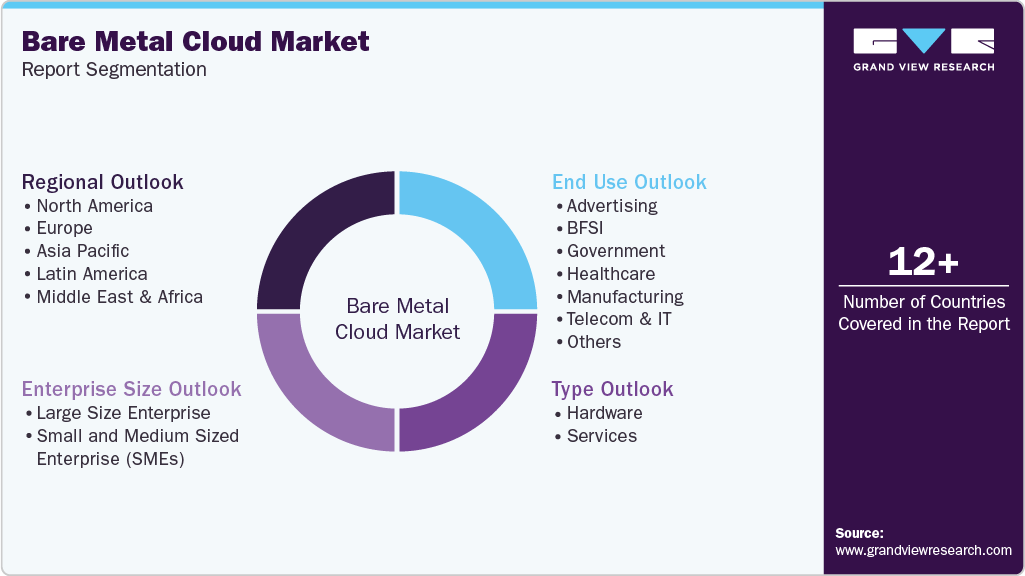

Bare Metal Cloud Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Hardware, Services), By Enterprise Size (SMEs, Large Enterprises), By End Use (Advertising, BFSI, Government, Healthcare, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-025-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bare Metal Cloud Market Summary

The global bare metal cloud market size was estimated at USD 11.66 billion in 2025 and is projected to reach USD 52.66 billion by 2033, growing at a CAGR of 21.4% from 2026 to 2033. The market growth is attributed to rising enterprise demand for high-performance, secure, and dedicated infrastructure as organizations shift latency-sensitive workloads to bare metal cloud solutions.

Key Market Trends & Insights

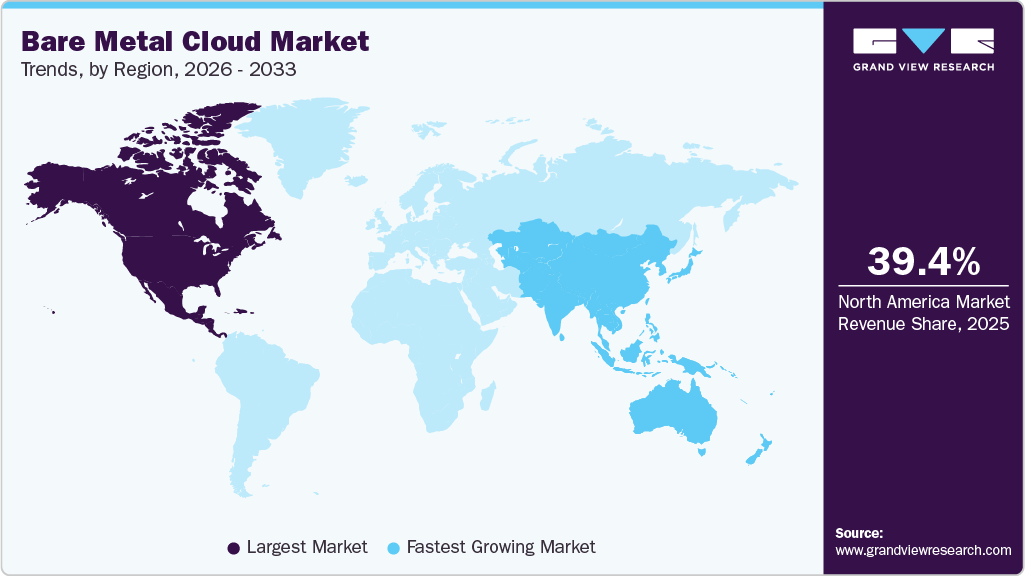

- North America held a 39.5% revenue share of the global bare metal cloud industry in 2025.

- In the U.S., the market is driven by its advanced digital infrastructure, widespread adoption of dedicated servers by enterprises, and growing demand for high-performance, low-latency, and secure environments for critical workloads.

- By type, the hardware segment held the largest revenue share of 62.3% in 2025.

- By enterprise size, the large enterprise segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.66 billion

- 2033 Projected Market Size: USD 52.66 billion

- CAGR (2026-2033): 21.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

This growth is accelerated by enterprises seeking dedicated, high-performance infrastructure to support real time dependent workloads, artificial intelligence applications, and data-intensive operations, while avoiding the limitations of virtualization overhead. Key drivers include the rising adoption of hybrid cloud strategies, enhanced security for regulated sectors such as BFSI and healthcare, and the demand for customizable compute resources that ensure predictable performance and full hardware control. The regional scenario in the market for bare metal cloud, where North America maintains a dominant position due to its advanced IT ecosystems, and Asia Pacific emerging as the fastest-growing region, is driven by digital transformation initiatives.

The market continued to evolve with significant advancements in cloud infrastructure. For instance, in June 2025, OVHcloud partnered with Crayon to deliver transformative, cost-effective cloud solutions globally, including in Europe. The agreement enabled organizations to access secure, high-performance infrastructure across 45+ countries. Crayon provided strategic and technical expertise, while OVHcloud offered sustainable, sovereign cloud options, including bare metal servers, hosted private cloud, public cloud, and managed Kubernetes, supporting digital transformation and optimized performance-price outcomes. Such innovations highlight the market’s shift toward automated, GPU-optimized solutions tailored for AI and high-performance computing, positioning bare metal cloud as a critical enabler for next-generation enterprise IT.

Type Insights

The hardware segment accounted for the largest revenue share of 62.3% in the global market in 2025, including the physical servers, networking, and storage infrastructure that clients rent on a dedicated, non-virtualized basis. The market is driven by the growing demand for high-performance computing (HPC), Artificial Intelligence (AI)/Machine Learning (ML) workloads, and other data-intensive applications, which require the maximum raw computational power, lowest latency, and complete hardware control that bare metal affords by eliminating the virtualization overhead inherent in traditional cloud environments. Industry providers continue to introduce more advanced and powerful infrastructure solutions. In November 2023, OVHcloud launched its second-generation Bare Metal Scale servers in France, delivering enhanced compute performance for demanding workloads across various industries. These servers are powered by AMD and NVIDIA processors. This development will drive demand for high-performance server components in the hardware segment of the market.

The services segment is expected to register the CAGR over the forecast period from 2026 to 2033, driven by the need for simplified operations and expertise to fully leverage the raw performance of dedicated infrastructure. As enterprises adopt bare metal for complex, high-performance workloads such as AI/ML training, big data analytics, and high-frequency trading, they increasingly require professional support to manage the complex tasks of initial provisioning, infrastructure lifecycle management, and ensuring regulatory compliance. By outsourcing these operational complexities to providers, businesses can focus on their core applications and innovation, making the sophisticated bare metal offering as accessible and easy to manage as a virtualized public cloud service.

Enterprise Size Insights

The large size enterprise segment accounted for the largest market share of 56.3% in 2025, reflecting the significant high-performance and regulatory demands of global corporations in sectors such as BFSI, IT & Telecom, and manufacturing. This dominance is driven by the need for optimal performance, physical data isolation, and regulatory compliance for mission-critical, data-intensive workloads such as complex AI/ML model training, high-frequency trading, and big data analytics, where the elimination of the hypervisor overhead is paramount. Large enterprises leverage bare metal to ensure consistent, predictable latency and full hardware control, which is often an essential for internal compliance policies or external regulations such as HIPAA or PCI DSS.

The Small and Medium-Sized Enterprise (SMEs) segment is expected to grow at the fastest CAGR during the forecast period from 2026 to 2033, driven by the need for dedicated, high-performance computing without the capital expenditure of on-premises hardware. This growth is primarily fueled by the compelling combination of performance and cost-efficiency, as bare metal eliminates the performance overhead, offering superior speed and predictable latency critical for workloads such as Big Data analytics, high-traffic e-commerce platforms, and resource-intensive applications. To meet this rising demand, cloud providers are expanding their bare metal offerings in the key regional markets. For instance, in January 2024, Equinix launched Equinix Metal and Equinix Network Edge in Mumbai, India, expanding their digital services for the regional bare metal cloud users. The offerings enabled enterprises to deploy infrastructure rapidly with cloud-like flexibility and improved performance. This development is expected to enhance adoption among small and medium-sized enterprises by providing cost-efficient, consumption-based access to high-performance bare metal infrastructure.

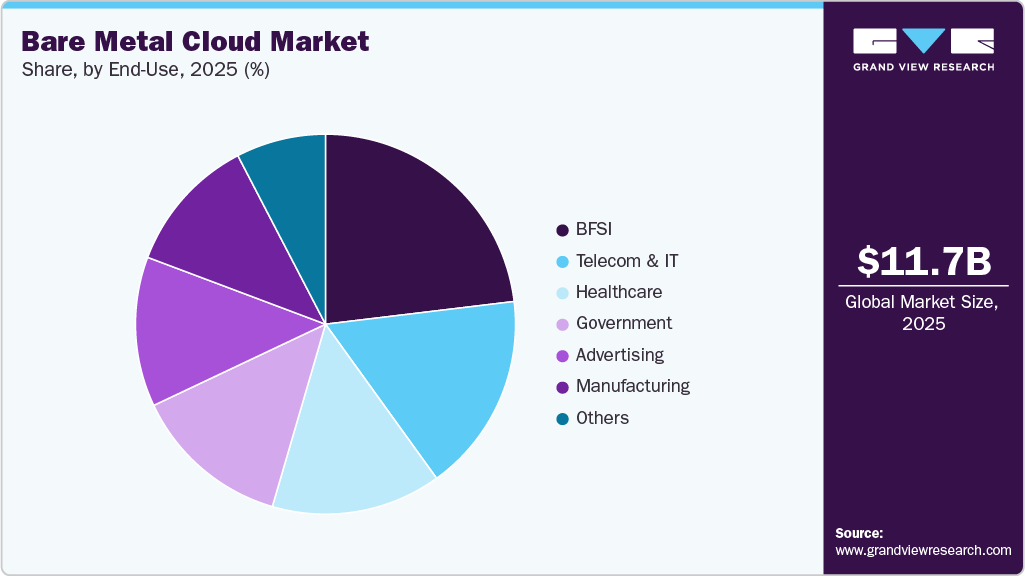

End Use Insights

The BFSI segment accounted for the largest market share of 23.0% in 2025, fundamentally driven by its exceptionally high regulatory and performance requirements. As financial institutions increasingly rely on real-time analytics, complex quantitative models, and large-scale stress testing, they require infrastructure that delivers predictable, ultra-low latency performance without the interference that is common in shared environments, along with strong physical and network isolation for sensitive data. This dedicated, single-tenant nature inherent to bare metal addresses critical regulatory compliance mandates, such as PCI DSS, HIPAA, and regional data residency laws, which are challenging to meet reliably within standard virtualized public cloud offerings.

The manufacturing segment is expected to register the fastest growth during the forecast period, driven by the rising demand for Industry 4.0 technologies, which require unparalleled computational performance and predictable, low-latency infrastructure. This fundamental shift is primarily fueled by the imperative to support applications such as Digital Twin simulations, advanced Computer-Aided Design (CAD) rendering, real-time Industrial IoT data analytics, and AI/ML models used for predictive maintenance and quality control on the factory floor. Unlike virtualized environments, bare metal cloud offers dedicated, physical hardware resources, ensuring the consistent, raw processing power essential for time-sensitive operational systems and intensive data ingestion from thousands of connected sensors. To meet this need, key providers are rolling out specialized solutions such as Vultr's GPU-Optimized Bare Metal Servers, which feature the latest high-core count CPUs and powerful NVIDIA GPUs, perfectly configured to handle the similarity and memory demands of complex manufacturing workloads while offering the agile, on-demand provisioning and scaling capabilities expected of a cloud service.

Regional Insights

North America bare metal cloud industry accounted for the largest market share of 39.4% in 2025, fueled by a mature digital economy and widespread enterprise adoption across key sectors such as finance, healthcare, and technology. At its core, bare metal cloud delivers single-tenant physical servers provisioned on demand, offering unmatched control, security, and latency reduction compared to traditional virtualized environments, which makes it ideal for mission-critical applications in a region where regulatory compliance and data sovereignty are paramount. Driving this momentum are several interconnected factors, including the explosive rise of artificial intelligence and machine learning workloads that require raw computational power for training models and real-time analytics, alongside the proliferation of high-frequency trading in banking, financial services, and insurance where even microseconds of delay can impact outcomes. Major infrastructure investments and strategic partnerships have further accelerated the region’s bare metal cloud adoption. For instance, in October 2024, Equinix announced a US-based joint venture with GIC and CPP Investments exceeding USD 15 billion, which aimed to expand its xScale hyperscale data centers and support growing AI, cloud, and bare metal infrastructure demand through large-capacity campus developments.

U.S. Bare Metal Cloud Market Trends

The U.S. bare metal cloud industry is driven by strong demand from large enterprises in various industries such as BFSI, healthcare, gaming, and technology that need dedicated high-performance servers for AI training, real-time analytics, and low-latency applications. Companies prefer bare metal over virtualized clouds when consistent CPU performance, strict security compliance, and full root access are non-negotiable, especially under regulations such as HIPAA, PCI-DSS, and FedRAMP. Adoption is strongest among Fortune 1000 firms running big data platforms, high-frequency trading systems, and containerized workloads that benefit from direct hardware access without the noise of multi-tenant environments. Cost predictability, elimination of the hypervisor tax, and seamless integration with existing hybrid cloud setups further accelerate the shift from traditional colocation to on-demand bare metal services across the country.

Europe Bare Metal Cloud Market Trends

The bare metal cloud industry in Europe is anticipated to register significant growth from 2026 to 2033, fueled by enterprises seeking dedicated, high-performance infrastructure amid rising digital demands. This growth stems from the region's robust economy and the surging need for secure cloud solutions that align with stringent data protection rules, such as GDPR, enabling businesses in finance, healthcare, and manufacturing to handle latency-sensitive tasks without incurring virtualization overheads. Key drivers include the push for hybrid cloud setups that blend on-premises control with scalable resources, alongside heightened investments in AI and real-time analytics that require unshared hardware for optimal speed and reliability. European cloud service providers have responded by introducing advanced, high-performance bare metal offerings to meet these evolving enterprise requirements. For instance, in June 2024, OVHcloud in Europe launched its third-generation Advance Bare Metal servers powered by AMD EPYC 4004 Series processors, delivering high-performance, cost-efficient solutions for web hosting, SaaS, virtualization, and enterprise workloads across the European countries.

The bare metal cloud industry in the UK is poised for accelerated growth from 2026 to 2033, supported by organizations from various industries increasingly choose dedicated servers to meet strict regulatory requirements, including FCA rules and data residency obligations, while avoiding the noise and variability of multi-tenant environments. Growing adoption of hybrid IT strategies, rising AI workloads, and the need for low-latency edge computing further drive interest in bare metal solutions. Domestic provider such as Fasthosts Internet Limited alongside global players with UK data centers such as Equinix Metal and OVHcloud, compete strongly by offering rapid deployment, transparent pricing, and certified compliance. Overall, the UK market values predictable high performance and sovereignty, making bare metal a preferred option for mission-critical applications where shared cloud resources fall short.

The bare metal cloud industry in Germany accounted for the largest share in 2025, driven by its strong industrial base, strict data protection requirements, and growing demand for sovereign IT infrastructure among enterprises in manufacturing, automotive, and financial services. Companies are increasingly choosing bare metal servers to meet the low-latency needs of Industry 4.0 applications, AI training, and secure private cloud environments, while remaining fully compliant with German and EU regulations. The preference for local data centers and German-based providers remains high, with organizations valuing direct hardware control, predictable performance, and freedom from noisy-neighbor issues common in multi-tenant public clouds. To address these evolving enterprise needs, leading cloud providers have expanded high-availability, multi-zone infrastructures across Germany. For instance, in November 2025, OVHcloud strengthened its Germany presence by launching its first 3-AZ cloud region in Berlin, enhancing security, resilience, and high availability for enterprises and public organizations. Therefore, the German market favors long-term bare metal contracts that deliver cost stability, high security, and performance certainty for mission-critical workloads.

Asia Pacific Bare Metal Cloud Market Trends

Asia Pacific bare metal cloud industry is expected to register the fastest CAGR from 2026 to 2033, driven by surging demand for dedicated, high-performance servers that bypass virtualization overheads. This growth reflects a shift among enterprises toward single-tenant environments that deliver superior speed, security, and customization for workloads such as AI training, real-time analytics, and e-commerce scaling. Key driving factors include accelerated digital transformation across major economies such as China, India, and Japan, where government initiatives for data center expansion and 5G rollout are boosting connectivity and low-latency needs, rising investments in edge computing to support IoT proliferation, and the push for hybrid cloud models that integrate bare metal with public services for cost efficiency. To capitalize on these market opportunities, market players have invested in strategic data center expansions across the region. For instance, in April 2025, OpenMetal expanded its Asia-Pacific presence by launching a new data center in Singapore, delivering high-performance bare metal servers and private cloud solutions, enhancing connectivity, security, and availability for enterprises across the Singapore.

The bare metal cloud industry in China held a dominant share in 2025. Major drivers include the explosive demand for AI training and inference, real-time gaming platforms, financial trading systems, and big data analytics where latency and security remain critical concerns. Local providers such as Alibaba Cloud, Tencent Cloud, and Huawei Cloud dominate the landscape, while global player such as Oracle also maintain strong footholds through local data centers that meet strict data-sovereignty rules. Government policies supporting “new infrastructure” and domestic chip development further encourage companies to choose bare metal instances built on Chinese-made processors.

The bare metal cloud industry in India is poised for rapid expansion from 2026 to 2033, as enterprises, especially in BFSI, e-commerce, and IT services, look for dedicated servers that deliver consistent high performance without the noise of multi-tenant environments. Companies prefer bare metal for running heavy databases, real-time trading platforms, large-scale ERP systems, and AI/ML workloads where latency and security are non-negotiable. The push from local data center players such as CtrlS, Web Werks, and Yotta, along with global names such as Oracle, IBM, and Equinix expanding dedicated host zones in Mumbai, Chennai, and Delhi-NCR, has made availability much better in the last two years. For instance, in October 2024, Webyne expanded its India presence by launching a new server facility in Noida in partnership with NTT, delivering enhanced cloud hosting, dedicated servers, and VPS solutions. Moreover, a strong government focus on data localization under the Personal Data Protection Bill and RBI guidelines for banks has further accelerated adoption among large financial institutions. Start-ups and mid-size firms are also warming up to bare metal because monthly pricing has become competitive and deployment time has dropped to a few hours. With the 5G rollout gathering pace and edge locations emerging in tier-2 cities, demand for low-latency bare metal instances is expected to rise. Overall, Indian enterprises now see bare metal not as a premium option but as a practical choice for critical workloads that need guaranteed resources and full control.

Key Bare Metal Cloud Company Insights

Key players operating in the bare metal cloud industry are IBM Corporation, Equinix Metal, Oracle Corporation, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Nutanix launched innovations to enhance its hybrid cloud platform. Key announcements included deep integration with NVIDIA for Agentic AI, a new partnership with Pure Storage, and the debut of Cloud Native AOS for Kubernetes storage. These expansions, along with the preview of Nutanix Cloud Clusters on Google Cloud, offered customers greater flexibility, efficiency, and security across distributed environments.

-

In May 2025, Atlantic.Net launched a new high-performance GPU Cloud Hosting offering, allowing customers to deploy GPU-powered cloud servers in under 60 seconds. The service is designed to deliver high-performance, cost-effective AI and machine learning computing, targeting businesses, developers, and researchers.

-

In October 2023, NetApp launched NetApp Storage on Equinix Metal globally, introducing a joint Bare-Metal-as-a-Service (BMaaS) solution via NetApp Keystone. The offering delivered single-tenant, high-performance storage with flexible pay-as-you-go pricing and low-latency connectivity to major public clouds worldwide.

-

In February 2023, Airtel India and Vultr announced a strategic partnership to launch Vultr’s high-performance Cloud Compute, Cloud GPU services across India. Hosted in Airtel’s data centers in Mumbai, Delhi-NCR, and Bangalore, the offering targeted Indian enterprises seeking cost-effective, globally scalable cloud solutions for AI, ML, and digital transformation.

Key Bare Metal Cloud Companies:

The following are the leading companies in the bare metal cloud market. These companies collectively hold the largest Market share and dictate industry trends.

- DataBank Holdings, Ltd.

- IBM Corporation

- BIGSTEP

- Equinix, Inc.

- Hivelocity, Inc

- Hetzner Online GmbH

- HorizonlQ

- Linode, LLC

- Lumen Technologies

- OVH SAS

- Oracle

- phoenixNAP

- Scaleway SAS

- Vapor IO, Inc.

- Zenlayer

Bare Metal Cloud Market Report Scope

Report Attribute

Details

Market size in 2026

USD 13.56 billion

Revenue forecast in 2033

USD 52.66 billion

Growth rate

CAGR of 21.4% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

DataBank Holdings, Ltd.; IBM Corporation; BIGSTEP; Equinix, Inc.; Hivelocity, Inc; Hetzner Online GmbH; HorizonlQ; Linode, LLC; Lumen Technologies; OVH SAS; Oracle; phoenixNAP; Scaleway SAS; Vapor IO, Inc.; Zenlayer

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Enterprise Size and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bare Metal Cloud Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the bare metal cloud market report based on type, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Bare Metal Compute

-

Bare Metal Network

-

Bare Metal Storage

-

-

Services

-

Integration & Migration

-

Consulting & Assessment

-

Maintained Services

-

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Size Enterprise

-

Small and Medium Sized Enterprise (SMEs)

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Advertising

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Telecom & IT

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bare metal cloud market size was estimated at USD 11.66 billion in 2025 and is expected to reach USD 13.56 billion in 2026.

b. The global bare metal cloud market is expected to grow at a compound annual growth rate of 21.4% from 2026 to 2033 to reach USD 52.66 billion by 2033.

b. The hardware segment dominated the bare metal cloud market in 2025 due to the high demand for dedicated physical servers that deliver superior performance, enhanced security, and greater control over workloads compared to virtualized or shared cloud infrastructure.

b. Some key players operating in the market include DataBank Holdings, Ltd., IBM Corporation, BIGSTEP, Equinix, Inc., Hivelocity, Inc, Hetzner Online GmbH, HorizonlQ, Linode, LLC, Lumen Technologies, OVH SAS, Oracle, phoenixNAP, Scaleway SAS, Vapor IO, Inc., Zenlayer and Others.

b. Factors such as the growing demand for high-performance computing, data-intensive workloads, and secure, dedicated server environments that offer full hardware control and predictable performance play a key role in accelerating the bare metal cloud market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.