- Home

- »

- Medical Devices

- »

-

Global Bariatric Surgery Devices Market Size, Industry Report, 2022GVR Report cover

![Bariatric Surgery Devices Market Size, Share & Trends Report]()

Bariatric Surgery Devices Market Size, Share & Trends Analysis Report By Procedures (Adjustable Gastric Band, Vertical Sleeve Gastrectomy, Roux-en-Y Gastric Bypass), And Segment Forecasts, 2012 - 2022

- Report ID: 978-1-68038-616-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2012 - 2015

- Forecast Period: 2016 - 2022

- Industry: Healthcare

Industry Insights

The global bariatric surgery devices market size was valued at USD 1.3 billion in 2014 and is projected to grow at a CAGR of 10.15% over the forecast period. Increasing incidence rate of obesity in adults due to changing lifestyle habits and excessive intake of calories are major drivers of the bariatric surgery devices market. Moreover, government support and increasing awareness about unhealthy food and drinks available in the market, and their effect on BMI is further projected to increase the bariatric surgeries demand over the forecast period.

According to the WHO data review of 2016, 1.9 billion people are overweight out of which 650 million suffer from obesity. Almost 13% of the population in the age range of 18 years and older are obese and 41 million children under the age of 5 years suffer from obesity. The American Heart Association has estimated the total medical cost to reach up to USD 957 billion from USD 861 billion by 2030. The huge healthcare spending has alarmed the government to take action to reduce the incidence of obesity and the long-term chronic diseases related to it. In 2017, the Centers for Disease Control and Prevention (CDC), funded around USD 8.5 million to 50 states along with the District of Columbia to enhance strategies to reduce obesity in areas with high-obesity levels.

The market is majorly driven by the growing obesity incidence rate in adults and cutting-edge robotic technologies increasing operational efficiency. The National Institute for Health and Care Excellence (NICE) recommends bariatric surgery as opposed to lifestyle and medication and also suggests earlier consideration of surgery for people with diabetes mellitus. Such developments are expected to boost market growth in the coming years. Furthermore, increasing reimbursement coverage and sponsored bariatric surgeries by the regional governments of the developed nations is further expected to propel the market growth.

In February 2018, the American Society for Metabolic and Bariatric Surgery (ASMBS) added intragastric balloons to the list of recommended devices used for bariatric procedures. Europe had 3 such devices approved and in 2015-16, FDA too approved these devices in the U.S. These approvals and recommendations are anticipated to boost the market growth to a great extent.

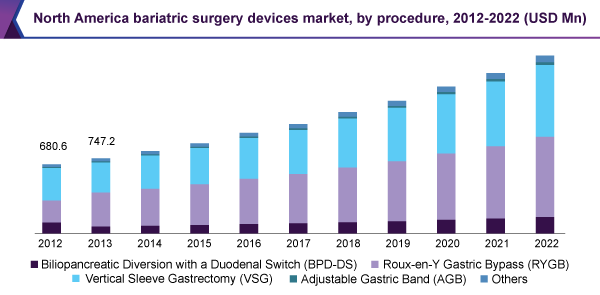

Procedure Insights

Roux-en-Y Gastric Bypass (RYGB) dominated the bariatric surgery devices market in 2014. Gastric bypass surgeries were performed through open surgery causing large incisions on the belly. Hence, the introduction of laparoscopic bypass surgeries overtook the conventional methods and was performed with small minimal incisions.

Over the past decade, the growing acceptance for laparoscopic surgery has also surged the popularity of this minimally invasive technique for this surgery. Laparoscopic surgery offers more convenience to patients with minimal incision. This surgery makes the stomach a small pouch and allows minimal food to pass into the small intestine. Bypassing the small intestine leads to lesser nutrient and fat absorption and thus helping in weight loss.

Though gastric bypass surgeries dominate the bariatric surgery devices market, it is expected that sleeve gastrectomy will be the fastest-growing market during the forecast period, as it has been recently approved by the FDA and is an incision-less surgery. This procedure has witnessed various developments in recent years. According to the American Society for Metabolic and Bariatric Surgery (ASMBS), out of 179,000 surgeries performed, sleeve gastrectomy accounted for the major share (42.1%) followed by gastric bypass. In June 2012, the Centers for Medicare and Medicaid Services (CMS) released the CMS Laparoscopic Sleeve Gastrectomy National Care Determination under which it provided coverage for laparoscopic sleeve gastrectomy (LSG).

Regional Insights

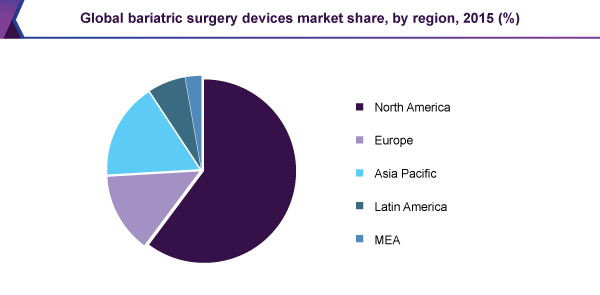

The North America bariatric surgery devices market was the largest in 2014, owing to high obesity rates along with huge government-supported funding and research activities are undertaken by the industry players to evaluate the efficiency of their surgeries to treat obesity. For instance, bariatric surgeries, which were insured by Medicare only for population having BMI 40 and above was revised and decreased to 30 and above. This change benefited a large population who were obese and could not afford the huge surgery, surgeons, and hospital costs. In addition, North America has the highest population with obesity incidences. In 2016, the costs related to obesity ranged from USD 147 billion to USD 210 billion per year.

In addition to government efforts to control obesity, industry players are investing in research to link obesity with various chronic complications. In June 2015, Ethicon, a subsidiary of Johnson and Johnson invested over USD 3.2 million to study the effects of bariatric surgery on Type 2 diabetes and obesity. Moreover, the company also launched three new endocutter and energy products to assist in bariatric surgery procedures. Another industry player, Scitech launched a complete line for endosurgery in the 18th Brazilian Congress of Bariatric and Metabolic Surgery in October 2017.

Obesity in Europe is increasing at an alarming rate with Ireland topping the chart. The report submitted by the WHO on European Modelling Obesity Project stated the various interventions and healthcare cost burden related to obesity, if not addressed. Hence, the government is funding various academic institutes to come up with innovative strategies. In August 2015, the National Cancer Institute (NCI) was awarded a grant of USD 750,000 to the University of Kentucky to study the link between breast cancer and obesity.

Asia Pacific is the fastest-growing market with a CAGR of over 10.5% owing to the huge obese population and increasing medical tourism due to Surgery performed at affordable costs. The Procedures, which is offered at USD 25,000 in the U.S., is offered at USD 12,000 in Asia Pacific countries. Even industry players have extended their research facilities in India to study the obesity-related factors here. For instance, Covidien has established a new research facility in Hyderabad to understand the factors contributing to obesity in India.

Bariatric Surgery Devices Market Share Insights

Key industry contributors are Allergan Inc., Covidien Plc, Johnson and Johnson, Intuitive Surgical Inc., GI Dynamics Inc., TransEnterix Inc., USGI Medical Inc., Semiled Ltd., Cousin Biotech, and Mediflex Surgical Procedures. The industry contributors are innovating newer technologies, which are non-invasive reducing patients’ time in the hospitals, reducing the chances of infection, and saving cost.

Smaller players are also implementing strategies such as acquisitions to expand their product portfolio and gain roots in the industry. In May 2017, EnteroMedics Inc. acquired BarioSurg, Inc. through which they also acquired the rights to the company’s Gastric Vest System. The transaction was worth USD 2 million.

In August 2015, the ORBERA bariatric system was approved by the FDA for patients with a BMI range of 30 to 40. In addition to this, in April 2015, Intuitive Surgical Inc. received the CE mark in Europe to sell EndoWrist Stapler for da Vinci Si and Xi Surgical Systems.

Industry contributors are striving to change the traditional methods of performing surgeries and innovating newer techniques or devices helping surgeons perform the procedures in an effective manner. In June 2015, Medtronic launched GastriSail, a device for sleeve gastrectomy. The device changed the traditional method of using three devices, thus reducing infection and irritation.

Manufacturers are also conducting collaborative exercises to study the effect of surgeries on co-morbidities. For instance, In May 2014, GI Dynamics Inc. collaborated with GSK, to study endobarrier induced changes in bile acid, responsible for controlling energy and glucose homeostasis. In addition to this, in June 2015, Ethicon invested around USD 3.2 million. The investment was to study the effect of bariatric surgery on Type 2 diabetes and obesity.

The government funding to increase awareness of obesity, the preference for incision-less surgeries, and industry technological innovations enabling bariatric surgeries with small incisions are expected to spur market growth.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2012 - 2015

Forecast period

2016 - 2022

Market representation

Revenue in USD Million & CAGR from 2015 to 2022

Regional scope

North America, Europe, Asia Pacific, Latin America,& MEA

Country scope

U.S., Canada, Germany, UK, France, Japan, China, India, Brazil, Mexico, & South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2012 to 2022. For the purpose of this study, Grand View Research has segmented the global bariatric surgery devices market report based on procedure and region:

-

Procedure Outlook (Revenue, USD Million; 2012 - 2022)

-

Adjustable Gastric Band (AGB)

-

Vertical Sleeve Gastrectomy (VSG)

-

Roux-en-Y Gastric Bypass (RYGB)

-

Biliopancreatic Diversion with a Duodenal Switch (BPD-DS)

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2012 - 2022)

-

North America

-

The U.S. and Canada

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."