- Home

- »

- Medical Devices

- »

-

Behavioral Health Care Software And Services Market Report, 2030GVR Report cover

![Behavioral Health Care Software And Services Market Size, Share & Trends Report]()

Behavioral Health Care Software And Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Support Services), By Delivery Model, By Function, By End Use, By Disorder, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-405-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Behavioral Health Care Software And Services Market Summary

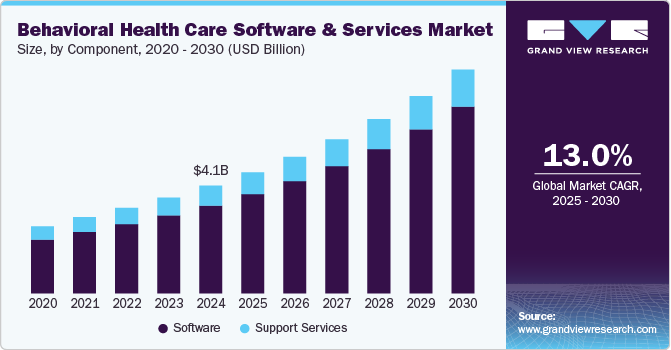

The global behavioral health care software and services market size was estimated at USD 4,142.5 million in 2024 and is projected to reach USD 8,605.8 million by 2030, growing at a CAGR of 13.0% from 2025 to 2030. Several key factors are driving market growth, including government funding, a rising acceptance of mental health software, favorable behavioral health reforms across the globe, and high demand for mental health services despite a shortage of providers are some of the major factors contributing to market growth.

Key Market Trends & Insights

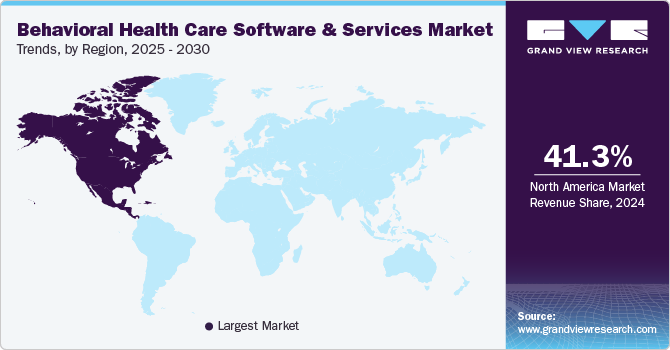

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR during the forecast period.

- In terms of segment, software accounted for a revenue of USD 2,737.0 million in 2022.

- Software is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,142.5 Million

- 2030 Projected Market Size: USD 8,605.8 Million

- CAGR (2025-2030): 13.0%

- North America: Largest market in 2024

For instance, the U.S., government initiatives to promote EHR adoption in psychiatry hospitals and facilities.

The utilization of management software by healthcare providers is expected to improve the treatment of mental health issues. Furthermore, adopting integrated electronic health records (EHRs) can help behavioral health practices save costs and manage operations more efficiently. Tele-mental health involves using video conferencing to connect with patients at a distance. This real-time monitoring system reduces challenges related to information sharing and confidentiality, which are particularly prevalent in cases of substance abuse, facilitating better communication between patients and caregivers. Combining modern technology with established therapeutic methods enhances the effectiveness and efficiency of care.

Video conferencing has allowed medical professionals to provide remote consultations through telepsychiatry. As per the 2023 National Survey on Drug Use and Health (NSDUH), 48.5 million Americans aged 12 and above (16.7%) struggled with a substance use disorder within the past year. Furthermore, 10.2% of individuals in this age group experienced an alcohol use disorder during the same timeframe. Only one out of every seven patients received the necessary care. Governments are especially concerned about the high costs of healthcare related to the treatment of disorders related to behavioral health. Around 264 million people of all ages suffer from depression, which is a common condition.

Moreover, depression and anxiety have a substantial economic impact. According to the Mental Health Foundation, untreated mental health problems account for 13% of all diseases in the world. In addition, depression and other mental health issues are anticipated to overtake all other global causes of morbidity and mortality by the year 2030. Similarly, the 2023 United States National Survey on Drug Use and Health (NSDUH) reported that 20.4 million American adults experienced both a mental health disorder and a substance use disorder, or co-occurring disorders, within the past year. Mental problems cost Canada more than USD 50 billion per year, according to the Centre for Addiction and Mental Health. The requirement for and development of extensive paperwork (which results in doctors losing productivity) and ineffective revenue cycle management by service providers are the primary contributors to the high cost of treatments.

The need to address these concerns has increased the awareness and acceptance of mental health solutions to decrease drug errors and paperwork, increase productivity through quick access to patient data, increase workflow efficiency, and lower healthcare costs. These benefits have accelerated the adoption of mental health software, particularly among large hospitals and community clinics.

The market is also driven by an increasing demand for mental health services, accelerated by growing awareness of mental health issues and the need for accessible treatment options. Regulatory changes such as integrating mental health into healthcare policies further propel the market as providers seek compliant solutions that enhance patient care and streamline administrative processes. The rise of telehealth and remote patient monitoring technologies contributes significantly, enabling providers to offer more flexible and efficient care. For instance, Rock Health says 80% of consumers have accessed telemedicine services at least once. In addition, 73% of individuals living in rural areas have engaged with telemedicine. Patients particularly favor telemedicine for managing prescriptions (61%) and addressing minor illnesses (51%). Moreover, the need for data analytics to improve outcomes and manage population health drives innovation and investment in behavioral health software solutions.

Market Concentration & Characteristics

The market is characterized by a high degree of innovation owing to growing smartphone adoption and enhanced internet connectivity, which contribute to telemedicine solutions expansion by making healthcare services more convenient and accessible for patients. Moreover, growth is driven by the rising prevalence of target diseases and the growing demand for teleradiology for second opinions and emergencies. For instance, in September 2024 , Iris Telehealth introduced a Virtual Clinic incorporating AI insights for behavioral health.

The market is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary expertise, technologies, and distribution channels to capture a larger market share. For instance, in the first quarter of 2024, 42 deals were recorded, marking the highest number since late 2022. This total included 24 traditional “control position” mergers and acquisitions and 18 “growth equity” deals where investors, often from venture capital firms, acquire a minority stake in companies with strong potential for growth. Private equity played a significant role in this M&A activity, comprising 18 of the 24 reported transactions, including eight platform deals.

Regulations significantly impact the market by shaping compliance requirements and driving the adoption of technology solutions. Increasingly stringent regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the 21st Century Cures Act, mandate robust data privacy and security measures, compelling organizations to invest in software that ensures compliance while safeguarding patient information.

Several market players are expanding their business by launching new solutions to expand their product portfolio. For instance, in July 2024, Greenspace Health, a company offering behavioral health services through Measurement-Based Care (MBC), announced the launch of MBC 2.0. This latest platform iteration will improve features while utilizing AI and predictive technologies to enhance MBC's effectiveness greatly.

Component Insights

The software segment dominated the market with the largest revenue share in 2024 and is anticipated to grow with the fastest CAGR of 13.5% over the forecast period, owing to factors, including the increasing prevalence of mental health disorders and the growing emphasis on integrated care models that require robust technological support. The segment is further bifurcated into integrated and standalone. Advances in telehealth technologies have further accelerated this growth, enabling providers to reach patients remotely and efficiently. The need for real-time analytics to improve treatment outcomes and operational efficiency also fuels innovation, making advanced software essential in the behavioral healthcare landscape.

Increased adoption of technological solutions for managing financial, administrative, and clinical functions of psychiatry practices is responsible for segment growth. EHR systems have integrated claims and billing functionality that can manage complex billing procedures, and its mobile version enables patients to access services on the go. The software provides revenue cycle management to streamline the claims process. These solutions allow healthcare professionals to design and choose the optimal treatment plan for a person suffering from issues, such as depression, stress, anxiety, substance abuse, and addiction. Furthermore, it helps to design treatment plans based on clinical evidence and related patient records.

Delivery Model Insights

The subscription segment dominated the market with the largest revenue share in 2024 and is anticipated to register the fastest growth with a CAGR of 13.3% over the forecast period. Unlike large medical practices or hospitals, most small-scale mental healthcare professionals have limited capital to invest in technological solutions. Furthermore, many practitioners are not eligible for incentives for meaningful use of EHRs because of the modest size of their practices. Small-scale practices are, therefore, prevented from implementing EHRs due to low reimbursement. In addition, medical practitioners are reluctant to spend thousands of dollars on software. As a result, small practices prefer subscription-based services due to financial constraints.

Furthermore, various affordable options are available that can provide optimal return on investment. Large facilities prefer purchasing and installing software solutions for smooth workflow management. Earlier, professionals had limited options to suit their particular needs. However, with the advent of technological advancements, a variety of options are now available in the market, thereby favoring the growth of the ownership segment.

Function Insights

By function, the clinical segment dominated the market with a share of 50.4% in 2024. Behavioral health software provides clinical services such as claim filings, documentation, scheduling appointments, billing, and coding. Market players offer standalone solutions and all-inclusive solutions. For instance, Rethink, a provider of behavioral health software, offers practice management and clinical software for Applied Behavior Analysis (ABA) therapy providers.

The administrative segment in the market is anticipated to witness the fastest CAGR growth over the forecast period. Facilities, especially large-scale centers, usually require centralized scheduling systems to view multiple providers in one place. Administrative functions such as scheduling are beneficial as they provide timely care delivery at a lower cost. In addition, document management reduces data overload in healthcare settings.

Disorder Insights

By disorder, the anxiety segment dominated the market with a revenue share of 32.1% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. With the increasing prevalence of depression and anxiety, there is a growing demand for digital solutions that support individuals in coping with these conditions. These apps generally offer features such as mood tracking, guided meditation, cognitive-behavioral therapy techniques, relaxation exercises, and access to behavioral health providers. For instance, AbleTo, Inc., a digital behavioral health company, offers a three-minute assessment tool developed to screen people for common behavioral health conditions such as anxiety and depression.

The substance abuse segment in the market is anticipated to witness significant CAGR growth over the forecast period. Factors such as supportive government initiatives, drug awareness campaigns and prevention programs, and launching a new mobile app for treating substance abuse fuel the market growth. For instance, in February 2021, the U.S. FDA approved the reSET app, a cognitive behavioral therapy-based tool for use in marijuana, alcohol, cocaine, and stimulant substance use disorders.

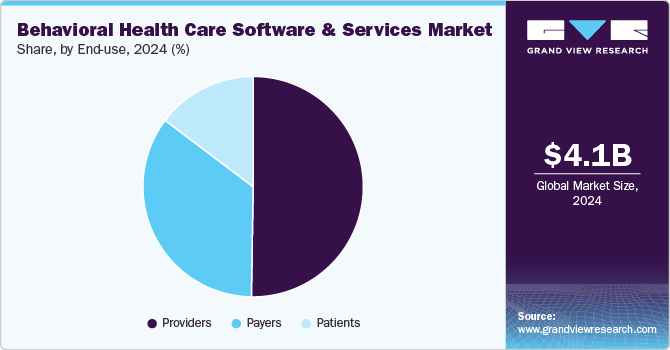

End Use Insights

By end use, the providers dominated the market with a revenue share of 50.2% in 2024. The limited number of EHR providers specific to mental care increases the demand for software suppliers. An increase in the adoption of EHR by providers for improving clinical, financial, & administrative efficiency is a key factor expected to drive market growth. For instance, Matellio, a software development company, offers a specialized digital solution to behavioral health professionals developed to streamline the administration, delivery, and monitoring of mental health and substance abuse treatment services.

The payers segment is anticipated to witness the fastest CAGR growth over the forecast period, owing to improved reimbursement rates for behavioral health care software. Furthermore, the segment growth is attributed to these solutions' ability to streamline claims processing, reduce turnaround times, and enhance customer satisfaction.

Regional Insights

North America dominated the behavioral health care software and services market with a revenue share of 41.3% in 2024. The emerging technologies for behavioral health management, expanding reimbursement coverage, and growing awareness regarding substance abuse drive market growth. The adoption of behavioral health care software by care providers is anticipated to enhance the management of mental health issues and treatment prospects. Behavioral health providers adopt integrated EHRs for effective practice management and cost savings.

U.S. Behavioral Health Care Software And Services Market Trends

The behavioral health care software and services market in the U.S. held the largest market share in 2024. Growing investments and favorable government initiatives fuel the market growth. For instance, in May 2022, Osmind, a San Francisco-based software development company, raised USD 40 million in a Series B financing round to expand its technology. The company develops e-health record software for the psychiatrist, and its EHR technology is aimed at novel therapies such as psychedelic drugs and neuromodulation treatments, including transcranial magnetic stimulation (TMS).

Europe Behavioral Health Care Software And Services Market Trends

The behavioral health care software and services market in Europe is anticipated to register a significant growth rate during the forecast period. Adopting behavioral health solutions for better self-care by patients in their homes and offices also fuels this growth. Improved workflow efficiency and reduced healthcare costs are key advantages driving the behavioral healthcare software and services software market. Integrating behavioral health software with a subscription delivery model enables enhanced data accessibility and real-time analysis.

Germany behavioral health care software and services market is anticipated to register a considerable growth rate during the forecast period. Favorable reimbursement policies in the country drive market growth. For instance, in December 2023, Mindable Health GmbH developed the Mindable: Soziale Phobie health app and introduced it in the Directory of Digital Health Applications (DiGAs), thus eligible for reimbursement. It helps users in reducing and managing their social anxiety.

The behavioral health care software and services marketin the UK is anticipated to register a considerable growth rate during the forecast period. Adopting behavioral health care software and services is facilitated by shifting from traditional therapy approaches toward patient-centered and personalized care. Various types of apps, such as depression and anxiety management and substance abuse, play a crucial role in preserving overall health, promoting a healthier lifestyle, and reducing stress. Thus, such factors are boosting market growth.

Asia Pacific Behavioral Health Care Software And Services Market Trends

The behavioral health care software and services market in Asia Pacific is anticipated to grow fastest over the forecast period. Increasing smartphone and internet penetration and the rising geriatric population in China and Japan are anticipated to fuel regional growth. Asian countries such as China and India have a large number of smartphone users, providing enormous opportunities for the market to propel.

Japan behavioral health care software and services market is anticipated to grow considerably during the forecast period. The growing prevalence of mental health issues and anxiety, innovative behavioral healthcare software, and the growing geriatric population fuel the market growth. Japanese app developers are adopting various strategies to attract consumers and maintain a competitive edge in the market. Users are motivated to use such apps to enhance their mental health.

Latin America Behavioral Health Care Software And Services Market Trends

The behavioral health care software and services market in Latin America is witnessing steady growth. A notable trend in the market growth is the technological advancements in these apps. Leading market players focus on providing innovative solutions using cutting-edge technologies to cater to users' needs and enhance their competitiveness.

Argentina behavioral health care software and services market is anticipated to register considerable growth during the forecast period. Increasing smartphone penetration and internet connectivity have made these software and services more accessible to a broader population. For instance, according to WorldData.info in Argentina, mobile connections reached 69.73 million in 2023.

Middle East & Africa Behavioral Health Care Software And Services Market Trends

The behavioral healthcare software and services market in the Middle East and Africa region is experiencing lucrative growth. Factors such as rapid urbanization, socioeconomic changes, and growing awareness and acceptance of mental health issues lead to an increased demand for accessible and convenient behavioral health support.

The UAE behavioral health care software and services market is anticipated to register a considerable growth rate during the forecast period. The UAE is one of the most favorable markets for healthcare and digital platforms. Factors such as favorable government initiatives and a rising number of startups promoting behavioral health care software and services apps are propelling market growth in the country. Key players focus on developing newer products to meet the growing demand for better care.

Key Behavioral Health Care Software And Services Company Insights

Key participants in the market are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Behavioral Health Care Software And Services Companies:

The following are the leading companies in the behavioral health care software and services market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle (Cerner Corporation)

- Core Solutions, Inc.

- Epic Systems Corporation.

- Meditab

- Holmusk

- Netsmart Technologies, Inc.

- Qualifacts

- Welligent

Recent Developments

-

In April 2024, Talkspace, an online behavioral health company, introduced its Behavioral Health Consortium, a network of specialty providers featuring Ria Health, Charlie Health, and Bicycle Health. This consortium facilitates Talkspace clinicians to refer insured members to clinically-vetted-network, like-minded, specialty care providers who offer a higher level of care for treatment for substance use, alcoholism, and eating disorders.

-

In February 2024, the Substance Abuse and Mental Health Services Administration (SAMHSA) partnered with the Office of the National Coordinator for Health Information Technology (ONC). For the next three years, the two organizations invested over USD 20 million in SAMHSA funds to advance health information technology (IT) in behavioral healthcare.

Behavioral Health Care Software And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.66 billion

Revenue forecast in 2030

USD 8.61 billion

Growth rate

CAGR of 13.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, delivery model, function, disorder, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Oracle (Cerner Corporation); Core Solutions, Inc.; Epic Systems Corporation; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualifacts; Welligent

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Behavioral Health Care Software And Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research, Inc. has segmented the behavioral health care software and services market report based on component, delivery model, function. disorder, end use, and region:

-

Component Outlook (Revenue USD Million, 2018 - 2030)

-

Software

-

Integrated

-

Standalone

-

-

Support Services

-

-

Delivery Model Outlook (Revenue USD Million, 2018 - 2030)

-

Ownership

-

Subscription

-

-

Function Outlook (Revenue USD Million, 2018 - 2030)

-

Clinical

-

EHRs

-

Clinical Decision Support

-

Care Plans

-

E-Prescribing

-

Telehealth

-

-

Administrative

-

Patient/Client Scheduling

-

Document Management

-

Case Management

-

Workforce Management

-

Business Intelligence

-

-

Financial

-

Revenue Cycle Management

-

Managed Care

-

General Ledger

-

Payroll

-

-

-

Disorder Outlook (Revenue USD Million, 2018 - 2030)

-

Anxiety

-

Post-Traumatic Stress Disorder (PSTD)

-

Substance Abuse

-

Bipolar Disorders

-

Schizophrenia

-

Others

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Providers

-

Hospitals & Clinics

-

Community Centers

-

-

Payers

-

Patients

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global behavioral health care software and services market size was estimated at USD 4.14 billion in 2024 and is expected to reach USD 4.66 billion in 2025.

b. The global behavioral health care software and services market is expected to grow at a compound annual growth rate of 13.0 % from 2025 to 2030 to reach USD 8.61 billion by 2030.

b. North America dominated the behavioral health care software and services market with a share of 41.3% in 2024. This is attributable to the increasing awareness regarding mental health software and improved Medicare policies.

b. Some key players operating in the behavioral health care software and services market are Welligent, Inc.; Cerner Corporation; Netsmart Technologies; Epic; Meditab; Holmusk; Qualifacts Systems, Inc.; and Core solutions, Inc.

b. Key factors that are driving the behavioral health care software and services market growth include the adoption of management software by healthcare providers to improve the treatment for mental health issues.

b. In terms of components, the software segment dominated the behavioral health care software and services market with a share of 81.6% in 2024. This is attributable to the increased adoption of technological solutions for the management of financial, administrative, and clinical functions of psychiatry practices

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.