- Home

- »

- Pharmaceuticals

- »

-

Benzodiazepine Drugs Market Size And Share Report, 2030GVR Report cover

![Benzodiazepine Drugs Market Size, Share & Trends Report]()

Benzodiazepine Drugs Market Size, Share & Trends Analysis Report By Product (Chlordiazepoxide, Diazepam, Lorazepam, Alprazolam, Clonazepam, Others), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-181-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Benzodiazepine Drugs Market Size & Trends

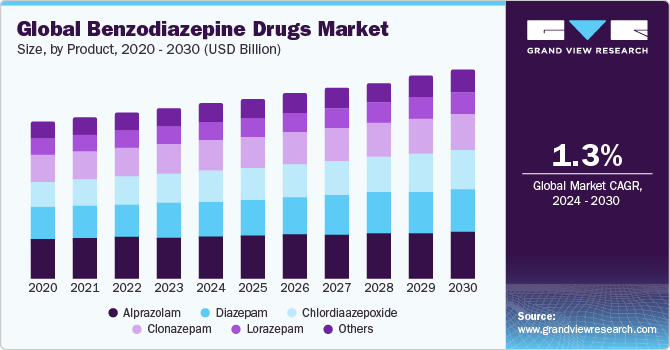

The global benzodiazepine drugs market is expected to grow at a compound annual growth rate (CAGR) of 2.68% from 2024 to 2030. Major factors responsible for the market growth include the rising incidence of stress disorders and anxiety, the development of new effective medications for seizures, and the increasing number of product approvals by regulatory authorities. For instance, in May 2022, the Food and Drug Administration granted approval for VOQUEZNA TRIPLE PAK (amoxicillin, vonoprazan, and clarithromycin) and VOQUEZNA DUAL PAK (amoxicillin, vonoprazan) for the therapeutic management of an infection with H. pylori in adults, as reported by Phathom Pharmaceuticals.

Concerns regarding the excessive use of benzodiazepines and their potential for addiction have grown in recent years. As a result, there are currently initiatives are being conducted to develop alternative drugs for the treatment of anxiety disorders and seizures that are equally effective and carry a lower risk of dependence and addiction. Industry players are working to create novel drugs for the therapeutic management of seizures, anticipating this effort to fuel growth in the benzodiazepine medications market over the forecast period. For instance, according to an article published by Springer Nature in August 2022, diazepam, a benzodiazepine drug, is approved by the U.S. FDA and the European Medicines Agency for managing convulsive diseases, including seizures, acute alcohol withdrawal syndrome, skeletal muscular spasms, and anxiety. Benzodiazepines, such as lorazepam, midazolam, diazepam, and clonazepam, are widely recognized as the primary choice of drugs for the initial management of acute seizures.

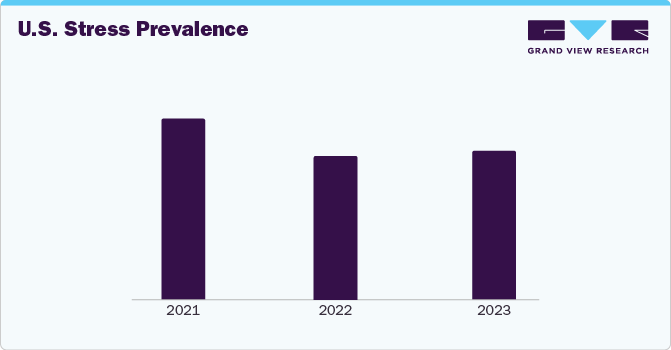

In recent times, there has been a noticeable increase in the prevalence of stress-related disorders and conditions associated with anxiety. This rise can be attributed to a variety of factors, including the fast-paced nature of contemporary living, economic pressures, and the aftermath of events such as the COVID-19 pandemic. Consequently, there has been a growing demand for pharmaceutical interventions aimed at alleviating the symptoms commonly associated with these disorders. The rising prevalence of stress disorders and anxiety has heightened the demand for benzodiazepine medications, influencing the benzodiazepine drugs market and resulting in increased sales and revenue for pharmaceutical firms that manufacture these treatments.

Product Insights

Based on the product, the benzodiazepine drugs market is segmented into chlordiazepoxide, diazepam, lorazepam, alprazolam, clonazepam, and others. The diazepam segment held the largest market share in 2023, owing to the introduction of a new administration route, strategic partnerships between companies for diazepam's development and commercialization, and the lower prescription costs associated with diazepam. These factors contribute to the significant growth of the diazepam segment. For instance, Valtoco, developed by Neurelis, Inc., introduces a distinctive diazepam formulation that blends a special vitamin E-based solution with Intravail absorption enhancement. This exclusive blend guarantees exceptional absorption, tolerance, and consistency in a nasal format. Administered as a nasal spray, Valtoco is specifically designed for the treatment of both pediatric and adult patients who occasionally need diazepam to manage episodes of acute repetitive seizure activity, often known as cluster seizures.

Distribution Channel Insights

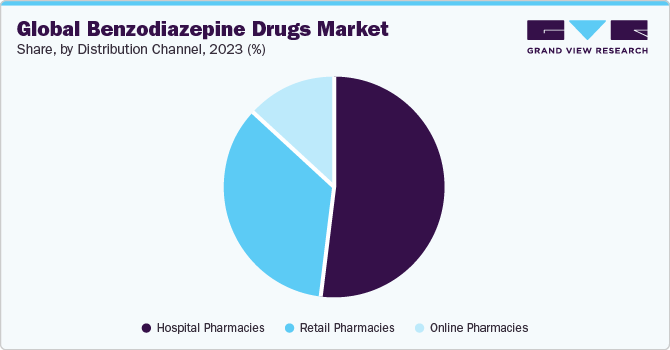

On the basis of the distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Hospitals are preferred by patients due to their accessibility and treatment convenience. Pharmacists play a crucial role in maintaining medication safety and quality control by adhering to storage guidelines and conducting regular inspections. Furthermore, the substantial volume of surgical procedures conducted in hospital settings is anticipated to be a key factor propelling the growth of this market segment.

Regional Insights

North America held the largest market share in 2023. Factors contributing to regional market growth include substantial research investments made by both private entities and government agencies within the healthcare sector. Furthermore, North America is home to significant pharmaceutical corporations and research facilities that promote the discovery and marketing of novel medications. However, the APAC region is expected to grow at the fastest rate over the forecast period.

Key Companies & Market Share Insights

Key players operating in the market are Pfizer Inc., F. Hoffmann-La Roche Ltd., Bausch Health Companies Inc., Mylan Inc., Teva Pharmaceutical Industries Ltd., and Sun Pharmaceutical Industries Ltd. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In May 2023, Hikma Pharmaceuticals PLC launched Diazepam Injection, USP for dose 50mg/10mL in the U.S. It is used to treat anxiety-related disorders and provides short-term relief. The product is also used to help ease the muscles and relax muscle spasms.

-

In March 2022, Pfizer Inc. entered into a strategic agreement and acquired Arena Pharmaceuticals. The acquisition offered a potentially superior strategy catering to the requirements of a wider range of patients dealing with immune-inflammatory conditions, possibly offering the best available approach.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."